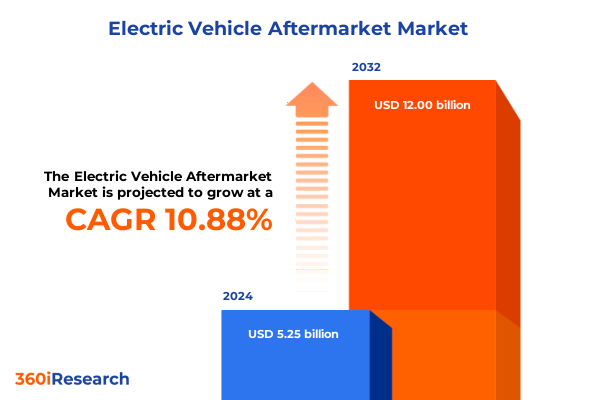

The Electric Vehicle Aftermarket Market size was estimated at USD 5.82 billion in 2025 and expected to reach USD 6.45 billion in 2026, at a CAGR of 10.89% to reach USD 12.00 billion by 2032.

Electric vehicle aftermarket is transforming how maintenance, repairs, and upgrades are delivered for the burgeoning global EV fleet with infrastructure and service innovation

The global electric vehicle fleet has grown at an unprecedented pace, with worldwide electric car sales exceeding 17 million in 2024 and the cumulative stock reaching nearly 58 million vehicles by year-end, accounting for roughly 4% of the total passenger car fleet.¹ This surge in electrification is underpinned by aggressive policy measures, consumer incentives, and advancements in battery technology, all converging to accelerate adoption across major markets.² In the United States, electric car sales climbed by approximately 10% in the first quarter of 2025, driven in part by existing tax credits and an expanding range of models, thus reinforcing the momentum behind fleet electrification.³

As the pool of electric vehicles on the road expands, the aftermarket ecosystem must adapt to address unique maintenance and repair requirements. Unlike internal combustion engine vehicles, EVs rely heavily on battery management systems, high-voltage components, and sophisticated thermal control units, necessitating specialized expertise among service providers.⁴ Additionally, the growth of EV ownership has spurred demand for charging infrastructure servicing, second-life battery repurposing, and end-to-end diagnostics, all of which contribute to the evolving complexity of the aftermarket landscape.

The increasing integration of digital connectivity and over-the-air software updates further reshapes the aftermarket by creating opportunities for remote diagnostics, predictive maintenance, and continuous performance enhancements. Providers that can harness real-time vehicle data to anticipate component failures and optimize service schedules are best positioned to offer seamless, efficient experiences to EV owners, driving both customer satisfaction and operational efficiency.⁵

Innovations in predictive maintenance, software updates, and supply chain localization are reshaping the electric vehicle aftermarket ecosystem

Predictive maintenance has emerged as a cornerstone of the modern electric vehicle aftermarket, leveraging advanced sensor networks and cloud-based analytics to monitor battery health, temperature variations, and power electronics performance. By proactively identifying potential issues before they escalate into failures, service providers can reduce vehicle downtime, extend component lifespans, and optimize resource allocation.⁶ This shift from reactive to predictive servicing represents a fundamental transformation, underpinned by breakthroughs in machine learning algorithms and connected vehicle platforms that enable continuous monitoring and smart decision-making.

Simultaneously, the rise of software-defined vehicles has introduced a new dimension to aftermarket service offerings. Over-the-air updates for electronic control units and infotainment systems now allow automakers to deploy feature enhancements, security patches, and performance optimizations without requiring physical workshop visits.⁷ This trend accelerates the pace of innovation while reshaping customer expectations around vehicle maintenance, compelling service networks to develop expertise in software diagnostics and electronics calibration alongside traditional mechanical repair skills.

Moreover, geopolitical developments and trade policy shifts-such as the introduction of higher tariffs on imported vehicles and parts-have catalyzed supply chain localization efforts. Manufacturers and component suppliers are increasingly investing in regional assembly facilities and onshore production of critical modules, including battery cells and power electronics, to mitigate tariff exposure and logistical bottlenecks.⁸ This evolution towards localized sourcing not only enhances supply chain resilience but also creates new opportunities for domestic aftermarket suppliers to partner with OEMs in developing region-specific solutions.

