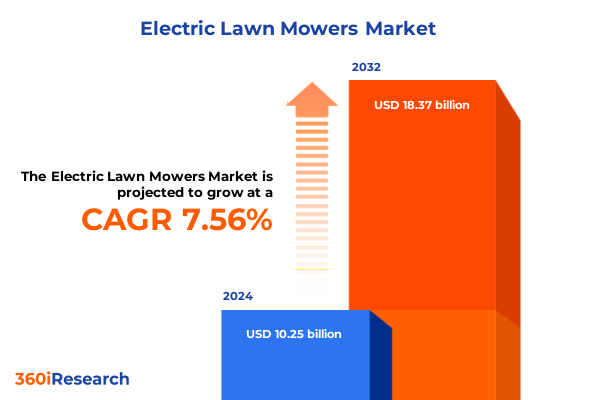

The Electric Lawn Mowers Market size was estimated at USD 10.99 billion in 2025 and expected to reach USD 11.79 billion in 2026, at a CAGR of 7.61% to reach USD 18.37 billion by 2032.

Setting the Stage for a Greener Future as Innovative Electric Lawn Mowers Revolutionize Residential and Commercial Landscaping Practices Worldwide

The widespread shift toward electric lawn mowers represents a pivotal moment in landscaping technology, driven by mounting environmental awareness, regulatory pressure, and advancements in battery chemistry. Consumers and commercial operators alike are increasingly drawn to devices that reduce greenhouse gas emissions, diminish noise pollution, and deliver performance on par with traditional gas-powered models. In this context, leading equipment manufacturers are racing to introduce battery-powered solutions that combine durability, runtime, and user-friendly operation. The result is a dynamic landscape characterized by rapid iteration cycles and collaboration between battery innovators, motor designers, and digital service providers.

Moreover, the convergence of smart home ecosystems and remote monitoring capabilities has elevated customer expectations. Today’s buyers seek intuitive interfaces that integrate with mobile applications to schedule operations, monitor battery health, and receive maintenance alerts. Consequently, the electric lawn mower sector is evolving from a purely mechanical business into a sophisticated fusion of hardware, software, and data analytics. Looking ahead, this technological renaissance promises to reshape consumer habits, drive new distribution models, and foster closer alignment between service providers, municipalities, and end users.

Navigating Unprecedented Environmental, Technological, Regulatory, and Consumer-Driven Transformations Shaping the Electric Lawn Mower Landscape Globally

The electric lawn mower industry is currently experiencing transformative shifts along multiple dimensions. First, stringent emissions regulations imposed in urban centers are forcing power equipment manufacturers to accelerate product development cycles. These rules not only ban gas-powered engines in many municipalities but also establish performance criteria that electric alternatives must meet. In response, research and development teams have optimized motor efficiency and adopted advanced battery chemistries to ensure consistent power output, even under heavy load conditions.

Simultaneously, breakthroughs in lithium-ion technology are extending runtime while reducing charging intervals. Manufacturers are leveraging cell-level innovations alongside intelligent battery management systems to safeguard longevity and thermal stability. Furthermore, the proliferation of smart connectivity and Internet of Things frameworks allows real-time diagnostics, firmware updates, and predictive maintenance. As a result, service intervals can be scheduled proactively, minimizing downtime and operational costs.

Consumer preferences are also steering the sector toward more modular, ergonomic, and user-centric designs. Lightweight materials combined with adjustable handles and noise-reduction features appeal to homeowners, while professional landscaping firms demand robust, zero-emission fleet solutions that integrate with broader property management platforms. In this way, environmental imperatives, technological advancements, and evolving user demands are collectively reshaping the competitive landscape.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Supply Chains Pricing and Production Strategies in the Electric Lawn Mower Sector

In early 2025, the United States implemented a suite of tariffs targeting imported electric lawn mower components and finished units, marking a significant inflection point for industry participants. These duties, levied primarily on battery packs, motors, and electronic control modules sourced from key manufacturing hubs, have introduced upward pressure on production costs. Domestic manufacturers, while benefiting from a relative cost advantage, have encountered new challenges securing sufficient volumes of high-performance battery cells, given global competition and limited output capacities.

