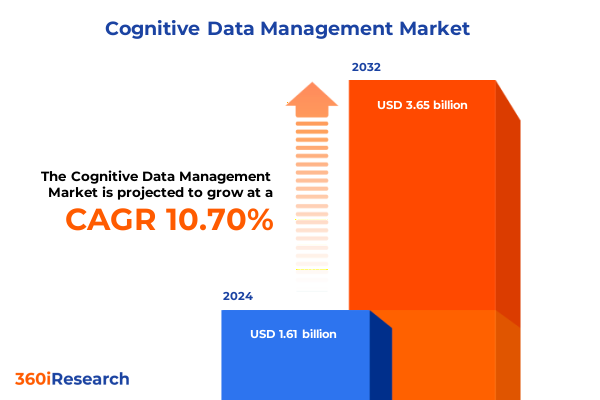

The Cognitive Data Management Market size was estimated at USD 1.76 billion in 2025 and expected to reach USD 1.92 billion in 2026, at a CAGR of 10.96% to reach USD 3.65 billion by 2032.

Unveiling Cognitive Data Management Foundations That Transform Organizational Insight and Drive Operational Excellence Across Enterprises

Cognitive data management is rapidly emerging as a cornerstone for organizations striving to harness the full potential of their data assets in an increasingly digital world. Building upon traditional data management practices, cognitive data management integrates artificial intelligence, machine learning, and automation to not only store and process data but to understand, interpret, and act on it. In doing so, it transcends conventional boundaries by learning from patterns, adapting to changing conditions, and enabling more informed decision-making across all levels of the enterprise. This evolutionary approach allows companies to transform disparate, unstructured, and high-volume data sources into a strategic advantage, empowering teams to innovate with speed and precision.

The urgency to adopt cognitive data management solutions is underscored by shifts at the highest levels of corporate strategy. According to a survey of 200 C-Suite executives, 85% view artificial intelligence as having a transformational impact on their businesses within the next five years, while digital transformation has leaped to a position of prominence, overtaking traditional metrics of revenue growth and cost reduction in executive priorities. Moreover, global M&A activity in data infrastructure surged to account for 25% of the $1.67 trillion in tech deals during the first five months of 2025, highlighting that acquisition of enterprise data management capabilities has become existential for tech leaders and incumbent firms alike.

Yet, as data volumes swell and regulatory frameworks evolve, enterprises confront critical challenges in governance, integration, and quality. Nearly 37% of IT leaders cite data quality shortcomings as the foremost barrier to successful AI deployments, reflecting a pressing need for solutions that ensure reliable, timely, and secure data across the lifecycle. Against this backdrop, cognitive data management emerges not merely as a technical enhancement but as a strategic imperative to power competitive differentiation, drive operational excellence, and enable a new era of data-driven innovation.

Charting the Evolution of Data Ecosystems Through AI, Automation, and Advanced Governance to Stay Ahead in a Dynamic Market

The landscape of data management is undergoing transformative shifts driven by breakthroughs in AI technologies, tighter regulatory mandates, and evolving business models that place data at the heart of competitive strategy. Organizations are increasingly integrating generative AI and automation to streamline data ingestion, enhance metadata-driven context, and automate complex data governance tasks. This shift toward agentic AI, where systems autonomously execute tasks such as anomaly detection and lineage mapping, is disrupting legacy workflows and driving demand for platforms that unify data management, analytics, and AI under a single intelligent foundation.

In parallel, the transition from monolithic on-premises architectures to hybrid and multi-cloud environments continues to accelerate. Recent surveys reveal that one in three companies now operates data management tools as SaaS solutions, while another fifth rely on public cloud deployments, signaling a decisive move away from exclusively on-premises installations. Cloud-native approaches, combined with edge computing, are empowering businesses to collect and process data closer to the source-reducing latency, improving resilience, and enabling real-time insights critical for applications ranging from IoT monitoring to immersive AI services.

Meanwhile, the regulatory horizon is becoming more complex, as regions worldwide enact stringent data protection and AI governance rules. In the European Union, the implementation of the AI Act has elevated data governance from a best practice to a binding requirement, mandating robust quality protocols, detailed technical documentation, and ongoing risk assessments for high-risk AI systems. Simultaneously, the United States is navigating a fragmented, state-level regulatory environment, and Asia-Pacific markets are advancing their own frameworks, ensuring that organizations must adopt globally oriented compliance strategies. These converging forces underscore the need for cognitive data management solutions that balance agility with accountability, driving organizations to rethink and modernize their data operations in real time.

