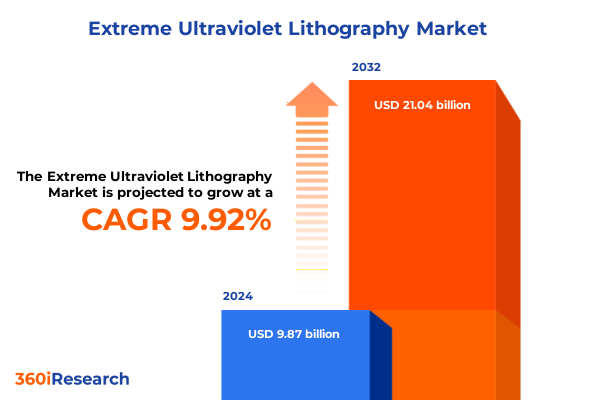

The Extreme Ultraviolet Lithography Market size was estimated at USD 10.83 billion in 2025 and expected to reach USD 11.79 billion in 2026, at a CAGR of 9.94% to reach USD 21.04 billion by 2032.

Introduction to EUV Lithography's transformative potential in pushing semiconductor innovation to new horizons and enabling next generation device architectures

Extreme ultraviolet lithography has emerged as a cornerstone technology in the relentless pursuit of device miniaturization and performance enhancement. As leading fabs transition from deep ultraviolet methods to sub-nanometer patterning, the capabilities of EUV systems become indispensable in overcoming the physical and economic barriers that have long constrained Moore’s Law. Grounded in the use of 13.5-nanometer wavelength light, EUV lithography enables the definition of critical features with unmatched precision, setting the stage for the next wave of high-performance microprocessors, system-on-chips, and advanced memory solutions.

Despite its technical complexity and substantial capital requirements, EUV has transitioned from experimental pilot lines to high-volume manufacturing environments. Continued refinements in source power, scanner throughput, and defectivity controls have driven down unit costs while improving yield and cycle time. These advancements have laid the groundwork for broader industry uptake, empowering foundries and integrated device manufacturers to push device architectures beyond previous limitations. The unfolding EUV narrative is one of collaboration across equipment suppliers, materials innovators, and end users, all united by the shared ambition to unlock new nodes and catalyze transformative shifts across the semiconductor value chain.

Exploring the revolutionary shifts in semiconductor manufacturing landscape driven by EUV advancements reshaping technology paradigms globally

The semiconductor landscape is undergoing a profound evolution as EUV technology disrupts traditional photolithographic paradigms. Where multiple patterning strategies once dominated at advanced nodes, single-exposure EUV tools now streamline process complexity and reduce cycle time. This shift is not merely incremental; it redefines the economics and technical ingenuity necessary for next-generation logic and memory devices. Foundries have reported significant reductions in lithography steps per layer, enabling more agile design cycles and freeing capacity for emerging logic variants, even as memory suppliers harness EUV for tighter pitch DRAM and NAND geometries.

Beyond lithography itself, the ripple effects of EUV integration extend to resist chemistry, mask fabrication, and inspection ecosystems. Chemically amplified and metal-oxide resists are being tailored to withstand higher energy densities, while mask writers adapt to new absorber materials and pellicle solutions. The entire supply chain is synchronizing around these demands, fostering unprecedented levels of cross-company collaboration. As a result, equipment providers are delivering systems with enhanced throughput, and materials suppliers are unveiling novel formulations that balance sensitivity and resolution, collectively reshaping the competitive contours of semiconductor manufacturing.

Assessing the layered impact of recent United States trade measures on EUV equipment deployment and supply chain resilience in semiconductor ecosystem

Recent trade measures enacted by the United States have had a compounding effect on EUV equipment deployment across global supply chains. Export controls introduced under national security mandates have limited shipments of advanced lithography systems to certain regions, creating a stratified market environment. Companies in restricted jurisdictions face extended lead times and compliance complexities, prompting some to reevaluate capacity expansion plans or to source alternative patterning solutions.

Concurrently, increased duties on select semiconductor-related imports have placed upward pressure on tool acquisition costs for affected end users. As a result, foundries and integrated device manufacturers are weighing the benefits of early EUV adoption against the financial and logistical impact of modifying procurement strategies. To mitigate these challenges, industry participants are exploring collaborative financing models and shared tool deployment arrangements that distribute risk and optimize utilization. While these developments have introduced a fresh layer of strategic decision making, they have also galvanized the community to enhance supply chain resiliency and forge stronger intercompany alliances.

