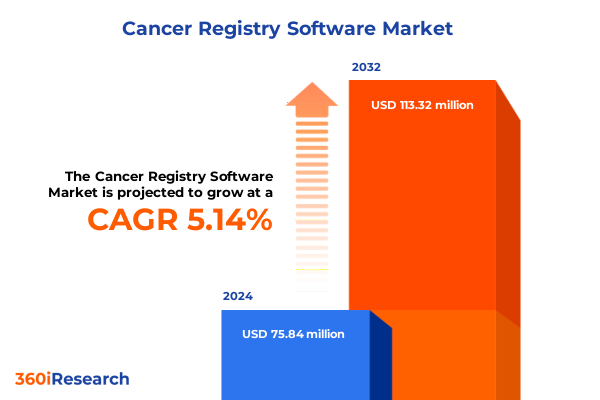

The Cancer Registry Software Market size was estimated at USD 79.43 million in 2025 and expected to reach USD 86.83 million in 2026, at a CAGR of 5.20% to reach USD 113.32 million by 2032.

Laying the Foundation for Understanding the Evolution and Scope of Cancer Registry Software Within Today’s Healthcare Data Management Landscape

In an era defined by exponential growth in healthcare data and ever-strengthening demands for quality patient outcomes, cancer registry software has emerged as an indispensable tool for clinicians, researchers, and administrators alike. This critical system orchestrates the collection, standardization, and analysis of demographic, diagnostic, treatment, and follow-up information, creating a unified source of truth that supports epidemiological research, regulatory reporting, and value-based care initiatives. By harnessing this software, organizations gain unprecedented visibility into population health trends, while ensuring compliance with evolving data security and privacy regulations.

The convergence of data‐driven decision making and precision medicine has further elevated the importance of robust registry solutions. Advanced analytics and machine learning models rely on high-quality, structured datasets that span diverse clinical and molecular parameters. As a result, registry software has grown beyond mere data repositories to become analytical powerhouses capable of generating predictive insights, identifying patient cohorts for clinical trials, and optimizing resource allocation. This transition underscores how deeply integrated registry platforms have become within broader healthcare informatics ecosystems.

Moreover, regulatory bodies now mandate detailed reporting of cancer incidence, mortality, and treatment outcomes to inform public health strategies and funding priorities. Healthcare providers and government agencies depend on registry software to automate compliance workflows, reduce manual data entry, and ensure the timely submission of accurate reports. Consequently, registry solutions play a pivotal role in protecting public health, guiding policy development, and catalyzing research breakthroughs. As such, understanding the current landscape and future trajectory of cancer registry software is foundational for any organization committed to excellence in oncology care and research.

Uncovering the Transformative Technological and Operational Shifts Reshaping Cancer Registry Software Across Stakeholders and Use Cases

Over the past decade, cancer registry software has experienced profound transformation as technology innovations and shifting care models reshaped stakeholder expectations. Early systems focused primarily on static data capture, requiring extensive manual intervention to populate case records and generate basic frequency counts. However, the advent of interoperable standards such as HL7 FHIR and advanced APIs has streamlined data exchange across electronic health record systems, laboratories, and imaging platforms, enabling near-real-time registry updates and reducing the latency between patient encounters and data availability.

Simultaneously, the proliferation of cloud computing has liberated registry platforms from on-premise constraints, offering scalability, high availability, and integrated security protocols without demanding significant infrastructure investments. Cloud-native registry solutions now leverage elastic resources to accommodate variable workloads, while hybrid deployment architectures have emerged to address data sovereignty and latency requirements. This flexibility has expanded the potential user base from large academic institutions to smaller community hospitals and research centers that previously lacked the capital for substantial IT deployments.

Another pivotal shift lies in the rise of artificial intelligence and machine learning capabilities integrated directly into registry software. Automated data cleansing and normalization engines can ingest unstructured pathology reports and clinical notes, converting them into analyzable formats with minimal human intervention. Predictive analytics modules further empower researchers to model patient prognoses, optimize treatment pathways, and forecast resource utilization. This move toward advanced analytics not only enhances operational efficiency but also drives clinical innovation by illuminating patterns that were once hidden amidst siloed datasets.

These technological advances coincide with a broader industry transition to value-based care, where reimbursements and performance metrics hinge on demonstrable patient outcomes and cost-effective practices. Cancer registry software now supports quality metrics tracking and patient management workflows-such as appointment scheduling and case tracking-so providers can proactively address gaps in care and measure the impact of interventions. Together, these transformative shifts have redefined registry platforms from passive record-keeping tools into dynamic engines of clinical intelligence and strategic decision support.