The cumulative impact of 2025 U.S. tariffs has introduced significant cost pressures and strategic challenges across the electric vehicle aftermarket supply chain

In early 2025, the United States implemented a 25% tariff on imported automobiles and auto parts, significantly altering cost structures across the electric vehicle aftermarket supply chain.¹⁰ This tariff regime has imposed material additional expenses for service providers and parts distributors, as components previously sourced from low-cost manufacturing hubs now incur substantial duty charges. Automakers and aftermarket specialists alike are confronting these new cost pressures while striving to maintain price competitiveness and service quality.

For benchmark cases, Tesla estimates that the applied tariff could translate into approximately $4,000 in added costs per vehicle, representing a near 9% price increase for consumers, while other brands such as Volkswagen anticipate tariff-related cost hikes of up to $5,500 per unit.¹⁰ Beyond vehicle imports, tariffs on steel and aluminum have contributed an incremental $400 to $500 in production costs per vehicle on average, exerting further upward pressure on replacement parts and structural components.¹¹

The impact extends to the smallest aftermarket operators and independent workshops as well. Industry associations have warned that tariff expenses are predominantly absorbed by domestic businesses, which must pay duty charges upfront and may lack sufficient capital buffers.¹² These financial strains risk delaying essential vehicle repairs, reducing inventory availability, and, in extreme cases, curtailing operational capacity. As a result, the aftermarket landscape now demands innovative cost-management strategies and collaborative partnerships to distribute tariff burdens and sustain service accessibility.

A comprehensive view of electric vehicle aftermarket segmentations reveals diverse component, service, channel, propulsion, and vehicle type dynamics

The electric vehicle aftermarket encompasses a wide array of component types, each with its own maintenance requirements and replacement cycles. Core systems include the battery system-comprising cells, cooling subsystems, and integrated battery packs-as well as charging infrastructure that spans mobile, public, and wall-mounted units. Drivetrain components such as electric motors, power electronics, and transmissions further require specialized repair capabilities, while electrical subsystems including infotainment modules, sensors, and wiring harnesses demand expert diagnostics. Thermal management solutions, from coolant pumps to HVAC units and radiators, play a critical role in preserving battery performance, and specialized tires and wheels tailored for all-season, alloy, or winter conditions ensure safety and efficiency under diverse driving environments.

Service offerings in the aftermarket range from routine maintenance services-covering battery, motor, and tire inspections-to repair services for critical components like battery modules, charging units, and electric drive systems. Retrofitting services have also gained traction, enabling conversions of traditional vehicles to electrified platforms and performance upgrades for existing EVs. Software upgrades, including ECU enhancements, infotainment improvements, and over-the-air firmware updates, have become an integral part of the customer experience, allowing vehicles to evolve post-delivery.

The channels through which these services and parts reach end users are equally diverse. Traditional authorized dealerships and independent workshops offer direct, in-person support, while OEM websites and third-party e-commerce platforms provide digital access to parts ordering and remote service scheduling. On the propulsion front, aftermarket solutions extend across battery electric vehicles, fuel cell electric vehicles, and plug-in hybrids, each presenting unique technical considerations. Finally, the electric vehicle universe spans multiple vehicle types-from commercial trucks and off-highway equipment to passenger cars and two-wheelers-underscoring the breadth of expertise required to serve this rapidly maturing market.

This comprehensive research report categorizes the Electric Vehicle Aftermarket market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Service Type

- Propulsion Type

- Vehicle Type

- Sales Channel

Regional dynamics in the electric vehicle aftermarket highlight unique drivers and challenges across Americas, Europe Middle East Africa, and Asia-Pacific markets

In the Americas, robust policy incentives and substantial infrastructure investments have accelerated the adoption of electric vehicles, which in turn has driven demand for specialized aftermarket services. The United States, bolstered by federal tax credits and state-level rebate programs, logged electric car sales growth of approximately 10% in the first quarter of 2025, underscoring a resilient consumer appetite despite broader economic headwinds.³ Additionally, strategic partnerships-such as the recent agreement between a leading battery supplier and a major automaker to deliver 100 GWh of domestically produced cells between 2028 and 2033-signal a deepening domestic supply chain that will reinforce aftermarket part availability and technical expertise.¹⁴

