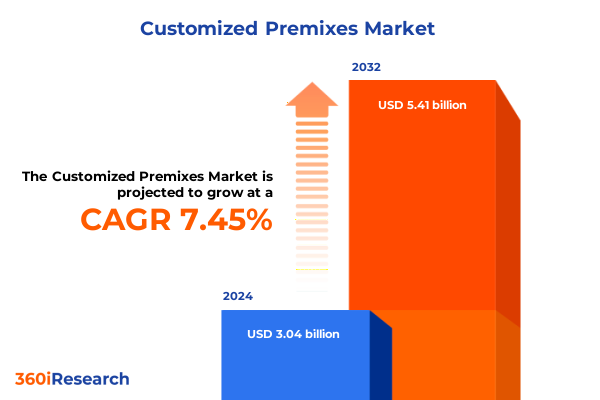

The Customized Premixes Market size was estimated at USD 3.25 billion in 2025 and expected to reach USD 3.47 billion in 2026, at a CAGR of 7.55% to reach USD 5.41 billion by 2032.

Exploring the Strategic Importance of Customized Nutrient Premixes in Accelerating Product Innovation and Competitive Differentiation Across Industries

Introducing Customized Nutrient Premixes as a Cornerstone of Modern Industrial Formulation begins by recognizing an industry in transition where demand for precision nutrition and enhanced performance is reshaping the way manufacturers approach raw material blending. The evolution from generic fortification to finely tuned premixes underscores the need for solutions that deliver consistent efficacy, cost control, and supply chain reliability. As formulators across food and beverage, nutraceuticals, pharmaceuticals, personal care, and animal nutrition seek to meet exacting specifications, customized premixes emerge as a pivotal driver of innovation and market differentiation.

Against a backdrop of increasingly stringent regulatory landscapes and rising consumer expectations, producers are compelled to adopt premixes that not only ensure compliance but also enhance product quality and shelf life. The imperative for tailored solutions extends beyond mere nutrient delivery, encompassing functionalities such as taste masking, targeted release, and specialized stability profiles. This introduction sets the stage for a deep dive into how customized premixes are redefining formulation strategies and elevating end-product performance across a spectrum of applications.

How Digital Innovation Sustainability Imperatives and Personalized Nutrition Are Converging to Transform the Customized Premix Ecosystem

The landscape of customized premixes is undergoing transformative shifts fueled by converging trends that span technological breakthroughs and changing stakeholder priorities. Digital formulation platforms leveraging artificial intelligence and machine learning are enabling rapid design of optimal nutrient blends, reducing lead times and minimizing resource waste. Concurrently, the rising emphasis on sustainability is driving adoption of eco-efficient processing methods and sourcing of responsibly produced ingredients. Premix manufacturers are integrating life-cycle analysis and carbon footprint reduction strategies to align with corporate ESG commitments and consumer demand for transparency.

Moreover, the surge in personalized nutrition is extending into clinical and pet care segments, where demographic insights and health data inform hyper-specific premix solutions. Such advancements are complemented by continuous processing technologies, which enhance production flexibility and support just-in-time manufacturing models. Lastly, an increased focus on clean-label formulations and non-GMO sourcing is prompting premix developers to innovate with plant-derived carriers and natural excipients. These transformative shifts collectively underscore a landscape where agility, precision, and sustainability converge to redefine the future of customized nutrient premixes.

Navigating Supply Chain Resilience Strategies in Response to 2025 United States Tariff Pressures on Customized Premix Components

In 2025, the cumulative impact of tariffs imposed on premix ingredients has reverberated across domestic supply chains and cost structures. Manufacturers reliant on key vitamins, minerals, and specialty amino acids sourced from international suppliers have faced incremental cost pressures, compelling many to reconsider sourcing strategies and inventory management. The increased import duties have not only elevated input costs but have also introduced greater volatility into procurement cycles, prompting strategic stockpiling and accelerated qualification of alternative regional suppliers.

These tariff-induced shifts have spurred collaboration between premix producers and raw material suppliers to optimize formulations that mitigate cost escalation without compromising on performance. Some stakeholders have negotiated fixed-rate contracts to hedge against further tariff fluctuations, while others have invested in backward integration and localized production capacity. In parallel, end users in food and beverage, nutraceuticals, and animal feed have adjusted pricing models and reformulated products to absorb or pass on additional costs. Collectively, the tariff regime of 2025 has catalyzed supply chain resilience initiatives and fostered a more diversified supplier landscape.

