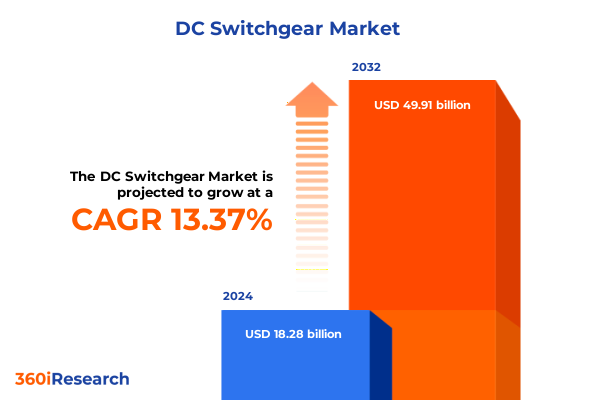

The DC Switchgear Market size was estimated at USD 20.63 billion in 2025 and expected to reach USD 23.28 billion in 2026, at a CAGR of 13.44% to reach USD 49.91 billion by 2032.

Exploring the Pivotal Role of DC Switchgear in Advancing Power Distribution Reliability and Efficiency Across Emerging and Established Sectors

DC switchgear has emerged as a foundational element in the evolving landscape of power distribution, offering seamless control, protection, and isolation functions across diverse direct-current applications. From large-scale utility installations to niche industrial environments, these specialized assemblies safeguard equipment against electrical faults, optimize operational continuity, and support rapid response to emerging grid demands. This introduction outlines the critical attributes of DC switchgear, emphasizing its unrivaled capacity to manage steady-state currents with minimal losses while integrating advanced safety features that protect infrastructure and personnel alike.

As electrification initiatives accelerate worldwide, the demand for reliable DC switchgear continues to intensify. The transition to renewable energy sources, expansion of data center deployments, and proliferation of electric-mobility charging networks have underscored the need for robust switchgear solutions capable of handling bidirectional power flows and variable load profiles. Moreover, ongoing efforts to phase out high-global-warming-potential insulating gases drive innovation toward eco-friendly alternatives without compromising dielectric performance. In this context, DC switchgear stands as a pivotal enabler of modern power architectures, balancing stringent reliability requirements with the agility needed to navigate dynamic operational environments.

Unraveling the Transformative Technological and Regulatory Forces Reshaping the DC Switchgear Ecosystem in the Era of Electrification and Sustainability

The DC switchgear landscape is undergoing profound transformation, propelled by converging technological, regulatory, and market forces that demand ever-greater performance, sustainability, and flexibility. Advances in power electronics have delivered modular designs that streamline installation and maintenance, while intelligent monitoring platforms now embed sensors and communication interfaces that continuously assess temperature, current, and insulation integrity. Simultaneously, global mandates to reduce greenhouse gas emissions have triggered revisions of insulating-gas regulations, accelerating the development of clean-air and vacuum-insulated alternatives. These shifts are redefining conventional switchgear architectures, blending digital innovation with materially optimized components.

In parallel, standardization bodies have introduced updated specifications targeting DC safety protocols and interoperability between manufacturer solutions. This regulatory push is complemented by growing user expectations for turnkey systems that accommodate diverse voltage classes and power-flow scenarios without extensive customization. Consequently, suppliers are forging strategic collaborations across the value chain, integrating software analytics and predictive-maintenance capabilities to deliver end-to-end lifecycle management. Together, these transformative forces are reshaping the way DC switchgear is conceived, engineered, and deployed, setting new benchmarks for reliability and operational insight.

Analyzing the Ripple Effects of Recent United States Tariff Measures on DC Switchgear Supply Chains, Cost Structures, and Market Resilience

In 2025, a new wave of United States tariff measures targeting critical electrical components and raw materials created significant ripples throughout the DC switchgear supply chain. Import duties imposed on high-purity copper conductors, semiconductor modules, and specialized insulating gases elevated production costs for both domestic and offshore manufacturers. With quasi-fixed manufacturing expenses and limited capacity to absorb surcharges, many suppliers passed on increased prices to end users, prompting project planners and system integrators to reevaluate procurement strategies.

