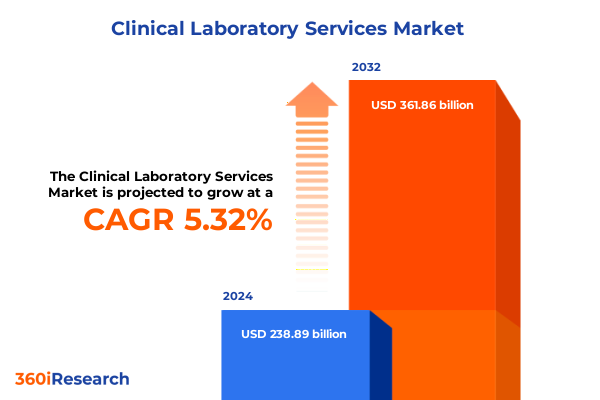

The Clinical Laboratory Services Market size was estimated at USD 250.81 billion in 2025 and expected to reach USD 263.53 billion in 2026, at a CAGR of 5.37% to reach USD 361.86 billion by 2032.

Establishing the Pivotal Role of Clinical Laboratory Services in Advancing Patient Outcomes and Driving Healthcare Innovation Nationwide

Clinical laboratory services have emerged as the silent backbone of modern healthcare, offering indispensable diagnostic clarity that underpins clinical decision-making across care settings. At the intersection of cutting-edge technology and patient-centric care, laboratories are uniquely positioned to translate complex biochemical and molecular data into actionable insights for physicians and public health authorities. As healthcare systems face mounting pressures to improve outcomes while containing costs, the strategic importance of reliable, rapid diagnostic testing continues to escalate, catalyzing significant investments in laboratory infrastructure and digital capabilities.

The rapidly evolving landscape demands agile adaptation to novel testing modalities, automation platforms, and integrated data management systems that optimize workflow efficiency and accuracy. Meanwhile, regulatory frameworks and quality standards have intensified, compelling laboratories to uphold rigorous compliance measures while streamlining processes. In this context, the introduction sets the stage for an in-depth exploration of transformative dynamics influencing the clinical laboratory market, examining economic, regulatory, and technological vectors that collectively define the current state of diagnostic services. By understanding these foundational elements, decision-makers can effectively align investments with long-term objectives, ensuring resilient operations and sustained competitive differentiation.

Unveiling the Transformative Technological and Operational Shifts Reshaping Modern Clinical Laboratory Services for Improved Efficiency and Accuracy

The clinical laboratory sector is undergoing a paradigm shift characterized by the convergence of advanced diagnostics, data analytics, and personalized medicine. Automated high-throughput analyzers and robotics have become integral to reducing manual errors and expediting sample processing, enabling laboratories to manage surging test volumes with enhanced precision. Concurrently, molecular diagnostics tools such as real-time and digital PCR have transitioned from early adopters’ research environments into mainstream clinical workflows, facilitating rapid pathogen detection and genetic profiling at scale.

Moreover, the infusion of artificial intelligence and machine learning into laboratory information systems has unlocked predictive maintenance capabilities and anomaly detection in test results, driving both operational excellence and clinical confidence. These technological advances coincide with a growing emphasis on decentralized testing models; point-of-care analyzers are increasingly deployed in outpatient clinics, emergency departments, and even patient homes. This shift not only accelerates turnaround times but also fosters a more proactive approach to disease management, underscoring the transformative potential of distributed diagnostics in enhancing care delivery across diverse clinical settings.

Analyzing the Cumulative Impact of Newly Implemented United States Tariffs on Clinical Laboratory Supply Chains and Service Delivery in 2025

In 2025, the implementation of new tariff policies on imported reagents, consumables, and diagnostic equipment has introduced substantive cost pressures for clinical laboratory operators in the United States. Tariff escalations on key inputs have reverberated through procurement budgets, compelling laboratories to reassess supplier relationships and negotiate alternative sourcing strategies. These measures, initially aimed at bolstering domestic manufacturing, have yielded both intended and unintended consequences across the supply chain.

