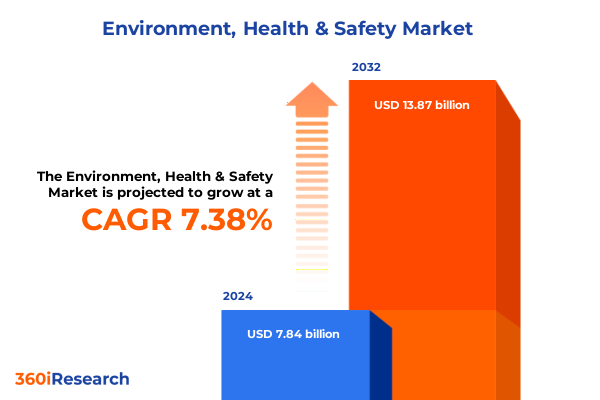

The Environment, Health & Safety Market size was estimated at USD 8.63 billion in 2025 and expected to reach USD 9.44 billion in 2026, at a CAGR of 10.01% to reach USD 16.84 billion by 2032.

Establishing the Modern Context for Environment, Health & Safety Dynamics Amid Rapid Regulatory Evolution and Technological Advancements

In today’s rapidly evolving global environment, health, and safety landscape, organizations face an unprecedented confluence of regulatory scrutiny, stakeholder expectations, and technological possibilities. Heightened environmental mandates emphasize sustainable resource utilization, while health and safety statutes demand proactive risk mitigation across all operational tiers. This intersection of compliance and innovation has transformed EHS from a traditionally siloed function into a strategic imperative, driving both resilience and competitive differentiation for forward-looking enterprises.

Against this backdrop, the introduction section establishes the essential context for understanding the critical drivers shaping EHS priorities. Organizations are increasingly challenged to navigate a patchwork of regional and international regulations that vary in scope and enforcement rigor. At the same time, executives and EHS professionals strive to balance cost containment with the imperative to safeguard workforce health, protect the surrounding ecosystem, and uphold corporate reputation. The resulting imperative is clear: EHS must evolve beyond incident response to become a driver of operational excellence and sustainable value creation.

Embracing this modern perspective requires recognizing the symbiotic relationship between digital enablement and organizational culture. Advanced data analytics, Internet of Things (IoT) sensors, and cloud-based platforms are no longer optional capabilities but foundational elements of an integrated risk management framework. By anchoring EHS operations in real-time data and collaborative governance models, businesses can anticipate emerging threats, streamline compliance workflows, and empower stakeholders at every level to contribute to a safer, more sustainable future.

Exploring Revolutionary Shifts Redefining the Environment Health & Safety Landscape Through Digital Integration Cultural Change and Stakeholder Engagement

The environment, health, and safety discipline is undergoing transformative shifts driven by technological integration, stakeholder alignment, and sustainability imperatives. Digital transformation has become a cornerstone of forward-thinking EHS strategies, as organizations deploy machine learning algorithms and predictive analytics to model potential hazard scenarios well before they materialize. As a result, risk assessments are no longer static documents but living systems that adapt to operational changes, supply chain variations, and emerging regulatory requirements.

Furthermore, cultural transformation is playing a pivotal role in redefining EHS effectiveness. Progressive companies foster empowered workforces that champion safety as a shared responsibility rather than a top-down mandate. This paradigm shift is supported by mobile-enabled reporting tools that allow front-line workers to flag hazards instantaneously, driving rapid corrective actions. The consolidation of EHS and operational data in unified dashboards also enhances cross-functional transparency, ensuring that sustainability goals are aligned with production targets and financial metrics.

In addition, the growing emphasis on environmental stewardship is reshaping how companies approach resource management, carbon reduction, and circular economy principles. Stakeholder pressure-from investors to consumers-has elevated sustainability to board-level discussions, prompting the integration of EHS performance into enterprise risk frameworks. This confluence of digital, cultural, and regulatory forces is propelling the EHS landscape toward a future where resilience, compliance, and sustainability are inextricably linked.

