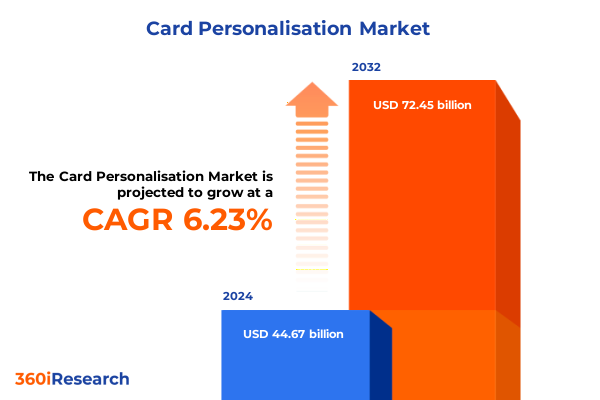

The Card Personalisation Market size was estimated at USD 47.34 billion in 2025 and expected to reach USD 50.19 billion in 2026, at a CAGR of 6.26% to reach USD 72.45 billion by 2032.

Unveiling the Evolving Landscape of Card Personalization as Digital Transformation and Security Imperatives Drive Payment Industry Innovation

The card personalization market stands at the intersection of rigorous security demands and rapid digital transformation, shaping a new paradigm in payment solutions. As end users and financial institutions seek more secure, durable, and visually engaging cards, providers are accelerating their adoption of embedded chip technologies, secure printing methods, and integrated data analytics. This shift reflects a broader industry movement toward seamless, contactless experiences driven by consumer expectations for mobility, convenience, and fraud protection.

Against a backdrop of evolving regulatory frameworks and heightened awareness around data security, banks and card issuers are investing heavily in personalization platforms that enable real-time card issuance, dynamic design customization, and advanced authentication features. Meanwhile, technological advances such as cloud-based services and the Internet of Things (IoT) facilitate greater interoperability between card production lines and enterprise systems. Consequently, collaboration between card manufacturers, technology vendors, and service providers has intensified, laying the groundwork for a more agile, responsive market. As a result, the sector is poised for transformative growth, with key stakeholders focusing on innovation, compliance, and customer-centricity.

Navigating Transformative Shifts Fueled by Advanced Technologies and Regulatory Changes Revolutionizing Card Personalization Processes and Practices

In recent years, technological breakthroughs and regulatory shifts have converged to redefine card personalization processes and value chains. The integration of artificial intelligence (AI) and machine learning into personalization platforms now enables predictive analytics, which optimize print workloads and anticipate cardholder behavior. Concurrently, the proliferation of advanced printing technologies-ranging from high-resolution digital embossing to precision laser engraving-has raised production quality and security thresholds while streamlining operational workflows.

On the regulatory front, global mandates such as the European Payment Services Directive (PSD2) and EMV migration timelines have compelled issuers and manufacturers to bolster authentication mechanisms and align personalization standards. Similarly, sustainability considerations are prompting players to explore eco-friendly materials and low-energy printing processes that reduce carbon footprints without compromising card longevity. Transitional partnerships between hardware suppliers and software developers are emerging to address these multifaceted demands, resulting in cohesive solutions that merge robust security with an enhanced user experience. Consequently, the market is witnessing a rapid evolution toward end-to-end personalization ecosystems that offer flexibility, compliance, and scalability.

Analyzing the Cumulative Impact of the 2025 United States Tariffs on Card Personalization Supply Chains Costs and Strategic Sourcing Approaches

The tariff landscape in the United States has undergone significant changes in 2025, exerting upward pressure on costs for components vital to card personalization operations. Notably, a new Section 232 investigation into semiconductor and related equipment imports has introduced fresh levies that may reach double-digit rates by early 2026, creating uncertainty for card manufacturers reliant on high-precision chips and controllers. Furthermore, effective January 2025, tariff rates on critical electronic components, including integrated circuits and diodes, have doubled from 25 percent to 50 percent, tightening margins and prompting supply chain reconsiderations among industry stakeholders.

In addition to broad electronics duties, the U.S. Trade Representative’s February 2025 tranche of Section 301 tariffs escalated import duties to 35 percent on select microcontrollers and memory chips sourced from China. This targeted measure underscores the administration’s dual strategy of reinforcing domestic semiconductor capacity while curbing reliance on foreign production. As a result, card personalization providers are evaluating nearshore sourcing and strategic inventory management to mitigate lead‐time volatility. The cumulative effect of these tariffs is a recalibration of procurement models, with an emphasis on supplier diversification, cost pass‐through mechanisms, and technology substitutions to sustain operational continuity.

