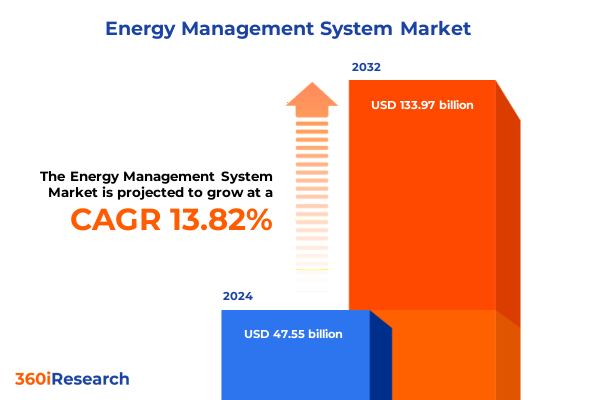

The Energy Management System Market size was estimated at USD 53.35 billion in 2025 and expected to reach USD 59.85 billion in 2026, at a CAGR of 14.05% to reach USD 133.97 billion by 2032.

Exploring the Evolving Role of Energy Management Systems in Driving Operational Efficiency, Sustainability Objectives, Regulatory Compliance, and Intelligent Decision-Making Across Diverse Industries

Energy management systems have emerged as critical enablers for organizations striving to balance operational performance with ambitious sustainability goals. As businesses face escalating energy costs, intensifying regulatory mandates, and growing pressure to decarbonize, the ability to monitor, control, and optimize energy consumption in real time has become indispensable. Evolving technologies such as the Internet of Things, edge computing, and artificial intelligence now converge to deliver unprecedented visibility into energy flows, predictive insights, and automated responses that can transform how facilities operate and how strategic decisions are made.

This executive summary provides an overview of the key drivers shaping the energy management system landscape and outlines the structural shifts that define competitive positioning. It highlights how integrated hardware controllers, advanced sensors, and sophisticated analytics platforms work in concert with expert consulting and maintenance services to deliver end-to-end solutions. Moreover, it examines the influence of regional regulatory frameworks, tariff adjustments, and shifting end-user requirements on deployment choices across commercial, industrial, and residential environments.

By presenting segmentation analysis, regional insights, and actionable recommendations, this introduction sets the stage for a comprehensive examination designed to empower decision-makers. It underscores the strategic imperatives organizations must embrace to harness the full potential of energy management systems and lays the groundwork for deeper exploration in the following sections.

Revealing How Digitalization, Decarbonization, AI-Powered Automation, and Regulatory Updates Are Reshaping Energy Management System Models and Architectures

The energy management system landscape is undergoing profound transformation driven by digital innovation, sustainability imperatives, and evolving regulatory mandates. Digitalization has introduced an interconnected fabric of sensors, controllers, and analytics engines that enable granular monitoring and automated control, replacing legacy manual processes. As a result, organizations gain the agility to respond dynamically to consumption patterns, optimize asset performance, and integrate renewable energy sources without compromising system stability.

Simultaneously, global decarbonization commitments have elevated the role of energy management systems from cost-saving utilities to strategic platforms that underpin corporate net-zero targets. In parallel, artificial intelligence and machine learning algorithms are increasingly embedded within software modules to predict equipment failures, forecast demand fluctuations, and recommend real-time adjustments that reduce waste and improve resilience. This fusion of AI and domain expertise marks the transition from passive monitoring to proactive, intelligent energy orchestration.

Regulatory frameworks are also evolving, with governments imposing stringent efficiency standards, carbon pricing mechanisms, and reporting requirements that reinforce the need for transparent energy oversight. These emerging rules are reshaping vendor offerings and compelling organizations to adopt platforms capable of comprehensive compliance reporting. As a result, the next generation of energy management systems is characterized by modular architectures, open data integration, and scalable cloud-native components that can adapt to diverse industry needs and regulatory environments.

Analyzing the Impact of 2025 United States Tariffs on Energy Management System Supply Chains, Cost Structures, Adoption Trends, and Competitive Market Behavior

The implementation of new United States tariffs in 2025 has exerted a notable influence on global energy management system supply chains and cost structures. Hardware manufacturers reliant on imports of controllers, meters, and advanced sensors have experienced increased input costs, prompting many to re-evaluate sourcing strategies and negotiate long-term agreements with domestic suppliers. As a consequence, some vendors have accelerated their transition toward localized contract manufacturing to mitigate exposure to tariff fluctuations and cross-border logistical complexities.

