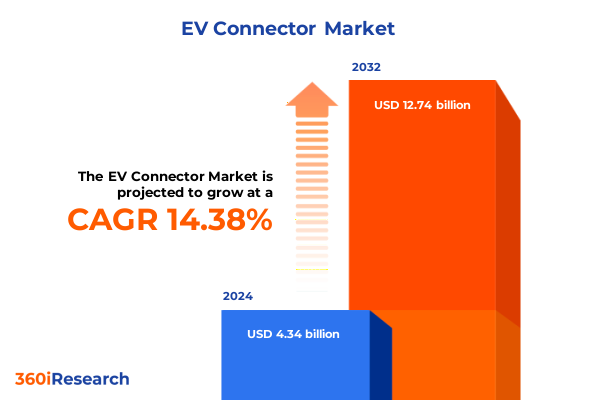

The EV Connector Market size was estimated at USD 4.92 billion in 2025 and expected to reach USD 5.60 billion in 2026, at a CAGR of 14.53% to reach USD 12.74 billion by 2032.

Rapid acceleration in the electric vehicle connector domain driven by stringent emissions targets and evolving charging technology demands

The electric vehicle connector market is experiencing an unprecedented surge as automakers, utilities, and infrastructure providers accelerate investments to support the transition to zero-emission transportation. Fueled by mounting regulatory commitments to decarbonize road transport, falling battery costs, and heightened consumer demand for cleaner mobility options, industry stakeholders are scaling production of specialized connectors that enable efficient power transfer between vehicles and charging stations. Concurrently, technological advancements in fast- and ultra-fast-charging architectures are reshaping system requirements, driving the development of more robust connectors capable of handling higher power outputs and more frequent charge cycles. As a result, the market landscape is marked by intense competition, rapid product innovation, and strategic partnerships spanning vehicle manufacturers, charging network operators, and component suppliers, all seeking to capture value in an ecosystem projected to expand exponentially over the coming decade.

Modular platforms and digital smart connectivity converge to redefine reliability and interoperability in EV charging networks

The electric vehicle connector landscape is undergoing transformative shifts that extend well beyond incremental improvements in power handling capacity. Industry participants are embracing modular connector platforms that support future-proofed upgrades, allowing existing charging infrastructure to adapt seamlessly to emerging standards and higher power levels. Interoperability has become a critical focal point, prompting collaborative standardization efforts among global consortia to ensure that new connectors accommodate diverse vehicle architectures and charging protocols. Digital integration is also on the rise, with smart connectors embedding sensors and communication modules to deliver real-time diagnostics, dynamic load balancing, and firmware updates-capabilities that were inconceivable even a few years ago. Furthermore, rapid progress in materials science is yielding connectors that combine enhanced conductivity with improved mechanical resilience, reducing maintenance costs and extending service life. Together, these shifts are redefining expectations for reliability, scalability, and user experience across the charging value chain.

Escalating import tariffs on essential metals and components trigger strategic shifts toward domestic manufacturing and material innovation

The introduction of comprehensive U.S. tariffs on imported raw materials and finished charging equipment in 2025 has compounded cost pressures across the electric vehicle connector supply chain. Tariffs levied on copper, steel, and aluminum-essential inputs for conductor fabrication and connector housing-have driven component costs higher, prompting manufacturers to reassess global sourcing strategies and explore domestic material procurement. At the same time, the 25% Section 232 duties on steel and aluminum imports have incentivized greater investment in U.S. manufacturing capacity, with some suppliers relocating production closer to key assembly hubs to mitigate lead times and avoid additional duties. Transformers, which dominate costs in high-power DC charging systems, have also been affected by elevated tariffs and extended delivery schedules, exacerbating project timelines for large-scale deployments; however, the predominance of domestic electrical material sourcing-estimated at 80%–90% of conduit and panel requirements-has provided some buffer against overall project cost escalation. These policy-driven dynamics have accelerated the push for supply chain domestication, spurred innovation in composite materials to reduce reliance on tariffed metals, and reshaped long-term strategic planning for industry leaders navigating a more protectionist trade environment.