Diving into critical segmentation insights revealing how equipment types applications wafer sizes user profiles and materials shape the EUV market dynamics

Segmentation analysis reveals that equipment choice has become a defining factor in capital planning and process architecture evolution. Within the scanner portfolio, high numerical aperture systems are positioned to drive the deepest sub-nanometer patterning, while low numerical aperture platforms continue to serve mature nodes with established throughput gains. This divergence informs investment priorities and capacity roadmaps across leading fabs.

On the application front, the logic device segment is bifurcated into microprocessors and system-on-chips, each with distinct patterning tolerance and defectivity requirements, whereas memory devices split into dynamic random-access memory and NAND flash, where cell pitch and layer stacking dynamics demand bespoke lithography approaches. This dual-track growth trajectory underscores the need for versatile tool strategies.

Wafer size considerations further complicate the picture: the 200 millimeter platform persists in legacy and specialty applications, with 300 millimeter wafers dominating mainstream manufacturing, while early-stage pilot lines explore the potential of 450 millimeter substrates, primarily in prototype settings. Each wafer dimension influences throughput, tool footprint, and economic thresholds.

End users-from the largest pure-play foundries through global IDM operations-leverage EUV in line with their production cadences and node priorities. Strategic alliances among key foundry partners and IDM players shape ecosystem collaboration models that accelerate adoption.

In the realm of resist materials, chemically amplified and metal-oxide formulations cater to the sensitivity and resolution needs of cutting-edge nodes. Negative and positive chemically amplified resists compete on line-edge roughness and exposure latitude, even as hafnium-based and zirconium-based oxide resists offer alternative etch resistance profiles. This multi-pronged segmentation matrix underscores the nuanced choices confronting equipment specifiers and process engineers.

This comprehensive research report categorizes the Extreme Ultraviolet Lithography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Application

- Wafer Size

- End User

- Resist Material

Uncovering key regional dynamics and growth trajectories across the Americas Europe Middle East Africa and Asia Pacific driving EUV adoption trends

Regional dynamics underscore divergent adoption drivers and strategic imperatives across global geographies. In the Americas, advanced packaging and heterogeneous integration initiatives have spurred localized EUV deployments, supported by a robust semiconductor equipment ecosystem rooted in decades of photolithography expertise. This region’s emphasis on design–manufacturing co-location fuels pilot lines that validate novel process nodes and interconnect schemes.

Europe, the Middle East, and Africa present a mosaic of opportunities shaped by government-led advanced technology programs and growing collaboration between local research institutes and global foundries. Proximity to innovation hubs fosters early trials of high-NA systems, while regional supply chain integration initiatives aim to localize critical materials and components.

Asia–Pacific remains the epicenter of high-volume EUV adoption, with leading pure-play foundries and IDMs driving aggressive tool rollouts across multiple fabs. Government incentives and cluster economics in key markets support capacity expansions, positioning this region as both the biggest beneficiary and the principal innovator of EUV-driven node transitions. Cross-border partnerships further accelerate technology diffusion and ensure that Asia–Pacific continues to set the pace for worldwide lithography advancements.

This comprehensive research report examines key regions that drive the evolution of the Extreme Ultraviolet Lithography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting influential industry players and their strategic initiatives shaping technological advancement and competitive edge in the EUV lithography domain

A core constellation of technology providers and end users is shaping the EUV landscape through targeted R&D collaborations and strategic platform deployments. Leading scanner suppliers are advancing source power and optics lifetime, while materials specialists refine resist sensitivity and mitigate defectivity through advanced polymer design and nanoparticle formulations. Collaborative ventures between equipment manufacturers and leading foundries accelerate integration of in situ metrology and enable predictive maintenance frameworks that minimize downtime.

Meanwhile, foundries and IDMs are leveraging dedicated pilot lines to validate multiplexed patterning flows, driving tool vendors to deliver modular upgrades and automated calibration services. Cross-company partnerships have also led to federated learning approaches that harmonize overlay controls across global fab networks. As players refine their competitive positions, the resulting ecosystem fosters continuous improvement loops that elevate overall process stability and yield. This dynamic interplay is forging the next chapter in semiconductor scaling, characterized by tighter partnerships and shared risk–reward models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Extreme Ultraviolet Lithography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADVANTEST CORPORATION

- AGC Inc.

- Applied Materials Inc.

- ASML Holding N.V.

- Carl Zeiss AG

- Edmund Optics Inc.

- Energetiq Technology Inc.

- HOYA Corporation

- Intel Corporation

- KLA Corporation

- Lasertec Corporation

- MKS Instruments Inc.