Consequently, pricing strategies have been reevaluated across the value chain. Retailers have adjusted suggested retail prices to account for increased import duties, while end users are exhibiting greater price sensitivity. To compensate, several market leaders have restructured supply agreements, forging partnerships with domestic and allied overseas suppliers to insulate themselves from tariff volatility. Moreover, companies are exploring onshore assembly and component manufacturing incentives offered by federal and state governments, thereby mitigating customs-related cost escalations.

Looking ahead, the cumulative effect of these 2025 tariffs underscores the importance of diversified sourcing strategies and adaptive manufacturing footprints. Firms that proactively reengineer their supply networks, invest in local capacity, and leverage trade compliance expertise will be best positioned to maintain competitive pricing without compromising product quality or technological innovation.

Unlocking Critical Market Segmentation Insights Spanning Product Variants End-Users Distribution Channels Battery Technologies and Lawn Size Preferences

A nuanced understanding of market segments is essential for aligning product portfolios with end-user requirements. When examining product types, the industry is bifurcated between corded electric models and battery-powered units. Within the battery-powered domain, voltage categories delineate system capabilities: below 18V offerings suit small-scale residential use, whereas the 18V to 36V range accommodates general-purpose applications, with further subdivisions into cells rated under 2Ah for light-duty trimming, 2Ah to 4Ah configurations for mid-level endurance, and above 4Ah packs for extended runtime. Units exceeding 36V target professional landscapers demanding high-thrust cutting power and rapid execution.

End-user segmentation reveals a clear dichotomy between residential consumers seeking ease of use, noise reduction, and cost-effective maintenance, and commercial operators who prioritize runtime consistency, durability, and integration with fleet management solutions. Distribution channels split into offline and online pathways, with mass merchants and specialty stores serving as primary brick-and-mortar outlets. The digital realm includes direct-to-consumer brand websites offering customized bundles and rapid customer support, alongside e-commerce marketplaces that facilitate price comparisons and expedited delivery.

Battery chemistries further refine segmentation, ranging from traditional lead-acid designs to nickel metal hydride cells, though lithium-ion dominates due to superior energy density. Within the latter, lithium iron phosphate variants deliver enhanced thermal stability and safety for residential products, while nickel manganese cobalt configurations provide optimal power-to-weight ratios for professional series. Finally, lawn size preferences-small lawns under a quarter acre, medium plots up to half an acre, and large expanses exceeding this threshold-drive feature sets, runtime expectations, and accessory compatibility across the entire product lineup.

This comprehensive research report categorizes the Electric Lawn Mowers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Motor Type

- Blade Type

- End User

- Distribution Channel

Unveiling Regional Dynamics and Growth Patterns across the Americas Europe Middle East Africa and Asia-Pacific Electric Lawn Mower Markets with Focus on Emerging and Established Territories for Comprehensive Perspective

Regional dynamics in the electric lawn mower market exhibit marked contrasts shaped by regulatory frameworks, consumer behavior, and infrastructure readiness. In the Americas, particularly within the United States and Canada, federal and state-level incentives encourage the adoption of zero-emission equipment, spurring aggressive marketing campaigns by manufacturers. Urban municipalities have rolled out rebate programs and expedited permitting for electric landscaping fleets, while rural consumers embrace battery-powered mowers for quiet operation and ease of maintenance in residential settings.

Europe, the Middle East, and Africa present a multifaceted picture. Western European nations uphold stringent emissions targets, driving widespread electrification in professional landscaping services. The Middle East, with its burgeoning luxury property developments, increasingly integrates electric mowers for upscale estates, emphasizing premium performance and aesthetic design. Meanwhile, African markets remain nascent but possess high growth potential, as infrastructure improvements and rising disposable incomes pave the way for entry-level battery-powered models.