Assessing the Cumulative Effects of 2025 United States Tariff Policies on the Procurement and Deployment of Cancer Registry Solutions

In 2025, the United States enacted a series of tariff adjustments targeting imported information technology hardware and certain specialized software packages integral to cancer registry system deployments. While software licensing and subscription services themselves generally intangible and exempt from direct duties, the imposition of increased import levies on servers, networking equipment, and high-performance storage arrays has incrementally elevated the total cost of ownership for on-premise solutions. As healthcare organizations assess capital budgets amidst constrained reimbursements, these additional costs have spurred a reevaluation of infrastructure strategies and accelerated cloud migration for data storage and computational workloads.

The cumulative effect of these tariffs has manifested in two principal ways. First, vendors have begun to incorporate incremental infrastructure surcharges into maintenance and implementation contracts, transferring a portion of the hardware cost impact to end users. This adjustment has sparked negotiations around cost-allocation models, with many providers exploring managed service frameworks to bundle hardware procurement, deployment, and ongoing support under predictable subscription fees. Second, the tariffs have underscored the strategic appeal of hybrid cloud deployments that minimize on-site hardware dependencies while preserving data residency and performance for critical registry operations.

Meanwhile, cloud-native registries have leveraged this shifting cost landscape to position subscription-based models as compelling alternatives. By abstracting infrastructure provisioning to hyperscale providers and consolidating multi-tenant environments, these vendors have been able to shield clients from tariff volatility and deliver transparent per-user or per-case pricing structures. Organizations previously reticent to embrace public cloud due to security or compliance concerns have also shown growing willingness to explore private and hybrid cloud configurations, balancing data sovereignty with predictable total cost trajectories.

Ultimately, the 2025 tariff changes have functioned as a catalyst rather than an impediment for cancer registry software adoption. They have prompted vendors and buyers to reevaluate delivery models, prioritize infrastructure flexibility, and develop contractual frameworks that mitigate external economic pressures. As a result, the market continues to evolve toward scalable, cloud-augmented architectures that accommodate diverse deployment preferences while insulating end users from future trade policy fluctuations.

Delving Into Component, Deployment Mode, End User, and Application Dimensions to Reveal Critical Segmentation Insights for Cancer Registry Software

A nuanced understanding of market segments reveals the critical drivers and pain points that shape vendor strategies and customer adoption within the cancer registry software domain. From a component perspective, the software category itself bifurcates into perpetual licensing and subscription models. Subscription offerings have gained momentum by bundling ongoing feature updates, cloud hosting, and support services, whereas license-based solutions appeal to organizations seeking fixed-cost ownership and greater customization autonomy. On the services side, consulting, implementation, and training and support form distinct engagement phases, underscoring the importance of vendor expertise in configuring complex workflows, migrating legacy records, and ensuring user proficiency.

Deployment mode further differentiates market demand between cloud and on-premise solutions. Public cloud deployments have become prevalent due to their rapid provisioning and cost efficiency, while private cloud configurations cater to stringent compliance requirements through dedicated environments. Hybrid cloud arrangements unite the benefits of both approaches by storing sensitive data on-site while leveraging public cloud for compute-intensive analytics. This flexibility enables organizations to optimize performance, security, and cost metrics across varied use cases.

End-user segmentation highlights diverse institutional requirements and purchasing behaviors. Academic institutions value research extensibility and deep analytics integrations, while cancer research centers often demand support for large-scale cohort studies and novel trial designs. Clinical laboratories require seamless connectivity to diagnostic instruments and automated case flagging, whereas government agencies prioritize standardized reporting formats and nationwide data aggregation. Hospitals focus on operational workflows, balancing appointment scheduling, case tracking, and compliance management with everyday clinical demands.

Application-level segmentation further clarifies capability requirements. Data management encompasses both integration of disparate data streams and secure storage architectures, ensuring registries can ingest and archive high volumes of structured and unstructured information. Patient management modules facilitate appointment scheduling and case tracking, streamlining patient throughput and follow-up processes. Quality management functions address compliance and workflow orchestration, enabling organizations to monitor adherence to clinical protocols and regulatory guidelines. Reporting and analytics features deliver predictive analytics engines that model patient outcomes and regulatory reporting frameworks designed to satisfy federal and international mandates. Together, these interlocking segments illuminate the multifaceted value propositions necessary for comprehensive registry solutions.

This comprehensive research report categorizes the Cancer Registry Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End User

- Application

Mapping Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Illuminate Divergent Trends in Cancer Registry Software Adoption

Regional dynamics reveal significant variations in adoption patterns, driven by differing regulatory landscapes, healthcare infrastructure maturity, and technology investment priorities. In the Americas, the United States leads with broad uptake of cloud-native registries supported by robust interoperability mandates and substantial private investment. Canada mirrors this trajectory, albeit at a measured pace, focusing on federated data sharing across provincial networks. Latin American markets exhibit nascent registry programs, with an emphasis on foundational data capture and increasing interest in subscription-based cloud models that lower entry barriers.

