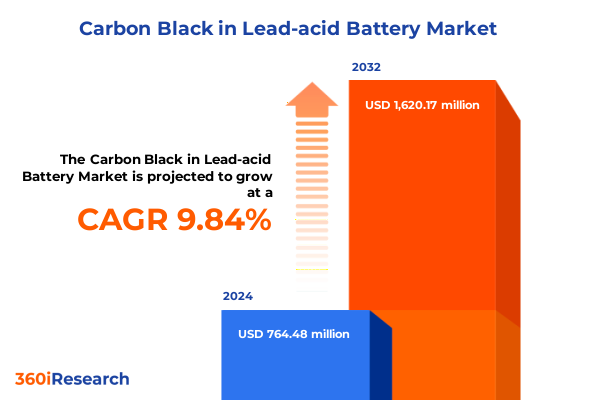

The Carbon Black in Lead-acid Battery Market size was estimated at USD 836.64 million in 2025 and expected to reach USD 916.71 million in 2026, at a CAGR of 9.90% to reach USD 1,620.17 million by 2032.

Setting the Stage for Understanding the Role of Carbon Black in Enhancing Lead-Acid Battery Performance and Market Dynamics

The lead-acid battery industry has long relied on carbon black as a foundational component to elevate electrochemical performance and extend service life. In its earliest applications, carbon black served primarily as a conductive additive, significantly reducing internal resistance within battery plates. Over time, the material’s role has become increasingly sophisticated, with manufacturers demanding specialized grades tailored to the unique requirements of flooded and sealed battery formats. This evolution underscores carbon black’s transition from a commodity filler to a precision-engineered material that directly influences battery efficiency and durability.

High-purity, low-ash carbon black grades are now essential to meet the rigorous standards of modern battery production. Advanced series such as “PureCel” and PRINTEX® C exemplify the strides taken by leading suppliers to optimize particle size distribution and surface area for maximum conductivity. These innovations address critical factors including charge acceptance, cycle stability, and sulfation resistance. As a result, battery producers can achieve deeper cycling capabilities and longer operational life spans, driving widespread adoption across diverse sectors such as automotive start-stop systems and renewable energy storage solutions.

Today, carbon black specialists collaborate closely with electrode manufacturers to co-develop formulations that balance electrical performance with mechanical robustness. These partnerships have propelled advancements in grid design, enabling higher active-material loading without compromising conductivity. Consequently, end-users benefit from improved state-of-charge retention under high-demand conditions, reinforcing carbon black’s central role in delivering reliable, cost-effective energy storage.

Exploring the Disruptive Technological and Market Transitions Reshaping Carbon Black Integration in Lead-Acid Battery Applications

Industrial electrification, renewable energy integration, and the proliferation of advanced telecommunication networks are reshaping the global energy storage landscape. As traditional flooded lead-acid batteries give way to dual-purpose valve-regulated lead-acid designs, the demand for carbon black grades that deliver both high conductivity and structural integrity has surged. This shift has prompted carbon black manufacturers to refine their production processes, investing in controlled furnace and thermal black technologies that enable precise control over surface chemistry and particle morphology.

Simultaneously, hybrid additive development is forging a new frontier in battery performance. By blending conductive and hybrid carbon black additives, innovators can tailor electrode porosity and optimize electrolyte infiltration. This hybrid approach enhances charge distribution across the active material, reducing localized overpotential and mitigating degradation pathways. Such transformative formulations are gaining traction in motive power and industrial applications where long cycle life and deep discharge tolerance are paramount.

Coupled with these material innovations, the industry is witnessing a strategic pivot towards circular economy principles. Manufacturers are exploring recycled carbon black streams and renewable feedstocks to reduce environmental footprints. This movement, aligned with global decarbonization goals, is driving collaborative research into post-consumer battery reclamation and closed-loop production systems. Ultimately, these technological and material shifts are redefining how stakeholders approach performance optimization, cost management, and sustainability within the lead-acid battery sector.

