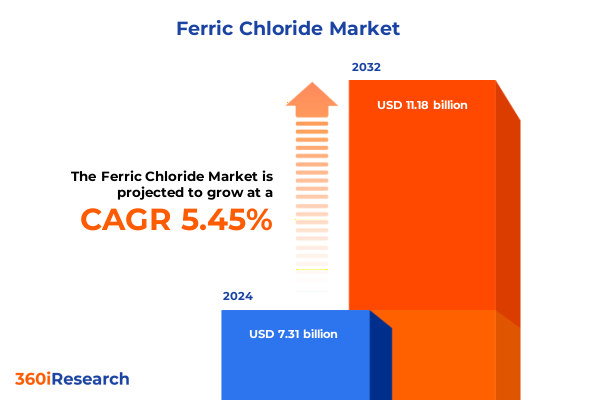

The Ferric Chloride Market size was estimated at USD 7.70 billion in 2025 and expected to reach USD 8.15 billion in 2026, at a CAGR of 5.46% to reach USD 11.18 billion by 2032.

Discover How Ferric Chloride Is Reshaping Industrial Processes Through Its Versatile Applications and Emerging Strategic Importance in Modern Manufacturing

Ferric chloride, an essential industrial chemical, has earned its place as a cornerstone reagent for etching and treatment processes across diverse manufacturing segments. Synthesized through the reaction of iron with chlorine or hydrochloric acid, ferric chloride presents a highly soluble iron(III) complex prized for its oxidative properties. Its intrinsic reactivity and controlled corrosivity enable precise metal removal, making it invaluable for cutting-edge printed circuit board production. Beyond electronics, its capabilities in coagulation underpin critical water treatment applications, while its acidifying behavior supports specialized metal surface treatments. Consequently, ferric chloride acts as a bridge between traditional chemical processes and rapidly evolving industrial demands.

In recent years, the chemical industry has witnessed a strategic elevation of ferric chloride driven by tighter environmental standards and surging digitalization in manufacturing. As environmental regulations intensify, producers and end users are adopting greener process designs that leverage ferric chloride’s recyclability and reduced sludge generation. Meanwhile, advanced imaging and microfabrication techniques in electronics are redefining etching requirements, necessitating superior etchant consistency and purity levels. This convergence of regulatory pressures and technological progress underscores the imperative for industry stakeholders to gain a holistic understanding of the ferric chloride landscape. With this foundation established, subsequent analysis explores the transformative shifts and strategic considerations shaping the market trajectory.

Unveiling the Paradigm Shifts Driving Ferric Chloride Application Dynamics and Market Evolution in the Face of Technological and Environmental Pressures

The ferric chloride landscape is undergoing profound transformations as stakeholders respond to technological innovations and sustainability mandates. In printed circuit board fabrication, the shift from rigid to flexible substrates has amplified the demand for etchants with finely tuned reactivity profiles. This migration toward flexible board etching is complemented by emerging digital lithography methods that require ferric chloride solutions with consistent ionic strength and minimal particulate contamination. Consequently, suppliers are investing in process improvements and real-time quality monitoring to maintain performance in high-precision applications.

Moreover, heightened environmental scrutiny is prompting the rollout of advanced water treatment solutions that exploit ferric chloride’s coagulation efficiency. Municipal treatment plants are increasingly integrating ferric chloride into modular, automated dosing systems to address tightening effluent criteria and reduce sludge handling costs. Concurrently, industrial wastewater treatment operations are adopting hybrid treatment trains that combine ferric chloride coagulation with membrane filtration and advanced oxidation processes. These integrated approaches not only enhance removal efficiencies for challenging contaminants but also foster resource recovery and water reuse, further reinforcing ferric chloride’s role in sustainable industrial practices.

Assessing the Cumulative Impact of United States Trade Tariffs on Ferric Chloride Supply Chains and Pricing Structures in 2025

United States trade policy in 2025 continues to influence the domestic availability and cost structure of ferric chloride, shaping strategic procurement and production decisions. Cumulative tariffs imposed under Section 232 and Section 301 extend beyond steel and aluminum into specialty chemicals, elevating import duties on key raw materials sourced from major exporting countries. As a result, chemical producers are facing increased landed costs, necessitating the recalibration of supply chain strategies. Many end users are exploring domestic sourcing alternatives or engaging in long-term supply agreements with select overseas suppliers willing to absorb part of the tariff burden to maintain market share.

These tariff-driven adjustments have also spurred geographic diversification of raw material procurement. Companies are establishing new partnerships with suppliers in regions exempt from high duty rates or negotiating tariff mitigation through foreign trade zones. In parallel, there is a gradual shift toward upstream vertical integration to secure controllable access to ferric chloride feedstocks. Although the immediate effect has been moderate cost inflation, the cumulative impact is setting the stage for a more resilient and regionally balanced supply network. Consequently, industry players are realigning capital investments and operational footprints to optimize production efficiencies under the new trade environment.