Moreover, these trade interventions intensified conversations around supply-chain resilience. Organizations began to explore nearshoring options and multi-sourcing agreements to mitigate tariff exposure and avoid single-source dependencies. At the same time, the drive to reduce reliance on SF6, owing to its high global-warming potential and volatile pricing, spurred accelerated development of clean-air solutions. Collectively, tariff-induced cost pressures and environmental regulations have strengthened the case for innovative materials, localized production footprints, and vertically integrated supply chains that can better withstand external shocks while sustaining performance standards.

Decoding Critical Demand Drivers Through Multi-Dimensional Segmentation Analysis to Illuminate End-User, Technology, and Specification Preferences in DC Switchgear

A granular examination of market segmentation reveals the multifaceted demand patterns that define the DC switchgear industry. When viewed through the lens of end-user classification, deployments range from commercial installations and data centers to industrial environments, where chemical processing, manufacturing lines, and mining operations impose rigorous safety and continuity requirements. The oil and gas sector relies on DC switchgear for reliable power control in remote drilling sites, while telecommunications networks demand compact, high-uptime solutions. Renewable energy applications further subdivide into hydropower, solar farms, and wind-turbine substations, each presenting unique voltage-stability and fault-interruption criteria. Transportation applications encompass both electric-vehicle charging depots and rail electrification systems, alongside utility grid applications that balance long-distance and distributed-generation scenarios.

Beyond end-user considerations, switchgear variants are differentiated by insulation type and design topology. Air-insulated systems remain prevalent for ease of maintenance, while gas-insulated configurations-categorized into SF6-filled and clean-air alternatives-address footprint constraints. Hybrid solutions combine both principles to optimize dielectric performance. Voltage-rating classifications span low, medium, and high tiers, with medium-voltage segments further delineated by ranges of up to 1.5kV–7.2kV, 7.2kV–36kV, and 36kV–50kV. Installation modalities distinguish between indoor and outdoor environments, each imposing specific enclosure and thermal-management requirements. Meanwhile, insulation media such as air, clean air, SF6, and vacuum dictate equipment size and dielectric strength.

Technical customization extends to actuator mechanisms and electrical capacities, encompassing automatic, manual, or motorized operation modes. Current-rating envelopes include units up to 1,000A, those between 1,000A and 5,000A, and robust solutions exceeding 5,000A. Component-level segmentation identifies breakers, disconnect switches, fuse units, and grounding switches as core building blocks, while phase selection-single or three-aligns with circuit design and load characteristics. This integrated segmentation framework underpins targeted product development, ensuring solutions are precisely tuned to sector-specific requirements.

This comprehensive research report categorizes the DC Switchgear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Voltage Rating

- Installation

- Insulation Type

- Technology

- Current Rating

- Component

- Phase

- End User

Mapping Regional Trends Shaping DC Switchgear Uptake Through Infrastructure Expansion, Policy Evolution, and Capital Flows Across Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping demand patterns and technology priorities for DC switchgear. In the Americas, robust investment in grid modernization projects across North America has been complemented by surging interest in electric-vehicle charging infrastructure, especially along major highway corridors and urban nodes. Data center proliferation in the United States and Canada has further driven demand for high-reliability switchgear capable of supporting uninterrupted DC feeds for server racks and backup battery arrays. Additionally, Latin American markets are advancing microgrid deployments in remote communities, where compact, resilient DC switchgear solutions are highly valued.

Within Europe, Middle East, and Africa, the regulatory imperative to decarbonize electrical networks has spurred widespread adoption of renewable-energy microgrids, particularly in offshore wind and solar installations. Countries in the European Union are rolling out incentive programs to phase out SF6-based equipment, favoring vacuum or clean-air alternatives to align with the Green Deal’s sustainability objectives. In the Middle East, large-scale solar parks and desalination facilities are integrating bespoke DC switchgear for enhanced safety and remote monitoring, while Africa’s utility horizon is marked by a blend of legacy grid reinforcement and leapfrog microgrid solutions.

