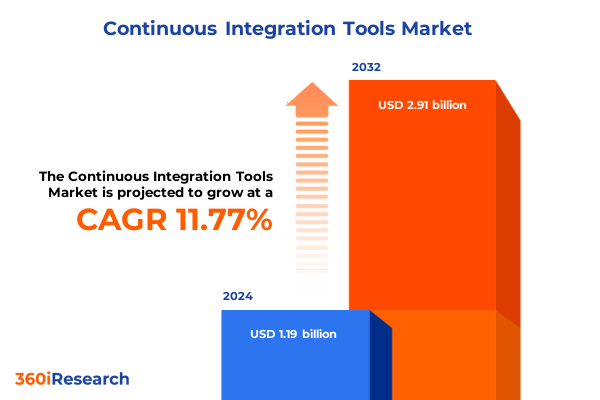

The Continuous Integration Tools Market size was estimated at USD 1.32 billion in 2025 and expected to reach USD 1.47 billion in 2026, at a CAGR of 11.91% to reach USD 2.91 billion by 2032.

Understanding How Continuous Integration Tools Empower Development Teams to Accelerate Delivery and Ensure Quality Across Modern Software Projects

In an era defined by rapid technological evolution and ever-increasing demands for software reliability, continuous integration tools have emerged as foundational pillars supporting modern development lifecycles. Organizations of all sizes and industries confront the dual imperatives of accelerating time to market while maintaining rigorous quality standards, creating a pressing need for robust CI frameworks. By automating the integration of code changes and enabling developers to continuously merge, build, and test their work, CI tools reduce bottlenecks, minimize integration conflicts, and foster a culture of shared responsibility among cross-functional teams.

Transitioning from traditional, manual build processes to an automated pipeline transforms the development environment by providing near-instantaneous feedback on code quality and compatibility. Each code commit triggers a cascade of predefined actions-from compilation and unit testing to security scans and static code analysis-allowing teams to detect and resolve defects at the earliest possible stage. This proactive approach not only curtails the cost and complexity of debugging phase but also underpins a more predictable release cadence, empowering organizations to adopt agile and DevOps methodologies at scale.

Moreover, continuous integration tools serve as a linchpin for collaboration among geographically dispersed teams, democratizing access to critical build artifacts, test results, and deployment logs. By centralizing the orchestration of workflows and generating transparent audit trails, CI platforms instill confidence in stakeholders and streamline governance requirements. As a result, these tools are instrumental in wrestling control from chaotic manual processes and establishing a reliable foundation for continuous delivery and continuous deployment strategies.

Revealing the Transformational Shifts in Continuous Integration Adoption Driven by Cloud Architectures and DevOps Culture Evolution in 2025

The software development landscape has witnessed profound transformations driven by the convergence of cloud-native architectures, container-based microservices, and a maturing DevOps culture. As businesses increasingly migrate workloads to public and private clouds to leverage scalability and elasticity, continuous integration pipelines have evolved to orchestrate distributed build agents, dynamic environments, and ephemeral test infrastructures. Containerization, in particular, has redefined how CI systems provision isolated, reproducible environments, enabling consistent test outcomes and seamless handoffs between development and operations teams.

Concurrently, the proliferation of hybrid deployments that integrate multi-cloud services with on-premise infrastructure has prompted CI platforms to adopt more flexible orchestration engines. Today’s CI solutions support integrations across private cloud clusters and public cloud providers, as well as on-premise bare-metal servers and virtualized hosts. This hybrid approach ensures that legacy applications and sensitive workloads cohabit with cloud-native services under a unified pipeline, fostering innovation without sacrificing compliance or performance.

Rapid innovation cycles have further accelerated the incorporation of intelligent automation within CI toolchains. Machine learning–driven test prioritization, predictive build optimization, and anomaly detection in pipeline health metrics have all become integral to modern CI offerings. These capabilities reduce feedback loops and enable teams to proactively address bottlenecks before they escalate. In tandem, rising interest in serverless architectures and function-as-a-service paradigms is reshaping how integration tests execute, demanding CI tools that can orchestrate highly dynamic, short-lived execution contexts.