These shifts have rippled into software and service segments as well. Suppliers of energy analytics platforms and consulting firms are recalibrating pricing models to account for elevated hardware margins while also offering flexible deployment options, such as hybrid cloud or on premise installations, to optimize total cost of ownership. End users, in turn, are placing greater emphasis on solutions that leverage advanced integration to maximize return on investment under tighter budget constraints.

The tariff-driven cost pressures have also reinforced the strategic importance of system interoperability and open standards. By adopting modular software platforms and universal communication protocols, organizations can reduce the impact of component price volatility and accelerate deployment cycles. In response, leading vendors are expanding partnerships with regional integrators and investing in R&D to deliver tariff-resilient architectures that support both wired and wireless connectivity across Ethernet, powerline, LPWAN, Wi-Fi, and Zigbee networks.

Delivering Integration Insights Across Component, End User, Deployment, Application, and Communication Segments to Inform Strategic Energy Management Decisions

Delivering Integration Insights Across Component, End User, Deployment, Application, and Communication Segments to Inform Strategic Energy Management Decisions

From a component perspective, the hardware segment encompasses controllers, meters, and sensors that form the critical infrastructure for real-time data acquisition and control. This foundational layer is complemented by consulting and maintenance services that ensure system reliability and long-term performance. Software modules further extend capabilities through building management interfaces, advanced energy analytics engines, and unified management platforms that aggregate insights and automate responses.

End-user segmentation reveals a broad spectrum of deployment scenarios. Commercial facilities span healthcare institutions, hospitality venues, and retail outlets each requiring tailored system configurations to address unique operational requirements. The industrial segment covers applications in automotive manufacturing, heavy industry, and oil and gas operations, where energy management systems must withstand rigorous process conditions. Meanwhile, residential adoption is gaining momentum as smart home solutions integrate energy optimization with consumer comfort and cost savings.

Deployment models range from cloud-based environments-whether private cloud infrastructures tailored for enhanced data security or public cloud platforms offering elastic scalability-to on premise installations that provide direct control over critical operational assets. Within application segments, organizations leverage demand response strategies to shift load, implement energy analytics with predictive forecasting and detailed reporting, and deploy monitoring and control solutions such as HVAC regulation and lighting management to fine-tune performance.

Underlying these deployments is the choice of communication technology. Wired options, including Ethernet and powerline communication, deliver high reliability and bandwidth for mission-critical operations. Wireless protocols such as LPWAN, Wi-Fi, and Zigbee facilitate flexible sensor networks and enable rapid scale-out, particularly in retrofitting scenarios. Together, these segment insights offer a holistic view of how organizations can align their energy management investments with strategic objectives.

This comprehensive research report categorizes the Energy Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Communication Technology

- Energy Source Integration

- Organization Size

- Deployment Model

- End Use

Highlighting Growth Drivers, Regulatory Environments, Infrastructure Capacity, and Investment Patterns Across the Americas, EMEA, and Asia-Pacific Regional Markets

Highlighting Growth Drivers, Regulatory Environments, Infrastructure Capacity, and Investment Patterns Across the Americas, EMEA, and Asia-Pacific Regional Markets

In the Americas, the focus on renewable integration and decarbonization has driven widespread adoption of energy management systems that can coordinate distributed resources such as rooftop solar and battery storage. Federal incentives and state-level efficiency mandates have created a fertile environment for technology providers, while utilities increasingly collaborate on demand response programs that reward customers for grid support. Infrastructure readiness varies between mature urban centers with established smart grid initiatives and emerging markets where pilot projects are accelerating modernization efforts.

Europe, the Middle East, and Africa present a complex mosaic of regulatory frameworks. The European Union’s stringent energy efficiency directives and carbon reporting obligations have propelled organizations to embrace integrated analytics and compliance reporting tools. In the Middle East, rapid urbanization and the transition from oil-centric economies are fostering investments in smart buildings and large-scale industrial installations. Across Africa, demand for resilient off-grid power solutions is steering interest in modular energy management platforms that can operate in remote and challenging environments.

