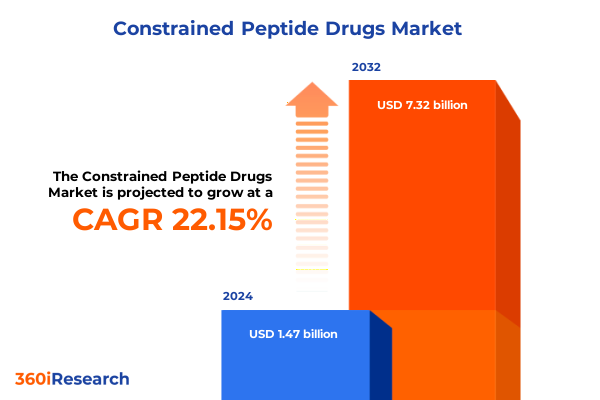

The Constrained Peptide Drugs Market size was estimated at USD 109.07 billion in 2025 and expected to reach USD 114.92 billion in 2026, at a CAGR of 5.46% to reach USD 158.33 billion by 2032.

Unveiling the Potential of Constrained Peptide Therapeutics: Pioneering Stability, Specificity, Innovation, and Research Impetus in Modern Medicine

Constrained peptide therapeutics have emerged as a breakthrough platform in modern medicine, marrying the high specificity of biologics with the stability and manufacturability of small molecules. These engineered scaffolds, featuring chemical cyclization or structural staples, have been designed to resist proteolytic degradation while retaining precise target engagement. Such attributes have expanded the therapeutic index of peptide drugs, paving the way for novel interventions across a spectrum of disease states.

As drug developers increasingly encounter limitations with conventional peptides-namely rapid clearance, suboptimal oral bioavailability, and off-target liabilities-constrained architectures offer a robust solution. By constraining backbone flexibility, these molecules demonstrate enhanced receptor affinity, tissue penetration, and prolonged circulation half-life. Coupled with advances in high-throughput screening and computational modeling, the industry has accelerated lead identification while optimizing pharmacokinetic profiles early in development.

The introduction of state-of-the-art synthesis and expression technologies has further catalyzed growth. Solid phase peptide synthesis and recombinant strategies have matured to accommodate complex cyclization chemistries at scale, reducing production hurdles. With bioconjugation platforms enabling targeted payload delivery, these peptides are now being explored in modalities from targeted oncology agents to antiviral inhibitors. This convergence of chemical innovation and biomanufacturing prowess underpins the transformative promise of constrained peptide drugs in addressing unmet clinical needs.

How Constrained Peptide Drug Development is Reshaping the Biopharmaceutical Landscape Through Cutting-Edge Engineering and Strategic Collaborations

The last decade has witnessed transformative shifts in peptide drug discovery, driven by interdisciplinary collaborations and engineering ingenuity. Traditionally, peptides were limited by susceptibility to enzymatic degradation and rapid renal clearance, which curtailed their development to niche applications. However, advances in structural biology, peptide cyclization, and stapling chemistries have reconfigured these liabilities into strengths. By adopting conformational constraints at key residues, developers can now fine-tune pharmacodynamics properties with unprecedented precision.

Strategic partnerships between biotech innovators and large pharmaceutical companies have further redefined the landscape. Smaller specialized firms contribute novel scaffolds and screening libraries, while established players bring clinical development expertise and global commercialization networks. This synergistic ecosystem accelerates translation of constrained candidates into clinical trials, shortening timelines and de-risking investments. Moreover, the integration of artificial intelligence and machine learning into peptide design workflows has enabled rapid virtual screening of millions of variants, refining target engagement metrics before chemical synthesis.

