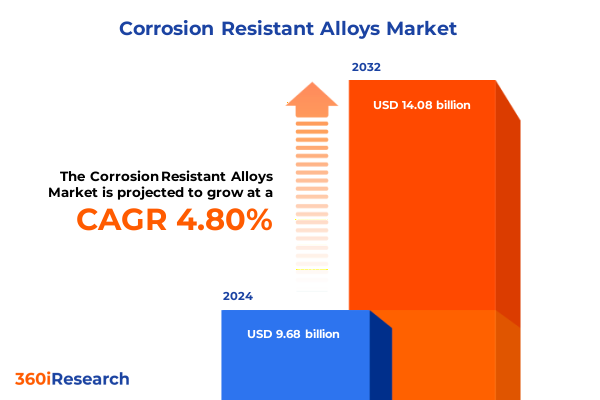

The Corrosion Resistant Alloys Market size was estimated at USD 10.12 billion in 2025 and expected to reach USD 10.58 billion in 2026, at a CAGR of 4.83% to reach USD 14.08 billion by 2032.

Exploring the fundamental importance of corrosion resistant alloys in safeguarding industrial assets across varied environments and demanding conditions

Corrosion resistant alloys represent the cornerstone of modern infrastructure integrity and longevity, combining exceptional chemical, mechanical, and thermal properties to withstand harsh environments. As industries across the globe confront increasingly severe operating conditions-from aggressive chemical exposure in processing plants to salt water erosion in marine applications-the demand for materials that resist degradation has never been more critical. These specialized alloys, encompassing advanced stainless steels, nickel-based superalloys, and high-strength titanium variants, deliver unparalleled performance where traditional metals fail. By mitigating corrosion, they enhance equipment reliability, reduce maintenance costs, and extend service lifecycles, thereby safeguarding capital investments and ensuring uninterrupted operations.

The evolution of corrosion resistant alloys has been driven by relentless innovation in metallurgical science, enabling the development of microstructures tailored for specific environmental challenges. Advances in alloy composition, heat treatment processes, and surface engineering have expanded the applicability of these materials across sectors such as oil and gas, power generation, chemical processing, and water treatment. By leveraging strategic alloying elements-such as chromium for passivation, molybdenum for pitting resistance, and nickel for high-temperature stability-engineers can precisely calibrate performance attributes to meet rigorous industry demands. Consequently, corroded component failures have diminished, while safety and system efficiency have markedly improved.

Understanding the foundational role of corrosion resistant alloys sets the stage for examining the transformative shifts redefining this landscape. From mounting regulatory pressures and elevated sustainability objectives to the integration of digital monitoring technologies and additive manufacturing, contemporary forces are reshaping material selection, production processes, and supply chain dynamics. These innovations promise to unlock new opportunities while challenging traditional business models, prompting stakeholders to reevaluate their strategic approaches in a rapidly evolving market.

Uncovering paradigm shifts that are redefining the corrosion resistant alloys landscape through technological breakthroughs and sustainability initiatives

In recent years, the corrosion resistant alloys sector has undergone profound transformation as industry priorities have shifted toward sustainability, digitalization, and agility. Environmental regulations are compelling manufacturers to reduce energy and water consumption, prompting a move away from resource-intensive production toward greener, more efficient processing methods. Innovations in low-carbon smelting and closed-loop recycling are gaining traction, fundamentally altering supply chains and material economics. As a result, companies are investing heavily in advanced metallurgical techniques to produce alloys with minimal ecological footprints, balancing performance with environmental stewardship.

Simultaneously, digital technologies are revolutionizing corrosion monitoring and predictive maintenance practices. Sensor-based systems, powered by the Industrial Internet of Things (IIoT), enable real-time analysis of corrosion rates and microstructural changes, allowing operators to anticipate material degradation before failures occur. By integrating predictive analytics and machine learning, decision-makers can optimize maintenance schedules, reduce unplanned downtime, and allocate resources more efficiently. This shift toward data-driven asset management is accelerating the adoption of smarter alloys designed for compatibility with digital inspection tools and non-destructive evaluation methods.

Moreover, additive manufacturing is emerging as a disruptive force in high-performance alloy fabrication. Metal 3D printing empowers engineers to create intricate geometries and graded structures that were previously unattainable with conventional casting and forging processes. This capability unlocks new design possibilities, enabling the production of lightweight, topology-optimized components with enhanced corrosion resistance in critical zones. As additive manufacturing matures, it promises to reshape procurement strategies, foster localized production, and reduce lead times, further catalyzing the evolution of the corrosion resistant alloys landscape.

