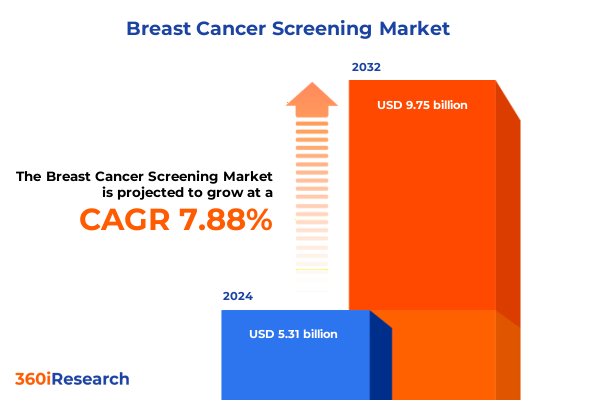

The Breast Cancer Screening Market size was estimated at USD 5.69 billion in 2025 and expected to reach USD 6.09 billion in 2026, at a CAGR of 8.00% to reach USD 9.75 billion by 2032.

Unveiling the Imperative of Evolving Breast Cancer Screening Approaches Amidst Technological Innovations, Shifting Demographics, and Evolving Policy Landscapes

Breast cancer remains a leading public health imperative in the United States and around the world, driving an urgent need to evolve screening paradigms in response to technological advancement, shifting demographic profiles, and complex policy dynamics. As incidence rates continue to climb among younger cohorts and mortality outcomes become increasingly tied to early detection, healthcare stakeholders find themselves at a pivotal crossroads. The recent final recommendation by the US Preventive Services Task Force, which endorses biennial screening mammography for women aged 40 to 74 years, underscores the critical importance of consistent, high-quality imaging interventions in reducing disease burden and saving lives.

How Rapid Technological Advances, Artificial Intelligence Integration, and Policy Mandates Are Redefining the Breast Cancer Screening Paradigm Across Care Continuums

The breast cancer screening landscape has undergone a rapid transformation driven by converging technological breakthroughs, artificial intelligence integration, and new legislative mandates. Advanced digital mammography systems paired with three-dimensional tomosynthesis have demonstrated improved lesion conspicuity, reducing recall rates and enhancing positive predictive values. Simultaneously, the integration of AI-driven detection algorithms is emerging as a vital adjunct to radiologist workflows, with recent data from a leading retrospective analysis showing that an AI-powered mammography solution successfully identified previously missed cancers, paving the way for broader adoption in routine practice. Furthermore, legislative requirements such as the FDA’s upcoming mandate for breast density notification and patient education reinforce the need for both providers and technology developers to collaborate closely in delivering personalized, risk-based screening pathways.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Measures on Imaging Equipment Costs, Supply Chain Stability, and Healthcare Investment Strategies

In 2025, a new wave of US tariffs on imported medical imaging equipment has reverberated across the breast cancer screening ecosystem, creating significant cost pressures and strategic recalibrations. A baseline 10% duty on advanced scanners has translated into additional capital expenditures of up to $200,000 per high-end MRI or CT system, straining already constrained hospital budgets and prompting delays in scheduled upgrades. At the same time, tariffs on Chinese-origin components have reached an aggregate of 145%, further inflating costs for manufacturers who rely on global supply chains for semiconductors, precision optics, and steel housings. Faced with shrinking profit margins and earnings adjustments, leading imaging vendors such as GE Healthcare have trimmed full-year guidance and accelerated strategies to localize production and secure tariff exemptions, demonstrating the imperative for industry players to develop resilient supply chain frameworks and agile cross-border partnerships in a volatile trade environment.

Illuminating Critical Segmentation Insights That Highlight Divergent Utilization Patterns and Strategic Opportunities in Breast Cancer Screening Technologies, Demographics, and Care Delivery Models

A nuanced understanding of breast cancer screening requires a deep dive into distinct segmentation dimensions, each revealing unique utilization and investment patterns. From a technology standpoint, the market encompasses conventional analog and digital two-dimensional mammography, advanced three-dimensional tomosynthesis, both contrast-enhanced and non-contrast magnetic resonance imaging, specialized molecular imaging modalities such as breast specific gamma imaging and scintimammography, thermography, and ultrasound variants-both automated and handheld. Demographically, risk-stratified screening utilization varies by age cohorts, with tailored outreach and scheduling protocols necessary for women under 40, those between 40 and 49, individuals from 50 to 69, and seniors aged 70 and above. Delivery models further segment programs into cloud-based offerings-encompassing both software-as-a-service and web-based platforms-and on-premise installations that cater to stringent data governance requirements. Finally, diverse end users ranging from large hospital systems and ambulatory care centers to diagnostic chains and primary and specialty clinics each demonstrate distinct procurement preferences, reimbursement challenges, and capacity constraints.

This comprehensive research report categorizes the Breast Cancer Screening market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Age Group

- Delivery Mode

- End User

Navigating Regional Dynamics by Exploring Divergent Growth Drivers, Policy Frameworks, and Screening Adoption Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional dynamics play a pivotal role in shaping screening adoption, driven by economic capacity, policy frameworks, and healthcare infrastructure maturity. In the Americas, mature reimbursement landscapes and robust public awareness campaigns support widespread deployment of both tomosynthesis and MRI-based adjunct screening, although cost containment pressures and supply chain disruptions are constraining capital investment cycles. In Europe, Middle East & Africa, the European Union’s updated Cancer Screening Recommendations extend mammography programs to women aged 45 to 74, backed by a voluntary quality assurance scheme that standardizes screening and care continuity across member states. Meanwhile, in Asia-Pacific, rapid infrastructure investments, government-sponsored mobile screening initiatives, and global training collaborations-such as the IARC’s launch of the CanScreen5 program-are driving the fastest growth rates, especially in emerging markets where access to advanced imaging platforms is being bolstered by public-private partnerships and decentralized delivery models.

