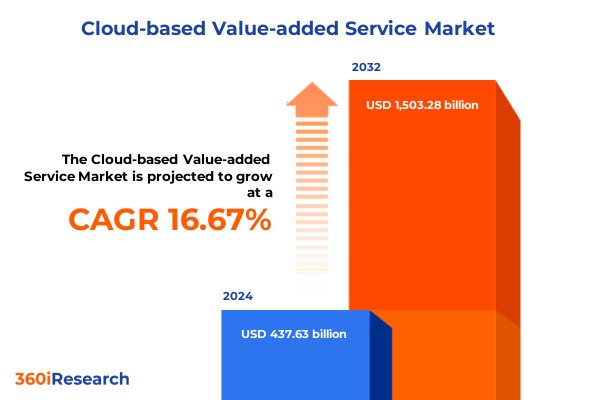

The Cloud-based Value-added Service Market size was estimated at USD 508.51 billion in 2025 and expected to reach USD 590.87 billion in 2026, at a CAGR of 16.74% to reach USD 1,503.28 billion by 2032.

How Cloud-Based Value-Added Services Are Redefining Digital Transformation Across Enterprise Ecosystems

The rapid evolution of digital infrastructure has elevated cloud-based value-added services into a critical driver of business transformation across industries. These services extend beyond traditional cloud storage and compute, offering advanced analytics, enhanced communication tools, robust content delivery networks, and cutting-edge security solutions that enable organizations to innovate at speed and scale. As enterprises strive to differentiate in saturated markets, the agility and flexibility conferred by these offerings have transitioned from optional enhancements to foundational elements of digital strategy.

Amidst this backdrop, stakeholders must navigate a complex ecosystem where technology convergence, shifting regulatory frameworks, and escalating customer expectations intersect. Cloud-based value-added services now serve as the connective tissue between on-premises investments and emerging architectures, such as edge computing and multi-cloud deployments. This executive summary sets the stage for a deeper dive into the transformative undercurrents shaping the landscape, offering leaders the insights required to harness these solutions effectively and build resilient, future-ready operations.

Emerging Technologies and Business Models Are Ushering in Foundational Shifts for Cloud Value-Added Service Delivery

The landscape of cloud-based value-added services is undergoing several seismic shifts propelled by emerging technologies and new business paradigms. First, the infusion of artificial intelligence and machine learning into analytics services is enabling predictive and prescriptive insights to be generated with unprecedented speed. Organizations that once relied solely on historical reporting now leverage real-time analytics to optimize operations and personalize customer experiences.

Concurrently, the ascent of edge computing is catalyzing a decentralization of data processing, bringing critical workloads closer to end users and IoT devices. This transition not only reduces latency for mission-critical applications but also alleviates bandwidth pressures on centralized data centers. Service providers are responding by bundling edge-enabled content delivery services that integrate caching, streaming distribution, and dynamic load balancing at the network’s periphery.

Meanwhile, blockchain integration and software-defined networking are reshaping communication and security paradigms. Decentralized ledgers are being embedded into identity and access management solutions, enhancing data integrity and auditability. At the same time, communication services have evolved past basic messaging and VoIP to deliver immersive video conferencing experiences underpinned by real-time threat detection and response capabilities. Collectively, these shifts are redefining how enterprises consume and integrate cloud-based value-added services, setting new benchmarks for performance, reliability, and user engagement.

Assessing the Strategic Repercussions of 2025 U.S. Tariff Adjustments on Cloud Service Supply Chains and Pricing

The introduction of new tariffs on hardware components and software imports by the United States government in early 2025 has created a ripple effect across the global cloud services value chain. As legacy network equipment and specialized microprocessors incurred higher duties, providers faced elevated procurement costs which were partially absorbed but also passed on through escalated subscription and usage fees. These incremental expenses have placed pressure on margin structures, prompting vendors to reexamine pricing models and operational efficiencies.