Deriving Strategic Segmentation Insights by Examining End User Verticals Channels Services Card Types and Printing Technologies

Diving into market segmentation reveals differentiated dynamics across end user verticals, channels, services, card types, and personalization technologies. Within the banking and financial sphere, large institutions are prioritizing integrated chip-and-PIN solutions for mass issuance, while smaller banks focus on modular thermal printing to balance cost and functionality. Corporate clients are adopting on-site personalization to rapidly deploy employee and access cards, whereas government entities emphasize stringent verification processes coupled with secure off-site production models to safeguard public programs.

Retailers leverage a blend of hardware, services, and software offerings to support branded gift and loyalty cards, with software suites enabling real-time design updates and consumer analytics. Credit card issuers demand multi-layer personalization, combining digital embossing with laser engraving for enhanced durability and brand differentiation. Meanwhile, debit and prepaid card providers gravitate toward high-throughput thermal printing systems for on-demand issuance, reflecting an emphasis on convenience and cost efficiency. Across personalization technologies, digital embossing leads in high-security contexts, inkjet printing offers rapid prototyping, and heat-free laser engraving secures tamper-resistant designs. This nuanced segmentation underscores the importance of tailored solutions that align with end user requirements, channel preferences, and technology capabilities.

This comprehensive research report categorizes the Card Personalisation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User

- Channel

- Service

- Card Type

- Technology

Uncovering Key Regional Insights Highlighting Market Drivers and Adoption Variances Across Americas EMEA and Asia-Pacific Territories

Regional analysis uncovers distinct drivers and maturity curves across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, robust digital infrastructure and early adoption of EMV standards have catalyzed the shift toward contactless personalization and secure chip integration. The United States continues to lead in on-demand issuance models, while Canada and Brazil show growing interest in dual-interface cards for transit and retail applications.

In Europe, Middle East & Africa, regulatory frameworks such as GDPR and PSD2 are steering personalization providers toward enhanced data protection and interoperability. Germany and France exemplify advanced EMV rollouts, whereas Middle Eastern markets are exploring multifunctional government ID programs that combine personalization with credential management. In Africa, expanding financial inclusion initiatives are driving growth in prepaid and micro-ATM card solutions.

Asia-Pacific exhibits the highest growth momentum, fueled by rapid e-commerce expansion and digital wallet integrations in China, India, and Southeast Asia. Local card personalization centers are scaling to meet fluctuating demand for gift, prepaid, and transit cards, while Australia and Japan prioritize smart card security and adherence to global EMV frameworks. Collectively, these regional dynamics illustrate the imperative for market participants to tailor their offerings to diverse regulatory environments, technological ecosystems, and end-user preferences.

This comprehensive research report examines key regions that drive the evolution of the Card Personalisation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Competitive Landscape with Key Company Initiatives Partnerships and Technology Roadmaps in Card Personalization Domain

Major industry players continue to drive innovation through strategic alliances, product diversification, and technology roadmaps. HID Global’s recent partnership with a leading chip manufacturer enhances its scope of in-house secure microcontroller integration, enabling faster personalization turnaround times and improved fraud resistance. IDEMIA has expanded its service portfolio by launching cloud-native personalization platforms that allow remote design updates and biometric authentication features, reinforcing its position in government ID programs.

Meanwhile, NXP Semiconductors is investing in next-generation smart card chips featuring post-quantum cryptography capabilities, targeting banking institutions seeking future-proof security. Entrust has bolstered its software suite with advanced color management and workflow automation tools, designed to optimize high-volume card issuance for retail and corporate clients. Emerging players specializing in eco-friendly card substrates are collaborating with established manufacturers to introduce recycled polymer solutions and energy-efficient printing processes. These competitive moves reflect a broader emphasis on integration, sustainability, and digital service enablement, as providers aim to differentiate through comprehensive personalization ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Card Personalisation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Entrust, Inc.

- Evolis SA

- Giesecke+Devrient GmbH

- HID Global Corporation

- IDEMIA Group SAS

- Matica Technologies Ltd

- NBS Technologies Limited

- SPS – Secure Personalization Solutions, Inc.