Differentiated power delivery and network integration requirements drive product innovation across vehicle, charging, network, and connector type segments

Insights gleaned from the market’s layered segmentation reveal that battery electric vehicles command the lion’s share of demand for dedicated high-power connectors, while plug-in hybrid configurations continue to rely on smaller, more versatile AC interfaces tailored for residential charging environments. Within charging methodologies, the single-phase AC segment caters primarily to home installations offering up to 7 kW, whereas three-phase AC solutions deliver mid-tier power for light commercial and multifamily use; in the realm of DC charging, fast-charge connectors serve highway corridor deployments, and ultra-fast interfaces are emerging as critical assets for commercial fleet and high-throughput public sites. Differentiation between networked and non-networked offerings highlights the growing importance of cloud-connected smart charging ecosystems, which provide remote monitoring and demand-response capabilities, contrasted with standalone units optimized for cost-sensitive residential applications. When considering installation contexts, commercial-grade connectors prioritize rugged construction and enhanced safety features, whereas residential installations focus on ease of use and aesthetic integration. End-user segmentation underscores the divergent requirements of commercial building owners-who demand interoperability and integrated payment systems-compared to homeowners seeking seamless at-home charging, and municipalities investing in public infrastructure with resilient, vandal-resistant connector designs. Power output segmentation further illustrates the fast-evolving spectrum from sub-7 kW level 2 solutions for urban dwellers to high-power ultrafast connectors exceeding 150 kW for long-distance travel. Finally, connector type preferences continue to evolve, with CCS emerging as the de facto standard in North America and Europe, while CHAdeMO, GB/T, Type 1, and Type 2 configurations persist in legacy and regional applications.

This comprehensive research report categorizes the EV Connector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Charging Type

- Network Type

- Power Output

- End User

- Distribution Channel

Diverse regional policy drivers and infrastructure mandates are shaping the pace and priorities of EV charging rollouts globally

The Americas lead in the rapid scaling of public charging infrastructure, buoyed by federal incentive programs and state-level rebate initiatives that have catalyzed the deployment of thousands of fast chargers along interstate corridors and in urban centers; meanwhile, North American OEMs are forging strategic alliances with network operators to ensure nationwide coverage. In Europe, Middle East & Africa, stringent EU regulations-such as AFIR mandating minimum fast-charging stations every 60 km-have prompted accelerated build-out in core markets like Germany and France, while emerging economies invest in targeted national schemes to bridge urban-rural charging gaps. Across the Asia-Pacific, China’s commanding role in global charging point additions continues unabated, supported by aggressive local subsidies and domestic standardization efforts, whereas markets in Japan, South Korea, and Southeast Asia are focusing on harmonizing High Power Charging rollouts with grid modernization plans and leveraging domestic manufacturing prowess to drive down hardware costs.

This comprehensive research report examines key regions that drive the evolution of the EV Connector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Pioneering organizations leverage modular platforms, strategic OEM alliances, and carve-out strategies to dominate high-growth EV charging segments

Leading-edge companies are distinguishing themselves through portfolio diversification, technological leadership, and strategic partnerships. ChargePoint’s recent launch of next-generation bidirectional AC Level 2 chargers, featuring speeds up to 19.2 kW, dynamic load balancing, and vehicle-to-home capability, exemplifies how networked charging innovators are embedding advanced grid-interactivity features into their hardware. The collaboration between GM and ChargePoint to install 500 DC fast-charging ports under the GM Energy brand demonstrates the value of OEM-network operator alliances in bridging coverage gaps for EV drivers. Siemens’ strategic carve-out of its eMobility division-combined with the integration of Heliox’s DC fast-charging expertise-underscores a pivot toward high-growth segments such as fleet and depot charging, and a more regionalized approach to serve divergent market requirements in North America and Europe. ABB E-mobility’s introduction of the modular A200/300 All-in-One chargers, the MCS1200 Megawatt Charging System for heavy vehicles, and the flexible ChargeDock Dispenser platform illustrates how modular, scalable architectures can reduce total cost of ownership while delivering superior reliability across public, fleet, and heavy-duty applications. Collectively, these initiatives reflect a market where product innovation, collaborative ecosystem partnerships, and agile business realignments are essential to capturing emerging opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the EV Connector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amphenol Communications Solutions

- Aptiv Global Operations Limited

- Aptiv PLC

- BESEN International Group

- Coroplast Fritz Müller GmbH & Co. KG

- Dyden Corporation

- Eaton Corporation plc

- Fujikura Ltd.

- Guchen Electronics

- Hirose Electric Co., Ltd.

- HUBER+SUHNER AG

- ITT Inc.