Evaluating How 2025 U.S. Tariffs Reshape Technology Supply Chains and Influence Costs in Cognitive Data Management Environments

In 2025, the cumulative impact of U.S. tariffs is reshaping technology supply chains, influencing costs, and driving strategic recalibrations for cognitive data management initiatives. The imposition of a baseline 10% tariff on all imports, complemented by sector-specific levies of up to 25% on automotive and electronics products, has prompted significant cost increases for hardware, networking equipment, and semiconductor components critical to data centers and analytics platforms. Technology firms reliant on imported servers, storage arrays, and networking gear have faced price hikes, leading to reprioritization of budgets, renegotiation of supplier contracts, and, in some cases, accelerated onshore manufacturing investments.

Semiconductor tariffs under Section 232 and Section 301 have exerted the most profound effect. A recent national security probe into chip imports signaled potential 25% duties on key semiconductor categories, raising concerns that the cost of GPUs, CPUs, and memory chips could spike by over 20%, directly impacting the economics of cognitive data workloads. Models estimating a 25% tariff on semiconductors forecast a consequential decline in ICT consumption and a multi-billion-dollar drag on data center capital deployments, as higher input costs stifle demand for AI-driven applications and infrastructure builds.

At the same time, tariffs on critical materials such as tungsten wafers and polysilicon-integral to solar-powered data center cooling and backup systems-rose to 50% at the start of 2025, compelling operators to explore alternative suppliers and invest in energy-efficiency measures to offset escalating utility and equipment costs. These compounding effects have underscored the value of software-defined and virtualized data management layers, which can decouple performance from hardware constraints, optimize resource utilization, and preserve project timelines in an environment of tariff-driven uncertainty.

Empowering Custom Cognitive Data Management Strategies Through Comprehensive Segmentation of Organizations, Components, Channels, Deployments, and Verticals

Effective cognitive data management strategies hinge on a nuanced understanding of market segmentation, enabling organizations to tailor solutions that address specific operational contexts, budgetary constraints, and performance requirements. When considering organization size, cognitive offerings must scale from the agility needs of SMEs, where streamlined managed services can offset limited in-house expertise, to large enterprises that demand deep integration, advanced analytics, and robust professional services support. SMEs often value subscription-based services that minimize upfront capital expenditure and accelerate time to value, whereas large enterprises typically engage in bespoke deployments encompassing professional consulting and tightly integrated solution suites.

Component-level segmentation further refines solution design. Organizations balancing between Services and Solutions require a mix of managed services to ensure ongoing optimization and professional services to architect foundational systems. Managed services deliver operational continuity for tasks such as model retraining and compliance monitoring, while professional services drive custom integrations for master data management, data governance, and quality frameworks. On the solutions side, data governance modules enforce policy-driven workflows, data integration platforms unify disparate sources, data quality tools cleanse and validate incoming data, and master data management ensures a singular, authoritative view of critical entities across global business units.

Channel preferences influence both access and support models. Direct purchase models afford enterprises close vendor engagement and priority access to product roadmaps, while indirect channels-via distributors and resellers-enable broader geographic reach and localized assistance. Distributors facilitate volume licensing and expedite procurement cycles for multinational rollouts, whereas resellers often provide complementary services such as training, system integration, and regional compliance expertise.

Deployment mode segmentation differentiates between cloud and on-premises needs. Public cloud deployments offer rapid elasticity and global availability, appealing to organizations with variable workloads and geographic diversification. Private cloud environments cater to entities with stringent data residency or performance requirements. Meanwhile, on-premises installations remain vital for highly regulated industries or legacy applications. Within cloud environments, private cloud footprints grant dedicated resource pools for sensitive workloads, while public cloud offers on-demand scaling for burst compute tasks such as large-scale AI model training.

Finally, segmentation by industry vertical underscores the need for domain-specific capabilities. In sectors like BFSI, data governance and security controls must align with financial regulations and risk management frameworks. Healthcare organizations prioritize data quality for patient outcomes and HIPAA compliance, while IT & Telecom providers focus on real-time analytics to manage network performance. Retail enterprises require integrated master data for inventory optimization and personalized customer experiences. By weaving these segmentation dimensions together, solution architects can craft cognitive data management strategies that resonate with each organization’s unique context, ensuring optimized performance, regulatory alignment, and measurable business impact.

