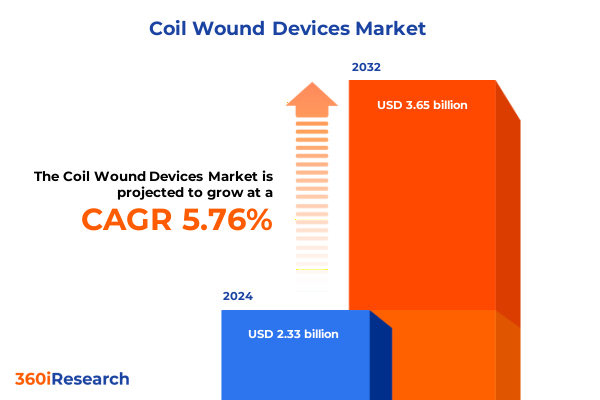

The Coil Wound Devices Market size was estimated at USD 2.46 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 5.77% to reach USD 3.65 billion by 2032.

Setting the Stage for a Transformative Era in Coil Wound Devices Driven by Electrification, Digital Innovation, and Shifting Industrial Demand Patterns

The coil wound device industry stands at the intersection of escalating electrification trends, burgeoning digital infrastructure demands, and an intensified global focus on energy efficiency. As a foundational component in power conversion, signal conditioning, and electromagnetic interference suppression, coil wound transformers, inductors, and related components underpin a vast array of industrial and consumer applications. Against this backdrop, the introduction of advanced materials, novel winding techniques, and integrated design platforms is redefining performance thresholds across voltage, frequency, size, and thermal resilience metrics.

This introductory section outlines the macroeconomic drivers catalyzing market evolution, including government incentives for renewable energy deployment, the accelerating adoption of electric vehicles, and the expansion of data center capacity worldwide. Moreover, it highlights how end users are demanding more compact, lightweight, and highly efficient magnetic devices to meet stricter regulatory standards and sustainability goals. By establishing this contextual framework, readers will gain a clear understanding of the forces shaping competitive positioning, supply chain complexity, and innovation imperatives within the coil wound device landscape.

Navigating the Pivotal Transformations Reshaping Coil Wound Devices Through Advanced Materials, Sustainability Imperatives, and Supply Chain Evolution

Innovation in coil wound devices is no longer incremental; it has become transformational across materials science, manufacturing processes, and digital integration. The advent of nanocrystalline and amorphous alloy cores is delivering unprecedented core loss reduction at high frequencies, while advanced polymer and ceramic insulations extend thermal operating windows and reliability under harsh environments. Concurrently, automated precision winding platforms leveraging robotics and real-time quality monitoring are accelerating throughput and dimensional accuracy, enabling complex planar and toroidal geometries at scale.

In parallel, the convergence of IoT-enabled condition monitoring systems and predictive analytics is revolutionizing maintenance paradigms for critical infrastructure. Smart coils equipped with embedded temperature, vibration, and current sensors are feeding data streams into analytics engines, allowing stakeholders to preemptively address performance degradation and prevent costly downtime. As sustainability ascends as a corporate priority, manufacturers are also optimizing supply chains to reduce carbon footprints, sourcing low-loss materials, and developing recyclable designs. Collectively, these shifts are redefining product roadmaps and requiring stakeholders to adapt swiftly to maintain competitive relevance.

Assessing the Far-Reaching Effects of 2025 U.S. Tariff Policies on Coil Wound Devices: Cost Pressures, Supply Chain Disruptions, and Market Responses

Since early 2025, U.S. trade policy has introduced sweeping reciprocal tariffs under emergency economic powers. A 10% universal levy was imposed on all imports effective April 5, 2025, with heightened duties for key trading partners, driving the effective tariff rate on Chinese goods to 54% after April 9, 2025. Additionally, the administration implemented a 10% “fentanyl supply chain” tariff on all imports from China beginning February 1, 2025, targeting precursor chemicals and related products.

These actions have reverberated through coil wound device supply chains, where critical raw materials-such as electrical steel, copper conductors, and specialized insulation films-have seen cost escalations. Industry reports indicate that tariffs on steel and copper have exacerbated existing material inflation, placing upward pressure on transformer manufacturing expenses and risking delivery delays as domestic producers struggle to fill capacity gaps. Legal uncertainty further complicates planning after a U.S. Court of International Trade injunction in late May 2025 halted enforcement of the “Liberation Day” reciprocal tariffs, introducing potential fluctuations in duty liabilities and requiring dynamic procurement strategies.