On one hand, tariff-driven cost increases have incentivized investment in local production capacities for critical reagents and diagnostic kits, fostering a more resilient domestic ecosystem. Yet, laboratories reliant on specialized assay components continue to navigate extended lead times and price variability, impacting routine testing services. In response, many organizations have accelerated adoption of lean inventory management and just-in-time procurement methodologies to mitigate financial strain and ensure service continuity. As these adaptive strategies gain traction, the long-term equilibrium between domestic supply stability and cost containment will remain a focal point for industry stakeholders seeking to balance strategic autonomy with financial sustainability.

In-depth Insights into Market Segmentation Across Service Types Technologies Diseases Samples and End Users to Inform Strategic Decision Making

The clinical laboratory market is inherently multifaceted, with service offerings encompassing a breadth of specialized testing modalities. Blood banking and transfusion services operate alongside advanced molecular diagnostics, while clinical chemistry testing subdivides into endocrinology chemistry, routine chemistry, and therapeutic drug monitoring. Genetic testing and immunology assays complement hematology and serology services, with medical microbiology further partitioned into infectious disease and transplant diagnostics. Pathology workflows integrate both cytopathology and histopathology analyses, and point-of-care testing extends rapid diagnostic capabilities to decentralized environments. This layered service segmentation fundamentally informs revenue streams and clinical value propositions alike.

Technological stratification introduces additional granularity, spanning chromatography systems, flow cytometry, immunoassay analyzers, PCR platforms-differentiated into digital, multiplex, and real-time configurations-as well as spectrophotometry and point-of-care analyzers. Such technology-driven segmentation shapes operational investment decisions and underlines the interplay between capital expenditure and throughput efficiency.

Disease-centric categorization underscores the targeted application of laboratory services across cardiovascular, diabetic, infectious, neurological, and oncological care pathways, each demanding discrete biomarker panels and analytical performance criteria. Sample type further modulates workflow complexity, with blood, saliva, tissue, and urine specimens necessitating distinct pre-analytical protocols. End-user segmentation traverses academic and research institutions, government and public health laboratories, hospital-based facilities, specialty clinics, physician offices, and standalone clinical laboratories, each with differentiated service-level expectations, procurement frameworks, and regulatory compliance requirements.

Understanding these segmentation layers provides a strategic lens through which laboratory leaders can tailor value propositions, prioritize capital investments, and optimize operational workflows to meet evolving clinical needs and regulatory mandates.

This comprehensive research report categorizes the Clinical Laboratory Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology

- Disease Category

- Sample Type

- End User

Exploring Key Regional Dynamics Shaping Clinical Laboratory Services across the Americas Europe Middle East Africa and Asia-Pacific Regions

Geographic variability remains a cornerstone of clinical laboratory service dynamics, with the Americas presenting a mature market environment characterized by high rates of automation adoption and robust reimbursement frameworks. Within North America, laboratories benefit from integrated healthcare networks and expansive reference laboratory infrastructures, whereas Latin America is marked by disparate public and private laboratory capacities, driving targeted investments in basic chemistry and hematology testing.

Across Europe, Middle East, and Africa, a mosaic of regulatory regimes and healthcare funding models shapes laboratory operations. Western European nations advance molecular and genomic diagnostics under well-established reimbursement policies, while emerging markets in Eastern Europe and the Middle East focus on expanding core microbiology and serology testing capabilities to address infectious disease burdens. In Africa, public health laboratories play an outsized role in disease surveillance, with donor-supported programs bolstering capacity for HIV, tuberculosis, and malaria diagnostics.

Asia-Pacific represents a high-growth frontier, propelled by government-led healthcare modernization initiatives in countries such as China and India. Rapid urbanization and rising middle-class demand for preventive care are accelerating adoption of point-of-care testing and digital laboratory platforms. Southeast Asian markets balance investments in foundational laboratory infrastructure with pilot programs for precision medicine, while Australia and Japan leverage advanced molecular and immunoassay technologies within highly regulated healthcare ecosystems.

Recognizing these regional distinctions enables industry participants to align market entry strategies, technology deployment, and partnership models with localized regulatory landscapes and clinical priorities.