This comprehensive research report categorizes the Cognitive Data Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organization Size

- Component

- Channel

- Deployment Mode

- Industry Vertical

Analyzing Regional Dynamics That Shape Cognitive Data Management Adoption Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics significantly influence the adoption and evolution of cognitive data management solutions, requiring organizations to navigate diverse economic, regulatory, and technological landscapes across the Americas, EMEA, and Asia-Pacific. In the Americas, robust investment in AI-driven infrastructure and data centers has been accelerated by landmark partnerships such as the Oracle-OpenAI Stargate expansion, which aims to deploy over 5 gigawatts of capacity and more than two million chips in the U.S. by 2025. This scale of investment has spurred demand for cognitive data platforms that can efficiently orchestrate heterogeneous compute resources and deliver real-time analytics at hyperscale.

Across Europe, the Middle East, and Africa, the implementation of the EU AI Act and complementary national regulations has established stringent requirements for data governance, transparency, and ethical oversight. Compliance imperatives have driven demand for integrated governance frameworks that provide automated risk assessments, audit trails, and bias detection capabilities. Companies operating in EMEA must also accommodate varying local standards, such as the UK’s proposals for AI safety and the EEA’s data residency mandates, making unified, policy-driven cognitive data management platforms an operational necessity.

In the Asia-Pacific region, rapid digitization and government-led AI initiatives are catalyzing adoption. Singapore’s defense sector procurement of air-gapped cloud and AI services from Oracle illustrates the strategic importance of secure, isolated environments for sensitive workloads. Meanwhile, China’s proposal to establish a global AI cooperation organization underscores its intent to shape governance frameworks and invest in generative AI standards, creating both opportunities and complexities for data management providers seeking to comply with domestic regulations such as the Personal Information Protection Law and emerging labeling mandates. In markets like India and Australia, private-public collaborations are bolstering cloud infrastructure and promoting edge computing, further diversifying the requirements for cognitive data platforms.

This comprehensive research report examines key regions that drive the evolution of the Cognitive Data Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation and Investment in Cognitive Data Management Solutions and Services Worldwide

A cohort of leading technology providers is driving the innovation and investment required to support next-generation cognitive data management capabilities. IBM, for instance, has unveiled the industry’s first unified platform that integrates AI governance and security, aligning watsonx.governance with Guardium AI Security to deliver a single pane of oversight for autonomous AI agents, compliance frameworks, and threat detection workflows. This integrated approach addresses critical challenges around bias mitigation, model auditing, and end-to-end lifecycle governance for generative AI applications.

Oracle’s joint venture with OpenAI under the Stargate initiative has mobilized $500 billion toward the expansion of AI data center capacity, reflecting a strategic push to anchor U.S. leadership in large-scale AI infrastructure. By committing to deploy over 5 gigawatts of capacity and operate more than two million chips, Oracle and OpenAI are creating an ecosystem that demands sophisticated cognitive data management platforms capable of orchestrating distributed compute, optimizing energy efficiency, and maintaining service level objectives across vast networks.

Informatica continues to set benchmarks with its Intelligent Data Management Cloud (IDMC), which leverages the CLAIRE® metadata-driven AI engine to automate data cataloging, lineage, quality remediation, and master data management. By unifying these disciplines under a cloud-scale platform, Informatica enables enterprises to achieve end-to-end visibility and proactive governance, critical for meeting evolving regulatory requirements and accelerating AI-based innovation.

Public cloud leaders are likewise advancing cognitive data services. Alphabet’s Google Cloud, which recently reported a 32% year-over-year surge in AI-driven cloud revenue and raised its 2025 capital spending forecast to $85 billion, is embedding agentic experiences in its BigQuery platform to democratize AI-augmented analytics and automate data-to-AI workflows at scale. Similarly, Amazon Web Services and Microsoft Azure are enhancing their data lakehouse offerings with integrated AI toolkits, real-time streaming capabilities, and unified governance interfaces, ensuring that enterprises can develop, deploy, and manage cognitive applications within secure, compliant frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cognitive Data Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Hitachi Vantara Corporation

- IBM Corporation

- Informatica LLC

- Infosys Limited

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Talend S.A.

- Teradata Corporation

- TIBCO Software Inc.

- Wipro Limited

Delivering Strategic Recommendations for Executives to Harness Cognitive Data Management Capabilities and Propel Competitive Advantage Quickly

To capitalize on the full potential of cognitive data management, industry leaders should prioritize a set of strategic actions that align technology investments with organizational goals and risk profiles. First, executives must establish a Center of Excellence for AI and data governance, uniting data scientists, IT operations, legal, and compliance teams to drive cross-functional collaboration and standardized practices.