Unveiling Core Segmentation Insights That Illuminate Product, Industry, Winding and Insulation Dynamics Driving Coil Wound Device Applications

Insight into market segmentation reveals nuanced dynamics driven by diverse product families, end-use industries, winding techniques, and insulation materials. In the product type dimension, traditional EI core transformers maintain a presence in high-power applications but face mounting competition from more compact and thermally efficient planar and toroidal designs. Inductors are differentiating themselves through specialized subcategories, including air core configurations for radio frequency applications, common mode chokes to mitigate electromagnetic interference, and power inductors optimized for energy storage and smoothing functions. Meanwhile, planar transformer technologies bifurcate into high-frequency units used in switch-mode power supplies, low-profile variants suited for space-constrained electronics, and PCB-mounted solutions that streamline assembly and thermal management.

End-use verticals further drive segmentation. Automotive electrification accelerates demand for high-reliability power magnetics in onboard chargers and DC-DC converters, while the consumer goods sector-comprising household appliances and portable electronics-prioritizes miniaturization and cost efficiency. Within energy and utilities, power generation platforms and transmission equipment impose rigorous safety and performance standards, prompting suppliers to tailor transformer and inductor designs accordingly. The healthcare segment’s imaging systems and medical instrumentation require ultra-low noise and robust insulation, and the IT & telecom market is fueling growth for data center power distribution units and telecommunications hardware.

Among winding methodologies, form, layer, and random winding techniques coexist, each optimized for specific balance of cost, performance, and manufacturability. Insulation selection across epoxy, polyester, and silicone substrates addresses tradeoffs between dielectric strength, flexibility, and thermal endurance. By mapping these intersecting segment dimensions, stakeholders can pinpoint areas of high growth potential and tailor product roadmaps to evolving technical and commercial requirements.

This comprehensive research report categorizes the Coil Wound Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Winding Technique

- Insulation Material

- End Use Industry

Discerning Critical Regional Dynamics in the Coil Wound Device Market Across the Americas, EMEA, and Asia-Pacific for Strategic Positioning

Regional dynamics in the coil wound device market reflect a blend of established hubs and emerging powerhouses, each shaped by unique regulatory, socioeconomic, and infrastructural factors. In the Americas, sustained investment in grid modernization, electric vehicle charging infrastructure, and industrial automation underpins demand for transformers and inductors. The region’s robust OEM ecosystem, combined with incentives for domestic manufacturing, has also prompted near-shoring initiatives aimed at reducing lead times and mitigating tariff exposure.

Across Europe, the Middle East, and Africa, stringent sustainability mandates and renewable integration targets are driving upgrade cycles for power magnetics in wind, solar, and hybrid energy systems. Regulatory frameworks such as the European Union’s Eco-Design Directive compel manufacturers to innovate low-loss core materials and recyclable component architectures. In parallel, emerging economies in the Gulf and North Africa are bolstering generation and transmission capacities, fuelling demand for both standardized and customized coil wound solutions.

The Asia-Pacific region remains the global manufacturing nucleus for coil wound devices, boasting extensive capacity in China, India, Japan, and Southeast Asia. Competitive cost structures and accelerating domestic consumption form a dual engine for growth, while government programs supporting electric mobility and smart grid deployments further amplify market opportunity. However, supply-chain concentration risks and recent trade policy shifts have prompted multinational players to diversify production footprints and forge strategic partnerships to secure supply continuity.

This comprehensive research report examines key regions that drive the evolution of the Coil Wound Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Strategic Initiatives Steering Innovation, Capacity Expansion, and Competitive Differentiation in Coil Wound Devices

Leading companies in the coil wound device arena are carving competitive advantage through targeted investments in research and development, strategic capacity expansion, and value-added service offerings. A number of global players have intensified focus on high-frequency planar technologies, leveraging proprietary core alloys and advanced winding processes to address stringent efficiency targets in power electronics. Others are enhancing in-house materials capabilities, vertically integrating insulation production to improve quality control and compress delivery timelines.

Collaborative alliances have also emerged as a strategic pathway, with several suppliers partnering with semiconductor and power module vendors to co-develop integrated magnetic-semiconductor platforms. These cross-industry joint ventures aim to accelerate time-to-market for next-generation power conversion solutions, aligning coil wound device roadmaps with evolving semiconductor power densities and switching frequencies.

Customer-centric service models further distinguish market leaders. By offering digital tools for rapid part selection, online configurators for custom winding designs, and predictive maintenance dashboards, these companies are elevating the customer experience and cultivating long-term partnerships. Such differentiated capabilities not only drive product premiumization but also create ecosystems where coil wound device suppliers become strategic enablers of broader solution stacks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coil Wound Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AVX Corporation

- Bourns, Inc.

- Coilcraft, Inc.

- Murata Manufacturing Co., Ltd.