This comprehensive research report examines key regions that drive the evolution of the Breast Cancer Screening market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders in Breast Cancer Screening to Understand Their Technological Leadership, Strategic Positioning, and Innovation Trajectories Amid Intensifying Competition

A cohort of leading industry players continues to define and recalibrate the competitive landscape. Hologic has emerged at the forefront of AI-enhanced mammography with its Genius AI Detection PRO solution, recently earning recognition for diagnostic accuracy improvements and workflow optimization at independent symposia. GE Healthcare remains a cornerstone in both digital mammography and MRI sectors, even as tariff-induced margin pressures necessitate a strategic pivot toward local production and targeted duty exemptions. Siemens Healthineers is distinguished by its innovations in photon-counting imaging technology, although recent trade tensions have spotlighted the need for diversified manufacturing footprints to preserve global market access. Fujifilm has made significant inroads in ultrasound-based screening and molecular breast imaging platforms, while Konica Minolta continues to champion user-friendly digital mammography systems optimized for community-based settings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Cancer Screening market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- Fujifilm Holdings Corporation

- GE HealthCare

- Hologic, Inc.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- NanoString Technologies, Inc.

- NIRAMAI Health Analytix Private Limited

- Novartis AG

- Oncocyte Corporation

- OncoStem Diagnostics Pvt. Ltd

- Pfizer Inc.

- Prelude Corporation

- Quest Diagnostics Incorporated

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers AG

- Syantra Inc.

- Vayyar Imaging, Ltd.

Delivering Actionable Recommendations to Empower Industry Stakeholders Through Targeted Innovation Investments, Collaborative Alliances, and Adaptive Supply Chain Resilience Strategies

To thrive in this evolving environment, industry stakeholders should prioritize strategic investments in AI-driven and next-generation imaging modalities that demonstrably improve early detection metrics. Establishing joint ventures and production partnerships that insulate core manufacturing operations from tariff volatility will be crucial to safeguarding profit margins and ensuring uninterrupted equipment supply. Equally important is active engagement with policymakers and advocacy groups to secure and expand duty exemptions for critical screening devices. Expanding mobile and cloud-based delivery models can address persistent access gaps in under-served demographics, while risk-adjusted screening protocols-guided by real-world data and population-specific calibration-offer the potential to optimize resource allocation and enhance equity across age and risk groups. Finally, forging cross-sector alliances with patient advocacy organizations will amplify outreach efforts and support sustainable screening participation rates.

Detailing the Rigorous Research Methodology That Underpins This Analysis Through Integrated Primary Interviews, Comprehensive Secondary Data Synthesis, and Multimodal Validation Techniques

This analysis is founded on a multi-layered research methodology designed to ensure both breadth and depth of insight. Comprehensive secondary research encompassed peer-reviewed clinical guidelines, policy directives, industry press releases, and financial filings. Key primary research interviews were conducted with radiology directors, screening program managers, and policy experts to validate market dynamics and to surface emerging trends. Quantitative data points were triangulated across multiple reputable sources, including regulatory bodies and financial disclosures, to minimize bias and reinforce accuracy. A robust quality assurance process, featuring iterative review cycles and cross-functional expert validation, underpins the credibility of the findings and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Cancer Screening market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Cancer Screening Market, by Technology

- Breast Cancer Screening Market, by Age Group

- Breast Cancer Screening Market, by Delivery Mode

- Breast Cancer Screening Market, by End User

- Breast Cancer Screening Market, by Region

- Breast Cancer Screening Market, by Group

- Breast Cancer Screening Market, by Country

- United States Breast Cancer Screening Market

- China Breast Cancer Screening Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Key Learnings to Conclude on the Imperative of Strategic Adaptation and Proactive Innovation in the Evolving Breast Cancer Screening Ecosystem

As the breast cancer screening ecosystem accelerates toward a future defined by precision, personalization, and policy alignment, organizations that embrace innovation and cultivate supply chain resilience will secure a distinct competitive advantage. The integration of advanced imaging technologies, coupled with strategic tariff mitigation and effective segmentation strategies, positions stakeholders to enhance early detection, optimize resource utilization, and mitigate disparities across populations. By translating these insights into decisive actions-anchored in robust market intelligence and collaborative partnerships-the industry can continue to drive meaningful improvements in patient outcomes and catalyze sustainable growth.

Empower Your Organization’s Strategic Vision by Securing Exclusive Access to Cutting-Edge Breast Cancer Screening Market Research Reports Today

If you are ready to capitalize on these insights and propel your organization to the forefront of breast cancer screening innovation, we invite you to engage directly with our expert team. Ketan Rohom, our Associate Director of Sales & Marketing, stands ready to guide you through the comprehensive market research report, ensuring that every strategic decision you make is rooted in the most robust and up-to-date intelligence. By securing this report, you will gain exclusive access to detailed analyses, nuanced segmentation examinations, and forward-looking recommendations that will sharpen your competitive edge. Connect with Ketan today to schedule a personalized briefing and take the first decisive step toward unlocking new growth opportunities in the dynamic breast cancer screening market

- How big is the Breast Cancer Screening Market?

- What is the Breast Cancer Screening Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?