Analyzing How the 2025 Tariff Adjustments Have Cumulatively Impacted Continuous Integration Toolchains and Software Supply Chains in the United States

In 2025, a series of tariff adjustments imposed by the United States government has reverberated across global technology supply chains, indirectly impacting the continuous integration ecosystem. Levies on imported semiconductor fabrication equipment and server hardware have elevated infrastructure acquisition costs for organizations maintaining on-premise integrations. As a result, development teams confronting increased capital expenditure on data center hardware have reevaluated the viability of sustaining traditional self-hosted CI agents, accelerating the pivot toward cloud-hosted pipelines and managed CI services.

Moreover, the heightened cost pressure has prompted vendors and enterprises alike to emphasize open source CI solutions that decouple licensing fees from usage volumes. Organizations are increasingly attracted to community-driven tools that offer extensibility, vendor-neutral integrations, and a transparent development roadmap. By leveraging open source platforms, teams mitigate the risk of fluctuating hardware costs and gain the flexibility to deploy CI pipelines across heterogeneous environments, from bare-metal servers to multi-cloud backends.

At the same time, tariff-induced supply constraints have spurred greater collaboration between domestic hardware manufacturers and CI tool vendors to develop optimized build agents and specialized appliance offerings. These co-engineered solutions promise improved throughput and certification assurances for regulated sectors, effectively offsetting some of the financial burdens imposed by international trade policies. Consequently, the 2025 tariff landscape has engendered both challenges and opportunities, compelling stakeholders to innovate in how they architect, deploy, and scale integration workflows.

Synthesizing Critical Segmentation Dynamics Across Deployment Models, Organization Sizes, Industry Verticals, Application Types, and Tool Types

A nuanced understanding of market segmentation reveals how diverse requirements shape the adoption and capabilities of continuous integration tools. Based on deployment model, organizations evaluate public and private cloud solutions, leverage hybrid configurations that blend multi-cloud services with integrated on-premise infrastructure, or maintain fully on-premise environments where bare-metal performance and virtualized flexibility meet jurisdictional controls. Transitioning from one deployment archetype to another often reflects strategic priorities around compliance, latency, or operational oversight.

Likewise, organization size exerts a significant influence on CI tooling strategies. Tier One enterprises and large-scale corporations prioritize extensive governance frameworks, enterprise-grade support, and integration with broader application lifecycle management suites, whereas medium, micro, and small enterprises often gravitate toward lightweight, easily configurable solutions that deliver rapid time to value without steep overhead. Small and micro enterprises in particular tend to adopt open source or freemium tools, whereas larger entities with complex regulatory demands invest in commercial CI solutions featuring dedicated SLAs and advanced analytics.

Industry vertical further delineates toolchain preferences, with financial institutions demanding rigorous security scanning and auditability, healthcare providers requiring compliance with data privacy regulations, and government organizations focusing on defense-grade certifications. In contrast, technology-driven sectors such as IT, telecom, and e-commerce place premium emphasis on integration with container orchestration and cloud-native development frameworks. Similarly, application type dictates pipeline architecture: modern microservices implementations often employ container-based and serverless testing stages, mobile application teams curate Android, cross-platform, and iOS–specific build agents, while web application development workflows balance multi-page application testing alongside single-page application frameworks.

Finally, tool type segmentation highlights the competitive dynamic between commercial and open source offerings. Enterprises seeking integrated dashboards, enterprise support, and out-of-the-box connectors often select commercial platforms such as mature CI suites from leading DevOps vendors, while open source projects remain attractive for customization potential and community-driven innovation. Organizations frequently adopt a hybrid approach, using open source engines for core pipeline orchestration and commercially licensed extensions for specialized tasks like advanced security scanning or enterprise reporting.

This comprehensive research report categorizes the Continuous Integration Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Tool Type

- Application Type

- Industry Vertical

- Deployment Model

- Organization Size

Examining Regional Variations and Growth Factors in Continuous Integration Tool Adoption Across the Americas EMEA and Asia Pacific

Regional variation significantly influences technology strategies in the continuous integration landscape. In the Americas, digital transformation initiatives in North America continue to drive robust adoption of sophisticated CI platforms, fueled by innovation hubs along both coasts and a mature ecosystem of cloud service providers. Enterprises in Canada and the United States leverage deep pools of DevOps talent to implement automated pipelines at scale, frequently integrating comprehensive observability and security tools to meet stringent compliance demands.