Across the Asia-Pacific region, distinct submarkets deliver unique trajectories. Japan, with limited green space but advanced IoT infrastructure, prioritizes compact, smart-enabled mowers that integrate with home automation systems. China’s massive manufacturing capacity positions it as both a production powerhouse and a growing domestic consumer base, where energy efficiency standards are tightening. In India and Southeast Asia, expanding urbanization and a young, tech-savvy population fuel demand for cost-effective electric solutions, prompting manufacturers to tailor entry-level offerings for budget-conscious buyers.

This comprehensive research report examines key regions that drive the evolution of the Electric Lawn Mowers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies Innovation Alliances and Market Positioning of Leading Electric Lawn Mower Manufacturers and Service Providers

Key market participants are executing diverse strategies to capture value in this evolving sector. Established manufacturers have increased investment in battery research, securing proprietary cell formulations and forging alliances with energy storage specialists. Concurrently, disruptive entrants and start-ups are leveraging subscription-based models and digital platforms to offer equipment-as-a-service, bundling maintenance, spare parts, and performance upgrades under one recurring fee. These new business models enhance customer retention by lowering upfront acquisition costs and providing predictable expense profiles.

In addition, strategic partnerships between original equipment manufacturers and major retail chains have streamlined distribution, enabling rapid scaling of flagship electric mower lines. Collaborative ventures with landscaping service providers have yielded customized fleet solutions that integrate GPS tracking, telematics, and maintenance scheduling, enhancing operational transparency and asset utilization. Cross-sector alliances with renewable energy firms are also emerging, whereby solar-powered charging stations complement mower deployment in remote or off-grid locations.

Furthermore, mergers and acquisitions activity underscores consolidation trends. Larger corporations are absorbing innovative technology-focused startups to internalize advanced battery management systems, altitude-tolerant motors, and ergonomic design platforms. This consolidation not only accelerates time-to-market for new features but also broadens product portfolios to address both residential and professional segments under unified brand architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Lawn Mowers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfred Kärcher SE & Co. KG

- AriensCo GmbH

- BAD BOY JOE LLC

- Caterpillar Inc.

- Chervon Holdings Limited

- Deere & Company

- Doosan Bobcat by Doosan Corporation

- Greenworks North America, LLC

- Honda Motor Co., Ltd.

- Husqvarna Group

- iRobot Corp.

- Jacobsen by Textron Inc.

- Kingdom Technologies Ltd

- Kubota Corporation

- MAKITA CORPORATION

- Mamibot Manufacturing USA Inc.

- NINGBO DAYE GARDEN MACHINERY CO., LTD.

- Positec Tool Corporation

- Robert Bosch Power Tools GmbH by Robert Bosch GmbH

- RYOBI Limited by Techtronic Industries Co. Ltd.

- SCAG Power Equipment by Metalcraft of Mayville, Inc.

- Stanley Black & Decker, Inc.

- STIGA S.p.A.

- STIHL HOLDING AG & CO. KG

- Swisher Inc.

- Toro Company

Formulating Practical and Strategic Recommendations for Industry Leaders to Enhance Product Development Distribution Sustainability and Customer Engagement

Industry leaders should prioritize modular battery ecosystems that allow end users to scale capacity based on lawn size and usage intensity. By adopting standardized interfaces across product lines, manufacturers can streamline component sourcing and facilitate seamless upgrades as new chemistries emerge. In parallel, expanding direct-to-consumer channels enhances margin control and fosters stronger brand loyalty through personalized digital experiences and subscription services for maintenance and parts replacement.

Furthermore, establishing diversified supply chain partnerships mitigates exposure to single-source risks, particularly in light of recent tariff implementations. Proactive engagement with domestic cell producers, coupled with strategic stockpiling agreements, ensures production continuity and guards against geopolitical disruptions. In addition, investing in circular economy initiatives-such as in-house battery recycling and remanufacturing programs-reinforces sustainability credentials while unlocking cost savings on raw materials.

Finally, embedding data analytics and predictive maintenance within product offerings elevates the value proposition, enabling predictive alerts for end-of-life components and usage-based warranty plans. By collaborating with IoT platform providers and leveraging machine learning algorithms, companies can deliver differentiated service bundles and drive long-term customer engagement. These combined strategic moves will position industry leaders to capitalize on accelerating demand, regulatory incentives, and evolving user expectations.