Across Europe, the Middle East, and Africa, regulatory frameworks remain the principal catalysts for electrification and aftermarket expansion. The European Union’s adjusted CO₂ emissions targets for 2025 allow OEMs flexibility over a three-year compliance window, yet they continue to mandate rising shares of zero-emission vehicles, thereby sustaining aftermarket growth in software services, charging infrastructure maintenance, and component retrofits.¹⁵ In the Middle East and Africa, nascent incentive programs and pilot initiatives for fleet electrification are beginning to stimulate investment in regional service networks, setting the stage for more comprehensive aftermarket ecosystems.

In Asia-Pacific, China’s leadership in electric mobility is unquestioned, with over 11 million electric car sales recorded in 2024 and expectations of capturing 60% of new car sales in 2025.¹ The maturation of domestic EV manufacturers, supported by favorable trade-in schemes and localized battery production, has created fertile ground for aftermarket providers specializing in battery maintenance, power electronics repair, and thermal system servicing. Japan and South Korea continue to advance fuel cell technologies, while India’s emerging EV market is spurring the growth of both organized workshops and informal service channels, reflecting diverse market maturity levels across the region.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Aftermarket market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key industry players are leveraging strategic partnerships, service network expansion, and technological innovation to gain a competitive edge in the electric vehicle aftermarket

Leading tier-one suppliers are expanding their portfolios to address the specific needs of electric powertrains and digital vehicle architectures. One such example is the introduction of modular eAxle systems, which integrate electric motors and inverters into a single compact unit, offering high power density and simplified installation across multiple vehicle classes.⁹ Beyond hardware, these suppliers are also unveiling fleet health monitoring solutions that leverage in-vehicle data to generate service recommendations, schedule appointments, and minimize downtime without additional hardware retrofits.⁹

Automotive workshop networks are scaling their operations through franchising and development rights agreements to ensure geographic coverage and service consistency. In early 2025, a major global provider announced the opening of new franchise locations throughout the American Southeast and secured exclusive development rights for multiple states, signaling confidence in the long-term growth of EV service demand.¹⁰ Concurrently, independent multi-brand service chains are investing in technician training programs focused on high-voltage safety, battery diagnostics, and software calibration to meet escalating aftermarket standards.

Traditional auto retailers are also adapting to new market realities. For instance, a leading U.S. dealership group reported that higher vehicle prices-partly driven by tariff-induced cost increases-have bolstered its aftersales and financial services revenue streams, enabling reinvestment into specialized EV service bays and technician certifications.¹² Similarly, volume OEMs have committed billions to retool domestic manufacturing facilities, not only to localize production but also to build integrated service centers that can handle next-generation electrified models and software-driven updates.¹³

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Aftermarket market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABB Ltd.

- AeroVironment, Inc.

- Akebono Brake Industry Co., Ltd.

- Aptiv PLC

- Bridgestone Corporation

- ChargePoint, Inc.

- ClipperCreek, Inc. by Enphase Energy, Inc.

- Delphi Technologies by BorgWarner Inc.

- DENSO Corporation

- EVBox B.V. by Engie SA

- GMB CORPORATION

- GUD Holdings Limited

- Hella KGaA Hueck & Co.

- Marelli Holdings Co., Ltd.

- MICHELIN

- NTN Corporation

- Robert Bosch GmbH

- Schaeffler Technologies AG & Co. KG

- Schneider Electric SE

- Siemens AG

- T Sportline, Inc.

- Tenneco Inc.

- The Yokohama Rubber Co., Ltd.

