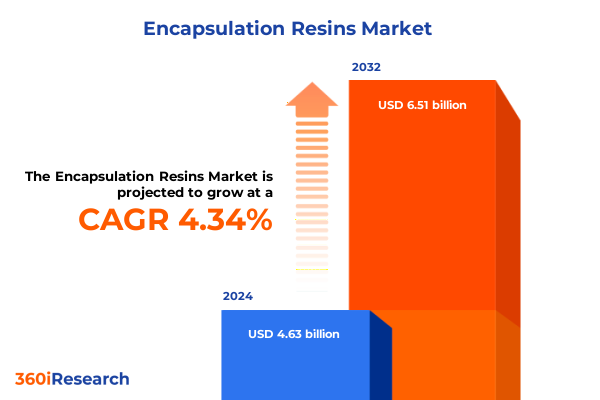

The Encapsulation Resins Market size was estimated at USD 4.83 billion in 2025 and expected to reach USD 5.04 billion in 2026, at a CAGR of 4.35% to reach USD 6.51 billion by 2032.

Unveiling the Strategic Imperatives Driving Advances in Encapsulation Resins for High-Performance Applications Across Diverse Industry Landscapes

Encapsulation resins have emerged as critical materials in safeguarding electronic and industrial components against mechanical shock, moisture ingress, and thermal stresses. As device architectures become increasingly compact and power-dense, the demand for resins that combine superior dielectric properties with robust thermal performance has never been greater. This introduction dissects the strategic role of encapsulation resins in modern manufacturing environments, highlighting the interplay between material innovation and end-user requirements.

In recent years, developments in resin chemistry and processing have unlocked new possibilities for performance optimization. High-purity formulations, advanced curing mechanisms, and tailored additive packages are enabling manufacturers to meet stringent reliability standards while minimizing production cycle times. As industries from automotive electronics to renewable energy ramp up integration of complex assemblies, encapsulation resins are positioned at the forefront of efforts to balance protection, processability, and sustainability.

Exploring the Convergence of Sustainability, Miniaturization, and Technological Breakthroughs Reshaping Encapsulation Resin Formulations Worldwide

The encapsulation resins landscape is undergoing profound transformation driven by three core vectors: environmental stewardship, electronic miniaturization, and breakthrough chemistries that address evolving end-use demands. Sustainable resin formulations-leveraging bio-based polyurethanes and eco-friendly epoxies-are gaining traction as regulatory frameworks tighten on volatile organic compounds and resource stewardship. Concurrently, the push toward ever-smaller electronic packages is amplifying the need for low-viscosity systems capable of penetrating high-aspect-ratio cavities without sacrificing mechanical integrity.

At the same time, material suppliers are advancing resin technologies to deliver thermally conductive and UV-curable options that significantly reduce production footprints. Innovations such as thermally conductive silicone potting sealants demonstrate how integration of high-performance fillers can elevate heat dissipation in power modules, as showcased by new Loctite PE 8086 AB epoxy-based solutions boasting high conductivity and low mixed viscosity for demanding automotive applications. Complementing this trend, next-generation silicone-free thermal gels like Bergquist Liqui Form TLF 6500 CGel-SF address the rigorous heat loads of ADAS domain controllers while aligning with sustainability mandates through low VOC and D4–D10–free formulations.

Meanwhile, regional manufacturers are accelerating development of bio-based resins. Electrolube’s introduction of plant-derived epoxy and polyurethane encapsulants illustrates how localized, renewable feedstocks can be harnessed to meet performance targets and circularity goals. Add to this the unveiling of extrudable silicone rubbers that ceramify under fire conditions-such as WACKER’s ELASTOSIL® R 531/60 designed for high-voltage batteries-and it becomes clear that the market is pivoting toward high-value, application-specific chemistries that enhance safety, reliability, and environmental compliance.

Analyzing How 2025 United States Tariff Measures Are Redefining Supply Chains, Cost Structures, and Innovation Trajectories in Encapsulation Resins

In 2025, the U.S. government instituted a series of tariff measures targeting chemical imports under both Section 301 and reciprocal tariff frameworks, with duties on certain precursors and additives reaching up to 50%. Chemical exporters from Brazil experienced immediate contract cancellations as buyers preemptively adjusted to looming duties, highlighting the disruptive potential of these policies on resin supply chains. Although bulk polymers such as polyethylene, polypropylene, and PET were initially exempted, broader exclusions are under constant review, creating an atmosphere of uncertainty for resin manufacturers and end users alike.

The new tariff landscape has driven resin formulators to reassess sourcing strategies, with many pursuing near-shoring and long-term supply agreements to stabilize input costs. Manufacturers dependent on Asian intermediates are redirecting volumes to domestic or alternate overseas facilities, prompting a recalibration of logistics networks. These supply-chain realignments not only mitigate tariff exposure but also foster resilience through geographical diversification and strengthened supplier partnerships.

