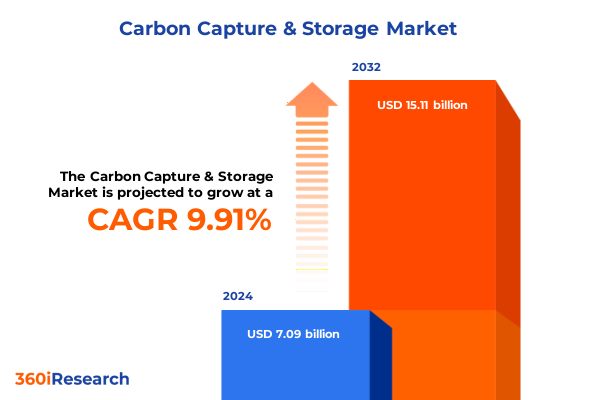

The Carbon Capture & Storage Market size was estimated at USD 7.73 billion in 2025 and expected to reach USD 8.43 billion in 2026, at a CAGR of 10.05% to reach USD 15.11 billion by 2032.

Navigating the Urgency and Potential of Carbon Capture and Storage Amid Intensifying Climate Commitments and Technological Advancements

As global greenhouse gas concentrations continue to intensify, the imperative to deploy carbon capture and storage solutions has never been more acute. The latest data from the International Energy Agency indicates that operational carbon capture and storage capacity surpassed 50 million tonnes of carbon dioxide in the first quarter of 2025, underscoring tangible progress in mitigating industrial emissions toward net-zero objectives. Meanwhile, the project pipeline suggests a potential expansion to capture capacity of approximately 430 million tonnes annually by 2030, reflecting a concerted effort across multiple regions to harness CCS as a critical climate strategy. These developments are complemented by a geographically diversified project base spanning over 50 countries, which illustrates the global recognition of CCS as essential for decarbonizing hard-to-abate sectors.

Beyond volume metrics, the momentum behind CCS deployment is propelled by a confluence of technological innovation and policy facilitation. Advanced capture methodologies such as oxyfuel combustion, along with emerging supercritical carbon dioxide power cycles, are driving down per-ton costs and enabling integration across power, industrial, and marine applications. Parallel to these technical strides, corporate commitments have surged, with industry titans advocating for stable regulatory frameworks and consistent incentives to sustain project economics and long-term investment horizons. Together, these dynamics establish a foundation upon which decision-makers can chart a roadmap for scalable carbon management solutions.

Accelerating Carbon Capture Breakthroughs and Policy Shifts Reshaping the Landscape of Emission Mitigation Technologies and Infrastructure Investments

Regulatory shifts and policy reversals in recent months have fundamentally altered the trajectory of carbon capture and storage initiatives. The issuance of the “Unleashing American Energy” Executive Order in January 2025 paused disbursements from key federal climate funds and removed social cost of carbon considerations from permitting decisions, setting the stage for a more contested policy environment. In contrast, tax credits established under prior legislation remain intact, creating a complex matrix of incentives and regulatory constraints that stakeholders must navigate to secure funding and project approvals.

Technological breakthroughs across sectors are reshaping expectations for CCS scalability. Enterprises are exploring novel Allam cycle power plants under demonstration, cross-border shipping terminals pioneered by Northern Lights deliver proof of concept for transnational storage logistics, and data center operators are investing in carbon removal ventures to offset residual emissions in high-intensity computing applications. These developments signal a broader shift toward integrated capture, transport, and storage networks capable of supporting diverse industrial and commercial use cases.

Assessing the Layered Repercussions of Recent United States Tariffs on Carbon Capture Technologies and Supply Chains in 2025

The imposition of sweeping tariff measures in early 2025 on imported energy and industrial equipment has introduced elevated costs for critical CCS system components, including membranes, compressors, and specialized steel alloys. These higher capital expenditures have prompted project developers to reevaluate supply chain strategies, explore domestic manufacturing alternatives, and adjust project timelines to accommodate new cost structures and regulatory compliance requirements.

Beyond immediate cost impacts, reciprocal trade tensions and policy uncertainty have dampened investor confidence, evidenced by a record volume of project cancellations in the first quarter of 2025 exceeding levels seen throughout 2024. The resulting slowdown in financing announcements and final investment decisions underscores the critical importance of coherent trade and regulatory frameworks to underpin continued momentum in CCS deployment.

