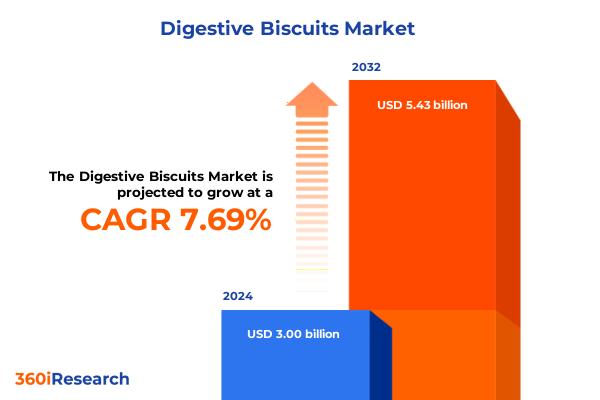

The Digestive Biscuits Market size was estimated at USD 3.23 billion in 2025 and expected to reach USD 3.48 billion in 2026, at a CAGR of 7.69% to reach USD 5.43 billion by 2032.

Establishing the Context for Digestive Biscuits Market Evolution Driven by Consumer Health Trends and Emerging Competitive Dynamics

The digestive biscuits market is at a pivotal juncture, shaped by evolving consumer behaviors, dietary priorities, and shifting retail landscapes. Once viewed primarily as a traditional tea-time accompaniment, these wholesome baked snacks have transcended their heritage to become emblematic of health-driven indulgence and functional nutrition. Rising awareness of dietary fiber benefits, combined with mounting demand for clean-label ingredients, has catalyzed product innovation and diversified flavor portfolios. As a result, manufacturers are broadening their offerings to meet the needs of health-conscious consumers while preserving the comforting familiarity intrinsic to the digestive biscuit category.

Concurrently, the retail environment for digestive biscuits has undergone a profound transformation. While brick-and-mortar grocery chains remain foundational channels, digital platforms are rapidly gaining ground, enabling direct interactions with end consumers and fostering data-driven marketing strategies. This digital pivot not only enhances convenience and transparency but also provides real-time insights into purchasing patterns and regional preferences. Consequently, stakeholders across the value chain-from ingredient suppliers to packaging innovators-are adapting to an ecosystem that demands agility, scalability, and a seamless omnichannel presence.

Against this backdrop, competitive dynamics are intensifying as both legacy brands and emerging challengers vie for market share. Established players are leveraging strategic partnerships and premium brand extensions, while nimble entrants capitalize on niche positioning and social media engagement. In this environment, understanding core drivers, regulatory shifts, and emerging risks is imperative for executives seeking to maintain momentum and capitalizing on new growth frontiers in 2025 and beyond.

Uncovering the Pivotal Shifts Shaping the Digestive Biscuits Realm Through Health Consciousness, Premiumization, and Digital Commerce Transformations

Consumer wellness narratives have fundamentally reshaped the digestive biscuits landscape, ushering in an era where nutritional positioning is as critical as taste. Brands are reformulating traditional recipes to reduce sugar content and fortify fiber levels, thereby aligning products with broader health and fitness trends. In parallel, the proliferation of alternative ingredients-such as ancient grains, plant-based proteins, and functional botanicals-has opened new avenues for differentiation, fueling premiumization and premium-value options that command higher price premiums.

Moreover, the digital commerce revolution represents a transformative shift in how digestive biscuits reach the consumer. The expansion of e-commerce, segmented into direct-to-consumer portals and third-party marketplaces, has streamlined distribution networks and created opportunities for subscription models. This direct engagement also enhances consumer loyalty through personalized offerings and targeted promotions, reducing reliance on traditional retail margins.

Equally significant is the sustainability imperative driving ingredient sourcing and packaging innovations. Environmental concerns have prompted manufacturers to adopt regenerative agriculture practices and to explore recyclable or compostable packaging formats. This shift resonates deeply with environmentally conscious consumers, bolstering brand equity while mitigating regulatory and reputational risks.

Collectively, these transformative shifts-health-oriented product innovation, e-commerce proliferation, and sustainability integration-are redefining value creation and competitive positioning within the global digestive biscuits ecosystem.