Assessing the Cumulative Consequences of 2025 United States Tariff Measures on Carbon Black Supply and Lead-Acid Battery Cost Structures

In January 2025, a 25% Section 301 tariff was implemented on non-lithium battery parts imported from China, directly affecting carbon black used in lead-acid battery electrodes. This tariff increase added substantial cost pressures for battery manufacturers reliant on Chinese feedstocks and finished carbon black products. In parallel, reciprocal tariffs on U.S. exports to China have altered the dynamics of global supply chains, prompting both suppliers and end-users to reassess sourcing strategies.

This layered tariff regime has translated into higher unit costs for carbon black, compelling manufacturers to evaluate alternative procurement channels from Asia-Pacific, Europe, and North America. While domestic producers have benefited from reduced competition, many lack the production capacity or the specialized grades essential for high-performance battery applications. Consequently, buyers are stocking safety inventories and renegotiating long-term contracts to mitigate the risk of supply shortages and abrupt price hikes.

Moreover, the effective tariff burden-comprising Section 301 duties, IEEPA levies, and reciprocal measures-has led to a recalibration of total landed costs. Some analyses suggest that the combined duties could increase the landed price of imported carbon black materials by up to 40% when including logistics and handling expenses. As a result, end-users in automotive, telecommunications, and industrial segments are exploring material substitutions, process optimizations, and collaborative initiatives with carbon black suppliers to manage cost escalations and maintain competitive battery pricing.

Uncovering In-Depth Segmentation Insights Revealing How Types, Functionalities, and Battery Applications Shape Carbon Black Utilization

Examining the market through the lens of granules, pellets, and powder forms reveals that each morphology serves distinct production processes and performance requirements. Granular carbon black, prized for its ease of handling, is often preferred in large-scale flooded battery manufacturing, whereas powder grades-characterized by ultra-fine particles-address the conductivity demands of sealed lead-acid systems. Pelleted carbon black occupies a middle ground, balancing flow properties with conductivity attributes for hybrid additive formulations.

When considering functionality, conductive additives continue to dominate traditional electrode designs, yet hybrid additives are emerging as a pivotal segment for applications requiring both enhanced electrical pathways and improved electrode densification. Within flooded and sealed lead-acid battery types, carbon black variants are selected based on their interaction with paste formulations, influencing factors such as paste thixotropy and curing behavior.

Differentiating natural and synthetic carbon black materials sheds light on sustainability considerations and performance trade-offs. Natural carbon black sourced from renewable feedstocks offers environmental benefits but often exhibits greater variability in ash content and surface area. In contrast, synthetic grades deliver tight specification control, enabling precise tuning of electrochemical properties in automotive starter batteries, industrial energy storage systems, and motive power applications ranging from aviation ground support to mining equipment.

Overlaying these material distinctions is a rich tapestry of end-use industry demand. Within the automotive sector, original equipment manufacturers prioritize high-conductivity grades that align with stringent performance benchmarks, while aftermarket producers emphasize cost-effective solutions. Telecommunications and utilities, especially in energy storage systems and uninterruptible power supplies, value long cycle life and material consistency, further guiding the evolution of carbon black formulations in the market.

This comprehensive research report categorizes the Carbon Black in Lead-acid Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Battery Type

- Battery Component

- Application

- Customer Type

- Sales Channel

Evaluating Regional Market Dynamics Across the Americas, Europe Middle East and Africa, and Asia-Pacific for Carbon Black in Lead-Acid Batteries

The Americas region, with its mature automotive and telecommunications sectors, represents a critical market for carbon black in lead-acid batteries. The United States, as a major importer of specialized carbon black grades, has experienced supply realignments post-tariff implementation, driving stronger domestic production capabilities and the formation of strategic alliances with regional suppliers.

In Europe, Middle East and Africa, environmental regulations and renewable energy integration propel the demand for sealed lead-acid and deep-cycle batteries, which in turn fuel the need for high-purity synthetic carbon black. Manufacturers in this region are investing in advanced furnace carbon black facilities to localize supply and reduce carbon footprints, aligning with stringent EU emissions targets and Middle Eastern energy storage mandates.