- Japan Aviation Electronics Industry, Ltd.

- JET Charge Pty Ltd.

- KINSUN Industries Inc.

- Koch Industries, Inc.

- KYOCERA Corporation

- Leoni AG

- MENNEKES Elektrotechnik GmbH & Co. KG

- Molex LLC

- OSRAM Licht AG

- Raydiall SAS.

- REMA Lipprandt GmbH & Co. KG

- Renhotec EV

- Robert Bosch GmbH

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- Samtec, Inc.

- Schneider Electric SE

- Shenglan Technology Co., Ltd.

- Siemens AG

- Sumitomo Electric Group

- TE Connectivity Ltd.

- Tesla, Inc.

- Yazaki Corporation

Strategic investments in modular architecture, localized production, and digital feature integration will fortify market leadership and supply chain resilience

Industry leaders should prioritize the development of modular connector platforms that support field upgrades to accommodate future power increases and evolving standards, thereby protecting end-user investment and shortening upgrade cycles. Strengthening domestic supply chains through localized production of critical components-especially copper conductors, housing materials, and transformer cores-will mitigate tariff-induced cost volatility and reduce lead times. Forming cross-sector partnerships, such as OEM-network operator alliances or utility collaborations, can accelerate infrastructure densification and streamline integration with grid management programs. Engaging proactively in standardization consortia will ensure interoperability and shape emerging protocols in favor of proprietary innovations. Investing in embedded digital features-such as remote diagnostics, load forecasting algorithms, and over-the-air firmware management-will enhance operational efficiency and open recurring software revenue streams. Finally, aligning product roadmaps with government incentive timelines and infrastructure mandates across key regions will optimize deployment strategies and secure early-mover advantages.

Robust synthesis of IEA deployment data, regulatory filings, and corporate disclosures underpins this comprehensive market analysis

This analysis synthesizes insights derived from a comprehensive review of publicly available industry data, primary corporate press releases, and authoritative regulatory frameworks. Secondary data sources include the IEA’s Global EV Outlook 2025, which provided regional charging deployment statistics, and governmental tariff documentation under Section 232 measures. Company-specific information was drawn from Business Wire filings and reputable financial news outlets, ensuring coverage of recent strategic partnerships, product launches, and corporate restructuring decisions. Qualitative insights were further enriched by monitoring consortium announcements on interoperability standards. The report’s segmentation and regional analysis are grounded in well-established market taxonomy, while company profiles reflect the latest publicly disclosed milestones. This triangulation of primary and secondary sources ensures a robust, fact-checked foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EV Connector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EV Connector Market, by Vehicle Type

- EV Connector Market, by Charging Type

- EV Connector Market, by Network Type

- EV Connector Market, by Power Output

- EV Connector Market, by End User

- EV Connector Market, by Distribution Channel

- EV Connector Market, by Region

- EV Connector Market, by Group

- EV Connector Market, by Country

- United States EV Connector Market

- China EV Connector Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Convergence of policy pressures, modular innovation, and network expansion is defining the next wave of competitiveness in EV connectors

The electric vehicle connector market stands at a pivotal juncture, shaped by a confluence of accelerating EV adoption, shifting trade policies, and rapid technological evolution. As power demands escalate and interoperability becomes paramount, modular and digitally enabled connectors will serve as critical enablers of reliable charging infrastructure. Tariffs on essential materials underscore the importance of supply chain agility and domestic capacity building, while regional policy mandates continue to drive differentiated deployment strategies across the Americas, EMEA, and Asia-Pacific. Competitive leaders are carving out new growth trajectories by forging strategic alliances, carving dedicated business units, and delivering platform-based hardware solutions that anticipate future requirements. By embracing a forward-looking, integrated approach-encompassing modular architectures, localized manufacturing, and advanced software services-industry stakeholders can secure sustainable competitive advantages and accelerate the global transition to electrified mobility.

Engage today with our Associate Director of Sales & Marketing to secure this critical electric vehicle connector market intelligence for your organization

Ready to elevate your strategic positioning and gain a competitive edge in the rapidly evolving electric vehicle connector market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored licensing options, enterprise subscription packages, or customized research briefs that align with your business objectives. Secure your copy of the comprehensive market research report today and empower your organization with actionable insights and data-driven intelligence.

- How big is the EV Connector Market?

- What is the EV Connector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?