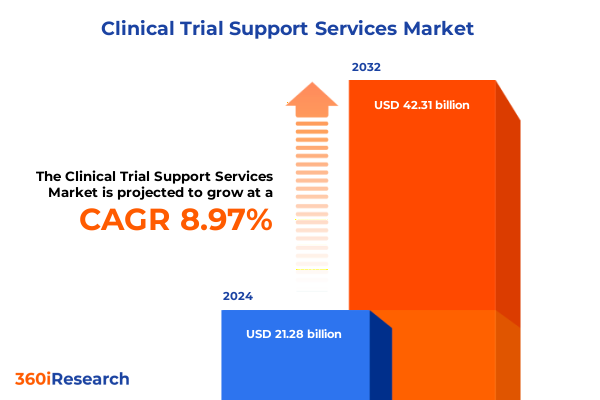

The Clinical Trial Support Services Market size was estimated at USD 23.08 billion in 2025 and expected to reach USD 25.08 billion in 2026, at a CAGR of 9.04% to reach USD 42.31 billion by 2032.

Setting the Stage for a Comprehensive Exploration of Clinical Trial Support Services Advancements and Market Dynamics in a Transformative Era

Clinical trial support services are now indispensable pillars in the journey from laboratory discovery to real-world patient impact. Accelerated by the growing complexity of therapeutic protocols and the advent of personalized medicine, these services have evolved far beyond traditional contract research activities. Today’s sponsors demand an integrated suite of offerings that span biostatistics, clinical logistics, protocol development, patient recruitment, data management, and regulatory compliance, all underpinned by robust medical writing and monitoring frameworks. The convergence of these functions within experienced support providers enables sponsors to navigate the multifaceted challenges of clinical development with agility and precision.

Against a backdrop of heightened competitive pressure and escalating operational costs, service providers are compelled to innovate across technology, process, and talent domains. From advanced analytics that drive predictive enrollment to remote monitoring approaches that optimize site oversight, the landscape has shifted toward decentralized and data-driven models. This report begins by framing the critical drivers and market dynamics that define the current environment. It then unpacks transformative shifts, quantifies the implications of recent tariff policy changes, dissects multidimensional segmentation insights, and delivers a comprehensive regional and competitive overview. In so doing, it equips decision-makers with the clarity needed to harness emerging opportunities and mitigate evolving risks throughout the clinical trial continuum.

Uncovering the Transformative Technological and Regulatory Shifts Reshaping the Clinical Trial Support Services Ecosystem in the Post-Pandemic Landscape

The clinical trial support services ecosystem is undergoing a paradigm shift driven by the rapid integration of digital technologies and the recalibration of regulatory frameworks in the aftermath of global health crises. Artificial intelligence and machine learning algorithms are being embedded within biostatistics workflows to enhance protocol design and accelerate data interpretation, while real-world data sources are being fused with traditional clinical trial datasets to generate deeper patient insights and refine endpoint selection. Simultaneously, the proliferation of decentralized trial models is redefining patient engagement, enabling virtual site visits and remote data capture that reduce geographic barriers and foster broader participant diversity.

Regulatory agencies have responded by issuing guidance that balances expedited review pathways with stringent quality standards, promoting risk-based monitoring and adopting flexible approaches to protocol amendments. These regulatory reforms, in concert with global harmonization initiatives, have lowered administrative impediments and facilitated more agile trial start-up processes. Moreover, the shift toward value-based care is compelling sponsors to incorporate patient-centred outcome measures and digital biomarkers, thereby amplifying demand for sophisticated medical writing and digital endpoint management.

This chapter explores how these converging forces are reshaping not only the roles of service providers but also the expectations of sponsors, patients, and regulators. By mapping technological advancements and policy evolutions against operational imperatives, it surfaces the strategic inflection points that leaders must navigate to remain competitive in a landscape defined by both unprecedented innovation and regulatory complexity.