Asia-Pacific remains the largest production and consumption hub, led by China’s expansive battery manufacturing ecosystem. Despite tariffs, Chinese suppliers continue to serve both domestic and export markets, leveraging low-cost feedstocks and scale economies. Meanwhile, emerging markets such as India and Southeast Asia are witnessing increased industrial battery adoption, particularly in telecommunications towers and uninterruptible power supply installations, fostering new opportunities for both natural and synthetic carbon black producers.

This comprehensive research report examines key regions that drive the evolution of the Carbon Black in Lead-acid Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Competitive Landscapes and Key Company Profiles Driving Innovations in Carbon Black for Lead-Acid Batteries

Global carbon black leaders are intensifying R&D initiatives to develop next-generation conductive additives that meet evolving battery performance requirements. Birla Carbon, with its PureCel series, maintains a strong presence by optimizing low-ash grades tailored for deep-cycle and high-power applications. Orion Engineered Carbons leverages its PRINTEX® C portfolio to address the conductive pathways and durability needs of industrial and motive power batteries, positioning itself as a go-to partner for high-demand cycling conditions.

Cabot Corporation continues to advance furnace black technology, evident in its VULCAN® XC range, which delivers reduced internal resistance for starter batteries. Its joint ventures in Asia and North America enhance global footprint while supporting localized production of battery-grade carbon black. Imerys Carbon Black, recognized for thermal black solutions, focuses on ultra-high surface area materials that optimize charge-discharge kinetics, a critical factor for telecommunications and energy storage systems.

Regional suppliers, including China Synthetic Rubber Corporation and Black Cat Carbon Black, capitalize on cost efficiencies to serve burgeoning domestic markets. Philips Carbon Black has committed to sustainable production practices and expanded capacity to address Africa and Middle East energy storage demands. Collectively, these key companies are shaping market direction through strategic capacity expansions, product innovation, and partnerships that bridge supply-demand gaps in a tariff-impacted environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Black in Lead-acid Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Group

- Beilum Carbon Chemical Limited

- Black Bear Carbon B.V.

- Cabot Corporation

- Denka Company Limited

- Evonik Industries AG

- Himadri Specialty Chemical Ltd.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Imerys S.A.

- Linyuan Advanced Materials Technology Co.,Ltd.

- Mitsubishi Chemical Group Corporation

- Ningxia Yuanda Xingbo Chemical Co., Ltd.

- OCI COMPANY Ltd.

- Omsk Carbon Group

- Orion S.A.

- PCBL Limited

- SGL Carbon SE

- Soltex, Inc.

- Tokai Carbon Co., Ltd.

Actionable Strategic Guides for Industry Leaders to Navigate Supply Chain Challenges and Leverage Carbon Black Advancements Effectively

Industry leaders should prioritize diversification of sourcing channels by integrating regional suppliers into their procurement strategies. Establishing dual-sourcing agreements, particularly in North America and Europe, can mitigate risks posed by concentrated supply from Asia-Pacific and fluctuating tariff landscapes. Investing in collaborative product development with carbon black manufacturers will accelerate the introduction of optimized additives tailored to next-generation battery chemistries.

Adopting value engineering approaches-such as evaluating hybrid additive blends-enables manufacturers to balance performance gains with cost control. By conducting joint cost-benefit analyses with suppliers, stakeholders can identify formulation adjustments that reduce material usage without compromising conductivity or cycle life. Additionally, exploring recycled carbon black streams through circular economy initiatives can provide both environmental and economic benefits, aligning with corporate sustainability targets.

Finally, engaging proactively with policy makers and trade bodies will ensure timely visibility into potential tariff revisions and import regulations. Companies that allocate resources to monitor trade developments can anticipate duty shifts and secure critical supply through early negotiations or exclusion requests. A structured risk management framework, integrating scenario planning for tariff outcomes, will empower decision-makers to respond swiftly to policy changes and maintain uninterrupted production.