- Samsung Electro-Mechanics Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Standex Electronics, Inc.

- Stonite Coil Corporation

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- TE Connectivity Corporation

- Vishay Intertechnology, Inc.

- Würth Elektronik Gruppe GmbH & Co. KG

- Yageo Corporation

Driving Proactive Strategies for Industry Leaders to Capitalize on Technological Advances, Regulatory Shifts, and Emerging Market Opportunities

To thrive amid accelerating technological and trade shifts, industry leaders must adopt proactive strategies that balance innovation, agility, and risk mitigation. First, prioritizing material science collaborations can yield next-generation core and insulation compositions that enhance efficiency and operating temperature ranges, directly addressing customer demands and regulatory pressures. Second, expanding flexible manufacturing footprints-through greenfield facilities, joint ventures, or contract manufacturing partnerships-will insulate supply chains from geopolitical and tariff disruptions and support just-in-time delivery models.

Furthermore, integrating digital twins and advanced analytics into production and service processes can improve yield, bolster quality assurance, and enable predictive maintenance offerings. Firms should also explore ecosystem plays, co-developing magnetic-semiconductor packages and turnkey modules that streamline design cycles and foster deeper customer engagement. Finally, maintaining regulatory foresight-through active participation in standards bodies and trade associations-will help anticipate policy shifts, shape favorable outcomes, and ensure compliance in complex global markets. Together, these actions will position organizations to capture emerging growth pockets while maintaining resilience in the face of external shocks.

Outlining Rigorous Research Methodology Underpinning Comprehensive Analysis of Coil Wound Devices Through Diverse Data Sources and Expert Validation

This research leverages a multi-pronged methodology to deliver comprehensive and reliable insights. Primary data collection included in-depth interviews with component manufacturers, end-use industry engineers, and procurement executives, providing firsthand perspectives on technology adoption, application requirements, and purchase drivers. Secondary research encompassed analysis of technical papers, patent filings, regulatory filings, and publicly available corporate disclosures to triangulate market trends and validate innovation trajectories.

Quantitative analysis involved mapping production and trade data across global customs databases, cross-referenced with supplier capacity reports and industry association statistics. Qualitative assessments were enriched by site visits to manufacturing and R&D facilities, enabling direct observation of process capabilities and sustainability practices. A dedicated expert panel reviewed preliminary findings to ensure consistency with field realities and to incorporate forward-looking scenario planning. Rigorous data cleansing and validation protocols underpinned all statistical modeling, ensuring that conclusions reflect both current conditions and foreseeable developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coil Wound Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coil Wound Devices Market, by Product Type

- Coil Wound Devices Market, by Winding Technique

- Coil Wound Devices Market, by Insulation Material

- Coil Wound Devices Market, by End Use Industry

- Coil Wound Devices Market, by Region

- Coil Wound Devices Market, by Group

- Coil Wound Devices Market, by Country

- United States Coil Wound Devices Market

- China Coil Wound Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesis of Insights and Strategic Imperatives Highlighting the Future Roadmap for Stakeholders in the Coil Wound Device Industry

In synthesizing the intricate dynamics of the coil wound device market, several strategic imperatives emerge. The confluence of advanced core materials, automated winding technologies, and digital service models is redefining performance benchmarks and reshaping value propositions. Concurrently, evolving trade policies and regional policy frameworks are introducing both risk and opportunity, underscoring the need for flexible supply chain configurations and regulatory engagement.

Segmentation analysis highlights targeted growth pockets in electrification, renewable integration, healthcare equipment, and high-frequency power electronics, each demanding tailored product architectures and service ecosystems. The regional landscape calls for balanced global and localized approaches, capitalizing on Asia-Pacific manufacturing strength while leveraging regional incentives and near-shoring initiatives in the Americas and EMEA.

Ultimately, success in this landscape will hinge on the ability to marry technological leadership with operational agility and customer-centric innovation. Firms that invest strategically in materials, digital capabilities, and ecosystem partnerships will not only withstand external shocks but will also chart a course toward sustainable growth and industry leadership.

Engage with Ketan Rohom to Unlock Premium Insights and Tailored Support for Your Strategic Decisions in Coil Wound Devices Market

Thank you for exploring this comprehensive analysis of the coil wound device market. To delve deeper into actionable insights, secure competitive advantage, and receive personalized guidance on leveraging market dynamics, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan’s expertise in tailoring market intelligence to strategic objectives will empower your organization to make informed decisions, optimize investments, and navigate emerging challenges with confidence. Reach out today to purchase the full market research report and transform these insights into your next growth milestone.

- How big is the Coil Wound Devices Market?

- What is the Coil Wound Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?