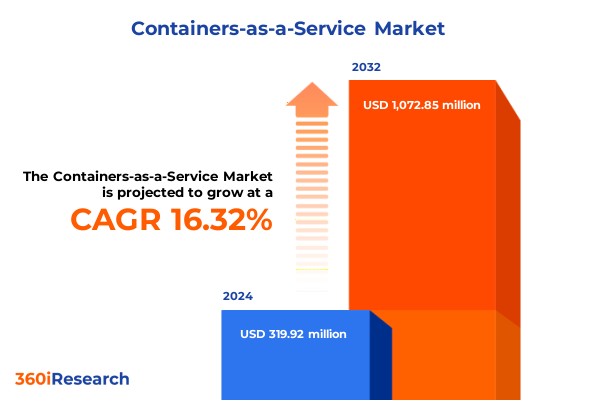

The Containers-as-a-Service Market size was estimated at USD 373.30 million in 2025 and expected to reach USD 440.74 million in 2026, at a CAGR of 16.27% to reach USD 1,072.85 million by 2032.

Pioneering the Next Wave of Cloud Innovation by Leveraging Scalable Containerized Service Architectures for Agile Enterprise Infrastructure and Operational Excellence

Containerization has emerged as one of the most transformative advances in cloud computing, ushering in a new era of rapid application deployment, improved resource utilization, and unparalleled infrastructure agility. As enterprises seek to modernize legacy systems and pivot toward microservices architectures, containers-as-a-service (CaaS) offerings have become central to digital transformation initiatives. By abstracting hardware dependencies and automating critical management tasks, CaaS platforms empower development teams to focus on innovation rather than operational overhead.

This report delivers a comprehensive executive summary of the current CaaS ecosystem, capturing the dynamics behind evolving service offerings, deployment strategies, and competitive landscapes. It synthesizes market drivers, technological enablers, and regulatory influences shaping adoption trends across industries. In addition, it examines how geopolitical developments and trade policy shifts are influencing cost structures and supply chain resiliency for container-based services. Readers will gain actionable insights into segmentation dimensions, regional growth pockets, and leading provider strategies that define the state of the market in 2025.

Understanding How Rapid Technological Advancements and Evolving Cloud Strategies Are Reshaping the Global Containers as a Service Landscape

The CaaS landscape is undergoing rapid transformation driven by a confluence of technological breakthroughs and evolving cloud strategies. Advances in orchestration frameworks have blurred the lines between on-premises and public cloud environments, facilitating seamless workload portability. At the same time, emerging networking paradigms such as software-defined overlays are delivering greater flexibility in multi-cloud deployments and unlocking new possibilities for network service chaining and policy enforcement.

Meanwhile, the growing sophistication of security tooling has embedded runtime protection, identity management, and vulnerability scanning directly into container pipelines, reducing risk and meeting stringent compliance mandates. Managed Kubernetes services have risen to prominence, with cloud platform providers and third-party specialists offering fully orchestrated environments that abstract away infrastructure complexities. These shifts reflect a broader industry trend toward service-centric consumption models, where enterprises pay only for the capabilities they consume, reducing the total cost of ownership and accelerating time to market.

Examining How 2025 United States Tariff Adjustments on Hardware and Software Imports Are Altering Cost Dynamics for Containerized Service Deployments

In 2025, adjustments to United States tariff policies on hardware and software imports have introduced new cost considerations for CaaS providers and their customers. Increased duties on semiconductor components and storage arrays are driving up the expense of data center infrastructure, while heightened levies on networking equipment have elevated the total cost of bandwidth orchestration solutions. These developments have prompted service providers to reassess vendor relationships and accelerate investments in domestic manufacturing partners to mitigate price volatility.

On the software side, the reclassification of certain open-source distribution licenses under updated trade regulations has created compliance challenges for global platforms, necessitating enhanced license management capabilities. In response, many CaaS operators are optimizing supply chains by diversifying hardware sourcing regions and leveraging pre-negotiated tariff exclusions. While these measures have moderated margin pressures, they have also underscored the strategic importance of procurement agility and regulatory intelligence in the evolving cost structure of containerized services.

