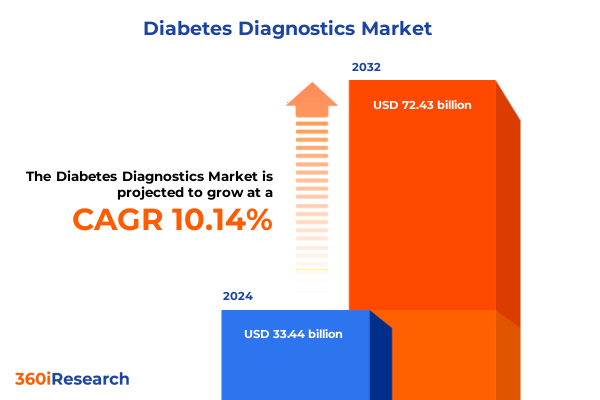

The Diabetes Diagnostics Market size was estimated at USD 36.44 billion in 2025 and expected to reach USD 39.71 billion in 2026, at a CAGR of 10.31% to reach USD 72.43 billion by 2032.

Anchoring the Executive Summary in the Accelerating Evolution of Diabetes Diagnostics Driven by Patient Needs and Technological Breakthroughs

The diabetes diagnostics sector is experiencing a rapid phase of transformation driven by increasing global prevalence of diabetes and a shift towards data-centric management paradigms. As chronic disease care embraces personalized medicine, stakeholders are compelled to rethink diagnostic approaches that were once episodic, moving instead towards continuous insight generation.

Technological breakthroughs in sensor miniaturization and algorithmic analytics have enabled a transition from traditional fingerstick glucose testing to continuous glucose monitoring, offering patients and clinicians richer datasets that inform more nuanced therapeutic decisions. Continuous data streams have emerged as a cornerstone of intensive insulin management, revealing glycemic patterns that were previously undetectable.

Concurrent with sensor innovation, digital health platforms and telemedicine capabilities have reshaped care pathways, requiring diagnostics to integrate seamlessly with electronic health records, patient portals, and mobile applications in order to support remote monitoring, real-time alerts, and predictive risk stratification. This integration empowers care teams to intervene proactively based on trend analyses rather than reactive event management.

Regulatory bodies in major markets have adapted approval processes to facilitate faster market entry for point-of-care testing devices and at-home diagnostic kits, incentivizing manufacturers to invest in rigorous clinical validation, user-friendly interfaces, and compliance with emerging cybersecurity standards. Harmonization efforts across jurisdictions have further accelerated the alignment of performance criteria, reducing development timelines for novel diagnostics.

Amid mounting pressure on healthcare budgets, the dual imperatives of affordability and accessibility have risen to prominence, creating a competitive environment where value-based pricing models, outcome-driven reimbursement policies, and patient assistance programs play a decisive role in shaping market adoption and long-term sustainability. Organizations that can balance cost efficiencies with clinical excellence will be best positioned to meet evolving patient and payer expectations.

Leveraging Disruptive Innovations and Emerging Care Models to Redefine Patient Engagement and Device Integration in Diabetes Diagnostics

Rapid digitalization and the proliferation of remote care models have catalyzed a fundamental shift in how diabetes diagnostics are developed, delivered, and consumed. Innovations in artificial intelligence and machine learning now underpin advanced predictive algorithms that can forecast hyperglycemic or hypoglycemic episodes before they occur, enabling preemptive therapeutic adjustments.

In parallel, the emergence of telemedicine as a mainstream channel for chronic disease management has prompted device manufacturers to prioritize seamless connectivity, ensuring that blood glucose meters and continuous monitoring systems can transmit data securely and in real time. This connectivity is further enhanced by cloud-based analytics that aggregate patient cohorts for population health initiatives and clinical research.

Another pivotal transformation is the ascent of point-of-care and at-home testing modalities that deliver timely Hba1c and ketone measurements outside traditional laboratory settings. The convergence of ease-of-use design, minimal sample requirements, and immediate result availability has broadened diagnostic reach into community clinics and rural areas, making diabetes management more inclusive.

Moreover, the integration of digital therapeutics with diagnostic hardware is carving out new value propositions, as software-guided insulin dosing, virtual coaching, and gamified adherence interventions intersect with sensor-driven insights. Stakeholders are exploring platform-based models that unify diagnostics, treatment guidance, and outcome tracking in a single ecosystem.