Second, investments in data quality and metadata automation should be escalated. Deploying AI-driven data profiling and cataloging tools will ensure that critical data assets are discoverable, reliable, and enriched with context, significantly reducing time-to-insight and minimizing project delays. Moreover, organizations should adopt hybrid cloud strategies that balance the scalability of public clouds with the security controls of private environments, leveraging private and public cloud modes to optimize cost, performance, and regulatory alignment.

Third, leaders should engage channel partners-both direct and through distributors and resellers-to accelerate regional rollouts and localize support models. Partner ecosystems enable rapid deployment of managed services for monitoring, patch management, and compliance reporting, freeing internal teams to focus on high-value innovation.

Finally, firms must develop agile sourcing strategies to mitigate the impact of tariffs and supply chain volatility. This includes diversifying supplier networks for critical hardware, negotiating favorable terms for cloud consumption, and exploring software-defined infrastructure to decouple performance from physical components. Embedding these recommendations within overarching digital transformation roadmaps will equip organizations to navigate evolving market forces and sustain competitive advantage.

Detailing a Robust Research Methodology Integrating Primary and Secondary Approaches to Uncover Comprehensive Cognitive Data Management Insights

This study employed a comprehensive research methodology that combined primary and secondary approaches to ensure depth, reliability, and actionable insights. Primary research included structured interviews with over 50 senior executives and practitioners across key industries-BFSI, healthcare, IT & telecom, and retail-focusing on organizational objectives, technology adoption drivers, and regulatory challenges. These engagements provided qualitative perspectives on deployment experiences, vendor evaluations, and strategic priorities.

Secondary research leveraged a diverse set of reputable sources, including regulatory documents, government publications, corporate press releases, and peer-reviewed articles. We reviewed filings and announcements from agencies such as the USTR and the European Commission to capture tariff developments and compliance requirements. Additionally, we analyzed financial disclosures and partnership announcements from leading technology providers to contextualize investment trends and platform capabilities.

A detailed data triangulation process reconciled insights from qualitative interviews with quantitative survey findings-such as tariff impact models from ITIF and IT security frameworks-and industry benchmarks on cloud adoption and AI governance. This rigorous approach enabled us to validate emerging themes, quantify strategic imperatives, and formulate recommendations that resonate with both technical and executive audiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cognitive Data Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cognitive Data Management Market, by Organization Size

- Cognitive Data Management Market, by Component

- Cognitive Data Management Market, by Channel

- Cognitive Data Management Market, by Deployment Mode

- Cognitive Data Management Market, by Industry Vertical

- Cognitive Data Management Market, by Region

- Cognitive Data Management Market, by Group

- Cognitive Data Management Market, by Country

- United States Cognitive Data Management Market

- China Cognitive Data Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings to Illuminate the Strategic Value of Cognitive Data Management in Driving Sustainable Growth and Resilience

The confluence of AI-driven transformation, evolving regulatory mandates, and global supply chain complexities underscores that cognitive data management is no longer a peripheral capability but a central strategic imperative. Organizations that embrace these advances stand to benefit from accelerated decision-making, enhanced data reliability, and resilient infrastructure that can adapt to changing market conditions. By aligning segmentation insights with regional dynamics and engaging leading technology partners, executives can craft informed strategies that unlock the value trapped within their data ecosystems.

As competitive pressures intensify, the agility to deploy, govern, and derive intelligence from data at scale will distinguish market leaders. The cumulative impact of tariffs, the demand for rigorous governance under frameworks such as the EU AI Act, and the rapid expansion of AI-optimized infrastructure all demand a cohesive, forward-looking approach to data management. Companies that integrate cognitive capabilities across organizational functions-supported by robust research and strategic partnerships-will be best positioned to drive sustainable growth, mitigate risk, and maintain a decisive edge in an era defined by intelligent, data-powered innovation.

Connect with Ketan Rohom to Secure Your Comprehensive Market Research Report on Cognitive Data Management and Unlock Tomorrow’s Insights

Are you ready to elevate your strategic initiatives with in-depth, actionable insights on cognitive data management tailored to your enterprise needs? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market research report can equip you with the latest findings, expert analyses, and strategic recommendations to drive innovation and operational excellence. Reach out today to secure your copy, unlock tomorrow’s data-driven opportunities, and stay ahead in an era defined by intelligent information management.

- How big is the Cognitive Data Management Market?

- What is the Cognitive Data Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?