Analyzing the Cumulative Impact of Elevated United States Tariff Measures in 2025 on Clinical Trial Support Services Cost Structures and Procurement Pathways

In early 2025, the United States implemented a series of elevated tariffs affecting key imported inputs for clinical trial support services, spanning diagnostic kits, analytical software licenses, and specialized laboratory reagents. These levies have reverberated throughout the supply chain, driving up procurement costs and prompting service providers to reassess sourcing strategies. The most immediate impact has been observed in logistics and supply chain management, where increased duty burdens have amplified storage and transportation expenses, particularly for temperature-sensitive materials.

As a countermeasure, many organizations are exploring near-shoring and domestic manufacturing partnerships to mitigate exposure to tariff fluctuations. This realignment is fostering deeper collaborations between service providers and local suppliers, as well as investments in qualified domestic labs equipped to meet Good Clinical Practice standards. While these adjustments entail upfront capital commitments and validation efforts, they promise greater supply chain resilience and reduced lead times over the medium term.

Beyond cost implications, the tariff-induced recalibration is catalyzing strategic shifts in clinical trial planning and protocol development. Sponsors and service providers are more rigorously evaluating the total landed cost of trial materials when selecting study sites, favoring regions with established domestic infrastructure. In turn, patient recruitment management teams are adapting enrollment strategies to capitalize on sites that offer streamlined handling of study supplies and lower tariff-related delays. This chapter delineates the full spectrum of operational consequences stemming from the 2025 tariff measures and highlights the tactical responses that will define competitive advantage in a cost-constrained environment.

Deriving Strategic Insights from Multidimensional Segmentation Paradigms Spanning Service Type Phase Sponsorship Execution Model Therapeutic Area and End User

A nuanced understanding of clinical trial support services emerges when the market is dissected across multiple segmentation frameworks. When viewed through the lens of service type, it becomes clear that biostatistics remains a cornerstone, with statistical consulting and programming capabilities driving protocol optimization and analytical rigor. Clinical logistics and supply chain management have also matured into strategic competencies, orchestrating the seamless movement of investigational products and ancillary materials. The spectrum extends through clinical trial planning and protocol development, site management, medical writing, and monitoring, the latter of which bifurcates into onsite and remote modalities. Patient recruitment management, encompassing both enrollment strategies and retention initiatives, underscores the critical junction between operational execution and patient centricity, while regulatory and compliance services anchor all activities in adherence to evolving standards.

Phase-specific dynamics further enrich this picture, as preclinical efforts lay the groundwork for Phase I safety protocols, which evolve into increasingly complex Phase II dose-finding and Phase III pivotal efficacy trials. Phase IV post-marketing studies then transition to long-term safety monitoring and real-world evidence generation. Correspondingly, sponsorship segmentation-from academic institutions and government entities to company-led studies and individual innovators-reveals divergent priorities, with academic and government trials often emphasizing exploratory endpoints and public health outcomes, while corporate sponsors pursue expedited pathways and competitive differentiation.

Execution models introduce additional variability. Full service providers deliver end-to-end solutions, whereas functional service providers focus on specific modular capabilities, and hybrid models blend both approaches to balance control with flexibility. Therapeutic area segmentation highlights oncology, immunology, and rare diseases as innovation hotbeds, while cardiology, endocrinology, gastroenterology, infectious disease, neurology, and respiratory disorders represent high-volume domains. Finally, end-user segmentation distinguishes clinical research organizations, hospitals and academic research centers, medical device firms, and pharmaceutical and biotechnology companies, each of which leverages and demands specialized support profiles to align with their strategic objectives.

This comprehensive research report categorizes the Clinical Trial Support Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Phase

- Sponsorship

- Execution Model

- Therapeutic Area

- End-User

Illuminating Regional Divergence in Clinical Trial Support Services with In-Depth Perspectives on the Americas Europe Middle East Africa and Asia-Pacific Arenas

Regional landscapes present distinctive challenges and opportunities for clinical trial support services providers. In the Americas, well-established infrastructure, a mature regulatory environment, and a large patient pool underpin robust trial activity. Nevertheless, providers must navigate state-level variances in regulations and contend with escalating labor and operational costs, especially in urban centers. The United States remains the epicenter for novel therapeutic development, while Latin American jurisdictions such as Brazil and Mexico are gaining traction as cost-efficient locations for patient recruitment and site management, driven by improving regulatory frameworks and expanding healthcare access.

