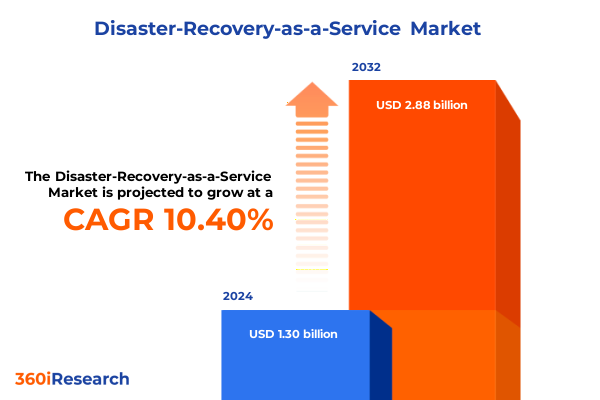

The Disaster-Recovery-as-a-Service Market size was estimated at USD 1.44 billion in 2025 and expected to reach USD 1.60 billion in 2026, at a CAGR of 10.91% to reach USD 2.98 billion by 2032.

Empowering Enterprises With Seamless Cloud-Driven Disaster Recovery Solutions To Safeguard Critical Operations And Ensure Uninterrupted Continuity

Disaster-Recovery-as-a-Service has emerged as a cornerstone for organizations seeking to safeguard critical operations against increasingly complex disruptions. In an era defined by pervasive cyber threats, evolving regulatory imperatives, and the proliferation of distributed work models, traditional recovery strategies fall short of meeting modern demands. Enterprises now require solutions that seamlessly replicate, protect, and restore data and applications in off-site cloud environments, ensuring continuity when unforeseen events threaten operational stability.

As business landscapes become more interconnected and digital transformation accelerates, downtime carries escalated financial, reputational, and compliance risks. Regulatory frameworks such as GDPR, HIPAA, and industry-specific mandates demand rigorous recovery capabilities and demonstrable resilience. Concurrently, the surge in remote collaboration and reliance on mission-critical applications underscores the need for rapid recovery point objectives and recovery time objectives that legacy infrastructures struggle to deliver.

Against this backdrop, DRaaS presents a compelling alternative by offering subscription-based, scalable, and flexible recovery services. It empowers IT teams to shift focus toward strategic initiatives rather than maintaining geographically dispersed secondary data centers. This introduction frames the essential role of DRaaS in securing business continuity, setting the stage for deeper exploration into transformative market shifts, tariff impacts, and segmentation-driven insights.

How Emerging Technologies And Strategic Innovations Are Reshaping Disaster Recovery As A Service For Unmatched Agility And Efficiency

The disaster recovery landscape is undergoing a profound transformation as organizations embrace hybrid and multi-cloud infrastructures that blend private and public environments. According to Flexera’s 2024 State of the Cloud Report, 73% of enterprises now operate hybrid cloud environments, reflecting the need to balance control, scalability, and cost-effectiveness (turn2search4). This shift has given rise to unified management platforms that provide centralized visibility and orchestration across distributed assets, reducing complexity and accelerating recovery workflows.

Artificial intelligence and machine learning are woven into DRaaS offerings to automate resource allocation, predict failure patterns, and optimize recovery orchestration. AI-driven analytics continuously monitor infrastructure health, flagging anomalies before they escalate into service disruptions and streamlining triage processes for faster remediation (turn2search0). Consequently, recovery plans dynamically adjust to evolving workloads and performance metrics, enhancing resiliency without manual intervention.

Edge computing is also converging with DRaaS, extending protection to remote sites and IoT deployments that require low-latency failover capabilities. By processing and replicating critical data closer to its source, organizations minimize bandwidth constraints and reinforce continuity for latency-sensitive applications (turn2search0). At the same time, zero trust security architectures are embedded at every layer-ensuring every user, device, and workload undergoes continuous verification as part of the recovery fabric (turn2search4).