Asia-Pacific markets exhibit a dual-track approach: established economies such as Japan and South Korea emphasize industrial automation and digital-ready switchgear, whereas emerging regions like India and Southeast Asia prioritize cost-effective, modular assemblies to electrify rural areas and bolster telecommunications backhaul. Rapid urbanization, coupled with ambitious carbon-reduction targets in China’s coastal provinces, has stimulated demand for medium-voltage DC switchgear that can seamlessly interface with energy-storage systems. Across all three regions, the drive for interoperability and lifecycle analytics remains a unifying theme.

This comprehensive research report examines key regions that drive the evolution of the DC Switchgear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers Driving Innovation and Competitive Advantage in the DC Switchgear Space Through Strategic Partnerships and Technology Roadmaps

Leading manufacturers in the DC switchgear domain are leveraging innovation and strategic alliances to differentiate their offerings and capture emerging growth pockets. One notable trend is the integration of digital twins that mirror real-time performance metrics, empowering operators to conduct what-if analyses under varying load conditions and preemptively schedule maintenance. Such solutions have been rolled out through partnerships between switchgear producers and software specialists, delivering combined hardware-software platforms that streamline asset-management workflows.

Product subsystems, from vacuum interruption modules to solid-insulation busbars, have undergone rapid refinement to achieve higher interrupting ratings and smaller footprints. Several legacy providers have invested in targeted acquisitions of niche technology firms, bolstering their capabilities in clean-air insulation and high-speed power electronic integration. At the same time, industry leaders are expanding aftermarket services, offering remote diagnostics, training, and spare-parts management to extend equipment lifecycles and fortify customer loyalty.

Meanwhile, a new breed of agile entrants is challenging incumbents with lean manufacturing models and design-for-sustainability principles. These newer players often focus on modular switchgear that can be factory assembled and containerized, reducing onsite labor and installation timelines. As the market advances, competitive positioning increasingly hinges on end-to-end solution portfolios that encompass engineering consultancy, financing options, and turnkey delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the DC Switchgear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- BRUSH Group

- C&S Electric Limited

- CG Power and Industrial Solutions Limited

- CHUANLI Electric Co., Ltd.

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- GE Vernova

- Hitachi Energy Ltd.

- Hitachi, Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- Larsen & Toubro Limited (L&T)

- Mitsubishi Electric Corporation

- Northvolt AB

- NR Electric Co., Ltd.

- Powell Industries, Inc.

- Schneider Electric India Pvt Ltd

- Schneider Electric SE

- SEL (Schweitzer Engineering Laboratories)

- Siemens AG

- Siemens Energy AG

- Sécheron SA

- TGOOD Electric Co., Ltd.

- Toshiba Infrastructure Systems & Solutions Corporation

Proposing Imperatives for Industry Stakeholders to Navigate Regulatory Challenges, Seize Emerging Opportunities, and Drive Sustainable Growth in DC Switchgear

Proposing imperatives for industry stakeholders centers on balancing innovation with resilience while addressing emerging regulatory and environmental demands. Organizations should prioritize the integration of intelligent condition-monitoring sensors within DC switchgear assemblies to facilitate predictive maintenance and reduce unplanned downtime. Concurrently, diversifying supply chains by establishing multi-source agreements and near-shore production facilities will mitigate tariff exposure and material-sourcing volatility. Embracing hybrid insulation designs that combine clean-air and vacuum principles can offer a pragmatic transitional pathway away from SF6 without disrupting performance benchmarks.

Collaborative engagement with standards bodies and regulatory agencies is essential to ensure that new switchgear technologies achieve timely certification and market acceptance. OEMs and end users alike should co-develop modular platforms which can be rapidly scaled for applications ranging from microgrids to large utility substations, unlocking cost efficiencies through standardized manufacturing processes. Expanding aftermarket service portfolios, including remote diagnostics and training programs, will not only drive recurring revenue streams but also fortify long-term customer relationships. Finally, investing in cross-functional R&D partnerships-spanning material science, power electronics, and digital analytics-will position stakeholders to capture the next wave of opportunities in electrified transportation, renewable integration, and industrial automation.

