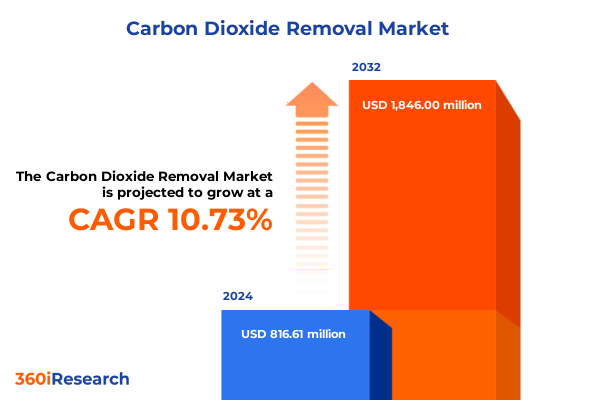

The Carbon Dioxide Removal Market size was estimated at USD 897.54 million in 2025 and expected to reach USD 988.73 million in 2026, at a CAGR of 10.85% to reach USD 1,846.00 million by 2032.

Setting the Stage for Carbon Dioxide Removal Strategies Amid Accelerating Climate Change and Intensifying Global Mitigation Imperatives

The accelerating pace of global climate imperatives demands a comprehensive and strategic response to carbon dioxide removal. In recent years, stakeholders from governments, corporations, and research institutions have elevated the discourse around engineered and nature-based solutions, recognizing that reducing emissions alone will not suffice. This report sets out to establish a foundational understanding of the key forces shaping the carbon dioxide removal landscape today, from policy catalysts to technological milestones.

Unveiling the Transformative Technological, Policy and Market Shifts Driving the Carbon Dioxide Removal Sector into a New Era of Innovation

Across the past decade, the carbon removal sector has evolved from experimental pilot projects to strategic components of national decarbonization roadmaps. Catalysts such as the Inflation Reduction Act, successive net-zero pledges, and mounting corporate commitments have fueled investment flows and policy attention. Simultaneously, technological innovations have crossed critical thresholds-enhanced weathering techniques have moved from laboratory demonstrations to outdoor field pilots, while direct air capture systems have scaled tenfold in capacity. These shifts have not only broadened the suite of viable removal pathways but have also accelerated commercial-scale deployment in strategic regions.

Concurrently, market structures are transforming. Carbon credit markets have matured, with voluntary standards increasingly integrating permanence and verification requirements. Regulatory landscapes are also tightening; carbon intensity tariffs and border carbon adjustments are compelling multinational supply chains to reassess sourcing strategies. In parallel, funding models have diversified beyond traditional venture capital, encompassing public–private partnerships and corporate investment vehicles. Taken together, these transformative shifts underscore the sector’s transition from niche experimentation to a burgeoning industry critical for meeting long-term climate goals.

Examining the Ripple Effects of 2025 United States Tariff Policies on Carbon Dioxide Removal Technology Adoption and International Supply Chains

In 2025, the United States introduced landmark tariff measures designed to align trade policy with carbon intensity objectives. The Foreign Pollution Fee Act, reintroduced in April, proposes fees on imports calibrated to embodied emissions, effectively raising the cost of carbon-intensive products and incentivizing low-emission manufacturing practices abroad. In parallel, Section 232 proclamations reinstated and expanded tariffs on steel and aluminum, heightening input costs for equipment manufacturers and prompting supply chain realignments. These measures collectively alter the economic calculus for carbon dioxide removal technologies that rely on specialized steel, rare minerals, and electrochemical components.

As a result, domestic manufacturing of capture equipment has surged, driven by a push to mitigate exposure to import levies and safeguard technology transfer. Analyses from independent institutions highlight a short-term risk of supply constraints and cost inflation, particularly for nascent direct air capture offerings and mineralization systems. However, in the medium term, this shift is expected to underpin a robust domestic ecosystem of component production, research and development facilities, and service providers, ultimately strengthening resilience and fostering innovation.

Internationally, U.S. tariff policies have catalyzed strategic realignments among key trading partners. Countries in Europe and Asia are exploring reciprocal measures and supply diversification strategies to maintain competitiveness in carbon removal exports. This dynamic interplay between trade policy and clean technology diffusion underscores the critical need for industry leaders to anticipate tariff trajectories and integrate procurement strategies that are resilient to evolving trade frameworks.

Deep Dive into Carbon Dioxide Removal Market Segmentation: Technology Types, Project Models, End Use Sectors, Deployment Scales, and Funding Structures Revealed

A multifaceted segmentation framework reveals the nuanced contours of the carbon dioxide removal market, guiding strategic decision-making across verticals. When viewed through the lens of technology type, the landscape extends from natural regeneration and afforestation initiatives to advanced mineral carbonation and ocean alkalinity enhancement approaches; each subcategory is defined by distinct resource requirements, lifecycle profiles, and deployment challenges. Project typologies further delineate trajectories, contrasting nature-based solutions like forest-based and blue carbon efforts with industrial-scale systems encompassing cryogenic separation, liquid solvent capture, and electrochemical extraction.