Deriving Segmentation Insights Revealing Usage Patterns Across Application Types, Product Forms, Grades, Packaging Options, and Distribution Channels

The ferric chloride market is meticulously segmented across multiple dimensions to reveal nuanced usage patterns and competitive dynamics. Based on application, the market is studied across Circuit Board Etching, Metal Surface Treatment, and Water Treatment. Circuit Board Etching is further explored through Flexible Board Etching and Rigid Board Etching, each with distinct performance and quality criteria. Metal Surface Treatment is dissected into Metal Etching, Passivation, and Pickling processes, where ferric chloride’s corrosive and complexing abilities are leveraged differently. Water Treatment is examined in the contexts of Industrial Process Water Treatment, Industrial Wastewater Treatment, and Municipal Treatment, reflecting varied purity and dosing protocols.

Product form segmentation examines ferric chloride in flake, liquid, and powder variations, each offering unique handling and storage characteristics. Grade distinctions highlight electronic grade, food grade, and industrial grade offerings, emphasizing purity levels and regulatory compliance requirements. Packaging insights account for bag, bulk, and drum configurations, tailored to user volume and logistics preferences. Finally, sales channel analysis spans direct procurement from manufacturers, distributor networks offering regional stock availability, and online platforms that enable rapid access for smaller end users. These segmentation layers collectively provide a comprehensive lens into how ferric chloride is tailored to meet specific operational demands across end-use industries.

This comprehensive research report categorizes the Ferric Chloride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Grade

- Packaging

- Application

- Sales Channel

Exploring Key Regional Variations Impacting Ferric Chloride Adoption and Industrial Applications Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in defining ferric chloride utilization trends, reflecting disparate regulatory regimes, industrial infrastructures, and resource endowments. In the Americas, stringent effluent regulations in North America and the expansion of advanced electronics manufacturing hubs have driven demand for high-purity ferric chloride solutions. Meanwhile, Latin American markets are gradually scaling up water treatment capacity, creating incremental demand for coagulation chemicals. Collaborative initiatives between municipal authorities and private water service providers are fostering the implementation of ferric chloride-based treatment modules in rapidly urbanizing areas.

Within Europe, Middle East & Africa, known collectively as EMEA, regulatory frameworks are emphasizing circular economy principles and resource recovery. European chemical producers are adopting closed-loop ferric chloride reclamation systems to minimize waste streams, while Middle Eastern industrial corridors are integrating ferric chloride into large-scale wastewater treatment initiatives to address water scarcity. Africa’s emerging manufacturing sectors are at an earlier stage of technology adoption but are poised for accelerated growth as infrastructure investments increase.

Asia-Pacific remains the fastest-evolving region, driven by the proliferation of flexible electronics manufacturing in East Asia and the expansion of municipal water treatment facilities in South Asia. Government incentives in countries such as China and India are reinforcing water reuse targets, bolstering ferric chloride demand. Moreover, several Asia-Pacific producers are exporting specialized grades of ferric chloride to global markets, leveraging cost-competitive production platforms and proximity to raw material sources.

This comprehensive research report examines key regions that drive the evolution of the Ferric Chloride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Ferric Chloride Manufacturers and Suppliers Shaping Industry Innovation, Competitive Strategies, and Operational Excellence Worldwide

Prominent chemical producers are vying to strengthen their positions in the ferric chloride space through strategic capacity expansions, product development, and value-added services. Leading global suppliers are investing in high-purity electronic grade formulations to capture a larger share of the advanced printed circuit board etching segment. Some firms have introduced concentrated liquid solutions combined with integrated monitoring packages that optimize dosing accuracy and minimize waste. Others are focusing on specialized formulations for water treatment, blending ferric chloride with coagulant polymers to deliver enhanced contaminant removal and lower sludge volumes.

Collaborative partnerships and joint ventures are also reshaping the competitive landscape. Major manufacturers are aligning with engineering firms to deliver turnkey coagulation systems, while smaller niche players are carving out market niches by providing tailored reagent blends for metal surface treatment. Additionally, investor interest in sustainable chemical processes is prompting several companies to enhance their environmental credentials through third-party certifications, waste valorization projects, and circular economy initiatives. These efforts are designed to differentiate offerings, secure premium pricing, and forge long-term customer relationships based on operational excellence and sustainability performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ferric Chloride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BPS Products, Inc.

- Chemifloc Limited

- Covia Holdings Inc.