Across Europe, the Middle East, and Africa, regulatory frameworks such as GDPR shape CI tool selection, prompting organizations to seek pipelines with built-in data protection features and on-premise artifact repositories. Western European nations, in particular, showcase rapid uptake of hybrid and multi-cloud pipelines, balancing public cloud benefits with localized data residency requirements. Meanwhile, Middle Eastern and African markets are experiencing nascent digital transformation efforts, with both public sector and private enterprises gradually investing in CI infrastructure to support emerging technology initiatives.

In the Asia-Pacific region, demand for CI tools is driven by a blend of large-scale enterprise modernization and the accelerated digital ambitions of small and medium enterprises. Markets such as Australia, Japan, and South Korea demonstrate advanced CI/CD maturity, often collaborating with domestic cloud providers to optimize deployment pipelines. Meanwhile, rapidly developing economies in Southeast Asia and India are prioritizing cost-effective, scalable CI solutions, adopting open source engines to bypass licensing barriers and harness the flexibility of container-centric architectures. Across all three major regions, localized talent availability, regulatory nuances, and cloud provider footprints remain critical determinants of CI adoption strategies.

This comprehensive research report examines key regions that drive the evolution of the Continuous Integration Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Continuous Integration Tool Vendors Strategies and Innovations Shaping the Future of Software Delivery Ecosystems

Leading vendors in the continuous integration domain are actively refining their offerings to address emerging customer needs and technological shifts. Established open source engines continue to evolve through vibrant community collaboration, with contributors enhancing plugin ecosystems, streamlining pipeline-as-code configurations, and fortifying security hardening by integrating vulnerability scanning directly into build workflows. These projects maintain a significant share of development interest due to their extensibility and minimal vendor lock-in.

Commercial CI platforms, on the other hand, are differentiating themselves by bundling advanced analytics, offering hosted pipeline services, and embedding AI-driven efficiency optimizations. Key providers are launching dedicated feature sets that address the challenges of microservices orchestration, offering seamless integrations with leading container registries, cloud-native observability tools, and enterprise compliance modules. Partnerships between CI vendors and cloud hyperscalers are also proliferating, enabling turnkey experiences for hybrid workloads and unified billing models.

Furthermore, a subset of forward-thinking tool vendors is investing in low-code/visual pipeline designers, aiming to democratize DevOps practices across non-engineering stakeholders. By lowering the barrier to entry, these innovations empower product teams and business analysts to participate in pipeline definition and quality gate configuration, ensuring alignment between development pipelines and broader business objectives. Collectively, vendor strategies underscore a shift toward more intelligent, context-aware integration platforms that can adapt to complex, multicloud, and hybrid environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Continuous Integration Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Atlassian Corporation Plc

- Broadcom Inc.

- Buildkite Limited

- CircleCI, Inc.

- CloudBees, Inc.

- Codefresh, Inc.

- GitLab Inc.

- Idera, Inc.

- International Business Machines Corporation

- JetBrains s.r.o.

- Microsoft Corporation

- Oracle Corporation

- Red Hat, Inc.

- Semaphore, Inc.

Empowering Industry Leaders with Targeted Recommendations for Maximizing Efficiency and Scalability Through Continuous Integration Best Practices

Industry leaders seeking to maximize the strategic value of continuous integration should first prioritize unifying pipeline orchestration under a single pane of glass, consolidating disparate toolchains to reduce operational complexity and licensing overhead. By standardizing on a flexible CI engine that accommodates both open source extensions and commercial plugins, organizations can tailor their toolsets to match evolving project requirements without sacrificing governance or auditability.

Next, shifting security left within the CI pipeline is paramount for maintaining resilience in the face of increasingly sophisticated cyber threats. Embedding static and dynamic code analysis, dependency vulnerability checks, and container image hardening at early stages of the build process ensures that security considerations are not an afterthought. Combined with automated compliance reporting, these practices enable teams to address security issues before they propagate through subsequent deployment stages.