- NTT Advanced Technology Corporation

- NuFlare Technology Inc.

- Park Systems

- Photronics Inc.

- Rigaku Corporation

- Samsung Electronics Co. Ltd.

- SUSS MicroTec SE

- Taiwan Semiconductor Manufacturing Company Limited

- TOPPAN Inc.

- TRUMPF

- Ushio Inc.

- Zygo Corporation

Empowering semiconductor leaders with actionable recommendations to optimize EUV deployment enhance supply chain agility and accelerate innovation cycles

Industry leaders should prioritize a three-pronged strategy that aligns technology readiness with supply chain agility and collaborative innovation. First, integration roadmaps must accommodate staggered tool deployments, pairing proven low-NA platforms for volume production with selective high-NA pilot lines to de-risk next-node initiatives. By sequencing capacity upgrades in harmony with node lifecycles, fabs can optimize capital efficiency and maintain process continuity.

Second, resilient supply network architectures need to incorporate alternative sourcing agreements for critical components such as light sources, pellicles, and advanced photoresists. Dual-sourcing agreements and framework partnerships can protect against export restrictions or logistics disruptions while providing predictable procurement timelines for the most cutting-edge materials.

Third, establishing cross-industry consortia for collaborative tool qualification and in-line metrology standardization will streamline technology transfer between equipment makers, bearers, and end users. Shared validation protocols and federated data platforms drive faster yield ramps and reduce time to revenue. Collectively, these measures will empower semiconductor organizations to translate EUV’s promise into sustained competitive advantage.

Illuminating the rigorous research methodology combining expert interviews data analysis and comprehensive validation processes underpinning the EUV study

The insights presented in this study are grounded in a structured methodology that combines qualitative expert interviews, primary data collection, and rigorous secondary research. Technical deep dives with process engineers, design architects, and supply chain managers provided firsthand perspectives on technology adoption drivers and operational challenges. These interviews encompassed a balanced mix of pure-play foundries, integrated device manufacturers, equipment suppliers, and materials specialists.

Complementing primary inputs, a comprehensive review of published technical papers, patent filings, and standardization organization reports ensured that the analysis reflects the most current industry developments. Data triangulation techniques were employed to validate emerging trends against multiple information sources, while a sensitivity framework was applied to gauge the impact of policy changes and trade measures. Finally, internal validation workshops brought together subject matter experts to refine key findings and validate assumptions, ensuring a robust and actionable deliverable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Extreme Ultraviolet Lithography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Extreme Ultraviolet Lithography Market, by Equipment Type

- Extreme Ultraviolet Lithography Market, by Application

- Extreme Ultraviolet Lithography Market, by Wafer Size

- Extreme Ultraviolet Lithography Market, by End User

- Extreme Ultraviolet Lithography Market, by Resist Material

- Extreme Ultraviolet Lithography Market, by Region

- Extreme Ultraviolet Lithography Market, by Group

- Extreme Ultraviolet Lithography Market, by Country

- United States Extreme Ultraviolet Lithography Market

- China Extreme Ultraviolet Lithography Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing critical insights and strategic imperatives highlighting the transformative journey and future prospects in EUV lithography landscape

This executive summary distills critical learnings on how extreme ultraviolet lithography is redefining the semiconductor roadmap. By examining technological innovations, policy implications, and segmentation nuances, the narrative offers a cohesive view of the opportunities and challenges that lie ahead. Strategic imperatives emphasize the importance of adaptable deployment models, resilient supply networks, and cross-industry collaboration to fully leverage EUV’s potential.

Looking forward, the maturation of high-NA scanners alongside the evolution of resist chemistries and pellicle systems will further expand the envelope of achievable device nodes. Concurrently, policy-driven trade measures will continue to shape global access and procurement strategies, making supply chain agility an enduring priority. Ultimately, organizations that orchestrate technology readiness with strategic partnerships and flexible financing models will unlock the greatest competitive gain in this transformative era of semiconductor manufacturing.

Unlock access to the EUV lithography research briefing by connecting with Associate Director Sales Marketing Ketan Rohom to inform your strategic plans

Unlocking a new frontier in semiconductor innovation begins with a deep dive into the intricacies of extreme ultraviolet lithography and its potential to redefine the boundaries of device performance. Engage directly with Associate Director Sales Marketing Ketan Rohom to inform your strategic plans

- How big is the Extreme Ultraviolet Lithography Market?

- What is the Extreme Ultraviolet Lithography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?