This comprehensive research report examines key regions that drive the evolution of the Clinical Laboratory Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Clinical Laboratory Service Providers Highlighting Strategic Initiatives Innovations and Competitive Strengths in the Global Arena

The global clinical laboratory services space is populated by a diverse array of providers, each pursuing distinct strategic imperatives. Leading reference laboratory networks have expanded through vertical integration, adding specialized testing divisions and digital health platforms to enhance end-to-end service delivery. Concurrently, multinational diagnostics manufacturers are partnering with academic centers to co-develop molecular assays and artificial intelligence–driven interpretive software, effectively bridging the gap between hardware innovation and clinical application.

Standalone commercial laboratories differentiate through niche service offerings, such as high-complexity genetic panels or companion diagnostics tailored to targeted therapies. These firms often leverage collaborative agreements with pharmaceutical and biotech organizations, securing early access to cutting-edge biomarkers and clinical trial specimens. Hospital-based laboratories, in contrast, emphasize integrated care pathways, embedding point-of-care testing systems directly within emergency and critical care units to streamline patient throughput. Moreover, public health agencies have undertaken large-scale modernization projects, adopting digital laboratory information management systems and cloud-enabled data analytics to fortify disease surveillance capabilities.

Amid this competitive constellation, strategic alliances and merger activity are frequent, driven by the pursuit of scale economies and complementary service portfolios. Market leaders continue to invest in research and development, focusing on high-sensitivity assays and predictive analytics to support precision diagnostics. Observing these corporate positioning strategies offers valuable insights into the competitive contours that define the future of laboratory testing services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Laboratory Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACM Medical Laboratory, Inc.

- Amedes Medical Services GmbH

- Arup Laboratories Inc.

- Bioreference Health, LLC by OPKO Health, Inc.

- Cerba HealthCare S.A.S.

- Charles River Laboratories

- Clinical Reference Laboratory, Inc.

- DaVita Inc. by United HealthCare Service LLC

- Empire City Laboratories, Inc.

- Eurofins Scientific SE

- Exact Sciences Corporation

- Genova Diagnostics

- Laboratory Corporation of America Holdings

- LifeLabs Inc.

- Millennium Health, LLC

- Myriad Genetics, Inc.

- NeoGenomics, Inc.

- Quest Diagnostics Incorporated

- SGS SA

- Siemens Healthineers AG

- Sonic Healthcare Ltd.

- SYNLAB International GmbH

- Thermo Fisher Scientific Inc.

- Unilabs AB by A.P Moller Holding

Actionable Recommendations for Industry Leaders to Navigate Disruptions Capitalize on Emerging Opportunities and Foster Sustainable Growth in Clinical Labs

Industry leaders should prioritize investment in interoperable digital ecosystems that seamlessly integrate laboratory instruments, information systems, and electronic health records, fostering real-time data sharing and decision support. By leveraging application programming interfaces and cloud-based architectures, laboratories can enhance operational agility and facilitate remote collaboration with clinical stakeholders. Transitioning to modular automation and robotics not only accelerates sample processing but also liberates technical staff to focus on high-value analytical tasks and assay development.

Developing strategic partnerships with reagent manufacturers and technology vendors is essential to secure preferential access to next-generation testing platforms and discounted supply contracts. Emphasizing vendor-neutral automation frameworks can mitigate supplier concentration risks and allow rapid adoption of emerging assay technologies. Furthermore, laboratories should expand decentralized testing capabilities by deploying validated point-of-care analyzers in ambulatory settings and home-based care models, thereby improving patient engagement and reducing hospital readmission rates.

To navigate tariff-induced cost pressures, organizations must adopt lean inventory management strategies, including demand forecasting analytics and just-in-time procurement workflows. Collaborative purchasing consortia can amplify negotiating power with suppliers, while predictive maintenance programs for critical instrumentation minimize unplanned downtime and repair costs. Cultivating a culture of continuous quality improvement-anchored by regular proficiency testing and root-cause failure analyses-will ensure sustained compliance and reinforce confidence among healthcare partners.