Within Europe, Middle East, and Africa, regulatory harmonization initiatives such as the European Cancer Federation’s unified data standards are fostering cross-border research collaborations. Western European nations prioritize advanced analytics and real-time reporting to meet stringent outcomes-based reimbursement criteria, while Eastern European markets concentrate on upgrading legacy on-premise installations. In the Middle East, governments are investing in national cancer registries to inform public health strategies, with private-public partnerships emerging to fund technology transfers. African programs remain largely donor-driven, focusing on core data collection and capacity building but demonstrating growing openness to cloud-hosted services as connectivity improves.

Asia-Pacific presents a heterogeneous landscape. Mature markets like Japan and South Korea boast sophisticated registry platforms integrated with genomic databases and precision oncology initiatives. Australia and New Zealand leverage centralized public health infrastructures to deploy unified national registries, streamlining case reporting and epidemiological analyses. Meanwhile, Southeast Asian and South Asian markets vary widely in technological readiness, with a mixture of on-premise legacy systems and pioneering cloud pilots funded by international health agencies. Across the region, rising cancer incidence and mounting regulatory pressure are driving accelerated investments in scalable, interoperable registry solutions.

This comprehensive research report examines key regions that drive the evolution of the Cancer Registry Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Postures and Value Propositions of Leading Vendors Driving Innovation and Competition in the Cancer Registry Software Market

A competitive landscape featuring both established health IT giants and specialized oncology registrars shapes the pace of innovation in the market. Leading multinational vendors differentiate through expansive global support networks, comprehensive service portfolios, and deep integration capabilities with broader electronic health record ecosystems. These players continue to invest in cloud infrastructure partnerships, artificial intelligence toolkits, and modular platform enhancements to maintain their market leadership.

Conversely, agile niche providers carve out market share by focusing exclusively on cancer registry workflows, developing highly configurable solutions that address unique regulatory requirements and research use cases. Their offerings often emphasize rapid deployment, user-friendly interfaces, and specialized training programs designed to accelerate adoption among clinical and research teams. Partnerships with academic centers and consortia help these vendors refine feature sets in response to emerging scientific insights and trial designs.

In recent years, a wave of strategic alliances, joint ventures, and platform integrations has further intensified competition. Major cloud service providers have launched managed registry services in collaboration with domain specialists, while data analytics firms have introduced turnkey reporting modules compatible with multiple registry engines. This convergence of expertise is broadening the solution landscape, giving buyers greater choice but also creating complexity in vendor selection and implementation planning.

To stand out, successful vendors are prioritizing customer success initiatives that include outcome-based pricing models, comprehensive training and support offerings, and collaborative roadmaps that align product development with evolving clinical and regulatory requirements. This customer-centric focus underscores a broader market trend: the recognition that long-term value in cancer registry software extends beyond initial deployment to include ongoing optimization, innovation, and partnership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Registry Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- C/Net Solutions

- Conduent, Inc.

- Dacima Software Inc.

- Elekta AB

- ERS, Inc.

- IBM Corporation

- Inspirata, Inc.

- IQVIA Inc

- Mckesson Corporation

- NAACCR, Inc.

- NeuralFrame, Inc

- NextPath LLC

- Omega Healthcare

- Onco, Inc.

- Ordinal Data, Inc

- Q-Centrix, LLC

- Rocky Mountain Cancer Data Systems

- Siemens Healthineers AG

Translating Market Intelligence Into Actionable Strategies and Priorities to Equip Industry Leaders for Success in Evolving Cancer Registry Software Environments

Industry leaders should prioritize a portfolio approach to deployment, balancing on-premise, private cloud, and public cloud options to meet diverse organizational requirements for security, compliance, and performance. Adopting hybrid architectures can mitigate tariff-driven hardware cost fluctuations while preserving the benefits of scalable analytics environments. Embedding AI-driven data normalization and predictive analytics capabilities will accelerate time to insight and deliver competitive differentiation in research and operational contexts.

To maximize return on investment, organizations must forge cross-functional teams that unite clinical, IT, research, and administrative stakeholders. This collaborative governance structure ensures that registry requirements align with broader institutional goals-whether supporting value-based care metrics, securing grant funding for cohort studies, or streamlining regulatory reporting. Engaging end users early in the configuration and training process enhances system adoption and drives continuous improvement in data quality and workflow efficiency.

Vendors are encouraged to develop outcome-oriented service offerings, linking subscription fees to performance benchmarks such as case submission accuracy, reporting turnaround times, and predictive model validity. Transparent service level agreements and regular executive reviews build trust and incentivize continuous innovation. Partnerships with academic and research institutions can generate proof-of-concept studies that showcase registry use cases in precision medicine and epidemiology, reinforcing the software’s strategic value beyond compliance and operations.

