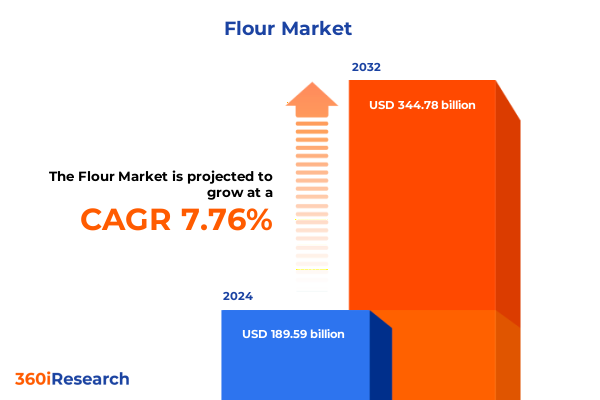

The Flour Market size was estimated at USD 204.06 billion in 2025 and expected to reach USD 219.64 billion in 2026, at a CAGR of 7.78% to reach USD 344.78 billion by 2032.

Exploring the Flour Market’s Evolution Driven by Consumer Trends, Technological Advances, and Global Supply Chain Transformations

Flour has long served as a cornerstone ingredient in a diverse array of food products, underpinning daily staples such as bread, pasta, and pastries. Beyond its foundational role in culinary traditions, its market dynamics reflect broader shifts in consumer preferences, manufacturing innovations, and global trade patterns. As demand for both conventional and alternative flours escalates, industry stakeholders are navigating the complexities of supply chain resilience, ingredient traceability, and regulatory compliance to meet evolving requirements.

In recent years, the sector’s evolution has been characterized by an intensified focus on health-oriented and specialty offerings. Driven by a growing appetite for gluten-free, high-protein, and organic alternatives, flour producers are investing in advanced milling techniques and precision blending to deliver differentiated products. In parallel, digital transformation across retail and distribution channels has empowered smaller artisanal mills to reach targeted audiences, reshaping competitive dynamics. Consequently, the stage is set for a profound redefinition of how flour is produced, distributed, and consumed.

Revolutionary Shifts Shaping Flour Production, Distribution, and Consumption Patterns in the Wake of Innovation and Sustainability Demands

The flour industry is experiencing an unprecedented wave of change fueled by innovation in production technologies and a heightened emphasis on sustainability. Automation and sensor-driven milling operations are enhancing yield consistency, reducing process inefficiencies, and enabling real-time quality assurance. Moreover, digital platforms for order management and logistics coordination have streamlined interactions between millers, distributors, and end-users, fostering greater agility and responsiveness.

Simultaneously, environmental stewardship has emerged as a critical driver of strategic decision-making. Mills and ingredient suppliers are increasingly adopting regenerative agriculture practices to preserve soil health and reduce carbon footprints. Packaging innovations-ranging from compostable bags to reusable bulk solutions-are mitigating waste and appealing to eco-conscious consumers. In turn, holistic supply chain transparency initiatives are enhancing stakeholder trust by offering end-to-end traceability of grain origins and processing methods.

Furthermore, shifting consumer behaviors are reinforcing these transformative shifts. A growing segment of shoppers prioritizes clean-label products, seeking clarity on ingredient sourcing and production ethics. This demand is catalyzing partnerships between legacy producers and specialty growers to co-develop novel flour variants that balance nutrition, flavor, and functional performance. As a result, the landscape of flour production and distribution is being reimagined through the convergence of technology, sustainability, and consumer empowerment.

Assessing the Ripple Effects of Recent United States Tariff Policies on Flour Imports, Costs, and Industry Sourcing Strategies in 2025

Recent tariff adjustments implemented by the United States have created ripple effects throughout the flour supply network. With increased duties levied on certain imported wheat and nut-based flours, domestic manufacturers are reassessing procurement strategies to manage cost pressures. These policy changes have translated into higher input expenses for downstream processors, compelling some organizations to renegotiate contracts or explore alternative ingredient sources within local markets.

Moreover, the cumulative impact of these tariffs has prompted a reevaluation of global sourcing partnerships. While some millers have deepened investments in domestic grain cultivation to offset import constraints, others are forging alliances with producers in low-tariff jurisdictions to diversify risk. In parallel, the rise in logistical complexity has underscored the importance of supply chain visibility tools, enabling stakeholders to anticipate disruptions and maintain consistent raw material availability. Collectively, these shifts underscore how trade policy in 2025 is reshaping cost structures and strategic priorities for flour industry participants.

Unveiling Critical Consumer and Channel Segmentation Insights Fueling Flour Market Diversification and Tailored Product Strategies Across Multiple Categories

A nuanced examination of market segmentation reveals distinctive drivers across flour types, applications, distribution channels, packaging formats, and grades. Within the type category, traditional wheat flours coexist alongside corn flour and a rapidly expanding specialty segment featuring almond, chickpea, and coconut variants. Each subcategory commands unique processing requirements and appeals to different consumer cohorts, from artisanal bakers to health-focused home cooks.