Detailing a Robust Mixed-Method Research Methodology Combining Primary Secondary and Quantitative Analytical Techniques with Expert Validation

This research follows a robust mixed-method approach, combining primary interviews with senior executives, product managers, and distribution partners across key regions. In-depth discussions illuminated strategic imperatives, supply chain intricacies, and evolving customer preferences. Complementing this, structured surveys targeted residential and commercial end users to quantify adoption drivers, feature prioritization, and pricing sensitivities.

Secondary research drew upon publicly available financial reports, patent filings, industry association publications, and regulatory documents to contextualize market trends and benchmark technological advancements. Quantitative analytical techniques, including cross-sectional analysis and trend extrapolations, facilitated identification of segment-specific growth vectors without relying on proprietary forecasting models. Moreover, expert validation workshops convened battery scientists, environmental policy specialists, and landscape management professionals to vet assumptions and refine insights.

Throughout the study, data triangulation ensured accuracy and reliability. Findings were continually cross-verified against multiple sources, and conflicting viewpoints were analyzed to present a balanced perspective. This rigorous methodology underpins the confidence and actionable nature of the recommendations provided to stakeholders operating across product development, distribution, and after-sales service domains.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Lawn Mowers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Lawn Mowers Market, by Product Type

- Electric Lawn Mowers Market, by Power Source

- Electric Lawn Mowers Market, by Motor Type

- Electric Lawn Mowers Market, by Blade Type

- Electric Lawn Mowers Market, by End User

- Electric Lawn Mowers Market, by Distribution Channel

- Electric Lawn Mowers Market, by Region

- Electric Lawn Mowers Market, by Group

- Electric Lawn Mowers Market, by Country

- United States Electric Lawn Mowers Market

- China Electric Lawn Mowers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings to Draw Actionable Conclusions on Technology Adoption Market Evolution and Strategic Pathways in the Electric Lawn Mower Industry

The electric lawn mower industry stands at the crossroads of technological innovation and environmental stewardship. Key findings reveal that battery advancements, regulatory mandates, and digital integration are collectively reshaping competitive dynamics. As a result, companies that invest in differentiated battery platforms and smart connectivity will capture premium market segments, while those embracing new distribution models can drive broader adoption among price-sensitive consumers.

Additionally, the 2025 tariff environment underscores the imperative for resilient supply chains and flexible manufacturing footprints. Organizations that proactively localize critical components and engage in strategic partnerships will mitigate cost pressures and strengthen global competitiveness. Regional insights highlight varied growth trajectories, from mature rebate-driven markets in North America to burgeoning demand in Asia-Pacific and preliminary uptake in Africa. By tailoring offerings to these distinct environments, firms can optimize revenue streams and accelerate time-to-market for targeted segments.

Ultimately, the convergence of sustainability mandates and consumer expectations demands a holistic strategy that blends product innovation, circular economy principles, and data-driven service delivery. This integrated approach will not only propel market share gains but also reinforce corporate social responsibility commitments, ensuring long-term viability in the evolving landscape of electric lawn care solutions.

Seize the Opportunity to Partner with Ketan Rohom for Expert Sales and Marketing Support and Secure Your Electric Lawn Mower Market Research Report Today

To explore the full depth of the electric lawn mower market and empower your organization with actionable insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing. With extensive expertise in aligning research findings with strategic objectives, Ketan can guide you through the nuances of the report and tailor a solution that meets your unique requirements. Engage directly to discuss volume licensing, bespoke consulting add-ons, and priority access to future updates. Secure your exclusive copy of the electric lawn mower market research report today and position your team at the forefront of innovation, sustainability, and market leadership. Don’t miss this opportunity to leverage cutting-edge analysis for competitive advantage – contact Ketan Rohom now and take the next step toward transforming your lawn care business.

- How big is the Electric Lawn Mowers Market?

- What is the Electric Lawn Mowers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?