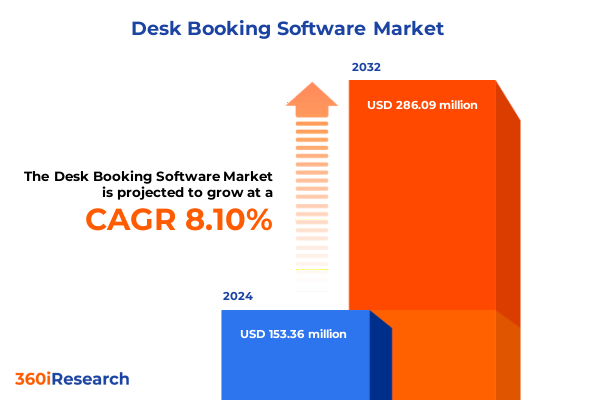

The Desk Booking Software Market size was estimated at USD 163.92 million in 2025 and expected to reach USD 181.15 million in 2026, at a CAGR of 8.28% to reach USD 286.08 million by 2032.

Revolutionizing Workplace Dynamics through Intelligent Desk Booking Strategies to Support Hybrid and Remote Collaboration Models

Organizations are navigating a fundamental shift in workplace dynamics as hybrid and remote collaboration models redefine where and how teams operate. Desk booking software has emerged as a critical enabler of this transformation, providing employees with the flexibility to reserve workspaces on demand while maximizing real estate efficiency. As companies adapt to evolving employee expectations and seek to optimize their physical environment investments, these platforms offer an integrated approach to space utilization, capacity monitoring, and workplace safety protocols. With a rapidly changing regulatory environment and heightened emphasis on employee well-being, solutions that streamline desk reservations and track occupancy in real time have become indispensable tools to support business continuity and enhance workforce satisfaction.

Building on this backdrop, the following executive summary distills an in-depth analysis of the desk booking software market. It explores the key drivers reshaping adoption, evaluates the cumulative effects of United States tariff measures enacted in 2025 on procurement and supply chain resilience, and articulates pivotal segmentation insights ranging from deployment mode and component offerings to organization size and industry verticals. Additionally, the report examines regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific, profiles leading technology providers, and outlines research methodologies employed to ensure data validity. The ensuing sections culminate in actionable recommendations for industry leaders and conclude with strategic considerations to inform future-proof workspace management practices.

Navigating the Evolution of Work Environments Driven by Digital Transformation Automation and Employee Experience Innovations

The landscape of desk booking solutions is undergoing transformative shifts driven by an unprecedented convergence of digital transformation, employee experience focus, and automation. Organizations are transitioning from legacy manual processes and static floor plans to intelligent, mobile-first platforms that leverage machine learning algorithms to predict space demand and suggest optimal seating arrangements. This move toward predictive analytics has elevated the role of workspace management from administrative coordination to strategic asset optimization, enabling facility managers to anticipate utilization patterns and implement proactive capacity planning.

Concurrently, the proliferation of Internet of Things (IoT) sensors and integrated building management systems has extended desk booking capabilities beyond simple reservation functions. Modern solutions now incorporate real-time occupancy detection, environmental controls, and touchless interactions to support health and safety mandates. As companies increasingly prioritize employee engagement, sophisticated user interfaces and seamless integration with collaboration tools empower workers to align desk selection with personal preferences, team proximity, and project requirements. Together, these innovations are reshaping how organizations design and manage their physical environments, driving a holistic shift from static office infrastructure toward adaptive, employee-centric ecosystems.

Assessing the Broad Consequences of United States 2025 Tariff Policies on Procurement Practices and Supply Chain Resilience in Desk Booking Solutions

The introduction of new United States tariffs in 2025 has created a ripple effect throughout the desk booking software ecosystem, influencing hardware procurement, software licensing, and service delivery models. With increased duties imposed on servers, sensors, and networking equipment imported from select regions, solution providers and enterprise buyers have encountered escalated acquisition costs and elongated fulfillment timelines. As a result, many technology vendors have recalibrated their supply chain strategies, diversifying component sourcing portfolios and forging closer partnerships with domestic manufacturers to mitigate exposure to trade barriers.

Moreover, these tariff measures have underscored the importance of modular software architectures and subscription-based pricing models that decouple core licensing fees from hardware dependencies. Organizations that had previously adopted on-premise deployments have accelerated their migration toward cloud-hosted platforms, reducing capital expenditures tied to tariff-affected hardware and benefiting from regular feature updates without incurring additional import levies. Simultaneously, service providers have enhanced their professional services portfolios-offering remote deployment support, pre-configured hardware bundles, and dedicated integration frameworks-to alleviate the impact of customs clearance delays and safeguard project timelines. In this context, a strategic blend of supply chain resilience, flexible delivery models, and localized partnerships has become essential to maintain uninterrupted access to critical desk booking capabilities.