Taken together, these transformative shifts underscore a landscape where agility, interoperability, and patient-centric design define competitive advantage, necessitating that industry participants reorient their R&D strategies and partnership models to thrive.

Assessing the Far-Reaching Consequences of 2025 US Import Tariffs on Supply Chains Pricing Dynamics and Domestic Manufacturing Priorities in Diabetes Diagnostics

In early 2025, adjustments to United States import tariffs on medical devices ushered in a complex array of supply chain and cost considerations for diabetes diagnostics manufacturers and distributors. Components sourced from key Asian markets, notably sensors, semiconductors, and chemical reagents, saw elevated duty rates that have reverberated across end markets.

Device assemblers and original equipment manufacturers have encountered margin erosion as elevated import costs feed into manufacturing overheads. Procurement teams are now recalibrating supplier portfolios, expanding qualification programs for alternative vendors in lower-tariff jurisdictions and exploring vertically integrated sourcing models to mitigate the direct impact of duty escalations.

Pricing committees within major diagnostic companies have been compelled to reassess list prices in key channels, balancing the need to preserve unit economics against payer and provider resistance to increased expenditures. Contract negotiations with group purchasing organizations, hospital systems, and public health entities are increasingly anchored in total cost of ownership analyses that factor in tariff-induced cost escalations.

In response, a wave of nearshoring initiatives has gained momentum, with select players investing in domestic sensor fabrication lines and reagent production facilities. Government incentives for reshoring strategic healthcare manufacturing capabilities have further incentivized capital deployment toward US-based operations, ultimately enhancing supply chain resilience and reducing exposure to cross-border tariff volatility.

Overall, the cumulative impact of the 2025 tariff revisions is fostering a more diversified and agile supply chain landscape, compelling stakeholders to adopt multi-pronged risk management strategies that balance cost, continuity, and compliance considerations.

Unveiling Actionable Insights Through Multifaceted Segmentation of Product Types End Users Channels and Test Technologies in Diabetes Diagnostics

Insightful segmentation analysis reveals nuanced dynamics across product categories, end-user cohorts, distribution channels, and test methodologies that are shaping strategic priorities for market participants. Within the realm of product types, legacy blood glucose meters continue to play a foundational role, yet the competitive battleground has shifted toward portable, interoperable models that can sync seamlessly with mobile interfaces. Continuous glucose monitoring systems have experienced pronounced uptake, particularly real-time scanning formats that yield ongoing glycemic trend data, while intermittent scanning paradigms address needs for cost-conscious patient groups. In the realm of Hba1c test kits, a clear divergence emerges between high-throughput laboratory assays favored by centralized diagnostic facilities and point-of-care devices designed for outpatient clinics seeking same-visit result delivery. The lancet category also reflects differentiation, as reusable lancing devices coexist alongside single-use lancets tailored for infection control protocols.

End users represent another critical axis of variation, with diagnostic laboratories sustaining demand for batch processing and research validation, while home care settings emphasize user convenience and device simplicity. Hospitals and clinics demand integration with clinical information systems and adherence to strict quality control processes, whereas research institutes prioritize high precision and adaptable workflows to support investigational studies.

Distribution channels have diversified in response to evolving purchasing behaviors. Traditional hospital pharmacies remain core revenue drivers, yet retail pharmacy partnerships have expanded to encompass over-the-counter glucose monitoring solutions. Wholesale distributors continue to underpin large-scale hospital and laboratory supply networks, and online pharmacies-both e-commerce platforms and retailer websites-have grown in significance as patients seek the convenience of direct-to-consumer ordering.

Across test technology segments, invasive blood sampling retains its status as the benchmark for accuracy, but minimally invasive sensors and emerging noninvasive techniques are progressively gaining traction, driven by patient preference for painless testing experiences and the promise of continuous, needle-free monitoring.

This comprehensive research report categorizes the Diabetes Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Test Technology

- End User

- Distribution Channel

Deciphering Regional Market Dynamics Across Americas Europe Middle East & Africa and Asia Pacific to Inform Strategic Priorities and Expansion Plans

Regional market dynamics present distinct opportunities and challenges across the Americas, Europe Middle East & Africa, and Asia Pacific, each influenced by unique demographic, regulatory, and economic factors. In the Americas, robust reimbursement frameworks and widespread insurance coverage underpin high penetration rates for both traditional and advanced diagnostic devices, with continuous glucose monitoring adoption particularly prominent among type 1 diabetes populations. Governmental initiatives aimed at expanding access to at-home testing have further catalyzed growth in rural and underserved regions, enhancing the reach of point-of-care solutions.

