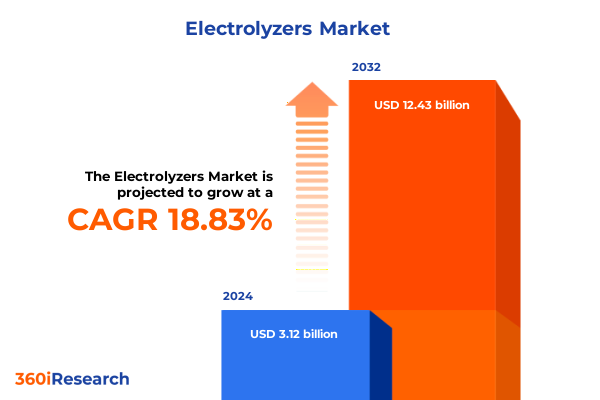

The Electrolyzers Market size was estimated at USD 3.67 billion in 2025 and expected to reach USD 4.32 billion in 2026, at a CAGR of 19.02% to reach USD 12.43 billion by 2032.

Unveiling the Essential Role of Electrolyzers in Driving the Global Shift Toward Sustainable Green Hydrogen Solutions at Scale and Fueling Industrial Transformation

Electrolyzers occupy a central position in the emerging green hydrogen economy, acting as the bridge between renewable electricity generation and decarbonized end-use sectors. As global stakeholders intensify efforts to achieve net-zero targets, the ability to efficiently split water into hydrogen and oxygen using clean power has become indispensable. In particular, electrolyzer systems that leverage solar and wind resources enable industrial facilities, power producers, and transportation networks to integrate low-carbon hydrogen into their operations without relying on fossil feedstocks.

Moreover, the scalability of electrolyzer installations-from modular stacks of a few hundred kilowatts to gigawatt-scale deployments-has unlocked new pathways for energy storage, grid balancing, and sector coupling. Decision-makers now evaluate technology choices not only on capital and operating costs but also on system flexibility, response time, and lifecycle environmental footprint. Consequently, electrolyzers are no longer viewed as isolated assets but as integral components of broader energy systems that require nuanced operational strategies.

In addition, supportive policy frameworks, including investment tax credits, production incentives, and clean hydrogen roadmaps, are accelerating project pipeline development across major economies. Public-private partnerships and consortiums are advancing demonstration projects, refining manufacturing processes, and optimizing supply chains for critical components. As a result, the electrolyzer landscape is evolving rapidly, laying the groundwork for the next phase of industrial transformation and large-scale green hydrogen adoption.

Mapping the Evolution of Electrolyzer Technology and Market Dynamics Amidst Innovations in Membrane Chemistry Modular Design and Renewable Energy Integration

The electrolyzer market has undergone significant technological innovation in recent years, with developments in membrane chemistry and cell design reshaping performance benchmarks. Proton exchange membrane configurations now offer rapid start-stop capabilities and high dynamic response, making them ideal for variable renewable energy inputs. Simultaneously, anion exchange membrane systems are emerging as cost-competitive alternatives that leverage lower-cost materials and simplified stack architectures.

Furthermore, advances in solid oxide electrolyzers promise high electrical efficiencies at elevated temperatures by exploiting favorable thermodynamic kinetics, although long-term durability in commercial applications remains under active investigation. Alkaline electrolyzers, meanwhile, continue to benefit from decades of operational history and established supply chains, driving further enhancements in stack lifetimes and system reliability.

Equally important is the shift toward modularization and digitalization. Manufacturers are now offering standardized skid-mounted units that can be deployed rapidly, scaled incrementally, and integrated with advanced process controls. Through digital twins, remote monitoring, and predictive maintenance algorithms, operators gain real-time visibility into performance metrics and can optimize efficiency under fluctuating power availability. Taken together, these transformative shifts are redefining cost trajectories and unlocking new use cases for green hydrogen across industrial, energy storage, and mobility sectors.

Analyzing the Comprehensive Effects of United States Tariffs Introduced in 2025 on Electrolyzer Supply Chains Cost Structures and Strategic Sourcing Decisions

In January 2025, the United States implemented targeted import tariffs aimed at electrolyzer components sourced from certain trading partners, marking a pivotal moment for supply chain strategies and project economics. By applying additional duties on selected membrane assemblies, catalysts, and balance-of-plant equipment, policymakers sought to stimulate domestic manufacturing and mitigate strategic vulnerabilities. As a result, upstream suppliers have accelerated capacity expansion initiatives, while downstream project developers are reevaluating sourcing decisions to minimize cost escalations.

Consequently, global manufacturers serving the US market have pursued joint ventures and licensing agreements to establish local production footholds. This surge in onshore fabrication has fostered closer collaboration between technical teams and regulatory bodies, expediting certification processes and ensuring compliance with stringent quality standards. Simultaneously, end users have adopted longer procurement lead-times and engaged in hedging strategies to buffer against potential tariff revisions.