Analyzing the Comprehensive Effects of Newly Implemented United States Tariffs on Global Digestive Biscuits Supply Chains and Pricing Dynamics

The introduction of new United States tariffs in early 2025 has reverberated across global supply chains for digestive biscuits, altering cost structures and procurement strategies. Tariff levies on key inputs, including specialized flours, coatings, and packaging materials sourced from select trading partners, have compelled manufacturers to reassess their sourcing matrices. As a result, many stakeholders have pursued diversification of supplier bases, engaging with regional producers in North America and Latin America to mitigate tariff exposure and ensure continuity of supply.

Simultaneously, cost pressures stemming from these duties have been incrementally passed to downstream channels, exerting an inflationary effect on retail prices. Retailers and distributors are adapting through renegotiated trade terms, strategic promotions, and selective assortment rationalization to manage basket affordability and maintain consumer loyalty. At the same time, premium and artisanal segments have demonstrated resilience by emphasizing value-added attributes such as organic certification, functional fortification, and limited-edition flavor innovations, which justify higher price points even in the face of tariff-induced margin compression.

Furthermore, the tariff landscape has accelerated nearshoring initiatives and regional manufacturing expansions within the United States. Investments in domestic production sites and local ingredient partnerships have mitigated some import costs while enhancing supply chain visibility and responsiveness. This structural shift toward greater localization supports speed-to-market and sustainability goals, but it also requires careful capital allocation and operational planning to realize long-term returns.

Ultimately, the cumulative impact of the 2025 tariffs is stimulating both risk management innovations and strategic realignments, underscoring the importance of adaptive sourcing frameworks and proactive pricing strategies in safeguarding profitability across the digestive biscuits value chain.

Revealing the Strategic Segmentation Layers That Illuminate Consumer Preferences and Distribution Efficiencies in the Digestive Biscuits Ecosystem

Insights from the distribution channel segmentation reveal that traditional grocery channels continue to anchor consumer accessibility, yet the rapid ascent of e-commerce channels underscores shifting purchase behaviors. Within the market analysis, convenience stores are recognized for driving impulse consumption, particularly in densely populated urban centers, whereas supermarket and hypermarket networks cater to bulk purchasing and family-oriented consumption occasions. The e-commerce dimension is further differentiated by direct-to-consumer platforms that enable brand-managed experiences and third-party marketplaces that offer expansive product assortments and rapid geographic reach.

Product type segmentation underscores that classic digestive biscuits maintain a loyal consumer base drawn to their simplicity and familiar taste profile, yet chocolate-coated variants demonstrate robust appeal among younger demographics seeking indulgence. Flavored extensions, especially those infused with oats or positioned as sugar-free alternatives, are gaining traction among health proponents and those with dietary constraints, signifying a clear opportunity for product diversification that balances taste and wellness.

The packaging format segmentation provides clarity on how consumers interact with the category across consumption contexts. Bulk packaging remains cost-effective for institutional buyers and household stockpiling, while single-pack formats drive convenience for on-the-go consumption. Multi-pack offerings, which include count-based and weight-based configurations, optimize value perception and align with promotional strategies employed by both mass retailers and e-retailers.

Finally, end-user segmentation highlights the contrast between foodservice channels-encompassing cafes, hotels, and restaurants-which favor bespoke and co-branded options, and household users, who prioritize value, variety, and nutritional credentials. These segmentation insights collectively inform tactical approaches to channel prioritization, portfolio development, and promotional alignment in responding to nuanced consumer and commercial demands.

This comprehensive research report categorizes the Digestive Biscuits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Format

- Distribution Channel

- End User

Navigating the Distinct Regional Dynamics Propelling Digestive Biscuits Demand Across Americas, EMEA, and Asia Pacific Markets

Regional dynamics fundamentally influence product formulation, branding, and distribution strategies within the digestive biscuits market. In the Americas, established consumer familiarity with wheat-based baked goods coexists with a growing penchant for health-oriented innovations. The United States market, in particular, is characterized by heightened demand for organic and functional variations, while Latin American markets display strong growth potential driven by expanding modern trade channels and rising disposable incomes.

In Europe, the Middle East, and Africa, traditions around tea and coffee consumption underpin sustained demand for digestive biscuits, with Western Europe favoring premium and artisanal offerings. Meanwhile, Eastern European consumers exhibit price sensitivity, prompting value-focused brands to maintain competitive pricing. In the Middle East, high interest in specialty flavors and gift-pack formats aligns with cultural gifting practices, whereas emerging African markets are stimulated by expanding supermarket chains and urbanization.