Crucially, the tariff-induced cost pressures have galvanized innovation efforts within R&D teams. By prioritizing alternative chemistries and process optimizations that reduce reliance on tariff-impacted feedstocks, industry leaders are accelerating the development of local manufacturing capabilities. This trend underscores the intertwined nature of trade policy and material innovation, reinforcing the strategic imperative to integrate procurement, production, and product development within a holistic, forward-looking framework.

Decoding the Layered Market Segmentation of Resin Types, Applications, End-Use Industries, and Form Factors to Reveal Strategic Growth Pathways

A nuanced understanding of encapsulation resin market segmentation reveals how material choices, application demands, end-use conditions, and form factors intersect to shape strategic opportunity spaces. Resin types range from epoxy systems-subdivided into Bisphenol A and Bisphenol F chemistries-to polyethylenes categorized by high- or low-density grades. Polypropylene offerings encompass both atactic and isotactic variants, while polyurethane portfolios balance thermoplastic and thermosetting formulations. Silicones complete the spectrum with liquid silicone rubber and room-temperature-vulcanizing silicon grades, each tailored to distinct processing requirements and performance benchmarks.

Application segmentation extends these distinctions, as hot-melt encapsulants based on EVA and polyolefin backbones compete with liquid coatings available in solventborne and waterborne variants. Powder coatings leverage either thermoplastic or thermoset resin matrices, whereas solvent-based encapsulants include acrylic and epoxy options, and waterborne systems encompass acrylic or polyurethane dispersions. These application-driven resin platforms address diverse production methodologies-from high-throughput coating lines to precision dispensing operations.

End-use segmentation further refines the market landscape, spanning aftermarket service segments focused on repairs and replacement parts, consumer electronics categories such as smartphones and televisions, industrial electronics deployments including PLCs and transformers, and original equipment manufacturing across body and interior electronics. Finally, form-based considerations-whether film, liquid, powder, or solid pellets-impact storage, handling, and process integration. Together, these layered segmentation lenses enable stakeholders to pinpoint high-value niches, align R&D investments, and anticipate shifts in demand dynamics.

This comprehensive research report categorizes the Encapsulation Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Form

- Application

- End-Use Industry

Illuminating Regional Dynamics Impacting Encapsulation Resin Adoption Across Americas, Europe-Middle East & Africa, and Asia-Pacific Market Ecosystems

Regional dynamics exert a profound influence on resin supply chains, regulatory environments, and end-user adoption. In the Americas, domestic resin production benefits from proximity to major electronic and automotive OEM clusters. Near-shoring initiatives in Mexico and Canada have gained momentum as tariff uncertainties drive manufacturers to shorten logistics routes and reduce exposure to fluctuating duties. Investment in local production capacity, particularly in the U.S. Gulf Coast petrochemical corridor, continues to underpin competitive positioning.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasize environmental compliance and carbon accounting under emerging ESG regimes. The EU’s forthcoming Carbon Border Adjustment Mechanism is prompting European formulators to audit resin raw materials for carbon intensity, while Middle Eastern resin producers leverage low-cost energy inputs to expand export capacity. In Africa, growing consumer electronics demand is catalyzing import-driven growth, even as logistical constraints present ongoing challenges to seamless market penetration.

In Asia-Pacific, resin production hubs in Southeast Asia, China, and India are expanding rapidly to meet swelling domestic and export demand from electronics, renewables, and automotive sectors. Subsidies and strategic trade agreements support capacity expansions, yet geopolitical considerations and retaliatory trade measures occasionally reorient trade flows to new regional corridors. These region-specific drivers underscore the importance of adaptive strategies that align production footprints, supply networks, and regulatory engagement with local market priorities.

This comprehensive research report examines key regions that drive the evolution of the Encapsulation Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Moves and Innovation Portfolios of Leading Players Shaping the Future of Encapsulation Resin Technologies

Leading material suppliers are actively differentiating through targeted product innovation, strategic partnerships, and capacity investments. Adhesive and coating specialists have rolled out advanced formulations designed to meet the thermal and mechanical demands of next-generation applications. For instance, new UV-curable polyacrylate gasketing solutions deliver rapid cure times and broad temperature resilience for automotive electronics housings. Concurrently, specialty chemical players are amplifying R&D efforts to enhance resin sustainability and reduce lifecycle environmental footprints.

Supplier consolidation and joint ventures remain prevalent, as incumbents seek to fortify downstream integration and leverage scale efficiencies. Multipurpose chemical conglomerates are blending functional resin portfolios with complementary adhesive and thermal management offerings to present comprehensive system solutions. At the same time, emerging regional players are capturing share through localized, value-engineered resins optimized for cost-sensitive applications in developing economies.

Beyond product pipelines, technology licensing and cross-industry collaborations are proliferating. Initiatives that pair resin chemistries with additive manufacturing, printed electronics, and advanced thermal interface materials illustrate how strategic alliances can accelerate adoption of disruptive encapsulation approaches. Overall, the competitive landscape is defined by a dual focus on performance differentiation and agility in responding to shifting policy, supply, and end-market dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Encapsulation Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- CDx Industrial

- Chase Corporation

- CHT Group

- ELANTAS GmbH

- Electrolube

- Epic Resins

- H.B. Fuller Company

- Hapco, Inc.