Exploring end use sectors uncovers the interdependencies between removal demand and hard-to-abate industries. Fabrication in the automotive, chemical, energy and power, and oil and gas sectors drives targeted demand for specialized removal credits and bespoke sequestration services. Deployment scale introduces additional complexity, as utility-scale hubs leverage integrated carbon transport networks, while pilot-scale sites prioritize rapid iteration and cost optimization. Lastly, funding models span public–private partnerships, corporate investment vehicles, and venture capital instruments, each reflecting unique risk appetites and return horizons. Together, these segmentation lenses illuminate the strategic pathways through which removal solutions can advance from concept to commercial reality.

This comprehensive research report categorizes the Carbon Dioxide Removal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Storage Method

- Application

- End-Use Industry

Analyzing Regional Dynamics in Carbon Dioxide Removal Adoption Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics exert a profound influence on the pace and character of carbon dioxide removal deployment. In the Americas, robust policy incentives and recent permitting milestones for large-scale storage hubs have positioned the region as a crucible for direct air capture and sequestration, even as debates persist around permitting timelines and community engagement. Moving eastward, Europe, the Middle East, and Africa exhibit a mosaic of regulatory approaches: the European Union’s pioneering carbon border adjustment mechanism spurs inward investment, while Gulf nations channel sovereign wealth into pilot projects that marry desalination co-benefits with mineralization pathways. Meanwhile, Africa is witnessing nascent coastal alkalinity projects focused on mangrove and seagrass restoration as blue carbon solutions.

In the Asia-Pacific, a confluence of industrial decarbonization imperatives and renewable energy surpluses is fostering the growth of enhanced weathering and ocean-based removal pilots. National research programs in Australia and Japan are accelerating olivine dissolution studies, while Southeast Asian nations explore public–private partnerships for soil carbon enhancement in rice paddies. Across all regions, the articulation of carbon removal within national climate strategies continues to evolve, reinforcing the criticality of regional nuance when designing deployment roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Carbon Dioxide Removal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Players Spearheading Carbon Dioxide Removal Solutions with Cutting Edge Approaches and Strategic Collaborations

A number of pioneering organizations have emerged at the forefront of the carbon dioxide removal arena, each charting distinct pathways toward scalability. One of the most visible is a Swiss direct air capture specialist whose flagship facilities in Iceland have demonstrated tenfold capacity growth, even as operational underperformance has prompted workforce realignment and technology recalibration. This entity’s strategic pivot to a multi-million-ton hub in the southern United States underscores the importance of renewable energy synergies and robust supply chain partnerships in driving cost reductions and performance gains.

On the industrial front, a leading energy company has integrated direct air capture through its acquisition of a Canadian innovator, rapidly advancing front-end engineering studies for multi-hundred-kiloton facilities and securing the first Class VI injection permits in key Permian Basin sequestration hubs. Complementing these efforts, mineralization ventures in the coastal zone are scaling ocean alkalinity pilots, deploying olivine sands along shoreline restoration projects to harness natural weathering processes while reinforcing coastal resilience. Meanwhile, agronomic carbon startups are pioneering biochar amendments and cover cropping initiatives in collaboration with multinational agricultural conglomerates, signaling the integration of removal practices into traditional land management.

These market leaders exemplify the symbiosis of technology innovation, strategic partnerships, and policy alignment that will define the next chapter of carbon removal deployment. Their trajectories offer instructive case studies for investors, policymakers, and corporate procurement teams seeking to navigate an increasingly complex ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Dioxide Removal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- "Global Thermostat by Zero Carbon Systems

- 1PointFive Inc.

- AirCapture LLC

- Arca Climate

- Blue Planet Systems

- Captura Corporation

- Carbfix hf.

- CarbiCrete

- Carbofex Oy

- Carbon Clean Solutions Limited.

- Carbon Engineering Ltd.

- CarbonBuilt, Inc.

- CarbonCure Technologies Inc.

- Cella Mineral Storage Inc.

- Charm Industrial, Inc.

- Climeworks AG

- Ebb Carbon, Inc.

- Eion Corp.

- Heimdal Inc.

- Heirloom Carbon Technologies, Inc.

- Inplanet GmbH

- Lithos Carbon Inc.

- Living Carbon PBC

- neustark AG

- Novocarbo GmbH

- Noya Inc.

- Pacific Biochar Benefit Corporation

- Parallel Carbon Inc.

- Planetary Technologies, Inc.