In response, many service providers accelerated investments in domestic manufacturing collaborations and nearshore data center build-outs to mitigate tariff burdens and ensure continuity of supply. Organizations that rely heavily on edge computing devices and IoT sensors witnessed localized procurement strategies gain traction, reducing exposure to cross-border duties. Moreover, the heightened cost environment spurred negotiations around freemium and tiered pricing models, enabling end users-particularly small and medium enterprises-to access basic service tiers without committing to capital-intensive contracts.

Crucially, the cumulative impact of these tariffs has underscored the importance of hybrid and multi-cloud deployment modes in optimizing total cost of ownership. By distributing workloads across private and public clouds based on cost sensitivity and performance requirements, enterprises have been able to cushion the tariff-driven price increases while maintaining scalability. Ultimately, the tariff regime has catalyzed a reevaluation of procurement, deployment, and pricing strategies for cloud-based value-added services, reinforcing the need for agile supply chain frameworks and diversified sourcing approaches.

Unveiling Multidimensional Segmentation Insights That Illuminate Diverse Demand Drivers and Deployment Strategies

Segmentation by service type reveals that analytics services have emerged as a cornerstone for business intelligence initiatives, with enterprises leveraging predictive and real-time analytics to drive decision automation and process optimization. Communication services continue to mature beyond legacy voice and messaging, with video conferencing platforms increasingly integrated with collaboration suites and advanced VoIP solutions that support global, distributed workforces. Content delivery services are expanding their edge caching infrastructures to support higher-resolution streaming distribution and to address growing consumer demand for immersive digital experiences. In parallel, security services remain pivotal, as organizations deploy comprehensive data protection, identity and access management, and threat detection and response tools to safeguard against sophisticated cyber threats.

When viewing the market through an end-user industry lens, sectors such as banking, financial services, and insurance have prioritized security and real-time analytics to comply with regulatory mandates and to enhance customer trust. Healthcare providers are harnessing secure communication services and edge-enabled analytics to streamline patient care workflows, while retail and e-commerce companies increasingly rely on content delivery and predictive analytics to personalize shopping experiences and improve conversion rates. Government agencies and manufacturing enterprises each pursue hybrid cloud deployments to reconcile legacy system dependencies with digital modernization objectives.

Organizational scale has also shaped adoption patterns: large enterprises often prefer subscription and tiered pricing frameworks that align with multi-year IT budgets, while small and medium enterprises gravitate toward freemium and pay-as-you-go models that minimize upfront commitments. Meanwhile, deployment mode preferences vary widely; public cloud environments are favored for rapid scalability, private clouds for sensitive workloads, and hybrid architectures for striking a balance between control and cost efficiency. Technologically, AI-powered and edge computing–enabled services are leading innovation roadmaps, while blockchain-integrated solutions find early adopters in finance and supply chain use cases. IoT-enabled offerings are fueling growth in intelligent manufacturing and smart city deployments, illustrating the diverse demands driving this market’s evolution.

This comprehensive research report categorizes the Cloud-based Value-added Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Organization Size

- Pricing Model

- Technology Type

- Deployment Mode

- End User Industry

Examining Regional Market Dynamics and Regulatory Influences That Shape Cloud Services Adoption Globally

Across the Americas, market momentum is driven by the presence of leading hyperscale providers and a robust ecosystem of technology startups. Enterprises in North America, in particular, leverage mature cloud infrastructures to deploy advanced analytics and security services at scale, while Latin American markets show accelerated adoption of cost-effective freemium models to expand digital inclusion. Shifting to Europe, the Middle East, and Africa region, stringent data sovereignty regulations have elevated demand for private and hybrid cloud configurations, prompting providers to invest in localized data centers and edge nodes to comply with regional governance requirements.

Asia-Pacific stands out for its rapid digital transformation initiatives, underpinned by government-led smart city and Industry 4.0 programs. Public cloud adoption soars in markets such as China and India, where telecommunications incumbents integrate analytics and content delivery services to meet the needs of vast, digitally savvy populations. At the same time, emerging economies across Southeast Asia and Oceania present fertile ground for IoT-enabled and edge computing deployments, as businesses look to optimize supply chains and enhance consumer engagement in densely networked urban centers.