- Thales Group SE

- Zebra Technologies Corporation

Actionable Strategic Recommendations Empowering Industry Leaders to Optimize Card Personalization Operations Navigate Tariffs and Leverage Emerging Technologies

Industry leaders should prioritize a multifaceted strategy that balances cost mitigation, innovation, and regulatory compliance. First, nearshoring critical component production closer to core markets can reduce lead-time variability and insulate operations from tariff fluctuations. Simultaneously, forging strategic supplier partnerships and implementing dual-sourcing frameworks will safeguard supply chains against unforeseen disruptions.

Second, investing in digital transformation initiatives-such as cloud-based personalization platforms and AI-driven predictive maintenance-can optimize print workloads and enhance uptime. Embedding advanced security modules like biometric verification and dynamic CVV technology will address emerging fraud risks and strengthen customer trust. Third, sustainability must be woven into the core strategy by adopting eco-friendly substrates and energy-efficient printing methods, aligning with corporate ESG commitments.

Finally, ongoing regulatory monitoring and proactive compliance planning will ensure seamless alignment with evolving standards such as PSD2, GDPR, and upcoming national credential mandates. By integrating these actionable recommendations, industry leaders can achieve operational resilience, drive differentiation, and capitalize on evolving market opportunities.

Detailed Explanation of the Rigorous Research Methodology Combining Primary Interviews Secondary Sources and Data Validation Techniques

This research employs a rigorous methodology combining primary interviews, secondary data exploration, and validation workshops to ensure accuracy and credibility. Primary research involved in-depth interviews with senior executives from card issuers, personalization service providers, and component manufacturers, alongside insights from industry associations and regulatory bodies. These dialogues illuminated real-time operational challenges, strategic priorities, and technology adoption roadmaps.

Secondary research encompassed a comprehensive review of company announcements, patent filings, technical white papers, and market reports to contextualize emerging trends. In addition, tariff schedules, trade investigation documents, and regulatory guidelines were analyzed to assess policy impacts. Data triangulation techniques reconciled quantitative findings with qualitative insights, while expert validation sessions with domain specialists ensured consistency and reliability. Consequently, the report delivers a holistic view of the card personalization ecosystem, grounded in empirical evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Card Personalisation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Card Personalisation Market, by End User

- Card Personalisation Market, by Channel

- Card Personalisation Market, by Service

- Card Personalisation Market, by Card Type

- Card Personalisation Market, by Technology

- Card Personalisation Market, by Region

- Card Personalisation Market, by Group

- Card Personalisation Market, by Country

- United States Card Personalisation Market

- China Card Personalisation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Reflections on How Market Dynamics Tariff Environments Technology Innovations and Segmentation Trends Converge in Card Personalization

In conclusion, the card personalization market is undergoing a profound transformation driven by technological innovation, regulatory imperatives, and evolving end-user expectations. Advanced printing technologies, AI-enabled analytics, and cloud-native platforms are redefining personalization workflows, while tariff changes and supply chain realignments necessitate strategic agility. Segmentation analysis underscores the importance of tailored solutions across diverse verticals, channels, and technology preferences, and regional insights highlight the varying adoption curves and regulatory landscapes shaping market opportunities.

Competitive dynamics are increasingly shaped by alliances, product roadmaps, and sustainability initiatives, as companies vie to deliver secure, scalable, and environmentally responsible personalization offerings. By adhering to the actionable recommendations outlined, organizations can navigate cost pressures, leverage emerging capabilities, and maintain compliance with evolving standards. Looking ahead, continued investment in R&D, strategic partnerships, and sustainable practices will be pivotal for stakeholders seeking to lead in this dynamic ecosystem.

Take the Next Step Towards Enhanced Payment Security and Personalization Insights by Engaging with Our Associate Director for Exclusive Research Access

To access unparalleled insights and gain a competitive edge in card personalization, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in translating complex market intelligence into actionable strategies ensures you receive tailored guidance on leveraging emerging technologies, navigating tariff landscapes, and capitalizing on growth segments. Reach out to him today to secure your comprehensive market research report and empower your organization with data-driven decisions that drive profitability and enhance customer experience in the rapidly evolving payment ecosystem

- How big is the Card Personalisation Market?

- What is the Card Personalisation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?