Across Asia-Pacific, the convergence of Western snacking habits and local taste preferences is driving both volume growth and high-margin opportunities. Markets such as India and China are witnessing rising penetration of branded digestive biscuits in urban centers, supported by substantial investments in cold-chain and last-mile logistics. In more mature markets like Japan and Australia, premium positioning and health-infused innovations resonate strongly with discerning consumers.

These regional insights underscore the necessity for granular market strategies that address localized consumption patterns, regulatory frameworks, and distribution infrastructure. Tailored approaches to flavor development, packaging design, and channel mix are essential to unlocking growth across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Digestive Biscuits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Competitive Positioning, and Strategic Partnerships in the Global Digestive Biscuits Market Landscape

Key competitors in the global digestive biscuits arena are advancing through targeted investments in research and development, strategic mergers and acquisitions, and robust brand-building initiatives. Major multinational manufacturers leverage established distribution networks and economies of scale to maintain dominant positions, while simultaneously pursuing premium and health-oriented brand extensions to capture evolving consumer segments.

Innovative challenger brands are capitalizing on their agility, introducing keto-friendly, gluten-free, and plant-based formulations to address niche dietary requirements. These brands utilize digital marketing channels and influencer partnerships to drive consumer engagement and secure shelf space in both e-commerce and select modern trade outlets. Private-label offerings from large retail chains further intensify competition by offering value-oriented alternatives with competitive pricing and localized flavors.

Collaborations between ingredient suppliers and manufacturers are also on the rise, enabling co-creation of proprietary blends and functional fortifications. This collaborative model enhances speed-to-market for novel product variants and supports intellectual property protections that differentiate brand portfolios. Additionally, some industry leaders are forging alliances with packaging innovators and technology providers to implement smart packaging solutions, improving freshness monitoring and consumer interactivity.

Overall, the competitive landscape is marked by a dual trajectory: on one hand, large players consolidate their core offerings through incremental innovation and supply chain integration; on the other, nimble entrants disrupt with differentiated positioning and direct consumer engagement strategies. Racing to capture varied consumer cohorts, companies are balancing investment between scale efficiencies and portfolio diversification.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digestive Biscuits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABISCO by Al-Babtain Industrial Group

- Annie's Homegrown, Inc.

- Bahlsen GmbH & Co KG

- Bakewell Biscuits Pvt. Ltd.

- Bonn Group

- Britannia Industries Limited

- Burton’s Foods Ltd.

- Campbell Soup Company

- Galletas Gullón S.A

- ITC Limited

- Kambly SA

- Kellogg Co

- Lotus Bakeries NV

- Mondelez International Inc.

- Mondelez International Inc.

- Nestle S.A.

- Parle Products Pvt. Ltd.

- Patanjali Ayurved Ltd.

- Pladis Foods Ltd

- Sunder Biscuit Industries

- The Ferrero Group

- The Kraft Heinz Company

- United Biscuit Private Ltd.

- Walker's Shortbread Ltd.

- Walker's Shortbread Ltd.

Delivering Pragmatic and High-Impact Recommendations for Industry Leaders to Seize Growth Opportunities in the Digestive Biscuits Sector

To capitalize on emerging growth frontiers, industry leaders should prioritize product innovation that marries health functionality with sensory appeal, exploring opportunities in fiber enrichment, alternative sweeteners, and plant-based formulations. By adopting a consumer-centric approach, companies can co-develop products with direct consumer feedback loops via digital platforms, reducing time to market and enhancing acceptance rates. Moreover, investment in modular production capabilities will allow rapid scaling of successful product variants while minimizing capital risk.

Strengthening omnichannel distribution is imperative. Brands must amplify their direct-to-consumer channels to collect first-party data and drive subscription-based loyalty models, while optimizing relationships with third-party retailers through data-sharing agreements and joint promotional planning. Integrating advanced analytics into demand forecasting can further streamline inventory management and mitigate the impact of seasonal demand fluctuations.

Strategic sourcing diversification is another critical lever in light of tariff fluctuations and supply chain volatility. Firms should cultivate regional supplier partnerships to shorten lead times and reduce exposure to trade policy shifts, complemented by periodic cost reviews and scenario planning exercises. Simultaneously, committing to sustainable sourcing frameworks will bolster brand authenticity and align with evolving regulatory standards.