Assessing how recent United States tariffs have reshaped supply chains, material costs, and competitive dynamics within the corrosion resistant alloys market

The introduction and expansion of United States tariffs in 2025 have exerted significant pressure on the corrosion resistant alloys market by reshaping material costs, supply chain configurations, and sourcing strategies. As of March 12, 2025, a sweeping 25% tariff on steel and aluminum imports under Section 232 was extended to include derivative products such as corrosion-resistant steel, effectively raising the cost of critical raw materials used across diverse alloy productions. In parallel, specific trade measures implemented earlier in the year-such as the drug war tariffs imposing a 25% duty on Canadian and Mexican imports and a 20% levy on Chinese goods-have further limited cost-effective alternatives, compelling buyers to absorb higher input costs or seek domestic substitutes.

These tariff adjustments have triggered a strategic reevaluation among downstream users, prompting nearshoring initiatives and extended inventory buffers to mitigate supply disruptions. Manufacturers have accelerated qualification of domestic mills for critical alloys, while also exploring alternative materials with comparable corrosion resistance but lower tariff exposure. In this context, some producers have successfully negotiated long-term contracts to lock in prices and secure priority allocations, reducing vulnerability to geopolitical shifts and trade policy volatility.

Furthermore, the cumulative effect of tariff-driven cost increases is accentuating the importance of material efficiency and lifecycle optimization. Companies are intensifying efforts to minimize scrap generation and enhance recycling rates, reclaiming valuable alloying elements from end-of-life products. By adopting advanced recovery technologies and closed-loop processes, industry leaders are seeking to offset tariff impacts and foster more resilient supply chains. Collectively, these measures underscore a decisive move toward strategic procurement, robust supply diversification, and heightened emphasis on domestic production capabilities in the post-2025 tariff environment.

Delivering deep insights into alloy types, industrial applications, end use sectors, product forms, and production processes shaping corrosion resistant alloy demand

A nuanced examination of market segmentation reveals that alloy type remains a pivotal determinant of application suitability and performance optimization. Within the nickel alloy category, superalloys such as Hastelloy, Inconel, and Monel exhibit exceptional resistance to pitting, crevice corrosion, and high-temperature oxidation, making them indispensable for chemical reactors and gas turbine components. Stainless steel variants-including austenitic, duplex, ferritic, and martensitic grades-strike a balance between cost efficiency and corrosion performance, particularly in food-grade environments and petrochemical pipelines. Meanwhile, titanium alloys such as Grade 2, Grade 5, and Grade 9 deliver lightweight strength and outstanding resistance to chloride-induced corrosion, solidifying their position in marine, aerospace, and biomedical sectors.

Application-focused segmentation underscores the critical role of corrosion resistant alloys in chemical processing, where exposure to aggressive acids and high pressures demands materials capable of maintaining structural integrity over extended service intervals. In marine environments, alloys must resist saltwater-induced degradation and biofouling, while in oil and gas exploration they must endure sour gas, hydrogen sulfide, and fluctuating temperatures. Power generation applies these materials in boiler tubes and heat exchangers to withstand steam oxidation, and water treatment systems depend on corrosion resistant alloys for pumps and piping exposed to chlorinated media and high-pH solutions.

Considering end use industry dynamics, the chemical, food and beverage, marine, petrochemical, pharmaceutical, and power generation sectors collectively drive demand by prioritizing process safety, purity maintenance, and regulatory compliance. Product form further influences procurement decisions: bars and rods serve forging operations; castings enable complex geometries; forged components ensure uniform grain structures; pipe and tube deliver fluid handling solutions; plate, sheet, and coil accommodate structural frameworks; and wire facilitates intricate fabrication tasks. Lastly, the dichotomy between cast and wrought production processes impacts mechanical properties and microstructural consistency, guiding alloy selection based on component criticality, tolerance requirements, and cost considerations.

This comprehensive research report categorizes the Corrosion Resistant Alloys market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Alloy Type

- Form

- Production Process

- End Use Industry

Analyzing regional dynamics in Americas, Europe Middle East and Africa, and Asia Pacific to reveal strategic opportunities and challenges in corrosion resistant alloys

Regional analysis reveals a diverse tapestry of growth drivers, regulatory frameworks, and supply considerations across the Americas, EMEA, and Asia-Pacific. In the Americas, robust infrastructure investment and a resurgence in domestic manufacturing have heightened procurement of corrosion resistant alloys for chemical plants, offshore platforms, and energy projects. Heightened environmental oversight and stringent safety standards also incentivize adoption of higher-performance materials, supporting a shift toward premium stainless steels and nickel superalloys.