- Gulf Fluor

- Kemira Oyj

- Kish Company, Inc.

- PVS Chemicals, Inc.

- Seqens Group

- Sidra Wasserchemidt GmbH

- Tessenderlo Group

- Tessy Skylabs

- Thatcher Company

- Vinnolit GmbH & Co. KG

Empowering Industry Leaders with Actionable Recommendations to Drive Growth, Enhance Sustainability, and Optimize Ferric Chloride Utilization Strategies

Industry leaders looking to capitalize on ferric chloride’s full potential should prioritize investments in advanced process control technologies that ensure consistent reagent performance. By integrating real-time analytical tools and digital dashboards, companies can reduce batch variability and optimize reagent usage, driving both cost efficiencies and quality improvements. Additionally, forging collaborative partnerships with end-users to co-develop specialized formulations can unlock new application opportunities and strengthen customer loyalty.

Furthermore, supply chain resilience must be elevated through diversified sourcing strategies and strategic inventory positioning. Establishing multiple supply corridors, including near-site production or toll manufacturing agreements, will mitigate tariff risks and geopolitical uncertainties. Embracing sustainable practices by implementing reagent recovery systems and waste valorization processes can also enhance environmental compliance and create novel revenue streams from byproduct sales. Ultimately, aligning product innovation with emerging digital and environmental trends will position organizations to lead in the evolving ferric chloride landscape.

Highlighting a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Quantitative Techniques for Ferric Chloride Market Insights

This research employs a multi-pronged methodology, beginning with primary interviews conducted with key stakeholders across the ferric chloride value chain, including chemical producers, formulators, equipment vendors, and end-users in electronics and water treatment sectors. Insights from these discussions have been triangulated against secondary data derived from regulatory publications, industry journals, and specialized trade press to validate trends and emerging challenges. Quantitative analysis techniques, such as cross-segment correlation and usage pattern modeling, have been applied to refine segmentation insights and identify high-impact applications.

Data integrity has been ensured through multiple rounds of internal quality checks and expert panel reviews. Respondent feedback has been calibrated against historical process data, trade flow statistics, and company press releases to maintain accuracy. Geographic coverage spans key production and consumption regions, enabling comparative assessments of regulatory impacts and technology adoption rates. This robust methodological framework underpins the report’s strategic insights and actionable recommendations, offering decision-makers a reliable foundation for informed planning and investment in the ferric chloride ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ferric Chloride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ferric Chloride Market, by Product Form

- Ferric Chloride Market, by Grade

- Ferric Chloride Market, by Packaging

- Ferric Chloride Market, by Application

- Ferric Chloride Market, by Sales Channel

- Ferric Chloride Market, by Region

- Ferric Chloride Market, by Group

- Ferric Chloride Market, by Country

- United States Ferric Chloride Market

- China Ferric Chloride Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Strategic Imperatives and Emerging Opportunities That Will Define Future Success in Ferric Chloride Markets Globally

In summary, ferric chloride continues to emerge as a vital reagent driving innovation in circuit board etching, metal surface treatment, and water purification processes worldwide. Technological advancements and regulatory imperatives have catalyzed shifts toward higher-purity formulations, integrated treatment systems, and sustainable process designs. Simultaneously, evolving trade policies and tariff structures are reshaping supply chain dynamics, compelling industry stakeholders to adopt more resilient and diversified procurement strategies.

Looking ahead, organizations that strategically align their product portfolios with digital process monitoring, environmental compliance, and collaborative development models will secure a competitive edge. Regional nuances-from high-growth Asia-Pacific electronics hubs to resource-constrained EMEA water treatment projects-underscore the importance of tailored strategies. By leveraging the insights and recommendations outlined here, decision-makers can navigate emerging challenges and capitalize on the expanding applications of ferric chloride. Ultimately, understanding the interplay between evolving market forces and technology trends will be critical to achieving long-term success in this dynamic sector.

Connect with Ketan Rohom To Unlock In-Depth Expertise and Secure Your Comprehensive Ferric Chloride Market Research Report Today

To gain a deeper competitive edge and unparalleled insights into the dynamics of the ferric chloride market, reach out directly to Ketan Rohom, whose expertise in sales and marketing strategy can guide you through tailored research solutions. Whether you aim to refine procurement strategies, evaluate emerging use cases, or benchmark supplier performance, engaging with Ketan will unlock the full breadth of actionable intelligence and best practices that drive superior decision-making. Information provided will be aligned with your organization’s objectives, ensuring that every recommendation is practical, timely, and aligned with industry standards. Connect with Ketan today to schedule a personalized consultation and secure immediate access to the comprehensive ferric chloride market research report.

- How big is the Ferric Chloride Market?

- What is the Ferric Chloride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?