Detailing a Robust Research Methodology Combining Extensive Secondary Analysis with Targeted Primary Validation to Underpin DC Switchgear Market Insights

This research is anchored in a robust methodology that begins with an exhaustive review of industry regulations, technical standards, trade publications, and patent filings. Comprehensive secondary analysis leverages vendor literature, whitepapers, and peer-reviewed articles to map the technological evolution and competitive landscape of DC switchgear. Publicly available filings, including corporate sustainability reports and trade-association data, were synthesized to understand macroeconomic and regulatory drivers.

To validate the secondary findings, a structured primary research phase was conducted comprising in-depth interviews with equipment manufacturers, project developers, distribution partners, and end-user technical leads. These consultations provided nuanced insights into product performance, procurement challenges, and adoption barriers. Data triangulation techniques were employed to reconcile divergent viewpoints, while cross-referencing with proprietary shipment and aftermarket databases ensured consistency in qualitative assessments.

Finally, the research exercised iterative peer review cycles with domain experts in power-system engineering and supply-chain management. This iterative approach honed the analytical framework, enabling the report to deliver strategically relevant insights and actionable guidance grounded in real-world application scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DC Switchgear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DC Switchgear Market, by Type

- DC Switchgear Market, by Voltage Rating

- DC Switchgear Market, by Installation

- DC Switchgear Market, by Insulation Type

- DC Switchgear Market, by Technology

- DC Switchgear Market, by Current Rating

- DC Switchgear Market, by Component

- DC Switchgear Market, by Phase

- DC Switchgear Market, by End User

- DC Switchgear Market, by Region

- DC Switchgear Market, by Group

- DC Switchgear Market, by Country

- United States DC Switchgear Market

- China DC Switchgear Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2385 ]

Concluding Perspectives on the Strategic Imperatives and Future Trajectory of the DC Switchgear Market Amid Dynamic Technological and Regulatory Evolutions

The DC switchgear sector stands at a critical juncture, shaped by accelerating electrification, stringent environmental mandates, and evolving tariff landscapes. As digital-enabled designs mature and hybrid insulation solutions gain market traction, industry participants must swiftly adapt to shifting performance expectations and regulatory requirements. The segmentation analysis underscores the importance of finely tuned solutions-from compact data-center switchgear to rugged industrial assemblies-that cater to distinct end-user needs and technical specifications. Regional insights reveal how infrastructure investments, policy directives, and capital flows are creating differentiated pockets of demand across the Americas, EMEA, and Asia-Pacific.

Key manufacturers have demonstrated that competitive advantage increasingly depends on integrated hardware-software offerings, aftermarket service excellence, and scalable production models that accommodate rapid customization. The actionable imperatives outlined in this summary articulate pathways to navigate supply-chain disruptions, accelerate product validation cycles, and foster strategic collaborations with standards bodies. Together, these findings provide a cohesive narrative that charts a forward-looking trajectory for DC switchgear, equipping decision-makers with the contextual intelligence required to seize emerging opportunities and build resilient power-distribution architectures.

Engage with Ketan Rohom to Secure Comprehensive DC Switchgear Market Intelligence That Empowers Informed Decisions and Accelerates Strategic Initiatives

We invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing, to explore the full breadth of insights and actionable strategies encompassed in our comprehensive DC switchgear market research report. By engaging directly with Ketan, you will gain clarity on the latest technological breakthroughs, regulatory developments, and competitive dynamics shaping the industry today. His expertise will guide you through tailored recommendations that align with your organization’s strategic objectives, helping you optimize investment decisions and accelerate time-to-value.

Securing this report is the first step toward empowering your team with the in-depth analysis required to stay ahead of market disruption. Contact Ketan to discuss pricing options, delivery timelines, and customized research add-ons designed to support your unique business challenges. Unlock the full potential of DC switchgear market intelligence and transform insights into impact.

- How big is the DC Switchgear Market?

- What is the DC Switchgear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?