- Webasto SE

- ZF Friedrichshafen AG

Actionable strategies for industry leaders encompass digital transformation, supply chain resilience, technical training, and collaborative partnerships to capture aftermarket growth

To capitalize on the evolving aftermarket landscape, industry leaders should prioritize digital transformation initiatives that integrate telematics, predictive analytics, and customer engagement platforms. By harnessing real-time data, service providers can shift from reactive repairs to proactive maintenance, enhancing reliability and customer loyalty. Investment in over-the-air service capabilities for software updates and remote diagnostics will further differentiate offerings and streamline operations.¹⁶

Building supply chain resilience is equally critical. Companies must explore nearshoring and dual-sourcing strategies to mitigate the impact of trade policy volatility and component shortages. Collaborative partnerships with battery cell manufacturers, power electronics suppliers, and localized assembly networks will help distribute cost risks and ensure continuous parts availability. Securing long-term agreements and co-investing in regional manufacturing hubs can provide stability in a tariff-sensitive environment.¹¹

Finally, upskilling the workforce should be at the forefront of aftermarket strategies. Structured training programs that emphasize high-voltage safety, thermal management, and software diagnostics will be vital as the technical complexity of electric vehicles intensifies. Establishing certification frameworks in collaboration with technical institutes and OEMs can ensure consistent service quality across franchises and independent workshops, while also elevating the overall standard of EV aftersales support.¹²

A robust research methodology combining primary interviews, secondary data analysis, and expert validation ensures comprehensive insights into the electric vehicle aftermarket

This report employs a rigorous, multi-stage research methodology to deliver actionable insights and reliable analysis. The process began with extensive secondary research, drawing on industry white papers, policy documents, automaker disclosures, and financial filings to map the current state of the electric vehicle aftermarket. This foundational phase was supplemented by data triangulation to validate key trends and reconcile disparate information sources.

Primary research constituted the next pillar of our approach, involving in-depth interviews with senior executives from OEMs, tier-one suppliers, aftermarket specialists, and trade associations. These conversations provided firsthand perspectives on operational challenges, emerging technologies, and strategic priorities. Quantitative surveys of service providers and parts distributors offered additional context on adoption rates for predictive maintenance, digital service platforms, and tariff mitigation strategies.

Finally, an expert panel comprising industry veterans and independent analysts reviewed preliminary findings, ensuring robustness and relevance. Their feedback guided final adjustments to the segmentation framework, regional assessments, and strategic recommendations, delivering a comprehensive analysis tailored to the needs of decision-makers in the electric vehicle aftermarket.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Aftermarket market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Aftermarket Market, by Component Type

- Electric Vehicle Aftermarket Market, by Service Type

- Electric Vehicle Aftermarket Market, by Propulsion Type

- Electric Vehicle Aftermarket Market, by Vehicle Type

- Electric Vehicle Aftermarket Market, by Sales Channel

- Electric Vehicle Aftermarket Market, by Region

- Electric Vehicle Aftermarket Market, by Group

- Electric Vehicle Aftermarket Market, by Country

- United States Electric Vehicle Aftermarket Market

- China Electric Vehicle Aftermarket Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

In summary, the electric vehicle aftermarket stands at a critical juncture driven by evolving technologies, regulatory shifts, and emerging service models

The electric vehicle aftermarket is undergoing a profound transformation driven by rapid electrification, digitalization, and shifting trade dynamics. As global EV fleets continue to expand, the need for specialized maintenance, parts replacement, and software-driven services will become even more pronounced. Market participants that embrace predictive maintenance, develop over-the-air service capabilities, and localize supply chains will gain a strategic advantage in this evolving landscape.

At the same time, policymakers and industry stakeholders alike must collaborate to address tariff-induced cost pressures and support the resilience of small and medium-sized service providers. By fostering partnerships, investing in workforce development, and leveraging technological innovation, the aftermarket ecosystem can deliver seamless, cost-effective solutions for electric vehicle owners while capturing the significant growth potential that electrification presents.

Ultimately, the companies that adapt swiftly, invest in digital and human capital, and cultivate agile supply networks will emerge as leaders in the next era of mobility, shaping a sustainable and customer-centric electric vehicle aftermarket.

Engage directly with Associate Director Ketan Rohom to explore tailored market insights and secure access to the full electric vehicle aftermarket research report

If you’re seeking in-depth analysis, tailored insights, and strategic intelligence to navigate the rapidly evolving electric vehicle aftermarket, connect with Associate Director Ketan Rohom today to secure your copy of the full market research report and unlock opportunities for growth and innovation.

- How big is the Electric Vehicle Aftermarket Market?

- What is the Electric Vehicle Aftermarket Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?