Asia-Pacific remains a dynamic and heterogeneous region. Developed markets such as Japan and South Korea emphasize high-precision automation and AI-driven optimization, while China’s ambitious decarbonization roadmap has spurred local innovation in grid-interactive building controls. Southeast Asian economies are focusing on affordable, cloud-based deployments to overcome limited IT infrastructure. Across the region, public-private partnerships and digitalization initiatives are creating new channels for solution providers to scale presences and tailor offerings to diverse regulatory and operational landscapes.

This comprehensive research report examines key regions that drive the evolution of the Energy Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Technology Differentiation, Strategic Alliances, Innovation Pipelines, and Competitive Positioning Among Top Energy Management System Companies

Exploring Technology Differentiation, Strategic Alliances, Innovation Pipelines, and Competitive Positioning Among Top Energy Management System Companies

Leading energy management system companies distinguish themselves through differentiated technology stacks that integrate edge computing capabilities, advanced machine learning algorithms, and user-centric dashboards. By prioritizing open API architectures and interoperability, these providers enable seamless integration with building automation systems, industrial control networks, and third-party analytics solutions. Their innovation roadmaps often include strategic acquisitions and co-development partnerships to accelerate feature rollouts and broaden service portfolios.

A notable trend is the formation of ecosystem alliances that bring together hardware manufacturers, software developers, and service integrators. These consortia leverage complementary strengths to address complex customer requirements, such as large-scale campus deployments or multi-site industrial operations. Vendors are also collaborating with utility partners to deliver turnkey demand response packages, blending technology expertise with grid management insights to unlock new revenue streams and enhance customer loyalty.

Competition is further intensified by specialized entrants focusing on niche applications such as predictive maintenance analytics, microgrid control, or advanced carbon accounting. These challengers push incumbents to continuously refine user experiences, streamline deployment workflows, and adopt subscription-based pricing models that lower barriers to entry. Overall, the strategic positioning of each company reflects a careful balance between core technology differentiation, partnership networks, and the ability to scale offerings across global markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Energy Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Broadcom Inc.

- Cisco Systems, Inc.

- Delta Electronics, Inc.

- E.On SE

- Eaton Corporation PLC

- Emerson Electric Co.

- General Electric Company

- Honeywell International, Inc.

- International Business Machine Corporation

- Itron, Inc.

- Johnson Controls Inc.

- Landis+Gyr AG

- Legrand S.A.

- Lutron Electronics Co., Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Sunverge Energy, Inc.

- Tantalus Systems Holding Inc.

- Toshiba Corporation

- Yokogawa Electric Corporation

Actionable Recommendations to Accelerate EMS Adoption, Boost Operational Efficiency, Drive Sustainability, and Elevate Stakeholder Value

Actionable Recommendations to Accelerate EMS Adoption, Boost Operational Efficiency, Drive Sustainability, and Elevate Stakeholder Value

Organizations should begin by conducting a holistic energy audit that spans hardware assets, software capabilities, and service contracts. By aligning system requirements with long-term decarbonization targets, decision-makers can prioritize investments in advanced analytics and AI-enabled optimization tools that deliver both cost savings and environmental benefits. It is essential to engage cross-functional teams-including facilities, IT, and sustainability leaders-to ensure that deployment strategies align with broader corporate objectives and compliance obligations.

To mitigate tariff-driven cost pressures, organizations are advised to diversify component sourcing and explore partnerships with regional integrators that offer localized manufacturing and support. Hybrid deployment models that combine private cloud security with on premise control can optimize total cost of ownership while preserving data sovereignty. Additionally, rigorous vendor evaluation should assess interoperability with existing automation systems and future scalability to accommodate emerging technologies such as edge AI and digital twins.

From a technological standpoint, prioritizing modular software architectures enables phased rollouts and minimizes disruption to core operations. Early adoption of open standards for communication and data exchange will reduce integration complexity and foster innovation by third-party developers. Finally, establishing key performance indicators tied to energy consumption, peak demand reduction, and carbon footprint will facilitate transparent reporting and continuous improvement. Implementing these actionable strategies will position organizations to realize full value from their energy management system investments.