By executing these integrated recommendations, industry participants can bolster resilience, optimize resource allocation, and secure competitive differentiation in an increasingly complex clinical laboratory ecosystem.

Methodological Framework Underpinning Rigorous Research Design Data Collection and Analytical Techniques Employed in This Clinical Laboratory Study

Our research methodology integrates both primary and secondary approaches to deliver a comprehensive analysis of the clinical laboratory services market. On the primary side, extensive interviews were conducted with C-suite executives, laboratory directors, procurement specialists, and regulatory affairs professionals across diverse geographic regions. These qualitative engagements provided nuanced perspectives on operational challenges, technology adoption timelines, and strategic priorities. Quantitative data were gathered via structured surveys targeting more than 200 laboratory facilities, capturing metrics related to testing volumes, equipment utilization, staffing levels, and sourcing preferences.

The secondary research component encompassed systematic reviews of industry publications, peer-reviewed journals, regulatory filings, and whitepapers from leading diagnostics associations. An exhaustive compilation of public financial disclosures and patent filings offered visibility into capital expenditure trends and innovation trajectories. Market intelligence databases were utilized to benchmark historical growth rates and identify emergent players. Data validation and triangulation steps included cross-referencing primary survey results with secondary sources and conducting follow-up interviews to resolve discrepancies.

Analytical techniques comprised SWOT analyses for major providers, segmentation performance assessments by service type and technology, and regional market dynamics mapping. Scenario modeling was employed to simulate the impact of tariff variations and supply chain disruptions on cost structures and delivery timelines. Ethical guidelines and confidentiality protocols were strictly adhered to, ensuring that proprietary insights remained secure throughout the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Laboratory Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Laboratory Services Market, by Service Type

- Clinical Laboratory Services Market, by Technology

- Clinical Laboratory Services Market, by Disease Category

- Clinical Laboratory Services Market, by Sample Type

- Clinical Laboratory Services Market, by End User

- Clinical Laboratory Services Market, by Region

- Clinical Laboratory Services Market, by Group

- Clinical Laboratory Services Market, by Country

- United States Clinical Laboratory Services Market

- China Clinical Laboratory Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Emerging Trends to Present a Concise Conclusion on the Future Trajectory of Clinical Laboratory Services

In synthesizing the broad spectrum of findings, it is evident that clinical laboratory services are at a crossroads of technological innovation and operational reinvention. The ascendancy of molecular diagnostics and artificial intelligence–driven analytics, coupled with the decentralization of testing capabilities, heralds a more agile and patient-centric diagnostic paradigm. Concurrently, geopolitical influences such as tariffs underscore the importance of supply chain resilience and strategic sourcing frameworks.

Segmentation analysis reveals that laboratories must tailor service offerings to discrete clinical pathways, deploying appropriate technologies and specimen-handling protocols to maximize diagnostic accuracy and throughput. Regional insights indicate divergent market maturity levels, necessitating customized go-to-market strategies that align with local regulatory and reimbursement environments. Competitive profiling underscores the value of partnerships, vertical integration, and continuous innovation as levers for maintaining market leadership.

Collectively, these insights point toward a future in which integrated digital ecosystems, decentralized testing modalities, and collaborative supply networks form the bedrock of sustainable laboratory operations. By embracing these imperatives, industry stakeholders can drive enhanced patient outcomes, streamline cost structures, and capitalize on the expanding role of diagnostics in personalized medicine.

Seize Strategic Advantage Today Connect with Ketan Rohom to Acquire the Comprehensive Market Research Report and Elevate Your Clinical Laboratory Services

Elevate your organization’s strategic position by obtaining a definitive market intelligence asset tailored to the nuanced complexities of clinical laboratory services in 2025. Engaging with Ketan Rohom ensures you benefit from guided expertise and a deeper understanding of industry currents that directly impact operational resilience and market responsiveness. Ready to leverage granular data and actionable insights to refine your competitive strategies and accelerate growth trajectories? Reach out today and transform market volatility into a roadmap for sustained success.

- How big is the Clinical Laboratory Services Market?

- What is the Clinical Laboratory Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?