Uncovering Critical Segmentation Perspectives from Deployment Modes to Industry Verticals Shaping Diverse Desk Booking Adoption Pathways

A nuanced understanding of market segmentation illuminates how deployment mode, component mix, organization size, and vertical industry specialization drive distinct adoption patterns and feature requirements. When evaluating deployment mode, cloud-native desk booking platforms continue to outpace on-premise solutions in adoption rates, as enterprises gravitate toward rapid implementation, scalability, and reduced infrastructure management burdens. Conversely, organizations with stringent data sovereignty mandates or legacy system integrations retain a preference for on-premise configurations, prioritizing direct control over sensitive workspace and employee information.

Component segmentation reveals a clear bifurcation between software functionality and complementary professional services. Leading vendors augment their core platform offerings with consulting, customization, and managed support services to accelerate time-to-value and ensure seamless integration with broader workplace management ecosystems. Regarding organization size, large enterprises demand advanced analytics, global deployment orchestration, and multi-country compliance support, whereas small and medium enterprises, particularly those at the medium end of the spectrum, seek cost-effective, out-of-the-box solutions with straightforward user experiences. Meanwhile, smaller enterprises tend to favor turnkey packages that bundle installation, training, and baseline maintenance in a single offering.

Vertical industry segmentation further underscores differentiated use cases and regulatory drivers. Banking, financial services, and insurance entities emphasize data protection, audit trails, and robust access controls, reflecting their rigorous compliance frameworks. Education institutions focus on capacity forecasting and contact tracing to manage campus safety, while healthcare organizations integrate desk booking with patient flow coordination and staff rostering systems. Information technology and telecom service providers leverage advanced API integrations and high-availability architectures to support round-the-clock operations, and retail enterprises capitalize on flexible space reconfiguration to accommodate seasonal workforce fluctuations.

This comprehensive research report categorizes the Desk Booking Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform & Interface

- Pricing Model

- Deployment Model

- End User Type

- Industry Vertical

Highlighting Regional Dynamics Influencing Desk Booking Utilization Trends Across the Americas EMEA and Asia-Pacific Evolving Market Landscapes

Regional market insights reveal stark contrasts in adoption drivers and innovation priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a mature corporate real estate market and strong emphasis on hybrid workforce policies have fueled widespread uptake of desk booking solutions, with numerous organizations integrating advanced analytics and mobile interfaces to support dispersed teams. Transitioning seamlessly from North American hubs, Europe, Middle East & Africa markets exhibit heightened focus on sustainability and energy efficiency, prompting solution providers to embed carbon-footprint tracking and smart‐lighting controls within their platforms. This region’s complex regulatory landscape also drives demand for localized data residency options and comprehensive compliance features.

Meanwhile, Asia-Pacific markets are characterized by rapid urbanization, high workspace density, and a growing recognition of employee experience as a competitive differentiator. In metropolitan centers, businesses are adopting flexible co-working models and hot desking arrangements at scale, leveraging smartphone-enabled reservation systems and real-time occupancy monitoring to optimize limited real estate. Across all regions, cross-border enterprises are harmonizing desk booking deployments through standardized governance frameworks, centralized dashboards, and multilingual user support. By comparing regional nuances, stakeholders can tailor deployment strategies to align with local expectations and regulatory imperatives while benefiting from global best practices.

This comprehensive research report examines key regions that drive the evolution of the Desk Booking Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Profiles and Innovation Trajectories of Leading Desk Booking Software Providers Transforming Workplace Efficiency

Leading desk booking solution providers distinguish themselves through differentiated offerings that blend core platform capabilities with strategic partnerships and continuous innovation roadmaps. Several global technology vendors have expanded their ecosystems by collaborating with building automation providers, IoT sensor manufacturers, and major cloud infrastructure services to deliver integrated solutions that manage space utilization, environmental comfort, and safety compliance in unison. These alliances enhance value propositions by enabling end-to-end visibility across workplace operations, facilitating maintenance automation, and supporting advanced energy management initiatives.

Simultaneously, agile disruptors have captured market share by prioritizing user-centric design, rapid feature iteration, and open application programming interfaces (APIs). By offering robust developer communities and flexible integration toolkits, these firms empower customers to connect desk booking systems with enterprise resource planning, human capital management, and facility maintenance platforms. This interoperability fosters a seamless user experience that aligns desk selection with calendar events, team collaboration workflows, and real-time occupancy insights. On the service delivery front, select providers have introduced outcome-based engagement models-tying professional services fees to defined performance indicators such as adoption rates and utilization targets-to reinforce mutual accountability and accelerate return on investment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Desk Booking Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgilQuest, LLC

- Appspace, Inc.

- Asure Software, Inc.

- Condeco Software Ltd

- Deskbird GmbH

- EMS Software, Inc.

- Envoy Inc

- Evoko Group AB

- iOFFICE Corp

- Matrix Booking Ltd

- Meetio AB

- Nexudus Ltd.

- Officely Ltd

- OfficeSpace Software, Inc.