- Henkel AG & Co. KGaA

- Hitachi, Ltd.

- Huntsman International LLC

- Longda Resin Group

- Master Bond Inc.

- MG Chemicals

- Olin Corporation

- Parker-Hannifin Corporation

- RBC Industries, Inc.

- Robnor ResinLab Ltd.

- Shin-Etsu Chemical Co. Ltd.

- Siltech Corporation

- The Dow Chemical Company

- United Resin, Inc.

- Von Roll Management AG

- Wacker Chemie AG

Delivering Tactical Recommendations to Propel Competitive Advantage and Supply Chain Resilience in the Encapsulation Resins Sector

To navigate the complexities of the contemporary encapsulation resins market, industry leaders must adopt a multi-pronged set of actions aimed at bolstering resilience and differentiation. Foremost, diversifying supply chains through qualification of alternate feedstock providers and near-shoring of critical intermediates will insulate operations from tariff volatility and logistical disruptions. By locking in long-term contracts and leveraging free trade agreements where available, organizations can stabilize input costs and maintain margin integrity.

Simultaneously, investments in sustainable resin chemistries-bio-based, recyclable, or low-VOC formulations-are essential to meet forthcoming ESG mandates and capture green premium segments. Collaborative R&D partnerships with academia and specialized startups can accelerate the commercialization of breakthrough materials, from thermally conductive UV-curable systems to hybrid biodegradable composites. Furthermore, embedding advanced data analytics in procurement and production functions enables real-time cost monitoring, predictive maintenance, and optimized batch scheduling.

Finally, cultivating cross-functional alignment between technical, commercial, and regulatory teams fosters agile decision-making. Integrating scenario-based planning that models tariff scenarios, raw-material price swings, and end-user technology roadmaps will empower stakeholders to anticipate shifts and pivot strategies proactively. By marrying operational dexterity with forward-looking innovation roadmaps, companies can secure competitive advantage in the dynamic encapsulation resins arena.

Outlining Rigorous Research Methodology Combining Qualitative Analysis, Quantitative Approaches, and Expert Validation for Encapsulation Resin Intelligence

This research integrates a rigorous methodology combining qualitative and quantitative approaches to ensure comprehensive and reliable insights. Primary data was collected through in-depth interviews with industry executives, technical experts, and procurement heads across resin manufacturing, OEM, and aftermarket sectors. Complementing these perspectives, secondary research encompassed peer-reviewed journals, trade press releases, and regulatory filings to contextualize market shifts and technological breakthroughs.

Quantitative analyses employed a bottom-up segmentation framework, mapping resin type usage across applications, end-use industries, and geographic regions. Cross-referencing consumption patterns with trade data and tariff schedules enabled precise evaluation of supply-chain dynamics. A Delphi validation process engaged a panel of subject-matter advisors to reconcile divergent forecasts and affirm critical drivers. Throughout, stringent data triangulation was applied to reconcile discrepancies and enhance result fidelity.

Finally, a continuous feedback loop with advisory board members and select pilot clients ensured that evolving market developments and policy announcements were promptly incorporated. This iterative approach guarantees that the final synthesis reflects both current realities and emerging trajectories in encapsulation resin markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Encapsulation Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Encapsulation Resins Market, by Resin Type

- Encapsulation Resins Market, by Form

- Encapsulation Resins Market, by Application

- Encapsulation Resins Market, by End-Use Industry

- Encapsulation Resins Market, by Region

- Encapsulation Resins Market, by Group

- Encapsulation Resins Market, by Country

- United States Encapsulation Resins Market

- China Encapsulation Resins Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Integrating Comprehensive Insights to Reinforce Strategic Imperatives and Unlock Sustainable Growth Trajectories in Encapsulation Resin Markets

In summary, encapsulation resins are at the confluence of intense innovation, policy-driven market shifts, and escalating performance demands. The interplay between sustainable chemistry, advanced thermal management, and adaptive supply-chain strategies will define success in the years ahead. Stakeholders who align product development with regulatory imperatives, fortify procurement against external shocks, and forge strategic alliances will be well positioned to capture emerging opportunities.

As the market continues to evolve, vigilance in monitoring trade policies, regional dynamics, and technological breakthroughs will be essential. Companies that embrace holistic, data-driven approaches to strategy formulation will unlock resilient growth pathways and reinforce their leadership in the encapsulation resins domain.

Engage with Ketan Rohom Today to Secure Your Access to Actionable Encapsulation Resin Market Intelligence and Drive Informed Decision-Making

Ready to transform your strategic approach to encapsulation resins? Reach out today to engage with Ketan Rohom, Associate Director of Sales & Marketing, and secure a comprehensive market research report tailored to your needs. Whether you’re navigating supply chain complexities, evaluating emerging resin chemistries, or aiming to fortify your competitive positioning, this report delivers the actionable insights required to drive informed decisions. Contact Ketan Rohom now to access in-depth analysis, expert guidance, and exclusive data that will empower your organization to thrive in the rapidly evolving encapsulation resins landscape.

- How big is the Encapsulation Resins Market?

- What is the Encapsulation Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?