In the Europe Middle East & Africa region, heterogeneity in regulatory pathways and reimbursement policies creates a mosaic of submarkets. Western European countries often lead in embracing novel diagnostic modalities facilitated by centralized health technology assessments, while emerging markets within the Middle East and Africa exhibit cost-sensitivity and emphasize multipurpose platforms that can flex to local infrastructure constraints. Collaborative programs between multinational manufacturers and regional distributors are instrumental in navigating import regulations and local registration processes.

The Asia Pacific region is marked by a rapidly expanding diabetes burden, with emerging economies such as India and China prioritizing large-scale screening and monitoring campaigns. Public health directives focused on early detection have driven demand for low-cost, easy-to-use blood glucose meters and Hba1c test kits, while urban centers show growing receptivity to digital health–enabled continuous monitoring systems. Regulatory agencies across the region are also accelerating approvals for novel technologies to address urgent healthcare needs.

Collectively, these regional landscapes underscore the importance of a tailored go-to-market strategy that aligns product portfolios, pricing frameworks, and channel partnerships with local system dynamics to maximize both reach and impact.

This comprehensive research report examines key regions that drive the evolution of the Diabetes Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Strategic Approaches Shaping Competitive Advantage and Innovation Trajectories in Diabetes Diagnostics

Competitive positioning in the diabetes diagnostics market is shaped by a core group of established leaders alongside agile newcomers focused on niche innovations. Major multinational corporations such as Roche and Abbott leverage expansive product portfolios spanning glucose meters, continuous monitoring systems, and Hba1c testing devices, reinforcing their market dominance through integrated digital platforms and service offerings. These incumbents capitalize on global distribution networks and strategic partnerships to sustain broad market coverage.

Specialized leaders in continuous monitoring, including Dexcom and Medtronic, continue to push the frontier of sensor accuracy, wearability, and connectivity, differentiating through algorithmic insights and ecosystem play where insulin delivery systems and digital coaching tools converge. Becton Dickinson maintains a strong foothold in lancet and consumables supply, while emerging entities such as Ascensia Diabetes Care are carving out segments by focusing on user experience and affordability.

Beyond diversified portfolios, key players are intensifying investment in software-driven analytics, subscription-based service models, and direct-to-consumer channels to future-proof their revenue streams. An uptick in merger and acquisition activity reflects a strategic imperative to fill gaps in digital capabilities, expand geographic reach, and accelerate time to market for complementary technologies.

Smaller innovators continue to drive specialized breakthroughs in noninvasive sensor research, microfluidics, and next-generation Hba1c assays, often collaborating with academic institutions and contract research organizations to expedite early-stage development. Their success in securing venture capital underscores confidence in emerging platforms that promise to redefine accuracy, user comfort, and clinical integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diabetes Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Acon Laboratories, Inc.

- AgaMatrix, Inc.

- Apex Biotechnology Corporation

- ARKRAY, Inc.

- B. Braun Melsungen AG

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Diabetomics, Inc.

- Diazyme Laboratories Inc

- F. Hoffmann-La Roche Ltd.

- ICON PLC

- Medtronic PLC

- Menarini Group

- Nova Biomedical Corporation

- Prestige Diagnostics

- Sanwa Kagaku Kenkyusho Co, Ltd.

- Siemens Healthineers AG

- Sinocare, Inc.

- Terumo Corporation

- Tosoh Bioscience, Inc.

- Trinity Biotech PLC

Formulating Proactive Strategic Initiatives for Market Leadership in a Rapidly Evolving Diabetes Diagnostics Ecosystem Focused on Growth and Resilience

To thrive amid accelerating innovation and market complexity, industry leaders should embrace a multi-layered strategic framework centered on digital ecosystem expansion, risk-averse supply chain diversification, and stakeholder collaboration. Prioritizing investments in software integration and platform interoperability will ensure diagnostic devices seamlessly align with electronic health records, telehealth services, and digital therapeutics, unlocking new models for patient engagement and real-time care coordination.

Supply chain resilience must become a cornerstone capability. Organizations should evaluate alternative sourcing arrangements, including pursuing domestic manufacturing partnerships and establishing dual-sourcing agreements in tariff-favorable jurisdictions. Building redundancy in critical component supplies will mitigate the impact of future policy shifts or geopolitical disruptions.