- Planon International B.V.

- Proxyclick BV

- Robin, Inc.

- Serraview Holdings Pty Ltd

- Sign In Workspace, Inc.

- Smartway2 Ltd

- SpaceIQ, Inc.

- Spacewell NV

- Tango Reserve, Inc.

- UnSpot S.L.

- WorkInSync Ltd

Offering Practical Strategic Roadmaps for Industry Leaders to Accelerate Desk Booking Adoption and Achieve Sustainable Workspace Optimization

To capture the full potential of desk booking solutions, industry leaders should adopt a phased strategic roadmap that begins with comprehensive stakeholder alignment and governance design. By prioritizing executive sponsorship and cross-functional steering committees, organizations can ensure that desk booking initiatives align with broader real estate, IT, and human resources objectives. Subsequently, selecting a deployment approach that balances cloud-based flexibility with regulatory compliance will mitigate implementation risks and streamline platform adoption.

Once foundational governance is established, leaders should focus on enhancing the user experience through targeted change management programs, interactive training modules, and ongoing support channels. Encouraging early adopters to champion best practices and sharing success metrics internally will drive momentum and cultural acceptance. Simultaneously, embedding advanced analytics dashboards will enable continuous performance measurement, revealing opportunities to refine desk allocation policies, optimize workspace layouts, and reduce operational costs. Finally, integrating desk booking with adjacent workplace management systems-such as visitor management, room scheduling, and maintenance workflows-will yield synergistic benefits that elevate organizational agility and reinforce long-term sustainability goals.

Detailing Rigorous Mixed-Method Qualitative and Quantitative Approaches Employed to Uncover Comprehensive Desk Booking Software Market Insights

This research employed a mixed-methodology approach, combining qualitative expert interviews with quantitative primary surveys to yield a holistic view of the desk booking software market. Key insights were derived from in-depth conversations with facility managers, IT executives, and workplace strategy consultants, ensuring that emerging trends and operational pain points were accurately captured. These discussions were complemented by structured surveys conducted across a broad spectrum of enterprise organizations, enabling statistical validation of feature preferences, deployment challenges, and adoption drivers.

Secondary research sources included industry whitepapers, regulatory filings, and product documentation, which provided historical context and identified competitive positioning strategies. Following data collection, rigorous triangulation techniques were applied to reconcile conflicting inputs and enhance result reliability. A multistage review process involving cross-regional analysts and subject-matter specialists was conducted to ensure consistency in interpretation and presentation. Finally, data integrity checks and peer validations were performed to confirm that the findings reflect current market realities and actionable intelligence for corporate decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Desk Booking Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Desk Booking Software Market, by Platform & Interface

- Desk Booking Software Market, by Pricing Model

- Desk Booking Software Market, by Deployment Model

- Desk Booking Software Market, by End User Type

- Desk Booking Software Market, by Industry Vertical

- Desk Booking Software Market, by Region

- Desk Booking Software Market, by Group

- Desk Booking Software Market, by Country

- United States Desk Booking Software Market

- China Desk Booking Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Findings and Strategic Implications of Desk Booking Trends for Forward-Looking Organizational Decision-Making

The analysis reveals that desk booking software has transcended mere scheduling functionality to become an integral component of strategic real estate and workplace optimization initiatives. By harnessing predictive analytics, IoT integration, and cloud scalability, organizations can not only streamline desk allocations but also derive actionable insights that inform broader facility planning and employee engagement strategies. Moreover, the cumulative impact of tariff policy shifts underscores the necessity for flexible procurement models and localized partnerships to sustain uninterrupted access to critical hardware and software components.

Segmentation insights demonstrate that deployment preferences, component mixtures, organizational complexity, and vertical-specific requirements each shape unique adoption pathways. Regional dynamics further highlight the importance of tailoring solutions to local regulatory landscapes and cultural norms, while competitive profiles underscore the value of interoperable ecosystems and outcome-based service offerings. By implementing the recommended strategic roadmap-which emphasizes governance alignment, user adoption, analytics integration, and system interoperability-industry leaders can navigate the evolving workspace management terrain and achieve sustained operational efficiency.

Connect with Ketan Rohom to Secure Your Comprehensive Desk Booking Software Market Research Report and Gain Actionable Strategic Insights Today

To explore the intricacies of desk booking software solutions and access deep strategic insights tailored for your organization’s growth trajectory, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your comprehensive market research report. This report is designed to equip decision-makers with actionable intelligence on deployment strategies, regional adoption patterns, competitive landscapes, and emerging best practices. Engage with Ketan today to discuss customized licensing options, receive a detailed demonstration, or arrange a one-on-one briefing that aligns with your specific business objectives. By partnering with Ketan Rohom, you will gain direct access to expert guidance and ongoing support to navigate the complex desk booking software ecosystem and drive measurable returns on your investment

- How big is the Desk Booking Software Market?

- What is the Desk Booking Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?