Navigating The Economic Ripples Of New United States Tariffs And Their Far-Reaching Effects On Cloud-Based Disaster Recovery Services

The imposition of new United States tariffs in 2025 has introduced fresh challenges for DRaaS providers and their customers by driving up the costs of essential hardware components. Many servers, networking switches, and storage arrays integral to cloud-backed recovery solutions fall under Section 301 tariffs on Chinese-origin electronics, resulting in import duties as high as 25% (turn0search0). These increased expenses place pressure on hyperscalers and managed service providers, who must choose between absorbing additional costs or passing them on to end users.

Supply chain reconfiguration has become a strategic imperative. Providers are evaluating alternative manufacturing hubs in Taiwan, Vietnam, and Mexico to mitigate tariff exposure, yet transitioning to new vendors entails qualification processes that can extend deployment timelines (turn0search2). Contract renegotiations with hardware vendors are underway, as stakeholders seek to stabilize pricing models and preserve service levels.

To counterbalance tariff-induced cost pressures, forward-looking DRaaS firms are accelerating adoption of software-defined infrastructure and hyperconverged platforms that maximize utilization of existing assets. Some are developing tariff-aware architectures that selectively source components least affected by duties, while others leverage multi-cloud distribution to capitalize on regional pricing differentials. These cost-mitigation strategies aim to uphold aggressive service level agreements and protect margins amid an evolving trade environment.

Dissecting Market Dynamics Through Service, Deployment, Organizational, And Industry-Based Perspectives To Tailor DRaaS Solutions Precisely

In examining market dynamics through the lens of service type, it becomes evident that organizations prioritize granular control over data protection by maintaining robust backup and restore capabilities. This segment accounted for approximately 45% of overall DRaaS demand in 2023, underscoring its fundamental role in business continuity strategies (turn3search4). Within this category, file-level and image-based backups cater to divergent recovery objectives-file-level for targeted restoration of critical documents, and image-based to capture full-system states for rapid site failover.

When considering deployment models, hybrid cloud has emerged as the fastest-growing approach, representing 38% of the market by 2023. This model’s fusion of private infrastructure security with public cloud scalability appeals to regulated industries such as finance and healthcare, where data sovereignty and elasticity must coexist (turn3search4). By contrast, purely private or public deployments suit organizations with singular compliance or cost-efficiency mandates.

Organizational size further differentiates DRaaS requirements. Large enterprises often demand extensive customization, advanced automation, and integration with existing on-premises architectures, while small and medium enterprises seek turnkey simplicity and predictable subscription-based pricing. Lastly, a vertical analysis reveals financial services and insurance as early adopters-driven by stringent uptime regulations-while sectors like higher education, energy, and government capitalize on specialized failover models tailored to institutional needs.

This comprehensive research report categorizes the Disaster-Recovery-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Industry Vertical

Unveiling Regional Variances In DRaaS Adoption Trends Across The Americas, EMEA, And Asia-Pacific To Guide Strategic Expansion

The Americas maintain a leadership position in DRaaS adoption, with North America alone accounting for 38.13% of the market in 2024. This dominance is fueled by the presence of major cloud providers, widespread digital transformation initiatives, and elevated regulatory standards for business continuity planning (turn4search3). Enterprises across the United States and Canada leverage mature IT infrastructures and deep cloud ecosystems to drive rapid deployment and continuous innovation.

Across Europe, Middle East, and Africa, stringent data protection regulations such as GDPR mandate rigorous recovery capabilities, positioning the region as a significant growth territory for DRaaS solutions. Regional data residency requirements and industry-specific compliance frameworks reinforce the need for hybrid architectures that can localize sensitive workloads while harnessing cloud scalability. This emphasis on regulatory alignment has encouraged providers to develop modular offerings with built-in compliance controls (turn4search4).