Europe, the Middle East, and Africa exhibit significant heterogeneity. Western Europe maintains strict regulatory oversight and high service quality expectations, reinforcing demand for comprehensive compliance services and sophisticated data management. Conversely, emerging markets in Eastern Europe, the Middle East, and Africa offer growing patient populations and favorable cost structures, albeit with variable infrastructure readiness. Cross-border harmonization initiatives such as the European Medicines Agency’s decentralized trial guidance are lowering barriers to entry, but providers must tailor methodologies to accommodate regional data privacy regulations and logistical nuances.

Asia-Pacific continues to solidify its status as a global hub for clinical research. China, Japan, South Korea, and Australia lead the region in regulatory modernization and investment in digital health ecosystems. Rapidly expanding sites in Southeast Asia and India complement this landscape, offering high patient availability and accelerating approval timelines. Providers operating across Asia-Pacific must balance the scale advantages of populous markets with the complexity of diverse regulatory regimes and varying quality standards, investing in localized expertise to optimize site selection and patient engagement strategies.

This comprehensive research report examines key regions that drive the evolution of the Clinical Trial Support Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Market Participants Spotlighting Innovative Partnerships Strategic Alliances and Core Competencies Driving the Clinical Trial Support Services

Leading participants in clinical trial support services are leveraging strategic partnerships, acquisitions, and technology investments to differentiate their value propositions. Collaborative alliances between analytics innovators and traditional contract research organizations are yielding integrated platforms that streamline data workflows from protocol inception through regulatory submission. Meanwhile, digital health startups are forging agreements with established players to embed remote patient monitoring and eConsent solutions within broader service portfolios. These alliances are redefining expectations for service orchestration and creating end-to-end digital ecosystems that enhance transparency and accelerate decision cycles.

Mergers and acquisitions continue to be a primary vehicle for expanding geographic reach and augmenting niche capabilities. Recent transactions have targeted specialized monitoring firms, regulatory consultancy boutiques, and real-world evidence providers, reflecting an industry trajectory toward consolidation of complementary expertise. The accumulation of diverse competencies under single organizational umbrellas enables rapid scaling of complex trials, particularly in areas like oncology and rare diseases where protocol intricacy demands deep domain knowledge.

Beyond consolidation, organic growth remains a critical focus. Leading firms are investing heavily in training programs to cultivate specialized talent pools, developing centers of excellence in therapeutic areas, and deploying advanced analytics infrastructures that harness artificial intelligence for predictive site selection and risk-based monitoring models. By balancing inorganic expansion with in-house innovation, these market participants are establishing resilient and differentiated service portfolios capable of meeting the evolving needs of sponsors across the clinical development lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Trial Support Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACM Global Laboratories, LLC

- Charles River Laboratories International, Inc.

- Clinipace, Inc

- CTI – Clinical Trial Services, Inc.

- Eurofins Scientific SE

- Fortrea Holdings Inc.

- ICON plc

- Laboratory Corporation of America Holdings

- Novotech Enterprises Private Limited

- Parexel International Corporation

- Premier Research Group Limited

- PSI CRO AG

- Syneos Health, Inc.

- Velocity Clinical Research, Inc

- Worldwide Clinical Trials, Inc.

- Wuxi AppTec Co., Ltd.

Empowering Industry Leaders with Actionable Strategies to Enhance Operational Efficiency Mitigate Risks and Seize Emerging Opportunities in Trial Support

Industry leaders must adopt proactive strategies to thrive in an environment defined by escalating complexity and cost pressures. Prioritizing investment in digital platforms that support decentralized trial components will enhance operational agility and patient engagement, particularly as multi-modality studies become prevalent. By deploying artificial intelligence-driven analytics for enrollment forecasting, risk-based monitoring, and adaptive trial design, organizations can optimize resource allocation and mitigate protocol deviations before they materialize.