Detailing a Research Methodology Combining Qualitative Expert Interviews, Quantitative Survey Data, Systematic Analysis, and Multi-Source Validation Processes

Detailing a Research Methodology Combining Qualitative Expert Interviews, Quantitative Survey Data, Systematic Analysis, and Multi-Source Validation Processes

This research integrates in-depth qualitative interviews with industry experts, including system integrators, technology vendors, and end-user energy managers, to capture nuanced insights into adoption drivers, implementation challenges, and evolving customer requirements. Complementing these interviews are quantitative surveys distributed across commercial, industrial, and residential segments, ensuring a representative understanding of deployment preferences, budget priorities, and satisfaction levels.

Secondary research sources encompass published regulatory filings, technical standards, policy directives, and academic literature. These materials serve to validate primary data points and contextualize findings within broader industry narratives. Data triangulation techniques are applied to reconcile discrepancies between qualitative feedback and survey results, enhancing the credibility of the analysis.

Systematic analysis protocols involve the categorization of responses according to established segment frameworks-spanning component, end user, deployment, application, and communication architectures. Statistical tools are used to identify correlations between investment drivers and technology adoption rates, while thematic analysis highlights emerging trends and pain points.

Finally, multi-source validation processes engage a panel of independent experts to review preliminary findings, ensuring accuracy, relevance, and actionable value. This robust methodology underpins the executive summary’s insights, delivering a comprehensive, reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Energy Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Energy Management System Market, by Offering

- Energy Management System Market, by Communication Technology

- Energy Management System Market, by Energy Source Integration

- Energy Management System Market, by Organization Size

- Energy Management System Market, by Deployment Model

- Energy Management System Market, by End Use

- Energy Management System Market, by Region

- Energy Management System Market, by Group

- Energy Management System Market, by Country

- United States Energy Management System Market

- China Energy Management System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Insights on How Energy Management Systems Enhance Operational Excellence, Advance Sustainability Objectives, and Fuel Technological Progress

Concluding Insights on How Energy Management Systems Enhance Operational Excellence, Advance Sustainability Objectives, and Fuel Technological Progress

Energy management systems stand at the forefront of organizational efforts to reconcile efficiency, cost control, and environmental stewardship. By unifying hardware controllers, advanced sensors, and AI-enabled analytics platforms, these solutions deliver real-time visibility into energy consumption and empower proactive decision-making. The integration of cloud and on premise deployments ensures that organizations can tailor their approach to data security requirements and scalability imperatives.

Regional variations-from decarbonization incentives in the Americas to diverse regulatory landscapes across EMEA and rapid innovation in Asia-Pacific-underscore the importance of market-specific strategies. Segmentation insights across component, end user, deployment, application, and communication dimensions reveal opportunities for targeted growth and highlight areas for technology enhancement. Tariff dynamics further emphasize the need for resilient supply chains and diversified sourcing to maintain competitive positioning.

As leading providers continue to refine their strategic alliances and innovation roadmaps, industry leaders must leverage the insights presented in this summary to inform their roadmaps. By embracing modular architectures, open standards, and data-driven performance metrics, organizations can accelerate their journey toward sustainable, efficient, and future-proof operations.

Connect with Associate Director Ketan Rohom to Access Tailored Energy Management System Insights and Secure Your Market Research Report Purchase

I invite you to connect with Associate Director Ketan Rohom to explore tailored insights into Energy Management Systems and secure your market research report today. Ketan brings a deep understanding of industry trends and technological advancements, ensuring that the analysis you receive aligns precisely with your organization’s strategic objectives. By engaging directly with him, you gain access to exclusive perspectives covering hardware, software, service, deployment, application, and communication segments. His guidance will help you navigate regulatory complexities, tariff impacts, and regional nuances to drive informed decision-making and maximize the return on your investment. Reach out now to discuss how our customized report can empower your team with actionable intelligence, comprehensive segmentation analysis, and forward-looking recommendations to stay ahead in the rapidly evolving energy management landscape

- How big is the Energy Management System Market?

- What is the Energy Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?