The Asia-Pacific region is experiencing the highest compound annual growth rates, propelled by accelerated cloud adoption, expanding SME sectors, and increased cyber risk awareness. Countries like China, India, and Australia are investing heavily in cloud resilience to support digital transformation agendas and safeguard critical infrastructure. As a result, APAC is poised to outpace other regions in new DRaaS engagements, supported by local data center expansions and partnerships between global and domestic providers (turn4search4).

This comprehensive research report examines key regions that drive the evolution of the Disaster-Recovery-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Market Leaders’ Strategic Approaches And Technological Innovations Driving Competitive Advantage In The DRaaS Sector

Leading DRaaS vendors distinguish themselves through differentiated service models and strategic technology partnerships. Druva’s Data Security Cloud stands out for its air-gapped and immutable protection mechanisms, offering seamless data orchestration across cloud, on-premises, and edge environments. Trusted by Fortune 500 organizations, its centralized approach to incident response and cyber remediation underscores its enterprise-grade resilience (turn1search0). IBM, drawing on decades of infrastructure expertise, integrates DRaaS within its broader consulting ecosystem to deliver customized hybrid recovery solutions that address complex legacy environments and regulatory mandates (turn1search0). Meanwhile, Sungard Availability Services combines extensive global data center capacity with professional services, enabling clients to design flexible recovery workflows aligned to unique compliance requirements (turn1search0).

Zerto’s continuous data protection technology has garnered prominence for converging backup, replication, and orchestration into a unified recovery platform, particularly in hybrid and multi-cloud scenarios. Its journal-based recovery and hypervisor-level replication simplify failover testing and compliance reporting, making it a preferred choice for organizations focused on granular RPO control (turn1search1). Microsoft’s Azure Site Recovery leverages native integration with Azure infrastructure to deliver cost-efficient VM replication, automated failover simulation, and cross-region orchestration-ideal for enterprises already committed to the Microsoft ecosystem (turn1search1).

Specialized providers such as Infrascale and Acronis cater to niche market segments with feature-rich, cloud-native offerings. Infrascale emphasizes simplicity through push-button recovery and intelligent automation, empowering lean IT teams to maintain rigorous service objectives without extensive in-house resources (turn1search5). Acronis focuses on service provider enablement, delivering multi-tenant disaster recovery services optimized for MSPs looking to bundle DRaaS with broader security portfolios (turn1search6).

This comprehensive research report delivers an in-depth overview of the principal market players in the Disaster-Recovery-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acronis International GmbH

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Expedient LLC

- Hewlett Packard Enterprise Company

- IBM Corporation

- InterVision Systems LLC

- Kaseya company

- Microsoft Corporation

- Recovery Point Systems Inc.

- Sungard Availability Services LP

- TierPoint LLC

- Veeam Software Group GmbH

- VMware, Inc.

Implementing Tactical Initiatives To Strengthen Resilience, Optimize Costs, And Accelerate Cloud-Based Disaster Recovery Maturity Across Enterprises

Industry leaders should prioritize diversification of hardware supply chains to mitigate the risk of tariff-induced cost volatility. By establishing relationships with multiple vendors across regions unaffected by current duties, organizations secure uninterrupted access to essential infrastructure components (turn0search0). In parallel, embracing hybrid multi-cloud strategies provides negotiating leverage and resilience, allowing enterprises to allocate workloads dynamically based on latency, cost, and compliance requirements (turn2search2).

Investing in software-defined infrastructure and hyperconverged platforms can significantly optimize existing resource utilization and delay capital-intensive hardware refresh cycles. Such architectures enable automated failover and self-service testing capabilities that drive operational efficiency and enhance recovery readiness. Additionally, embedding AI-driven orchestration and predictive analytics streamlines resource allocation and anomaly detection, reducing the manual overhead inherent in traditional recovery processes (turn2search0).

Finally, mapping service offerings to clearly defined customer segments-by service type, deployment model, organization size, and vertical-enables targeted solution design and marketing. Tailoring SLAs and pricing structures to meet the distinct needs of large enterprises versus SMEs, or financial services versus education, fosters stronger customer alignment and accelerates adoption across diverse market niches.