Unlocking Strategic Opportunities Through Comprehensive Application, Component Type, Formulation, and Channel Segmentation Analyses in Customized Premixes

An in-depth examination of market segmentation reveals critical insights for tailored strategy development. When analyzed by application, the prominence of animal feed is evident through its subdivisions in aquaculture feed, pet food, poultry, ruminant, and swine feed, each demanding specific nutrient matrices to optimize growth, health, and feed conversion ratios. Simultaneously, food and beverage applications draw distinct opportunities across bakery and confectionery, beverage formulations, and dairy product fortification where sensory attributes and functional stability are paramount. In nutraceutical and pharmaceutical contexts, premixes must meet rigorous purity and uniformity standards, while personal care blends focus on bioavailability and compatibility with cosmetic emulsions.

Analyzing the type of premix components uncovers nuanced differentiation among amino acids, enzymes, minerals, prebiotics, probiotics, and vitamins. Major minerals such as calcium and phosphorus are foundational for structural applications, whereas trace minerals including copper, iron, and zinc address metabolic functions. Fat-soluble vitamins like A, D, E, and K play critical roles in cellular health, complemented by water-soluble counterparts such as vitamin B complex and C for energy metabolism and immune support. In terms of form, liquid premixes facilitate rapid dispersion in aqueous systems, pellets offer ease of handling in feed mills, and powders deliver broad compatibility with dry mix processes. Distribution channel segmentation highlights the imperative to balance direct sales relationships with the logistical reach of distributors, the convenience of online procurement, and the enduring preference for brick-and-mortar retailers. Together, these segmentation insights guide market participants in aligning product portfolios with specific end-use requirements.

This comprehensive research report categorizes the Customized Premixes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- Distribution Channel

Examining Regional Dynamics and Growth Drivers in the Americas, Europe Middle East Africa, and Asia Pacific Customized Premix Markets

The Americas remain a focal point for customized premix innovation, driven by robust demand in North America’s pet food and dairy sectors alongside significant expansion in Latin America’s aquaculture and poultry feed industries. Regional growth is underpinned by evolving regulatory frameworks that incentivize nutrient optimization and traceability in supply chains. In Europe, Middle East, and Africa, diverse market maturity levels present both established markets in Western Europe with stringent quality standards and emerging opportunities in Middle Eastern livestock nutrition and African agricultural modernization. Regulatory harmonization efforts within the European Union further emphasize clean-label credentials and environmental compliance, shaping premix formulation trends.

Across Asia-Pacific, the acceleration of urbanization and rising consumer health awareness are elevating demand for fortified foods, nutraceuticals, and personal care products. China and India, in particular, are witnessing rapid growth in dietary supplement consumption, prompting local premix manufacturers to scale capabilities and partner with global firms for technology transfer. Southeast Asian agriculture is increasingly turning to feed premixes that support intensive farming models while addressing sustainability goals. These regional dynamics underscore the importance of localized formulation expertise, strategic alliances, and regulatory alignment to capture growth in diverse end markets.

This comprehensive research report examines key regions that drive the evolution of the Customized Premixes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Customized Premix Providers Excelling in Technological Innovation Strategic Partnerships and Sustainability

Leading entities in the customized premix landscape are distinguished by their vertically integrated production networks, robust research and development pipelines, and strategic partnerships. Key innovators leverage proprietary encapsulation technologies and digital formulation platforms to design multipurpose premixes that address evolving nutritional requirements. Collaborative initiatives between component suppliers and end users are fostering co-development of application-specific solutions, often anchored by performance guarantees and service level agreements.

In addition, several companies are investing in green chemistry and circular economy models, focusing on upcycling agricultural co-products into functional carriers and excipients for premixes. A growing number of market participants have established regional R&D centers to accelerate product adaptation for local regulatory and consumer preferences. Robust quality management systems and comprehensive traceability protocols have become differentiators, enabling premium positioning in high-value segments such as pharmaceuticals, clinical nutrition, and specialty pet care. Overall, the competitive landscape is marked by strategic agility, technological differentiation, and a relentless focus on customer collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customized Premixes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- BASF SE

- Cargill, Incorporated

- Corbion N.V.