Finally, maintaining rigorous data governance practices and preparing for evolving privacy regulations are essential. Organizations should implement encryption, role-based access controls, and audit trails that extend across multi-cloud environments. Periodic risk assessments and compliance audits further protect patient information and safeguard public trust. By adopting these actionable recommendations, industry leaders can navigate the complex registry software landscape and deliver impactful outcomes for patients and providers.

Outlining the Rigorous Methodological Framework and Analytical Techniques Underpinning Our Comprehensive Cancer Registry Software Market Research Process

Our research methodology combines robust primary research with comprehensive secondary analysis to ensure accuracy, relevance, and depth of insights. Primary research efforts included structured interviews with oncology registry administrators, IT decision-makers, and clinical researchers across a spectrum of healthcare institutions. These qualitative discussions uncovered vendor selection criteria, deployment challenges, and emerging use cases, offering firsthand perspectives on market dynamics and technology requirements.

Secondary research drew upon industry white papers, regulatory documentation, and peer-reviewed publications to contextualize primary findings within broader healthcare and policy trends. We analyzed public filings, vendor collateral, and independent case studies to validate claims regarding feature sets, deployment architectures, and partnership models. Data triangulation techniques were applied to reconcile differing viewpoints and ensure consistency across multiple information sources.

Segmentations such as component type, deployment mode, end user, and application domain were rigorously defined to facilitate comparative analysis. Regional breakdowns accounted for regulatory frameworks, infrastructure maturity, and funding mechanisms across the Americas, Europe Middle East & Africa, and Asia-Pacific. Competitive profiling assessed vendor strategies, product roadmaps, and customer satisfaction metrics, drawing on a combination of interview insights and third-party evaluations.

Throughout the research process, expert validation sessions with leading oncology informaticians and registry specialists refined our conclusions and identified emerging trends. By integrating qualitative depth with analytical rigor and cross-verified data, this methodology provides a reliable foundation for strategic decision making in the cancer registry software landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Registry Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Registry Software Market, by Component

- Cancer Registry Software Market, by Deployment Mode

- Cancer Registry Software Market, by End User

- Cancer Registry Software Market, by Application

- Cancer Registry Software Market, by Region

- Cancer Registry Software Market, by Group

- Cancer Registry Software Market, by Country

- United States Cancer Registry Software Market

- China Cancer Registry Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Insights and Reflections to Formulate a Cohesive Perspective on the Current State and Future Trajectories of Cancer Registry Software

The evolution of cancer registry software reflects a broader transformation in healthcare toward data-driven decision making, interoperability, and value-based care. Organizations are moving beyond legacy systems to embrace cloud-enabled platforms that support end-to-end workflows-from data integration to predictive analytics. At the same time, shifting trade policies have underscored the importance of flexible deployment models and cost-mitigation strategies that shield health systems from macroeconomic disruptions.

Critical segmentation dimensions-from component and deployment mode to end user and application domain-highlight the multifaceted nature of registry needs. Whether optimizing compliance reporting for government agencies, enabling cohort discovery in academic research, or automating case tracking in hospitals, each segment demands a tailored approach. Regional nuances further complicate adoption patterns, with diverse regulatory landscapes and infrastructure capabilities shaping vendor offerings and customer preferences.

Vendors that thrive in this dynamic environment will combine deep domain expertise with agile delivery models, seamless integration capabilities, and advanced analytics toolkits. Their ability to partner with customers on outcome-oriented benchmarks and continuously refine product roadmaps in alignment with clinical and research advancements will define market leadership. For healthcare organizations, the imperative is clear: adopt a strategic, flexible registry solution that not only addresses current operational needs but also anticipates future innovations in oncology care.

As the industry continues to evolve, cancer registry software will remain an essential pillar supporting population health management, regulatory compliance, and precision medicine initiatives. By synthesizing technological, economic, and regulatory factors, stakeholders can chart a path toward more efficient, effective, and patient-centric cancer care ecosystems.

Seizing Opportunities With Expert Guidance From Ketan Rohom to Access In-Depth Cancer Registry Software Research and Drive Informed Decision Making

To explore the full depth of these market dynamics and gain strategic clarity, connect with Ketan Rohom, Associate Director of Sales & Marketing, for tailored guidance and a complementary executive briefing. He will guide you through the report’s rich insights, addressing your unique organizational priorities and illustrating how advanced cancer registry software can unlock new operational efficiencies, enhance data-driven outcomes, and mitigate risk in a shifting regulatory environment. Engage today to secure your access to this essential research, so you can capitalize on emerging trends and drive impactful decisions that shape the future of cancer registry management.

- How big is the Cancer Registry Software Market?

- What is the Cancer Registry Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?