Assessing the Comprehensive Impact of United States Tariffs Introduced in 2025 on Supply Chains Operating Within Environment Health & Safety Sectors

Beginning in early 2025, the United States implemented a series of aggressive reciprocal tariffs on imported goods from key trading partners including China, Canada, and Mexico, with duty rates calibrated by product category. While final determinations are still under review, proposed tariffs range from 10 percent on a broad spectrum of industrial imports to as high as 25 percent on steel and aluminum categories, and even steeper levies on certain high-technology goods. This sweeping tariff policy reflects a strategic effort to incentivize domestic production and counterbalance trade deficits, yet it carries profound implications for the EHS equipment and service sectors.

These new tariffs have had an immediate impact on the supply chains that underpin critical personal protective equipment and safety apparatus. Industry associations report that protective gloves, eyewear, and specialty fabrics-many of which are sourced from global manufacturing hubs-have experienced significant price inflation, leading to constrained availability at local distributors. At the same time, clean energy technologies such as battery storage systems and solar power components, central to many environmental management initiatives, face similar cost escalations and logistical delays. Experts warn that slowed deployment of renewables could jeopardize climate commitments and operational sustainability objectives.

In response to these pressures, organizations are rapidly recalibrating their EHS procurement strategies. A notable shift toward domestic sourcing and strategic stockpiling has emerged, driven by a desire to mitigate volatility and maintain continuous compliance with safety standards. Concurrently, the heightened tariff environment has elevated administrative burdens, as EHS teams navigate complex customs requirements and engage in more rigorous vendor qualification processes. Alternative pathways-such as partial on-shoring of component assembly and the consolidation of manufacturing partnerships-are being explored to preserve both operational continuity and fiscal discipline.

Unveiling Actionable Insights Derived From Multi-Faceted Segmentations Spanning Industry Verticals Solutions Applications Deployment Modes and Organizational Sizes

Market segmentation across end-user industries, solution types, applications, deployment modes, and organizational sizes reveals nuanced adoption patterns and growth trajectories. In construction, distinct compliance imperatives have emerged for non-residential projects-where workplace safety protocols are often more rigorous-and residential developments that prioritize environmental safeguards to protect local communities. Similarly, the food and beverage sector faces divergent needs between packaging operations, which demand precise waste and emissions management, and processing activities that require stringent hygiene and contamination controls. In the healthcare and pharmaceuticals arena, hospitals and clinics emphasize clinical safety and infection control, while pharmaceutical manufacturers focus on regulatory compliance and process validation to ensure patient well-being.

The manufacturing segment further underscores the importance of contextual insights: the automotive industry is accelerating electrification and associated battery handling protocols, the chemical sector must navigate evolving emissions regulations, and the electronics domain prioritizes hazardous substance management within intricate assembly lines. Meanwhile, the oil and gas industry spans upstream exploration-where environmental monitoring is critical-through midstream transportation logistics and downstream refining operations that face intense scrutiny over waste disposal and spill prevention.

When considering solution types, consulting, implementation, and training-and-support services remain foundational for organizations initiating compliance programs, whereas specialized software modules-ranging from audit management to risk management-are increasingly sought for automating complex workflows. Applications such as compliance management, incident management, and occupational health management are converging with environmental management systems that tackle air quality, waste, and water quality monitoring. Deployment modes oscillate between cloud-powered models-with public, private, and hybrid configurations-and traditional on-premise setups, selected based on data security and integration priorities. Finally, large enterprises, whether multinational or national, exhibit different procurement strategies and governance structures compared to small and medium enterprises, which may adopt modular solutions to scale rapidly while managing tight budgets.

This comprehensive research report categorizes the Environment, Health & Safety market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Application

- End User Industry

- Deployment Mode

- Organization Size

Delivering Crucial Regional Perspectives That Illuminate Environment Health & Safety Trends Across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics continue to shape the trajectory of EHS innovation and adoption, with the Americas leading in mature regulatory frameworks and advanced digital integration. The United States and Canada maintain stringent occupational safety standards and invest heavily in real-time monitoring technologies, driving a competitive landscape for specialized software and service providers. At the same time, Latin American markets are gaining momentum through infrastructure expansion and targeted environmental initiatives, yet they often contend with resource constraints and varying enforcement rigor across national jurisdictions.