These regional dynamics are further influenced by the deployment of blockchain-based security solutions in Europe to meet GDPR and ePrivacy directives, while the Americas focus heavily on AI-driven predictive analytics to fuel competitive advantage. Across Asia-Pacific, the convergence of AI, IoT, and edge technologies reshapes value propositions, as end users demand low-latency, intelligent services. Together, these regional narratives underscore the importance of tailoring service portfolios and deployment approaches to local regulatory, infrastructural, and cultural contexts.

This comprehensive research report examines key regions that drive the evolution of the Cloud-based Value-added Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Movements and Innovation Strategies That Define Leading Cloud Value-Added Service Providers

Leading providers in this space have diversified their portfolios to encompass end-to-end cloud ecosystems that span core infrastructure, middleware, and specialized value-added modules. Strategic alliances and acquisitions have been common, enabling incumbents to integrate advanced analytics capabilities, fortified security modules, and edge computing platforms into unified offerings. New entrants have carved niches by delivering blockchain-backed identity management systems or by pioneering IoT-enabled edge services tailored for manufacturing environments.

In pursuit of competitive differentiation, vendors emphasize interoperability and open standards, collaborating with open-source communities to accelerate feature rollouts and to ensure compatibility with heterogeneous hybrid cloud estates. Service level agreements have evolved to include granular performance metrics-such as latency guarantees for streaming distribution and real-time analytics processing times-reflecting buyers’ growing expectations for reliability. Additionally, ecosystem strategies that foster third-party integrations, such as embedding communication APIs within enterprise resource planning systems, have become critical for expanding use cases and for driving platform stickiness.

Investment in research and development remains a key barometer of competitive positioning. Providers that prioritize AI-driven automation within their security suites or that build programmable edge nodes capable of hosting containerized workloads are increasingly viewed as market leaders. Looking ahead, those who can seamlessly blend pay-as-you-go flexibility with enterprise-grade governance, while delivering cutting-edge analytics and low-latency content delivery, will command attention across industry verticals and geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud-based Value-added Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 8x8 Inc.

- Adobe Inc.

- Alibaba Group

- ALSO Holding AG

- Amazon Web Services, Inc.

- Asana, Inc.

- Atlassian Pty. Ltd.

- Chief Telecom Inc.

- Cisco Systems, Inc.

- Dropbox, Inc.

- Ericsson Group

- Freshworks Inc.

- Gintel AS

- Huawei Cloud Computing Technologies Co., Ltd.

- HubSpot, Inc.

- Infobip d.d.

- Infosys Limited

- International Business Machines Corporation

- Intuit Inc.

- Kaleyra S.p.A.

- MessageBird B.V.

- Microsoft Corporation

- Okta, Inc.

- Oracle Corporation

- Rackspace Technology Global, Inc.

- RingCentral, Inc.

- RingCentral, Inc.

- Route Mobile Limited

- Salesforce, Inc.

- SAP SE

- Sinch AB

- Tata Communications Limited

- Twilio Inc.

- Vonage Holdings Corp.

- Zoho Corporation

Actionable Roadmap for Executives to Integrate Advanced Analytics, Hybrid Deployment, and Security Innovations

To capitalize on the accelerating demand for cloud-based value-added services, industry leaders should pursue an integrated approach that aligns service innovation with customer outcomes. First, embedding advanced analytics and AI capabilities directly into communication and content delivery platforms can drive deeper customer insights and personalized engagement. By deploying real-time analytics engines on edge infrastructure, organizations can capture and act on data at the point of generation, reducing response times and operational costs.

Second, forging partnerships with domestic hardware manufacturers and leveraging local data center expansions can mitigate the impacts of cross-border tariffs and improve service resiliency. A hybrid deployment strategy that dynamically shifts workloads between public and private clouds based on performance requirements and cost targets will further buffer against regulatory fluctuations. Meanwhile, embracing flexible pricing models-including tiered and pay-as-you-go options-will broaden addressable markets, particularly among medium and smaller enterprises seeking scalable entry points.