Detailing a Rigorous Research Methodology Integrating Primary and Secondary Data to Ensure Credible Carbon Black Market Insights

This research integrated both primary insights and authoritative secondary sources to construct a robust market analysis framework. Primary data was collected through structured interviews with senior executives from carbon black producers, battery manufacturers, and supply chain experts. These qualitative inputs provided nuanced perspectives on formulation trends, supply chain constraints, and technology roadmaps.

Secondary research encompassed a deep review of industry publications, trade associations, government trade bulletins, and corporate filings. Detailed analysis of tariff schedules, such as the January 2025 Section 301 updates and reciprocal duties, was performed to quantify regulatory impacts on material costs. Publications from legal and consultancy firms were also examined to validate the timing and scope of duty implementations.

The study employed a triangulation methodology to reconcile primary interview findings with secondary data points, ensuring consistency and credibility. Key assumptions were stress-tested through scenario analysis to gauge the sensitivity of cost structures to tariff variations. Finally, all findings were reviewed and endorsed by an external advisory board comprising battery technologists and trade policy specialists, guaranteeing the integrity and relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Black in Lead-acid Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Black in Lead-acid Battery Market, by Product Type

- Carbon Black in Lead-acid Battery Market, by Form

- Carbon Black in Lead-acid Battery Market, by Battery Type

- Carbon Black in Lead-acid Battery Market, by Battery Component

- Carbon Black in Lead-acid Battery Market, by Application

- Carbon Black in Lead-acid Battery Market, by Customer Type

- Carbon Black in Lead-acid Battery Market, by Sales Channel

- Carbon Black in Lead-acid Battery Market, by Region

- Carbon Black in Lead-acid Battery Market, by Group

- Carbon Black in Lead-acid Battery Market, by Country

- United States Carbon Black in Lead-acid Battery Market

- China Carbon Black in Lead-acid Battery Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Takeaways and Forward-Looking Considerations for Stakeholders in the Carbon Black Lead-Acid Battery Ecosystem

Across the analysis, carbon black emerges as a pivotal material driving performance enhancements and durability in lead-acid batteries. Technological innovations-from hybrid additive blends to sustainable feedstock sourcing-are transforming traditional supply chains and material formulations. While tariff-induced cost pressures have prompted strategic shifts in sourcing and inventory management, the industry’s adaptive capacity underscores its resilience.

Key segmentation insights illuminate how particle morphology, functionality, battery design, and end-use application converge to shape material preferences. Regionally, each market exhibits distinct drivers: the Americas prioritize automotive start-stop systems, Europe, Middle East and Africa focus on renewable integration, and Asia-Pacific leads production and emerging industrial demand. Leading producers such as Birla Carbon, Orion, and Cabot are at the forefront of R&D and capacity expansion, navigating both performance imperatives and regulatory landscapes.

Collectively, this executive summary highlights the interconnected nature of technological, regulatory, and market forces shaping the future of carbon black in lead-acid batteries. Stakeholders equipped with these insights can make informed strategic decisions to optimize performance, manage costs, and capitalize on emerging opportunities within a dynamic global environment.

Encouraging Engagement with Associate Director of Sales Marketing Ketan Rohom to Secure Comprehensive Carbon Black Market Research Insights

Engaging directly with Ketan Rohom as the Associate Director of Sales & Marketing at 360iResearch ensures you gain unparalleled access to the comprehensive carbon black in lead-acid battery market research report. His expertise in articulating the report’s strategic value will guide you through the insights most relevant to your organization’s objectives, from supply chain optimization to competitive intelligence. By partnering with him, you can customize the report’s delivery format, obtain additional data appendices, and secure priority briefings on emerging industry developments.

Contacting Ketan unlocks a consultative experience where you can explore tailored solutions such as executive summary sessions, data dashboards, and bespoke analysis workshops. His proven track record in client engagement means you will receive timely updates on critical market shifts, ensuring your decision-making remains agile in the face of dynamic tariff landscapes and evolving battery technologies. Reach out to Ketan today to transform high-level market intelligence into actionable strategies that drive growth and innovation within your organization.

- How big is the Carbon Black in Lead-acid Battery Market?

- What is the Carbon Black in Lead-acid Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?