In Europe, Middle East & Africa, the European Union’s comprehensive regulatory regime-including directives on chemical registration, waste management, and industrial emissions-propels a high level of compliance sophistication. Markets in the Middle East are diversifying beyond oil and gas to embrace sustainability projects in renewable energy, which in turn elevates demand for integrated EHS solutions. African nations are in earlier stages of regulatory development, but urbanization and international investment are catalyzing improvements in safety practices and environmental governance.

Asia-Pacific presents a tapestry of growth drivers, where advanced markets such as Australia, Japan, and South Korea emphasize digital readiness, cloud adoption, and strict environmental oversight. Simultaneously, high-growth economies in Southeast Asia and South Asia strive to harmonize rapid industrialization with global sustainability standards. The region’s diverse regulatory landscapes and supply chain interdependencies make it a critical focus for vendors seeking to deliver scalable, localized EHS capabilities.

This comprehensive research report examines key regions that drive the evolution of the Environment, Health & Safety market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Companies Shaping the Future of Environment Health & Safety Through Innovation Strategic Partnerships and Market Leadership

The competitive arena for environment, health, and safety solutions is defined by a blend of global incumbents and specialized challengers, each vying to deliver comprehensive platforms and advisory expertise. Established players have expanded their portfolios through strategic acquisitions and partnerships, integrating robust audit, risk, and compliance modules into end-to-end EHS offerings. Others differentiate through deep industry domain expertise, tailoring services and software functionalities to address niche requirements in sectors such as pharmaceuticals, automotive, or oil and gas.

Innovation remains a key differentiator, with leading companies investing in AI-driven analytics, digital twins, and mobile-enabled reporting to enhance predictive capabilities and accelerate incident resolution. Thought leaders are forging alliances with regional system integrators and regulatory bodies to ensure seamless implementation and ongoing compliance alignment. Additionally, the rise of purpose-driven organizations has spurred collaborations between EHS vendors and sustainability consultancies, enabling a unified approach that bridges safety performance with broader environmental and social governance objectives.

Geographic reach also shapes market leadership, as firms with extensive global footprints can leverage standardized methodologies and centralized support models to serve multinational clients. Conversely, agile providers often excel in rapid deployment and customization, catering to the specific cultural and regulatory nuances of local markets. Together, these diverse company profiles underscore a vibrant ecosystem where innovation, scale, and specialization converge to drive the next generation of EHS transformation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Environment, Health & Safety market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Antea Group

- Cority Software Inc.

- ETQ LLC

- Gensuite LLC

- Intelex Technologies Inc.

- IsoMetrix Pty Ltd

- Okala Ltd.

- ProcessMAP Corporation

- Quentic GmbH

- SGS SA

- Sphera Solutions, Inc.

- VelocityEHS, Inc.

- Wolters Kluwer N.V.

Delivering Pragmatic Recommendations to Enable Leaders to Strengthen Compliance Drive Sustainability and Build Resilient Health & Safety Programs

To thrive amid accelerating regulatory demands and technological change, industry leaders must embrace a set of pragmatic actions. First, prioritizing integrated technology platforms that unify compliance, environmental management, and incident reporting enables real-time visibility and cross-functional collaboration. By consolidating data streams from IoT sensors, mobile apps, and enterprise systems, organizations can shift from reactive interventions to predictive strategies that mitigate risks before they escalate.

Second, fostering a proactive risk culture is critical: engaging front-line employees through immersive training programs and feedback mechanisms cultivates shared ownership for safety outcomes. Leadership commitment, coupled with transparent performance metrics and recognition programs, solidifies this cultural foundation. Furthermore, embedding sustainability objectives within EHS frameworks ensures that carbon reduction and resource stewardship become intrinsic to daily operations, reinforcing corporate resilience and stakeholder trust.