Regulatory frameworks have adapted in response to these technological advances. Health authorities have released updated guidance on peptide characterizations, expediting review pathways for cyclic and stapled molecules with clear mechanisms of action. This regulatory clarity, combined with streamlined clinical protocols for biologically targeted agents, has emboldened developers to pursue first-in-class constructs across therapeutic areas that were previously deemed intractable.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Constrained Peptide Drug Supply Chains and Cost Structures

The United States’ implementation of targeted tariff measures in early 2025 has introduced both challenges and opportunities within constrained peptide supply chains. As import duties were levied on specialized raw materials and non-innovator peptide intermediates sourced from key manufacturing hubs, developers experienced a short-term spike in production costs. These cumulative levies compelled companies to reevaluate supplier portfolios and negotiate more favorable long-term contracts, fostering a renewed emphasis on supply chain resilience and onshore sourcing.

In response, several stakeholders have accelerated investments in domestic peptide synthesis capacity. Contract manufacturing organizations capable of solid phase peptide techniques and recombinant expression are scaling up their facilities to capture diverted demand. While these shifts have required capital expenditure and process optimization, the broader industry has leveraged tariff-induced market signals to drive vertical integration. Enhanced transparency around raw material provenance and cost structures has incentivized innovation in green chemistry approaches, such as enzyme-mediated macrocyclization, which can be deployed closer to end users.

Looking ahead, the enduring impact of these 2025 measures will likely be reflected in more robust regional supply networks. Although initial compliance hurdles tested manufacturers’ agility, the drive toward localized peptide production has mitigated single-source dependencies and sharpened competitive differentiation based on quality and lead times rather than purely on cost.

Strategic Market Segmentation Reveals Therapeutic Area, Peptide Type, Administration Route, Synthesis Method, and End User Dynamics

A multifaceted segmentation framework reveals critical drivers shaping the constrained peptide domain. When analyzed by therapeutic area, developers are intensely focusing on cardiovascular conditions, central nervous system disorders, infectious diseases, metabolic disruptions, and oncology. Within infectious diseases, antibacterial constructs are being optimized against resistant pathogens like MRSA and tuberculosis, while antiviral peptides target hepatitis and HIV. Metabolic indications draw on peptides differentiated for diabetes management in both Type 1 and Type 2 cohorts and obesity control, whereas oncology pipelines emphasize hematological malignancies and diverse solid tumors, including breast, lung, and prostate cancers.

Delineating by peptide type, market participants are exploring cyclized backbones for rigidity, D-amino acid-enriched sequences for enhanced protease resistance, macrocyclic scaffolds for complex binding surfaces, and stapled structures to stabilize alpha-helical motifs. Route of administration segmentation further informs formulation strategies, spanning intravenous infusion for acute care, oral delivery for chronic regimens, subcutaneous injection for outpatient convenience, and transdermal systems for sustained release.

Synthesis methodologies delineate the economic and logistic contours of the field, with recombinant technology facilitating large-scale biosynthetic routes and solid phase peptide synthesis enabling precise chemical modifications. Finally, end user segmentation underscores demand drivers among hospitals implementing biologic therapies, pharmaceutical companies scaling clinical testing, and academic or private research institutes advancing preclinical science. This layered segmentation provides a holistic view of the competitive and technological landscape, directing strategic prioritization across the value chain.

This comprehensive research report categorizes the Constrained Peptide Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Peptide Type

- Therapeutic Area

- Synthesis Method

- Route Of Administration

- End User

Comparative Regional Dynamics of Constrained Peptide Therapeutics Adoption Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics are shaping the global trajectory of constrained peptide therapeutics through unique regulatory, economic, and healthcare infrastructure factors. In the Americas, strong venture capital funding and a progressive regulatory environment have accelerated first-in-human trials, particularly in cardiovascular and metabolic domains. North American biomanufacturers are pioneering green chemistry and continuous flow synthesis, attracting partnerships with global stakeholders seeking supply diversification.