Strong alliances with payers and health systems are essential to secure favorable reimbursement and adoption pathways. Engaging early with value-based care pilots, demonstrating cost-effectiveness through real-world evidence, and contributing to outcomes-based contracts can reinforce the case for premium diagnostic technologies.

Expanding presence in high-growth emerging markets requires localized strategies that balance affordability with clinical performance. Collaborating with regional distributors, tailoring kits to infrastructure realities, and participating in public health screening initiatives can cultivate market traction and public sector support.

By adopting this proactive, integrated approach, companies can not only navigate current challenges but also position themselves as architects of the next era in diabetes diagnostics, driving patient outcomes and sustainable growth.

Detailing a Robust and Rigorous Research Methodology Combining Primary Expertise Secondary Data Verification and Multi-Tier Validation Techniques

Our research methodology integrates robust primary research, comprehensive secondary data analysis, and rigorous validation protocols to ensure the highest level of accuracy and relevance. Primary research encompassed in-depth interviews with a cross-section of industry experts, including clinical endocrinologists, procurement specialists, regulatory consultants, and technology developers, capturing qualitative insights into emerging trends and market drivers.

Secondary research drew upon publicly available sources such as regulatory filings, peer-reviewed literature, and professional society guidelines, as well as financial disclosures and corporate presentations, to contextualize primary findings within the broader market framework. Data from trade associations, government health agencies, and clinical trial registries were systematically reviewed to triangulate quantitative and qualitative evidence.

Key insights underwent a multi-tier validation process, including cross-verification against independent data repositories and feedback loops with subject matter experts. This iterative validation ensures that any discrepancies are reconciled and that forecast assumptions remain grounded in real-world dynamics.

A continuous quality control mechanism was embedded throughout the research lifecycle, with periodic updates following major regulatory announcements, technological milestones, and tariff adjustments. This vigilant approach maintains the report’s relevance and empowers stakeholders with timely, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diabetes Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diabetes Diagnostics Market, by Product Type

- Diabetes Diagnostics Market, by Test Technology

- Diabetes Diagnostics Market, by End User

- Diabetes Diagnostics Market, by Distribution Channel

- Diabetes Diagnostics Market, by Region

- Diabetes Diagnostics Market, by Group

- Diabetes Diagnostics Market, by Country

- United States Diabetes Diagnostics Market

- China Diabetes Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Navigate the Complexities and Opportunities in the Modern Diabetes Diagnostics Market

The convergence of sensor innovation, digital health integration, and shifting policy landscapes has rendered the diabetes diagnostics market both complex and full of opportunity. Strategic agility will be paramount as organizations navigate the dual imperatives of delivering clinical excellence and achieving cost efficiency, especially in the wake of recent tariff-induced supply chain recalibrations.

Key drivers such as the migration from episodic testing to continuous monitoring, the expansion of point-of-care modalities, and the ascent of patient-centric digital ecosystems will continue to redefine competitive benchmarks. Companies that can pivot quickly on technology adoption, forge resilient partnerships, and demonstrate robust economic value to payers will lead market evolution.

Regional heterogeneity underscores the need for adaptive go-to-market strategies that align product offerings and channel mix with local regulatory, reimbursement, and infrastructure realities. From advanced healthcare systems in the Americas to cost-sensitive environments in Asia Pacific, a one-size-fits-all approach risks ceding ground to more agile challengers.

Ultimately, this executive summary serves as a compass for stakeholders to harness emerging trends, mitigate risks, and capitalize on growth vectors. The insights within guide decision-makers to prioritize investments, refine strategic roadmaps, and unlock sustained value in a dynamic diagnostics ecosystem.

Take Action Today to Drive Diagnostics Excellence by Securing In-Depth Diabetes Insights with Our Authoritative Market Report Available for Purchase

Engaging with our in-depth diabetes diagnostics market research report offers a unique opportunity to gain unparalleled strategic insights and bolster competitive positioning. The report distills complex trends into actionable intelligence covering technological advances, regulatory shifts, and supply chain dynamics that are essential for driving growth and innovation. By partnering with Ketan Rohom, Associate Director, Sales & Marketing, you will be able to tailor the report’s findings to address your organization’s specific priorities and receive expert guidance on leveraging key opportunities. Don’t miss the chance to inform critical business decisions with rigorously validated data and nuanced analyses that only a dedicated specialist such as Ketan can provide. Reach out today to secure your copy and embark on a journey toward diagnostics excellence that empowers stakeholders across the value chain.

- How big is the Diabetes Diagnostics Market?

- What is the Diabetes Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?