Revealing Critical Service Offering, Deployment Models, Organizational Profiles, and Industry-Specific Trends Driving Containers as a Service Adoption

Insight into service offerings reveals that container management remains foundational, complemented by advanced networking, orchestration, security, and storage capabilities. Overlay and software-defined networking approaches now coexist, supporting highly dynamic traffic patterns in hybrid and multi-cloud topologies. Orchestration modules range from Apache Mesos and Docker Swarm to the dominant Kubernetes ecosystem, further bifurcated into managed and self-managed deployments. Within managed Kubernetes, both cloud-vendor and third-party options cater to differing preferences for integration depth and support levels. Security services encompass identity management, network segmentation, runtime threat prevention, and vulnerability management, securing containers throughout their lifecycle and across distributed environments.

From a deployment standpoint, hybrid cloud models are increasingly favored for balancing control and scalability, while private clouds provide stringent security for regulated workloads. Public cloud remains an attractive entry point for small and medium enterprises, offering rapid provisioning and usage-based billing. At the organizational level, large enterprises leverage CaaS to streamline global operations and enforce governance standards, whereas small and medium businesses prioritize speed of deployment and cost efficiency. Key verticals such as banking, financial services, insurance, healthcare, and life sciences drive demand for robust security and compliance features, and information technology, telecom, manufacturing, and retail sectors require scalable performance, high availability, and seamless integration with legacy systems.

This comprehensive research report categorizes the Containers-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Offering

- Deployment Model

- Organization Size

- End User Industry

Analyzing Regional Adoption Patterns across Americas, Europe Middle East and Africa, and Asia-Pacific to Uncover High-Growth Containers as a Service Markets

Geographic dynamics play a pivotal role in shaping CaaS adoption and innovation trajectories. In the Americas, North America leads the market with a mature ecosystem of cloud platforms, system integrators, and specialized service providers, supported by high network infrastructure quality and favorable regulatory frameworks. Brazil and Mexico are emerging as growth centers, driven by digital modernization initiatives and government incentives for local data hosting.

In Europe, Middle East, and Africa, enterprise adoption is characterized by rigorous data sovereignty and privacy regulations, prompting the proliferation of localized data centers and hybrid architectures. Developed EU markets emphasize integration with existing enterprise resource planning and legacy environments, whereas Middle East and Africa are witnessing greenfield cloud projects bolstered by national digital transformation strategies.

Asia-Pacific remains the fastest-growing region, propelled by rapid cloud adoption in China, Japan, India, Australia, and Southeast Asian markets. High demand for scalable infrastructure in e-commerce, telecommunications, and digital services has fueled partnerships between global cloud providers and local telcos, resulting in specialized hybrid offerings optimized for regional compliance and network performance.

This comprehensive research report examines key regions that drive the evolution of the Containers-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Container as a Service Providers and Their Strategic Innovations Driving Competitive Differentiation and Market Leadership

Leading organizations are steering the CaaS market through differentiated strategies and continuous innovation. Global hyperscale cloud providers have expanded managed Kubernetes services with integrated developer tools, security frameworks, and multi-region orchestration capabilities to retain enterprise customers. Traditional infrastructure vendors are embedding container runtimes into their virtualization portfolios, offering a unified platform for VM and container workloads. Meanwhile, pure-play CaaS specialists are carving out niches by focusing on edge-oriented deployments, advanced networking features, or specialized regulatory compliance offerings.

Strategic partnerships between cloud providers, network operators, and security technology firms are driving the creation of end-to-end container ecosystems that streamline adoption and accelerate time-to-value. These alliances enable seamless integration of logging, monitoring, policy enforcement, and CI/CD pipelines, delivering a consolidated operational experience. Investment in open-source communities remains robust, ensuring vibrant innovation cycles and broad community support for emerging frameworks and extensions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Containers-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Cloud Computing Co., Ltd.

- Alphabet Inc.

- Amazon Web Services, Inc.

- Ambassador Labs

- Atlassian, Inc.

- Cisco Systems, Inc.

- CMA CGM S.A.

- DH2i Company

- DigitalOcean, LLC

- Docker, Inc.

- Giant Swarm GmbH

- Google LLC

- Hewlett Packard Enterprise Development LP

- Hitachi Vantara LLC

- International Business Machines Corporation

- IONOS Inc.

- Microsoft Corporation

- Mirantis, Inc.

- Nirmata, Inc.

- Oracle Corporation

- Portainer

- Rancher Labs, Inc.

- Red Hat, Inc.

- Samsung Electronics Co Ltd.