Decoding Dynamic Segmentation Trends Highlighting Service, Technology, and End-Use Industry Perspectives Within the Carbon Capture Evolution

When examining the market through the lens of service offerings, distinct areas such as capture, monitoring, storage, and transport emerge as integral components of the CCS value chain. Capture services, serving as the initial extraction point for carbon from industrial streams, currently account for the majority of investment focus, while monitoring activities ensure the integrity and environmental safety of storage sites, and transportation modalities link capture hubs to subsurface reservoirs. Storage operations, often the final and most capital-intensive phase, require meticulous geological assessments to ensure long-term containment.

A complementary perspective arises by considering the underlying capture technologies. Approaches including oxy-fuel combustion, post-combustion capture, and pre-combustion frameworks each present unique operational profiles in terms of energy penalty, integration complexity, and retrofit potential. These technical distinctions dictate optimal deployment scenarios across existing facilities and new builds, guiding strategic decisions on technology adoption.

Finally, casting the segmentation in terms of end-use industry further illuminates demand dynamics. Hard-to-abate sectors such as cement, chemicals and petrochemicals, iron and steel, oil and gas, and power generation each present varying emission intensities and opportunities for carbon management. Cement operations, for instance, benefit from process-embedded capture solutions, while petrochemical complexes leverage integration synergies with existing molecular separation systems. Iron and steel producers are increasingly piloting capture modules to curtail furnace emissions, and oil and gas platforms are exploring offshore storage. Meanwhile, power generation continues to demonstrate relevance as both a major emitter and a critical application for post-combustion retrofits.

This comprehensive research report categorizes the Carbon Capture & Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Technology

- End-Use Industry

- Storage Formation

Comparative Regional Synergies and Challenges Across Americas, Europe Middle East Africa, and Asia Pacific in Advancing Carbon Capture Deployment

In the Americas, policy incentives and extensive geological storage sites have positioned the region as a leader in CCS deployment. Significant federal and state grants have underpinned pilot and demonstration projects, while private sector investments in capture plants adjacent to major refining and petrochemical complexes underscore a commitment to decarbonization. Corporate venture strategies align with government funding priorities, creating a synergistic landscape for project development.

Across Europe, the Middle East, and Africa, governmental collaborations and ambitious carbon pricing frameworks are accelerating CCS infrastructure build-out. Norway’s Northern Lights facility epitomizes pan-European cooperation by aggregating CO₂ from multiple industrial sources and channeling it through dedicated maritime routes to subsea storage beneath the North Sea, establishing a blueprint for shared cross-border storage hubs. Simultaneously, regulatory incentives across the UK and the EU have spurred feasibility studies in industrial clusters, even as budget review processes introduce measured pace to project approvals.

In the Asia-Pacific region, expanding capture capacity has emerged as a strategic priority in both developed and emerging economies. China alone commissioned four new CO₂ capture facilities in 2023, reflecting aggressive national decarbonization targets, and by 2030 regional capacity ambitions aim to reach tens of millions of tonnes per year. Middle Eastern energy producers are likewise integrating capture units into gas processing plants, seeking to leverage existing infrastructure for storage in geological formations.

This comprehensive research report examines key regions that drive the evolution of the Carbon Capture & Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Driving Innovation in Carbon Capture and Storage From Majors to Technology Developers and Emerging Collaborations

A consortium of energy majors and oilfield service entities has taken a leading role in scaling up CCS deployments. Equinor, Shell, and TotalEnergies have collectively established cross-border logistics and storage solutions, exemplified by Northern Lights, while ExxonMobil continues to refine capture techniques in partnership with research institutions to enhance energy efficiency and cost performance. These global players leverage deep technical expertise and capital resources to de-risk large-scale projects and set performance benchmarks for the industry.

Technology developers and industrial innovators are complementing this landscape by introducing modular capture units and novel sorbent materials. Start-ups and established equipment manufacturers alike are advancing all-in-one carbon capture modules capable of rapid deployment on power plants and industrial sites, while companies such as Wärtsilä have unveiled marine-grade systems for vessel exhaust capture, underscoring diversification of applications. Simultaneously, leading technology firms from the data center sector are financing bespoke CCS projects to ensure sustainable growth of high-density computing facilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Capture & Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ArcelorMittal S.A.

- Baker Hughes Company

- Carbfix hf.