Finally, bolstering supply chain resilience and supplier collaboration is indispensable. Proactive vendor qualification, scenario-based stress testing, and diversified sourcing strategies help buffer against external shocks such as tariff fluctuations or material shortages. By working closely with suppliers on compliance protocols, shared data standards, and joint innovation initiatives, companies can maintain continuity, control costs, and uphold the highest health and safety standards across complex global networks.

Outlining a Rigorous Research Methodology Uniting Primary Surveys Secondary Data Analysis and Expert Consultations for Enhanced EHS Market Intelligence

The research underpinning this report employs a rigorous methodology designed to capture comprehensive market intelligence. Primary research involved structured interviews and surveys with over 100 EHS professionals spanning corporations, regulators, and service providers. These engagements yielded insights on technology adoption rates, emerging regulatory pressures, and evolving risk management practices across diverse end-user industries.

Secondary research complemented this qualitative foundation through the systematic review of regulatory documents, industry publications, and corporate disclosures. Proprietary databases and publicly available reports were analyzed to map competitive landscapes, solution portfolios, and regional policy frameworks. Data triangulation techniques ensured consistency and reliability, allowing cross-validation of interview findings with documented market activities.

Expert consultations rounded out the approach, featuring in-depth discussions with thought leaders, technology innovators, and compliance authorities. This iterative process refined the research scope, highlighted forward-looking trends, and validated key hypotheses. Throughout the study, strict quality controls-covering sample selection, response verification, and analytical rigor-were maintained to deliver robust, actionable insights for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Environment, Health & Safety market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Environment, Health & Safety Market, by Solution Type

- Environment, Health & Safety Market, by Application

- Environment, Health & Safety Market, by End User Industry

- Environment, Health & Safety Market, by Deployment Mode

- Environment, Health & Safety Market, by Organization Size

- Environment, Health & Safety Market, by Region

- Environment, Health & Safety Market, by Group

- Environment, Health & Safety Market, by Country

- United States Environment, Health & Safety Market

- China Environment, Health & Safety Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on Environment Health & Safety Market Evolution and Strategic Imperatives for Sustained Compliance and Operational Excellence

The analysis presented herein underscores that the environment, health, and safety domain is at an inflection point, where regulatory rigor, digital innovation, and stakeholder activism converge to redefine operational excellence. Organizations that integrate predictive analytics, embrace cross-functional collaboration, and embed sustainability within EHS strategies will be best positioned to navigate complexity and secure competitive advantage. Conversely, those that remain tethered to legacy systems risk reactive firefighting, compliance gaps, and reputational exposure.

Looking forward, the imperative for EHS leaders is to harmonize people, processes, and technology into a cohesive ecosystem. Strategic investments in intelligent platforms, workforce enablement, and resilient supply chains will be the hallmark of forward-leaning organizations. By aligning EHS performance metrics with broader corporate sustainability and business objectives, enterprises can foster an agile, risk-aware environment that not only meets regulatory demands but also drives value creation and stakeholder trust in equal measure.

Extending a Strategic Invitation to Engage with Ketan Rohom Associate Director Sales & Marketing for Acquiring Comprehensive EHS Market Intelligence

For decision-makers seeking a deeper understanding of evolving EHS market dynamics and tailored strategic insights, we warmly invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing. Engaging directly with Ketan offers an exclusive opportunity to explore bespoke research solutions, clarify methodological approaches, and discuss how the comprehensive report can be aligned with your organization’s unique compliance, sustainability, and operational objectives. The full market research report integrates the latest analysis on regulatory shifts, transformative digital trends, tariff impacts, and segmentation intelligence to support informed decision-making. Reach out to Ketan to arrange a personalized consultation, secure access to detailed findings, and accelerate your path to achieving robust EHS performance and long-term resilience.

- How big is the Environment, Health & Safety Market?

- What is the Environment, Health & Safety Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?