Europe, the Middle East, and Africa present a heterogeneous landscape, where advanced markets like Germany and Switzerland prioritize precision oncology applications, supported by reimbursement pathways for targeted biologics. Conversely, emerging economies in the Middle East and Africa are building research capacity to address endemic infectious diseases, leveraging constrained peptides as novel antibacterial and antiviral tools. Divergent healthcare budgets and regulatory harmonization efforts across the European Union influence where to position clinical studies and commercial launch strategies.

Asia-Pacific stands out for its expansive contract development and manufacturing organization network, particularly in China, Japan, and South Korea. Local companies are investing heavily in peptide stapling and macrocyclization platforms, catering to both regional demands for hepatotropic antivirals and global oncology partnerships. Government incentives for biotech innovation further bolster this region’s capacity to serve as a manufacturing nexus and co-development partner.

This comprehensive research report examines key regions that drive the evolution of the Constrained Peptide Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of Leading Industry Players Driving Innovation, Collaboration, and Competitive Advantage in Constrained Peptide Therapeutics

Leading life science companies are at the forefront of constrained peptide innovation, harnessing proprietary platforms to deliver differentiated drug candidates. Amgen has demonstrated strategic prowess by combining computational design with novel macrocyclic scaffolds to pursue cardiovascular and metabolic indications, leveraging its global development footprint. Novartis has similarly expanded its oncology pipeline through collaborations with specialized biotech firms, integrating stapled peptide modules to target intracellular protein-protein interactions previously deemed undruggable.

Pfizer’s investment in green manufacturing technologies for solid phase peptide synthesis underscores a commitment to sustainable scale-up, which has attracted interest from partners intent on lowering environmental impact in late-stage production. AstraZeneca has adopted recombinant fusion constructs to enhance tissue targeting, particularly within the central nervous system space, navigating the blood-brain barrier with innovative cyclic peptides. Mid-sized players such as Bicycle Therapeutics and Amolyt Pharma continue to differentiate through platform exclusivity, leveraging D-peptide chemistries for improved oral bioavailability in outpatient chronic therapies. These competitive dynamics reflect an ecosystem where both established pharmaceutical giants and agile biotech innovators shape market progress through complementary strengths.

This comprehensive research report delivers an in-depth overview of the principal market players in the Constrained Peptide Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aileron Therapeutics, Inc.

- Alloy Therapeutics, Inc.

- Amgen Inc.

- Bicycle Therapeutics PLC

- Bio-Synthesis, Inc.

- Bristol-Myers Squibb Company

- Chugai Pharmaceutical Co., Ltd.

- Circle Pharma, Inc.

- Creative Peptides

- Eli Lilly and Company

- Encycle Therapeutics, Inc.

- F. Hoffmann-La Roche Ltd.

- Issar Pharmaceuticals, Inc.

- Lisata Therapeutics, Inc.

- Merck & Co., Inc.

- Neuland Laboratories Limited

- Novartis AG

- Pepscan Therapeutics B.V.

- Pepticom Ltd.

- Pfizer Inc.

- Phylogica Ltd.

- PolyPeptide Group

- Sanofi S.A.

- Santhera Pharmaceuticals AG

- Spexis AG

Strategic Recommendations for Industry Leaders to Enhance Pipeline Robustness, Optimize Supply Chains, and Foster Partnership Ecosystems

To capitalize on emerging opportunities, industry leaders should adopt a strategic roadmap emphasizing pipeline diversification, supply chain resilience, and collaborative alliances. Prioritizing platform integration enables rapid progression from hit identification to lead optimization, ensuring robust target engagement while de-risking early development. By investing in modular cyclization and stapling technologies, companies can create versatile libraries that address multiple disease contexts without reinventing foundational chemistries.

Strengthening onshore manufacturing capabilities mitigates exposure to geopolitical uncertainties and import tariff fluctuations. Organizations can establish joint ventures with regional contract development and manufacturing organizations, sharing technical expertise and risk while preserving cost efficiency. Additionally, fostering open innovation models-such as joint screening programs with academic institutions-enhances access to novel target classes and accelerates discovery pipelines.