Within Europe, the Middle East, and Africa, regulatory stringency around emissions and waste management propels material innovation, while aging infrastructure in Western Europe underscores the need for retrofit solutions utilizing duplex stainless steels and advanced nickel alloys. The Middle East’s petrochemical expansion continues to underpin demand, with large-scale plants prioritizing alloys that combat acid corrosion and high temperatures. In Africa, mining and power generation initiatives are catalyzing interest in titanium and specialized coatings, albeit tempered by logistical challenges and limited regional production capacity.

In the Asia-Pacific, rapid industrialization, urbanization, and energy diversification projects drive substantial consumption of corrosion resistant alloys. China’s chemical processing and desalination markets represent significant volume contributors, while Southeast Asia’s marine and offshore sectors rely heavily on titanium and duplex stainless steels. Japan and South Korea’s advanced manufacturing ecosystems foster R&D collaborations, yielding next-generation alloy formulations. However, regional tariff policies and trade tensions introduce supply chain complexities, prompting buyers to cultivate multi-source strategies and leverage local production incentives.

This comprehensive research report examines key regions that drive the evolution of the Corrosion Resistant Alloys market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading corrosion resistant alloys manufacturers to spotlight their strategies, technological strengths, and market positioning in a competitive landscape

A survey of leading corrosion resistant alloys producers highlights the competitive landscape defined by innovation, geographic reach, and diversified product portfolios. Allegheny Technologies Incorporated (ATI) in the United States commands a strong position through its High Performance Materials & Components segment, delivering titanium alloys and nickel-based superalloys for aerospace and energy markets, supported by extensive domestic manufacturing capacity. Carpenter Technology Corporation distinguishes itself through a focus on premium stainless steels and specialty alloys, driving advancements in additive manufacturing feedstock and high-temperature solutions for the turbine and aerospace industries.

Global players such as VDM Metals GmbH leverage deep metallurgical expertise to offer corrosion-resistant, heat-resistant nickel and cobalt alloys, catering to chemical processing and electronics applications from their production sites in Germany and the United States. Haynes International, a subsidiary of Acerinox, has built its reputation on nickel-base superalloys marketed under the Hastelloy brand, supplying high-temperature and corrosion-resistant materials to aerospace, industrial gas turbines, and chemical processing sectors from facility networks across North America and Asia.

European and Asian conglomerates-such as Outokumpu, Thyssenkrupp, and Sumitomo Metal Mining-extend their market influence through integrated steelmaking operations, advanced research centers, and global distribution networks. Specialty metals manufacturers like Sandvik AB and Special Metals Corporation compete through targeted alloy development, custom fabrication capabilities, and stringent quality certifications. Their combined efforts continue to push the boundaries of performance, reliability, and cost efficiency, fostering healthy competition and accelerating technological progress across the corrosion resistant alloys market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrosion Resistant Alloys market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acerinox, S.A.

- Allegheny Technologies Incorporated

- Aperam SA

- Carpenter Technology Corporation

- Haynes International, Inc.

- JFE Steel Corporation

- Jindal Stainless Limited

- Merck KGaA

- MetalTek International

- Mitsubishi Materials Corporation

- Nippon Steel Corporation

- Outokumpu Oyj

- POSCO Co., Ltd.

- ThyssenKrupp AG

Providing strategic recommendations for industry leaders to optimize procurement, innovate product development, and navigate regulatory and tariff complexities effectively

Industry leaders can seize emerging opportunities by adopting a strategic, multi-pronged approach that emphasizes supply resilience, innovation acceleration, and regulatory alignment. First, strengthening partnerships with key domestic and international mills through long-term agreements can secure priority access to critical alloy grades while mitigating exposure to tariff fluctuations. By formalizing collaborative R&D initiatives, stakeholders can jointly develop next-generation alloys with tailored properties to address evolving service conditions.

Concurrently, integrating digital asset management platforms and predictive analytics into maintenance strategies will yield actionable insights into corrosion progression and component lifecycle, reducing unplanned outages and optimizing spare parts inventories. Embracing advanced manufacturing techniques, such as directed energy deposition and powder bed fusion, presents opportunities to produce complex parts on demand, minimize lead times, and localize production closer to end customers, thereby reducing logistic risk and carbon footprints.