- StackPath, LLC by Akamai Technologies, Inc.

- Sumo Logic, Inc.

- Virtuozzo International GmbH

- VMware, Inc.

- XenonStack Pvt. Ltd.

Delivering Proven Strategic and Operational Guidance to Empower Industry Leaders in Maximizing ROI and Operational Efficiency with Containerized Services

To capitalize on the transformative potential of containers as a service, industry leaders should prioritize a security-first architecture that embeds runtime protection, identity governance, and vulnerability scanning directly into deployment pipelines. Embracing managed Kubernetes platforms can significantly reduce operational complexity and free internal teams to focus on core business differentiators. Moreover, adopting a hybrid cloud strategy ensures workload portability while maintaining control over sensitive data, enabling rapid scaling of mission-critical applications.

Organizations should invest in developing in-house expertise through targeted training programs and collaboration with specialized service providers. Establishing standardized governance frameworks for container lifecycles will drive consistency, minimize configuration drift, and ensure compliance with evolving regulations. Furthermore, optimizing cost through dynamic resource scheduling and leveraging spot instances for non-mission-critical workloads can yield significant savings. Finally, fostering partnerships with regional infrastructure and network providers can enhance performance and localize compliance, unlocking new markets and delivering superior user experiences.

Outlining Rigorous Qualitative and Quantitative Research Frameworks Employed to Analyze Market Drivers, Challenges, and Emerging Container Service Trends

This analysis is underpinned by a rigorous research methodology that integrates primary and secondary data sources. In-depth interviews with C-level executives, cloud architects, and DevOps practitioners provided firsthand perspectives on adoption drivers, technical challenges, and success metrics. These qualitative insights were complemented by quantitative surveys of over 200 enterprise organizations to capture deployment patterns, budget allocations, and strategic priorities.

Secondary research included extensive examination of corporate financial filings, technology white papers, regulatory documents, and open-source community repositories. Market dynamics were validated through triangulation of multiple data points, ensuring consistency and mitigating individual biases. A combination of top-down and bottom-up approaches was employed to structure the segmentation framework, while validation workshops with industry stakeholders refined the analytical model and ensured relevance to real-world decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Containers-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Containers-as-a-Service Market, by Service Offering

- Containers-as-a-Service Market, by Deployment Model

- Containers-as-a-Service Market, by Organization Size

- Containers-as-a-Service Market, by End User Industry

- Containers-as-a-Service Market, by Region

- Containers-as-a-Service Market, by Group

- Containers-as-a-Service Market, by Country

- United States Containers-as-a-Service Market

- China Containers-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Critical Findings and Strategic Imperatives to Guide Decision Makers in Harnessing Containers as a Service for Sustainable Business Innovation

Containerization represents a fundamental shift in how enterprises develop, deploy, and manage applications across disparate environments. The convergence of advanced orchestration, integrated security, and flexible networking has created a CaaS ecosystem that addresses the demands of modern digital businesses. While 2025 tariff changes have introduced new cost considerations, they have also accelerated innovation in supply chain resilience and domestic manufacturing partnerships.

Segmentation analysis reveals a diversified market where service offerings, deployment models, organization sizes, and industry verticals each follow distinct trajectories. Regional insights underscore the importance of localized strategies to navigate regulatory landscapes and optimize performance. Leading providers continue to differentiate through managed services, open-source collaboration, and strategic alliances.

By adopting the recommendations outlined, organizations can harness containers as a service to drive operational excellence, improve time to market, and sustain competitive advantage. As the ecosystem matures, proactive investment in security, governance, and hybrid cloud strategies will be essential to unlocking the full potential of containerized architectures.

Connect Directly with Associate Director Ketan Rohom to Secure Your Exclusive Containers as a Service Market Research Report

To explore the full breadth of the findings and gain tailored insights that address your unique strategic priorities, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding organizations through complex cloud adoption journeys ensures you receive personalized recommendations and rapid access to in-depth data. By initiating a conversation today, you can secure immediate access to the comprehensive market research report, obtain sample chapters for closer review, and discuss custom analysis packages. Partnering with Ketan accelerates your decision-making process and arms your leadership team with the critical intel needed to outpace competitors. Reach out now to transform container strategies into competitive advantage and harness tomorrow’s cloud innovation today.

- How big is the Containers-as-a-Service Market?

- What is the Containers-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?