- Carbon Clean Solutions Limited

- Carbon Engineering Ltd. by Oxy Low Carbon Ventures, LLC

- Chevron Corporation

- Climeworks AG

- COWI A/S

- Eaton Corporation plc

- Exxon Mobil Corporation

- Fluor Corporation

- GE Vernova Group

- Halliburton Energy Services, Inc.

- Hitachi, Ltd.

- Honeywell International Inc.

- Japan Petroleum Exploration Co., Ltd.

- LanzaTech, Inc.

- Linde PLC

- MAN Energy Solutions SE by Volkswagen AG

- Mitsubishi Heavy Industries, Ltd.

- PTT Exploration and Production Public Company Limited.

- SAIPEM SpA

- Santos Ltd.

- Saudi Arabian Oil Company

- Schlumberger Limited

- Shell PLC

- Siemens AG

- Technip Energies N.V.

- The EPCM Group

- TotalEnergies SE

Strategic Recommendations for Executive Leaders to Enhance Carbon Capture Adoption, Optimize Value Chains, and Secure Regulatory and Market Advantages

Executive leaders should prioritize the development of domestic supply chains for critical capture and compression equipment to mitigate exposure to tariff-induced cost escalations. By fostering partnerships with national manufacturing consortia and leveraging incentive programs for localized production, organizations can secure resilient sourcing channels while driving innovation in component design.

To capitalize on technological advancements, industry stakeholders must engage in collaborative demonstration projects that accelerate validation of emerging capture technologies under real-world operational conditions. Targeted pilot initiatives, combined with performance data sharing platforms, can reduce deployment risk and inform scalable implementation strategies.

In the policy sphere, companies are advised to maintain proactive dialogue with regulatory bodies to advocate for stable incentive mechanisms and streamlined permitting processes. Clear policy signaling-particularly regarding tax credits, carbon pricing, and environmental baselines-will be essential to sustain investor confidence and mobilize long-term capital commitments for CCS ventures.

Unveiling the Rigorous Methodological Framework Underpinning Insights in Carbon Capture Market Research and Analytical Rigor

This research synthesis is grounded in a robust combination of primary and secondary data collection. Primary inputs include in-depth interviews with industry executives, technology providers, and policy experts, ensuring insights reflect real-time market dynamics and stakeholder priorities.

Secondary analysis encompassed a systematic review of publicly available policy documents, technical white papers, and proprietary patent databases, enabling a comprehensive mapping of technological innovation trajectories and policy frameworks across jurisdictions.

Quantitative modeling leveraged scenario analysis techniques to assess the interplay between capital expenditure trends, regulatory incentive structures, and technology adoption rates, while qualitative cross-validation through expert panels ensured analytical rigor and relevance for strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Capture & Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Capture & Storage Market, by Service

- Carbon Capture & Storage Market, by Technology

- Carbon Capture & Storage Market, by End-Use Industry

- Carbon Capture & Storage Market, by Storage Formation

- Carbon Capture & Storage Market, by Region

- Carbon Capture & Storage Market, by Group

- Carbon Capture & Storage Market, by Country

- United States Carbon Capture & Storage Market

- China Carbon Capture & Storage Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Takeaways Emphasizing Collaboration, Technology Integration, and Policy Cohesion for the Future of Carbon Capture and Storage

In sum, the carbon capture and storage sector is poised at a pivotal inflection point, where technological maturation, evolving policy landscapes, and strategic industry collaborations converge to unlock decarbonization potential within hard-to-abate industries. Sustained progress hinges on the orchestration of stable incentives, targeted infrastructure investments, and cross-sector partnerships.

As global ambitions to achieve net-zero emissions intensify, CCS must be embedded within broader climate-action roadmaps-fortified by transparent governance, knowledge exchange, and adaptive innovation frameworks that balance environmental goals with economic viability.

With insights from transformative breakthroughs and cumulative policy impacts, organizations are better equipped to navigate the complexities of CCS deployment and drive meaningful progress toward a low-carbon future.

Engaging with Ketan Rohom to Secure Comprehensive Carbon Capture Research Insights and Propel Informed Investment and Strategic Decision Making

For access to the full-scale market research report and to explore tailored advisory services, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through detailed analyses, bespoke data insights, and strategic consultation to support your organization’s carbon capture initiatives and investment decisions.

- How big is the Carbon Capture & Storage Market?

- What is the Carbon Capture & Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?