Moreover, leaders should leverage AI-driven capabilities for predictive build scheduling and intelligent resource allocation, reducing idle compute costs and accelerating feedback loops. Integrating observability telemetry into build and test environments allows teams to identify performance bottlenecks in real time and optimize pipeline execution. To further improve collaboration, providing role-based access and visual dashboards ensures that stakeholders-from developers to executives-can monitor pipeline health, track release readiness, and make data-informed decisions.

Finally, cultivating a culture of continuous improvement by establishing cross-functional DevOps guilds encourages knowledge sharing and best practice dissemination. By fostering communities of practice around pipeline standards, test automation design, and infrastructure-as-code, organizations can drive consistent adoption of CI best practices and sustain long-term operational excellence.

Elucidating the Rigorous Research Methodology That Underpins the Analysis of Continuous Integration Tool Market Dynamics and Industry Trends

The research underpinning these insights combines rigorous primary and secondary methodologies to ensure a comprehensive view of the continuous integration tool landscape. Primary research involved in-depth interviews with senior DevOps architects, infrastructure engineers, and CI platform administrators across multiple industries, capturing firsthand experiences and strategic priorities when evaluating and deploying integration solutions.

Complementing the firsthand insights, secondary research drew upon publicly available technical documentation, vendor whitepapers, industry conference proceedings, and independent technology forums. Relevant professional networks and user communities were analyzed to gauge sentiment around open source plugin maturity, adoption patterns for hybrid cloud pipelines, and emerging preferences for AI-assisted pipeline automation.

Data triangulation techniques were employed to cross-verify qualitative feedback against observable product roadmaps and release notes, ensuring consistency in reported feature enhancements and vendor positioning. A structured framework for scoring CI platforms was developed, encompassing criteria such as ease of configuration, scalability under load, security integration depth, and ecosystem interoperability. Quality assurance measures, including peer review and methodological audits, were applied throughout to guarantee the validity and reliability of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Continuous Integration Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Continuous Integration Tools Market, by Tool Type

- Continuous Integration Tools Market, by Application Type

- Continuous Integration Tools Market, by Industry Vertical

- Continuous Integration Tools Market, by Deployment Model

- Continuous Integration Tools Market, by Organization Size

- Continuous Integration Tools Market, by Region

- Continuous Integration Tools Market, by Group

- Continuous Integration Tools Market, by Country

- United States Continuous Integration Tools Market

- China Continuous Integration Tools Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing Strategic Conclusions on the Crucial Role of Continuous Integration Tools in Enabling Agile, Secure, and Scalable Software Delivery Frameworks

Continuous integration tools have transcended their original purpose as simple build automation systems to become strategic enablers of agile, secure, and scalable software delivery frameworks. By centralizing orchestration, automating quality gates, and integrating security measures early in the development cycle, CI platforms foster a culture of continuous improvement and collaboration. Organizations that align their DevOps practices with robust CI implementations are better positioned to respond to market shifts, regulatory pressures, and competitive threats with agility.

Key enablers for success include adopting flexible deployment architectures that leverage cloud scalability while retaining on-premise controls, prioritizing open standards to avoid vendor lock-in, and embedding intelligent automation that accelerates feedback loops. As the ecosystem matures, the most forward-looking enterprises will likely embrace AI-driven optimizations, invest in pipeline observability, and nurture cross-functional teams dedicated to refining integration workflows.

Ultimately, continuous integration is more than a set of tools-it represents a foundational discipline that underpins modern software delivery. Organizations that treat CI as a strategic asset, rather than a tactical convenience, will unlock significant efficiencies, foster innovation at scale, and achieve sustainable competitive advantage in an increasingly dynamic digital landscape.

Contact Ketan Rohom Associate Director Sales & Marketing to Unlock In-Depth Continuous Integration Market Report Insights and Drive Strategic Decisions

Unlock unparalleled market intelligence and strategic foresight to enhance your competitive positioning and accelerate decision-making processes by acquiring the comprehensive market research report tailored for continuous integration tools and associated ecosystem insights Fundamentally designed to deliver actionable recommendations rooted in rigorous analysis and validated data To explore in-depth findings or discuss a tailored solution, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through premium research offerings and bespoke consultancy packages

- How big is the Continuous Integration Tools Market?

- What is the Continuous Integration Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?