Finally, proactive engagement with policymakers and trade associations is essential to influence tariff negotiations, secure favorable exclusion processes, and advocate for harmonized standards that facilitate cross-border material flows. By participating in industry consortia and certification committees, companies can stay ahead of regulatory changes, shape quality benchmarks, and anticipate compliance requirements. Through these measures, leaders will enhance operational agility, deepen customer trust, and foster sustainable growth in the dynamic corrosion resistant alloys sector.

Detailing rigorous research methodology encompassing primary expert interviews, secondary data analysis, and cross validation to ensure comprehensive market insights

This research rests on a rigorous methodology designed to ensure the accuracy, relevance, and comprehensiveness of its findings. Primary data were collected through in-depth interviews with industry thought leaders, including materials scientists, procurement executives, and regulatory specialists, who offered firsthand perspectives on technological trends and market dynamics. These qualitative insights were complemented by a structured survey conducted among engineering and maintenance professionals to quantify material preferences, procurement challenges, and performance expectations.

Secondary research encompassed an exhaustive review of public domain sources-such as government trade statistics, regulatory filings, patent databases, and academic literature-to establish historical baselines and validate emerging trends. Industry reports, technical white papers, and company disclosures were cross referenced to corroborate pricing mechanisms, tariff impacts, and competitive positioning. Trade association publications and conference proceedings further enriched the dataset by providing visibility into ongoing R&D breakthroughs and standardization initiatives.

A systematic data synthesis and triangulation process was employed to integrate multiple perspectives and identify consistencies across sources. By applying analytical frameworks-such as SWOT analysis and Porter’s Five Forces-to key segments, the study distilled strategic implications for stakeholders. This methodology ensures that recommendations are grounded in empirical evidence and reflective of the complex interplay between technological, economic, and regulatory factors shaping the corrosion resistant alloys market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrosion Resistant Alloys market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrosion Resistant Alloys Market, by Alloy Type

- Corrosion Resistant Alloys Market, by Form

- Corrosion Resistant Alloys Market, by Production Process

- Corrosion Resistant Alloys Market, by End Use Industry

- Corrosion Resistant Alloys Market, by Region

- Corrosion Resistant Alloys Market, by Group

- Corrosion Resistant Alloys Market, by Country

- United States Corrosion Resistant Alloys Market

- China Corrosion Resistant Alloys Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing critical findings to underscore the strategic imperatives and future outlook for stakeholders engaging with corrosion resistant alloys markets globally

This analysis has illuminated the pivotal factors shaping the corrosion resistant alloys domain, from the accelerating drive toward sustainability and digitalization to the profound market realignments prompted by 2025 United States tariff measures. Strategic segmentation of alloy types, applications, end use industries, product forms, and production methodologies has revealed nuanced demand patterns, while regional insights have underpinned differentiated growth outlooks across the Americas, EMEA, and Asia-Pacific.

Leading companies continue to differentiate themselves through metallurgical innovation, integrated supply chains, and strategic geographic footprints. By profiling these key market participants, stakeholders gain clarity on competitive positioning and technological focus areas. The actionable recommendations provided herein offer a roadmap for enhancing supply resilience, advancing product development, and engaging proactively with regulatory bodies, empowering industry leaders to navigate the evolving landscape with confidence.

Ultimately, the enduring value of corrosion resistant alloys lies in their ability to safeguard critical infrastructure, optimize operational performance, and drive long-term cost efficiencies. As markets evolve and end users demand ever-higher standards of reliability and environmental responsibility, stakeholders who embrace innovation, collaboration, and strategic foresight will secure a sustainable competitive edge in this vital materials sector.

Take decisive action by partnering with Ketan Rohom for tailored corrosion resistant alloys insights and strategic market advantage

I invite you to connect with Ketan Rohom, Associate Director of Sales and Marketing, to explore how this comprehensive analysis can inform your strategic initiatives and strengthen your competitive position. Engaging with Ketan will provide you with tailored guidance on leveraging insights, optimizing supply chains, and navigating tariff complexities to achieve operational excellence. Reach out today to secure your copy of the market research report and gain the clarity needed for confident decision-making in the evolving world of corrosion resistant alloys.

- How big is the Corrosion Resistant Alloys Market?

- What is the Corrosion Resistant Alloys Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?