Detailing The Rigorous Mixed-Methods Approach And Analytical Framework Underpinning Our Comprehensive DRaaS Market Research Study

This research employed a mixed-methods approach, combining comprehensive secondary data analysis with primary interviews to ensure robust and reliable insights. Secondary sources included publicly available financial reports, regulatory filings, vendor white papers, and trade publications, which provided foundational market context. Primary research comprised structured interviews with DRaaS technology leaders, CIOs, and IT reliability engineers, offering nuanced perspectives on adoption drivers, emerging use cases, and mitigation strategies.

Quantitative data were triangulated through cross-referencing vendor disclosures, verified financial performance metrics, and macroeconomic indicators relevant to IT infrastructure investments. Advanced analytics techniques were applied to normalize disparate data sets, identify outliers, and assess growth trends. Regional and vertical analyses were informed by industry-specific frameworks, ensuring that sectoral regulatory and operational nuances were accurately reflected. Rigorous validation workshops with subject-matter experts further enhanced the credibility of key findings and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disaster-Recovery-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disaster-Recovery-as-a-Service Market, by Service Type

- Disaster-Recovery-as-a-Service Market, by Deployment Model

- Disaster-Recovery-as-a-Service Market, by Industry Vertical

- Disaster-Recovery-as-a-Service Market, by Region

- Disaster-Recovery-as-a-Service Market, by Group

- Disaster-Recovery-as-a-Service Market, by Country

- United States Disaster-Recovery-as-a-Service Market

- China Disaster-Recovery-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2067 ]

Summarizing Key Findings To Illuminate The Path Forward In A Rapidly Evolving Disaster Recovery-As-A-Service Environment

The convergence of advanced technologies, shifting trade policies, and evolving organizational priorities underscores the critical importance of DRaaS for modern enterprises. As hybrid and multi-cloud models become the de facto standard, recovery solutions must evolve to deliver seamless orchestration, rapid recovery objectives, and integrated security controls. The 2025 tariff landscape has injected new cost pressures, yet it has also catalyzed innovation in software-defined and tariff-aware architectures that safeguard service continuity.

Segment-specific strategies reveal that backup and restore services will remain foundational, while emerging modalities such as pilot light and warm standby configurations gain traction for mission-critical workloads. Hybrid cloud deployments deliver the optimal balance between control and scalability, driving adoption across regulated and resource-constrained environments alike. Regionally, the Americas lead in maturity, EMEA drives compliance-centric innovation, and Asia-Pacific emerges as the fastest-growing opportunity.

By aligning product roadmaps with segmentation insights and regional growth trajectories, organizations can develop resilient, cost-effective recovery ecosystems. Collaborating with industry-leading providers and integrating AI-driven orchestration paves the way for next-generation DRaaS offerings that not only mitigate risks but also empower business agility.

Unlock Exclusive Insights And Propel Your Disaster Recovery Strategy Forward By Engaging With Ketan Rohom For The Full DRaaS Market Intelligence Report

Engaging directly with Ketan Rohom offers you personalized guidance to navigate the intricacies of the disaster recovery landscape and tailor strategies that align with your organization’s unique objectives. His expertise in sales and marketing ensures a seamless, consultative experience as you explore detailed findings, competitive benchmarks, and actionable insights that drive informed investment decisions. By connecting with Ketan, you gain early access to proprietary data visualizations, scenario analyses, and vendor performance comparisons that are not available in the public domain. Empower your leadership team with the clarity and confidence to select the optimal DRaaS solutions, optimize budgets, and strengthen business continuity posture. Reach out today to secure your copy of the comprehensive DRaaS market research report and begin transforming risk into resilience.

- How big is the Disaster-Recovery-as-a-Service Market?

- What is the Disaster-Recovery-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?