Finally, building cross-functional teams that integrate medicinal chemistry with data science and clinical operations will streamline decision-making. Embedding artificial intelligence into process analytics and design of experiments platforms can refine production parameters and predict clinical performance, yielding continuous improvement cycles from discovery through commercialization.

Comprehensive Research Framework Utilizing Primary Expert Interviews, Secondary Data Analysis, and Triangulation to Ensure Rigorous Market Insights

This analysis integrates a rigorous research methodology combining primary expert engagements, comprehensive secondary data reviews, and systematic data triangulation. Primary insights were obtained through structured interviews with R&D heads, manufacturing specialists, and regulatory affairs executives at leading biopharmaceutical firms. These discussions illuminated real-world challenges in peptide cyclization, supply chain bottlenecks, and emerging therapeutic priorities.

Secondary research encompassed peer-reviewed journals, patent landscapes, clinical trial registries, and public filings to construct a detailed understanding of constrained peptide platforms and competitive positioning. Market intelligence databases and regulatory guidance documents provided context on regional approval pathways and tariff frameworks. Cross-validation of findings occurred through comparative analysis of corporate announcements, collaboration ecosystems, and academic publications, ensuring consistency and reliability.

By integrating qualitative perspectives with quantitative reference points-such as synthesis throughput rates, pipeline stage distributions, and manufacturing capacity trends-this report delivers a nuanced perspective on both technological advances and commercial dynamics. The methodological rigor ensures that recommendations are grounded in actionable evidence, helping stakeholders make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Constrained Peptide Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Constrained Peptide Drugs Market, by Peptide Type

- Constrained Peptide Drugs Market, by Therapeutic Area

- Constrained Peptide Drugs Market, by Synthesis Method

- Constrained Peptide Drugs Market, by Route Of Administration

- Constrained Peptide Drugs Market, by End User

- Constrained Peptide Drugs Market, by Region

- Constrained Peptide Drugs Market, by Group

- Constrained Peptide Drugs Market, by Country

- United States Constrained Peptide Drugs Market

- China Constrained Peptide Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesis of Findings Underscores the Critical Role of Constrained Peptide Drugs in Addressing Unmet Medical Needs and Shaping Future Therapies

Constrained peptide drugs represent a paradigm shift in therapeutic design, offering versatile modalities that bridge the gap between traditional small molecules and monoclonal antibodies. Through innovations in cyclization, stapling, and D-amino acid incorporation, these molecules exhibit enhanced stability, precise target engagement, and improved pharmacokinetics. The collective momentum of technological advances, strategic partnerships, and evolving regulatory clarity underscores an inflection point in biopharmaceutical development.

Regional dynamics reveal that while the Americas drive early-stage innovation and funding, Europe Middle East Africa emphasizes precision oncology and emerging infectious disease solutions, and Asia-Pacific excels in scalable manufacturing and co-development initiatives. Although 2025 tariff measures introduced short-term cost pressures, they ultimately catalyzed supply chain diversification and onshore capacity expansion, strengthening the ecosystem’s resilience.

As leading companies continue to optimize platform technologies and pursue novel indications, stakeholders who embrace integrated R&D, supply chain agility, and open innovation will capture the most significant competitive advantages. The synthesis of these insights points to a dynamic future where constrained peptide therapeutics will play an increasingly central role in addressing critical unmet needs across therapeutic areas.

Engage with Our Associate Director of Sales and Marketing to Unlock Detailed Insights and Propel Your Constrained Peptide Drug Strategies Forward

Ready to transform your constrained peptide drug ambitions into strategic successes? Reach out today for a comprehensive deep dive that equips your team with actionable insights and competitive differentiation in this rapidly evolving therapeutic space. To access our full market research report and collaborate directly with our Associate Director of Sales & Marketing, Ketan Rohom, contact us now to secure the intelligence you need to lead the next wave of innovation.

- How big is the Constrained Peptide Drugs Market?

- What is the Constrained Peptide Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?