Enhancing supply chain resilience is equally imperative. Developing diversified sourcing networks and forging strategic relationships with domestic and regional partners will protect against tariff volatility and logistical disruptions. Concurrently, adopting integrated supply chain technologies-such as blockchain for provenance tracking and IoT-enabled monitoring devices-will improve transparency and compliance, fostering sponsor confidence in trial integrity.

Cultivating specialized expertise remains a cornerstone of differentiation. Investing in modular centers of excellence that focus on high-growth therapeutic areas, such as immuno-oncology and rare diseases, will position organizations as trusted advisors to sponsors tackling the most challenging clinical questions. Finally, embedding patient-centric approaches-including digitally enabled retention programs and culturally tailored recruitment strategies-will support enrollment efficiency and enhance data quality. By executing these recommendations, service providers can not only withstand external headwinds but also capitalize on emerging growth opportunities.

Detailing a Robust Research Methodology Integrating Rigorous Primary Engagement Secondary Intelligence and Analytical Techniques to Ensure Data Validity

This analysis is underpinned by a rigorous research methodology that integrates primary engagement with industry stakeholders and comprehensive secondary intelligence. Primary research encompassed in-depth interviews with senior executives from pharmaceutical companies, biotechnology sponsors, clinical research organizations, and technology vendors, ensuring a balanced perspective across the entire value chain. These conversations illuminated strategic priorities, emerging pain points, and early indicators of shifting investment patterns.

Secondary research involved a thorough review of regulatory publications, peer-reviewed journals, industry white papers, and corporate disclosures. Market activity tracking included monitoring partnership announcements, merger and acquisition transactions, and technology deployments to validate trends identified in primary interviews. Analytical techniques such as cross-segmentation analysis and regional benchmarking were employed to distill nuanced insights. Quality control measures included triangulation of data sources, peer reviews by subject matter experts, and iterative validation with advisory panels to ensure the integrity and relevance of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Trial Support Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Trial Support Services Market, by Service Type

- Clinical Trial Support Services Market, by Phase

- Clinical Trial Support Services Market, by Sponsorship

- Clinical Trial Support Services Market, by Execution Model

- Clinical Trial Support Services Market, by Therapeutic Area

- Clinical Trial Support Services Market, by End-User

- Clinical Trial Support Services Market, by Region

- Clinical Trial Support Services Market, by Group

- Clinical Trial Support Services Market, by Country

- United States Clinical Trial Support Services Market

- China Clinical Trial Support Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Illuminate Critical Pathways Forward and Strengthen Strategic Decision Making in Clinical Trial Support Services Landscapes

Synthesizing the core findings reveals a landscape in which innovation, regulatory agility, and operational resilience converge to define competitive advantage. Technological integration and digital transformation initiatives are accelerating trial timelines and enhancing data fidelity, while evolving regulatory frameworks are supporting more flexible and risk-based approaches. Simultaneously, geopolitical factors-such as the 2025 tariff measures-are reshaping supply chain strategies and site selection criteria, emphasizing the need for diversified sourcing and localized partnerships.

As sponsors and service providers navigate this dynamic environment, strategic decision makers must balance short-term pressures with long-term growth imperatives. Embracing modular execution models, deepening therapeutic area expertise, and fostering patient-centric practices will be critical to unlocking value. Moreover, a forward-looking posture that prioritizes continuous investment in talent development and digital capabilities will position organizations to capitalize on the next wave of clinical innovation and maintain leadership in the evolving clinical trial support services ecosystem.

Contact Ketan Rohom Associate Director Sales Marketing to Secure Your Access to the Definitive Market Research Report on Clinical Trial Support Services Today

Contact Ketan Rohom, the Associate Director of Sales & Marketing, to secure your access to the definitive market research report on clinical trial support services and chart a strategic advantage today.

- How big is the Clinical Trial Support Services Market?

- What is the Clinical Trial Support Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?