Finally, forging cross-industry alliances-particularly with packaging technology firms and foodservice distributors-can unlock new channels for product innovation and experiential marketing. Such collaborations offer avenues for co-branded initiatives and interactive consumer engagement, establishing digestive biscuits as a versatile, anytime snack option across occasions.

Articulating the Rigorous Multi-Source Research Methodology Underpinning Insights into the Digestive Biscuits Market Overview

Our research methodology integrates primary and secondary research, ensuring a robust foundation for the insights presented herein. Primary inputs were obtained through in-depth interviews with senior executives across manufacturing, distribution, and retail sectors, coupled with surveys of end-consumer preferences and consumption behaviors. Secondary sources included trade publications, regulatory filings, and company financial disclosures, which were vetted for credibility and cross-referenced to ensure accuracy.

Quantitative analyses were conducted using standardized frameworks to assess market segmentation, channel performance, and pricing dynamics. Statistical modeling was employed to identify correlation patterns between consumer demographics and product adoption rates. Simultaneously, supply chain evaluations were performed via value chain mapping and cost-structure benchmarking, providing clarity on margin drivers and potential efficiencies.

To ensure comprehensiveness, the study canvassed 15 key markets across three regions, with attention to regulatory environments, cultural consumption norms, and competitive intensity. Data integrity protocols included triangulation of multiple data points, reconciliation of conflicting inputs, and iterative validation with domain experts. This rigorous process ensures that the insights and recommendations are grounded in empirical evidence and reflective of the current market reality.

The methodology’s multi-source approach, combining qualitative depth and quantitative rigor, underpins the reliability of the strategic imperatives and market intelligence outlined in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digestive Biscuits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digestive Biscuits Market, by Product Type

- Digestive Biscuits Market, by Packaging Format

- Digestive Biscuits Market, by Distribution Channel

- Digestive Biscuits Market, by End User

- Digestive Biscuits Market, by Region

- Digestive Biscuits Market, by Group

- Digestive Biscuits Market, by Country

- United States Digestive Biscuits Market

- China Digestive Biscuits Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Illuminate the Future Trajectory and Strategic Imperatives of the Digestive Biscuits Market Ecosystem

Across the exploration of evolving consumer preferences, disruptive market forces, and policy headwinds, the digestive biscuits market emerges as a dynamic arena characterized by both continuity and change. The intersection of health-oriented reformulation, digital commerce expansion, and sustainability commitments delineates the critical factors that will shape future competitiveness. Enterprises capable of orchestrating agile supply chains, consumer-driven innovation, and omnichannel distribution are best positioned to navigate the complexities ahead.

The cumulative effects of the 2025 tariff adjustments serve as a catalyst for strategic realignments, underscoring the value of localized sourcing and adaptive pricing models. Concurrently, segmentation insights provide clarity on the nuances of distribution channels, product variants, packaging preferences, and end-user applications, enabling tailored strategies that resonate across diverse consumer and commercial segments.

Regionally, the trifurcated dynamic between the Americas, EMEA, and Asia-Pacific highlights the necessity of market-specific strategies. Whether through premiumization in Western Europe, value-driven offerings in Eastern Europe, or health-infused innovations in North America and Asia, differentiated regional approaches will unlock incremental growth and mitigate risk.

Ultimately, the capacity to integrate forward-looking consumer insights with resilient operational models will determine the trajectory of market leaders and challengers alike. As the category continues to evolve, sustained success will hinge upon strategic foresight, collaborative partnerships, and unwavering focus on consumer relevance.

Engage with Ketan Rohom to Unlock Comprehensive Digestive Biscuits Market Intelligence and Propel Strategic Decisions with Exclusive Research

Engaging directly with Ketan Rohom, who brings extensive expertise in sales and marketing for market research, empowers decision-makers to access tailored insights and personalized briefings that address specific organizational priorities. By initiating a conversation, stakeholders can explore custom data requests, deep-dive sessions, and strategic roadmaps aligned to their unique operational challenges. Connecting with this practice not only accelerates the procurement of the full market intelligence report but also facilitates ongoing advisory support to ensure that emerging trends translate into concrete business outcomes. Reach out to schedule a dedicated consultation and secure the actionable market intelligence necessary to guide product innovation, optimize go-to-market strategies, and drive sustainable growth in the competitive digestive biscuits ecosystem.

- How big is the Digestive Biscuits Market?

- What is the Digestive Biscuits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?