- Prometheus Fuels

- RepAir Carbon Inc.

- Silicate Limited

- Skytree

- Sustaera Inc.

- Verdox, Inc.

- Wakefield BioChar

Strategic Recommendations for Industry Leaders to Accelerate Carbon Dioxide Removal Deployment, Foster Partnerships, and Navigate Regulatory Landscapes

Industry leaders stand at a pivotal crossroads. To capitalize on evolving policy incentives and competitive pressures, organizations must architect integrated strategies that span the entire carbon removal value chain. First, aligning research-and-development roadmaps with public funding programs can accelerate pilot-to-commercial transitions. This means co-designing projects with government agencies and securing early-stage grants to de-risk technology scale-up. Second, forging cross-sector alliances-linking capture innovators with renewables providers, midstream operators, and agricultural enterprises-will be essential for optimizing energy inputs and streamlining logistics. Third, embedding removal solutions into corporate procurement frameworks through long-term offtake agreements can stabilize revenue streams and spur capital inflows.

Simultaneously, decision-makers must proactively engage with regulatory bodies to shape permitting regimes and tariff structures. By participating in policy consultations and consortiums, industry players can advocate for transparent crediting standards and science-based accounting principles. Moreover, investing in community engagement and environmental impact monitoring will build social license and unlock access to regional permitting processes. Lastly, organizations should institutionalize dynamic risk management protocols to anticipate tariff shifts and supply chain disruptions, leveraging scenario analyses and hedging strategies to preserve project economics.

Through these targeted actions, leaders can transform regulatory complexity into a strategic advantage, ensuring that carbon dioxide removal not only complements emissions reductions but also emerges as a resilient growth engine.

Transparent Outline of Research Methodology Employed to Ensure Robust Analysis, Comprehensive Data Collection, and Reliable Insights in Carbon Dioxide Removal Assessment

This analysis draws upon a multi-tiered research methodology designed to capture both breadth and depth in the carbon dioxide removal domain. Initial scoping involved an exhaustive review of peer-reviewed journals, government publications, and credible news outlets to map prevailing technology trends, policy developments, and trade actions. Concurrently, proprietary databases provided historical permitting and investment lineage, enabling the identification of key inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Dioxide Removal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Dioxide Removal Market, by Technology Type

- Carbon Dioxide Removal Market, by Storage Method

- Carbon Dioxide Removal Market, by Application

- Carbon Dioxide Removal Market, by End-Use Industry

- Carbon Dioxide Removal Market, by Region

- Carbon Dioxide Removal Market, by Group

- Carbon Dioxide Removal Market, by Country

- United States Carbon Dioxide Removal Market

- China Carbon Dioxide Removal Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesis of Critical Findings Highlighting the Urgency and Potential of Carbon Dioxide Removal Initiatives in Advancing Global Climate Goals and Sustainable Futures

As the urgency of the climate crisis intensifies, carbon dioxide removal has evolved from a conceptual sidebar to an indispensable complement to emissions mitigation efforts. Through the lens of technological maturation, shifting policy landscapes, and evolving market structures, this report has illuminated both the challenges and opportunities that lie ahead. From tariff-driven supply chain realignments to regional hubs harnessing nature-based pathways, the collective narrative underscores the sector’s dynamism and its central role in achieving net-zero targets.

Looking forward, the imperative is clear: stakeholders must collaborate across public, private, and research sectors to foster an ecosystem that rewards permanence, scalability, and transparency. Only by integrating strategic investment, thoughtful policy design, and rigorous community engagement can carbon dioxide removal deliver on its promise as a critical lever in the global climate strategy.

Unlock Cutting-Edge Carbon Dioxide Removal Market Intelligence with an Exclusive Call to Action to Engage Ketan Rohom, Associate Director of Sales & Marketing

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at our research firm, opens the door to a transformative opportunity to deepen your strategic understanding of the carbon dioxide removal market. Our comprehensive report delivers an unparalleled analysis of technological breakthroughs, policy developments, and market dynamics, equipping you with the insights required to guide investment decisions, shape corporate sustainability agendas, and navigate emerging supply chain challenges. By securing this report, you gain access to exclusive data on segmentation trends, a rigorous tariff impact assessment, and expert-led case studies that highlight success stories and pitfalls across regions and technologies. The report also outlines actionable recommendations tailored for executive leadership, ensuring that you can translate intelligence into measurable progress. To initiate the acquisition process and explore customized licensing options, connect with Ketan Rohom, whose expertise in aligning market intelligence with client needs will ensure you receive the right level of support. Reach out today to elevate your strategic position in the carbon dioxide removal arena and drive meaningful impact for both your enterprise and the broader climate agenda.

- How big is the Carbon Dioxide Removal Market?

- What is the Carbon Dioxide Removal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?