Moreover, the ripple effects extend to technology roadmaps. Research and development programs are prioritizing material innovation and process simplification to reduce tariff-sensitive content, while legal teams are intensifying efforts to secure duty exemptions under prevailing trade rules. Ultimately, the cumulative impact of these 2025 tariffs is reshaping competitive dynamics, reinforcing the case for vertically integrated supply chains, and accelerating investments in domestic electrolyzer capacity.

Extracting Actionable Insights from Comprehensive Segmentation of Electrolyzer Technologies Power Ratings Input Sources Cell Configurations and Applications

A deep dive into market segmentation reveals critical patterns that inform investment and technology strategies. Based on technology type, alkaline electrolyzers continue to offer reliable performance with mature manufacturing pathways, while proton exchange membrane units provide high purity outputs and rapid dynamic response. Anion exchange membrane platforms, meanwhile, are gaining traction for their potential to lower capital requirements, and solid oxide systems hold promise for industrial applications that can leverage high-temperature process heat.

When assessing power rating, systems up to 500 kW serve distributed energy use cases and pilot installations, mid-range units spanning 500 kW to 2 MW enable commercial and light industrial operations, and configurations above 2 MW cater to large-scale projects and hub concepts. Input source dynamics further influence deployment: coupling electrolyzers to hydropower facilities offers baseload stability, whereas solar and wind integrations demand flexible operation and sophisticated power management.

In addition, cell configuration exerts a profound impact on stack durability and maintenance regimes, with planar cells favored for compact footprints and tubular cells valued for robust heat management. On the application front, green hydrogen supports energy storage systems that balance renewable intermittency, underpins mobility solutions from rail corridors to heavy-duty road transport, and integrates into steel production processes as a direct reduction agent. By aligning technology attributes with specific end-use requirements, stakeholders can craft tailored solutions that optimize performance and cost-effectiveness.

This comprehensive research report categorizes the Electrolyzers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Power Rating

- Input Source

- Cell Configuration

- Application

Revealing Regional Drivers and Adoption Patterns across the Americas Europe Middle East Africa and Asia-Pacific in the Global Electrolyzer Ecosystem

Regional analysis underscores the diversity of drivers and challenges that shape electrolyzer adoption across global markets. In the Americas, strong policy incentives, such as production tax credits and clean hydrogen hubs, are catalyzing pilot projects and first-mover investments, while domestic manufacturers ramp up capacity to meet growing demand. Furthermore, partnerships between utilities and steel producers are exploring co-located electrolyzer installations to support decarbonization in heavy industry.

Across Europe, Middle East, and Africa, government roadmaps and carbon pricing frameworks are fostering cross-border initiatives and hydrogen valleys. European Union directives on renewable energy and state aid guidelines are guiding infrastructure build-out, whereas Middle Eastern investment funds are channeling capital into gigawatt-scale electrolyzer parks powered by solar resources. In Africa, nascent projects aim to link wind potential in coastal regions with green hydrogen export corridors.

Asia-Pacific markets exhibit varying maturity levels: established economies in Japan and South Korea target mid-term commercialization through integrated value chain partnerships, while emerging Southeast Asian nations leverage abundant hydropower to develop low-cost green hydrogen platforms. In parallel, Australia’s investment in renewable hydrogen exports and China’s scaling of manufacturing capacity contribute to evolving regional supply and demand balances. These geographical distinctions inform diverse strategic approaches to project development, financing, and policy engagement.

This comprehensive research report examines key regions that drive the evolution of the Electrolyzers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Trajectories of Leading Electrolyzer Manufacturers and Collaborators Shaping Market Progress and Capacity Scaling

Leading electrolyzer manufacturers and technology providers are deploying multifaceted strategies to capture emerging opportunities and address evolving customer requirements. Key players are forging alliances to bundle advanced membranes with proprietary catalysts, thereby enhancing system efficiencies and accelerating pathway to commercialization. At the same time, select firms are investing in scalable production lines that leverage automation and digital quality control to drive down unit costs and increase throughput.

Meanwhile, incumbent equipment vendors are expanding global footprints through strategic partnerships with project developers and engineering firms, ensuring end-to-end support from design and procurement to commissioning and after-market services. Concurrently, agile startups are carving niches by specializing in next-generation technologies, such as high-temperature solid oxide and anion exchange membrane systems, and collaborating with research institutions to validate disruptive designs under real-world conditions.

In addition, several companies are embracing integrated business models that link electrolyzer sales with hydrogen logistics, storage, and fueling infrastructure offerings. By providing bundled solutions, these organizations aim to simplify procurement, streamline operations, and deliver predictable performance outcomes. Taken together, these strategic moves, innovation trajectories, and capacity scaling initiatives are shaping competitive dynamics and establishing the foundation for long-term market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrolyzers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advent Technologies Holdings Inc.

- Air Liquide S.A.

- Asahi Kasei Corporation

- Cummins Inc.

- H2 Core Systems GmbH

- Hydrogen Optimized Inc.

- HydrogenPro ASA

- iGas energy GmbH

- INEOS AG

- ITM Power PLC

- John Cockerill SA

- Linde PLC

- McPhy Energy S.A.