- Farbest Brands

- Glanbia Plc

- Jubilant Ingrevia Limited

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Nutreco N.V.

- Piramal Enterprises Limited

- Prinova Group LLC

- SternVitamin GmbH & Co. KG

- Vitablend Netherlands B.V.

- Wright Enrichment, Inc.

Driving Growth Through Digital Formulation Collaboration Agile Manufacturing and Transparent Sustainability Practices in Customized Premix Production

Industry leaders can capitalize on emerging opportunities by integrating advanced digital tools into premix design and supply chain management. By leveraging predictive analytics to anticipate formulation performance and raw material volatility, companies can streamline product development and mitigate risk. Establishing cross-functional innovation hubs that unite R&D, procurement, and regulatory affairs will enable faster commercialization of tailored solutions and responsive adaptation to market shifts.

Moreover, forging strategic alliances with regional ingredient producers can enhance supply chain resilience and facilitate localized customization at scale. Companies should explore modular production plants equipped for batch and continuous processing to better serve fluctuating demand across applications. Embracing transparent sustainability reporting and third-party certifications will not only reinforce brand credibility but also meet the growing expectations of environmentally conscious end users. Finally, designing flexible commercial models-such as pay-per-performance or subscription-based premix services-can create recurring revenue streams while strengthening customer engagement and loyalty.

Employing a Dual Approach of Comprehensive Secondary Analysis and Structured Primary Engagements to Ensure Robust Customized Premix Insights

Our research methodology combined rigorous secondary intelligence with targeted primary engagements to ensure comprehensive market coverage and insight validity. Initially, an extensive review of scientific journals, patent filings, regulatory publications, and industry white papers provided foundational context and trend mapping. Following this, structured interviews were conducted with senior executives, formulation scientists, procurement managers, and regulatory specialists across leading premix manufacturers and end-user organizations to capture firsthand perspectives on market dynamics.

Quantitative data points were triangulated through cross-referencing corporate filings, trade association reports, and financial disclosures. Qualitative insights were corroborated via expert panels and thematic workshops, ensuring diverse stakeholder representation including regional distributors, sustainability experts, and academic researchers. All findings underwent internal validation through an iterative review process, combining statistical analysis with peer review to guarantee accuracy, relevance, and actionable depth.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customized Premixes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customized Premixes Market, by Type

- Customized Premixes Market, by Form

- Customized Premixes Market, by Application

- Customized Premixes Market, by Distribution Channel

- Customized Premixes Market, by Region

- Customized Premixes Market, by Group

- Customized Premixes Market, by Country

- United States Customized Premixes Market

- China Customized Premixes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Technological Progress Sustainability Drivers and Market Ecosystems to Cement Leadership in Customized Premix Solutions

In summary, the customized premix sector stands at a pivotal juncture where technological innovation, sustainability imperatives, and regulatory influences converge to redefine formulation paradigms. Stakeholders across the value chain must navigate tariff-induced cost pressures while capitalizing on digital tools and strategic partnerships to maintain competitive advantage. By aligning product offerings with precise segmentation demands and regional market intricacies, manufacturers can unlock high-value opportunities and foster resilient growth.

Ultimately, the ability to deliver tailored nutrient solutions with demonstrable performance attributes will determine market leadership. Continued investment in R&D, supply chain agility, and transparent sustainability practices will be essential for meeting evolving end-user requirements. As the industry progresses, companies that embrace a holistic, data-driven approach to premix design and commercialization will be best positioned to thrive in an increasingly complex and dynamic marketplace.

Initiate Your Customized Premix Market Journey with a Dedicated Consultation Designed to Maximize Strategic Growth Opportunities

To access unparalleled expertise and secure your competitive advantage in the customized premixes market, reach out to Ketan Rohom, Associate Director, Sales & Marketing, for a personalized consultation. Engage with a dedicated expert who can guide you through the nuances of this report and help tailor insights to your strategic priorities. Seize the opportunity to leverage actionable intelligence and drive growth by acquiring the comprehensive market research report today.

- How big is the Customized Premixes Market?

- What is the Customized Premixes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?