Lastly, elevating security services through blockchain-based identity management and continuous threat detection frameworks will address rising compliance demands and cyber risk concerns. Prioritizing open standards and interoperability will not only facilitate seamless hybrid cloud integrations but also foster a vibrant partner ecosystem that accelerates feature development and enhances customer value. By orchestrating these initiatives within a cohesive transformation roadmap, leaders can secure sustainable competitive advantages and future-proof their cloud-based value-added service portfolios.

Overview of Comprehensive Multi-Method Research Design and Validation Protocols Underpinning Findings

This research employs a rigorous multi-method methodology to ensure comprehensive coverage and data integrity. Primary research was conducted through in-depth interviews with senior executives spanning cloud service providers, enterprise IT leaders, and industry regulators. Insights from these qualitative engagements were triangulated with quantitative data obtained from proprietary surveys distributed across major end-user industries including financial services, healthcare, and manufacturing.

Secondary research sources incorporated publicly available financial reports, regulatory filings, and white papers from leading technology consortia, supplemented by analyses of patent filings to track innovation trajectories. Market segmentation was validated through cross-referencing service provider catalogs and end-user procurement records, ensuring that each dimension-from service type to deployment mode-accurately reflects current market offerings and adoption patterns.

To bolster reliability, all data points underwent rigorous data cleaning processes and consistency checks, while expert panels provided peer reviews of key findings. The integration of both primary and secondary inputs, along with continuous validation exercises, underpins the robustness of this report’s insights and underlines its value as a strategic decision-support tool.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud-based Value-added Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud-based Value-added Service Market, by Service Type

- Cloud-based Value-added Service Market, by Organization Size

- Cloud-based Value-added Service Market, by Pricing Model

- Cloud-based Value-added Service Market, by Technology Type

- Cloud-based Value-added Service Market, by Deployment Mode

- Cloud-based Value-added Service Market, by End User Industry

- Cloud-based Value-added Service Market, by Region

- Cloud-based Value-added Service Market, by Group

- Cloud-based Value-added Service Market, by Country

- United States Cloud-based Value-added Service Market

- China Cloud-based Value-added Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Strategic Imperatives and Future Outlook for Cloud-Based Value-Added Services Market

Cloud-based value-added services have transcended early adopter experimentation to become strategic imperatives for organizations striving to remain competitive in a digital-first world. The convergence of AI, edge computing, and hybrid deployment models is setting a new standard for performance, agility, and cost optimization. Meanwhile, evolving tariff landscapes and regional regulatory frameworks underscore the necessity for flexible sourcing, localized infrastructure, and adaptive pricing strategies.

Key takeaways from this analysis emphasize the criticality of embedding advanced analytics across service portfolios, reinforcing security with blockchain-driven identity and threat detection solutions, and tailoring deployment and pricing models to end-user needs. As providers continue to innovate around interoperability and ecosystem-based offerings, enterprises must adopt an equally dynamic approach, aligning technology investments with clearly defined business outcomes.

By leveraging the strategic and actionable insights presented here, decision-makers can chart a path toward resilient digital operations, unlock new avenues of customer engagement, and position their organizations to thrive amid ongoing technological and geopolitical shifts.

Connect with Ketan Rohom to Secure Comprehensive Market Intelligence that Drives Strategic Growth

To explore the full breadth of strategic insights and detailed analyses provided in this market research report, please contact Associate Director, Sales & Marketing Ketan Rohom for a personalized consultation and secure your copy today. Ketan brings extensive expertise in cloud-based value-added services and is ready to guide you through how this report can empower your organization’s next steps in a rapidly evolving market landscape. Reach out now to take advantage of early-purchase benefits and position your business at the forefront of innovation.

- How big is the Cloud-based Value-added Service Market?

- What is the Cloud-based Value-added Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?