- Nel ASA

- Next Hydrogen Solutions Inc.

- Ohmium International, Inc.

- OxEon Energy, LLC

- PERIC Hydrogen Technologies Co., Ltd

- Siemens Energy AG

- Sono-Tek Corporation

- Sumitomo Corporation

- Sunfire GmbH

- thyssenkrupp AG

- Topsoe A/S

- Toshiba Corporation

Empowering Industry Leaders with Practical Strategies for Navigating Technology Disruption Regulatory Shifts and Supply Chain Resilience for the Green Economy

To thrive amid rapid technological evolution and shifting policy landscapes, industry leaders must adopt a proactive stance and implement targeted strategies. First, diversifying supply chains by qualifying multiple membrane and catalyst vendors will reduce exposure to tariff volatility and strengthen resilience against component shortages. Furthermore, investing in localized manufacturing partnerships can accelerate delivery timelines and secure access to strategic policy incentives.

In parallel, organizations should prioritize research and development in emerging anion exchange membrane and solid oxide electrolysis to capture performance gains and cost reductions ahead of competitors. Establishing pilot lines and field demonstration sites will validate these technologies under operational conditions, providing critical data to inform scale-up decisions and de-risk capital allocation. Moreover, leveraging digital platforms for system monitoring and predictive maintenance will optimize asset uptime and operating expenditure profiles.

Engagement with regulatory bodies and trade associations is equally important, as proactive advocacy can influence the design of incentive programs, tariff exemptions, and certification standards. Finally, pursuing hydrogen integration projects across diverse application sectors-from mobility corridors to industrial clusters-will unlock economies of scope and reinforce the business case for large-scale deployments. By executing these recommendations, industry players can secure a competitive edge and position themselves for sustained growth.

Outlining a Rigorous Methodology of Primary Expert Interviews Secondary Data Analysis and Triangulation to Deliver Accurate Electrolyzer Insights

This analysis draws upon a rigorous methodology designed to ensure comprehensive coverage and data integrity. Primary research included in-depth interviews with executive-level stakeholders from a broad spectrum of electrolyzer manufacturers, project developers, technology integrators, and policy experts. These conversations provided nuanced perspectives on current challenges, emerging opportunities, and technology roadmaps.

Secondary research sources encompassed peer-reviewed journals, government publications, white papers from industry associations, and technical reports from recognized research institutes. Data points were cross-validated through triangulation, incorporating publicly disclosed company filings, patent databases, and conference proceedings to substantiate key trends and technology breakthroughs. Additionally, proprietary frameworks were applied to map evolving value chains and assess the interplay between renewable energy inputs and system performance metrics.

Quality assurance measures included iterative review cycles with subject matter experts, ensuring clarity, consistency, and factual accuracy. Where possible, real-world case studies were integrated to illustrate practical applications and validate theoretical constructs. Throughout the process, emphasis was placed on maintaining objectivity, minimizing bias, and presenting actionable insights that support strategic decision-making in the electrolyzer sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrolyzers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrolyzers Market, by Technology Type

- Electrolyzers Market, by Power Rating

- Electrolyzers Market, by Input Source

- Electrolyzers Market, by Cell Configuration

- Electrolyzers Market, by Application

- Electrolyzers Market, by Region

- Electrolyzers Market, by Group

- Electrolyzers Market, by Country

- United States Electrolyzers Market

- China Electrolyzers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways Showing How Electrolyzer Innovations Tariff Effects and Market Segmentation Converge to Define Future Industry Pathways

The evolution of electrolyzer technologies, coupled with dynamic regulatory environments and shifting trade policies, has ushered in a new era of opportunity and complexity. From advancements in membrane and cell design to the imperative of domestic manufacturing driven by tariff measures, stakeholders must navigate a multifaceted landscape to capitalize on the promise of green hydrogen.

Market segmentation analysis has illuminated the distinct requirements across small-scale demonstration projects, mid-range commercial deployments, and large-scale industrial applications. Regional insights reveal the influence of policy incentives and resource endowments in steering project pipelines and shaping competitive advantages. Meanwhile, leading companies are differentiating through strategic alliances, capacity scaling, and integrated service offerings, setting new benchmarks for performance and reliability.

In summary, the convergence of technology innovation, policy support, and strategic market positioning will define the pace and scope of electrolyzer adoption. Organizations that embrace adaptive supply chain strategies, invest in next-generation platforms, and foster collaborative ecosystems will be best positioned to drive decarbonization and secure long-term value creation in the green hydrogen economy.

Secure Your Comprehensive Electrolyzer Market Research Report Today with Expert Guidance from Associate Director in Sales and Marketing Ketan Rohom

To explore the full breadth of insights contained in this comprehensive electrolyzer market analysis and to secure immediate access to strategic guidance tailored for your organization, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise and dedication will ensure you receive a personalized consultation and seamless report acquisition process

- How big is the Electrolyzers Market?

- What is the Electrolyzers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?