Application-based segmentation further illuminates demand patterns across bakery products, confectionery, and pasta and noodle manufacture. Bread, cakes, pastries, cookies, and biscuits rely heavily on all-purpose and bread flours, whereas sugar and chocolate confections increasingly incorporate alternative flours for texture and nutritional enhancement. Meanwhile, noodles and pasta producers are experimenting with novel blends to meet regional taste preferences and dietary restrictions.

Distribution channel insights highlight the growing influence of online retail alongside traditional supermarkets, hypermarkets, and specialty stores. Convenience outlets continue to serve immediate consumption needs, particularly in urban centers. In tandem, packaging preferences span bulk formats for industrial use to retail sizes under one kilogram and larger packages up to fifty kilograms, accommodating both commercial bakers and value-conscious consumers. Finally, the dichotomy between conventional and organic grades underscores divergent consumer priorities, with organic flours commanding premium positioning among eco-minded and health-driven buyers.

This comprehensive research report categorizes the Flour market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- Distribution Channel

- Packaging

- Grade

Highlighting the Distinctive Regional Dynamics and Consumption Patterns Driving Flour Market Growth Across the Americas, EMEA, and Asia-Pacific

Across the Americas, the flour industry is bolstered by vast wheat-producing regions in North America and a mature baked goods market. This region’s vendors benefit from well-established distribution networks and a high degree of vertical integration, enabling efficient coordination between grain cultivation, milling, and retail operations. Furthermore, strong consumer interest in protein-enriched and gluten-free products continues to drive innovation among local producers, who leverage advanced processing technologies to introduce value-added offerings.

In Europe, the Middle East, and Africa, diverse regulatory frameworks and cultural preferences shape distinct consumption patterns. While Western Europe exhibits steady demand for whole-grain and ancient wheat varieties, markets in the Middle East and North Africa often rely on refined wheat flours for staple flatbreads and pastries. Procurement strategies vary accordingly, with local milling capacity complemented by strategic imports. Sustainability mandates from the European Union are also prompting regional producers to adopt eco-certifications and invest in low-impact packaging.

The Asia-Pacific region stands out for its rapid urbanization and growing bakery chain expansion. Rising incomes and changing dietary habits are fueling demand for bakery products, noodles, and confectionery, leading to increased flour consumption per capita. Local preferences for rice flour and cassava-based blends also coexist with wheat flour variants, creating a dynamic interplay of traditional and modern formulations. As a result, regional millers are tailoring product portfolios to reflect both indigenous staples and emerging global trends.

This comprehensive research report examines key regions that drive the evolution of the Flour market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Initiatives, Partnerships, and Innovations of Leading Flour Industry Players Driving Competitive Advantage and Market Leadership

Leading flour industry players are deploying strategic initiatives to maintain market leadership and capture emerging opportunities. Some organizations are prioritizing investments in innovative milling technologies that enhance particle size control and nutrient retention, thereby differentiating their product lines. At the same time, high-profile partnerships between manufacturers and ingredient specialists are accelerating the development of tailored solutions for bakery, confectionery, and pasta producers.

In addition, top-tier companies are forging alliances across the value chain to improve sustainability credentials and secure raw material access. Collaborations with agricultural cooperatives and technology providers are enabling traceable sourcing models. Furthermore, targeted acquisitions of regional mills and specialty brands are expanding geographic reach and product diversity. Through these concerted efforts, industry leaders are solidifying their competitive positioning and driving continual innovation in a rapidly evolving landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flour market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Ardent Mills LLC

- Associated British Foods plc

- Bunge Limited

- Cargill, Incorporated

- China National Cereals, Oils and Foodstuffs Corporation

- General Mills, Inc.

- GrainCorp Limited

- Grupo Minsa, S.A.B. de C.V.

- Wilmar International Limited

Delivering Actionable Strategic Recommendations for Flour Industry Leaders to Capitalize on Emerging Trends, Strengthen Supply Chains, and Enhance Profitability

Industry leaders can fortify their market position by investing in end-to-end digital platforms that unify procurement, production planning, and quality monitoring. By leveraging data analytics, millers can anticipate demand shifts, optimize batch scheduling, and reduce waste. In addition, enhancing supply chain visibility through blockchain or AI-driven traceability tools can bolster resilience against geopolitical disruptions and evolving trade policies.

Moreover, brand portfolios should be reevaluated to align with shifting consumer priorities. Expanding offerings of specialty flours and clean-label formulations can capture higher-margin segments, while premium organic lines appeal to eco-conscious demographics. Concurrently, agile packaging solutions that enable portion control and sustainability will resonate with modern buyers seeking convenience without compromising environmental responsibility.

Finally, strategic collaboration with downstream partners-such as bakeries and food service operators-can generate co-innovation opportunities. Joint product development initiatives, co-branded promotions, and pilot programs for novel formulations will strengthen channel relationships and accelerate market acceptance. By adopting these recommendations, flour industry participants can navigate complexity, harness emerging trends, and drive long-term growth.

Illuminating the Rigorous Research Methodology Employed to Deliver Comprehensive, Objective, and Actionable Intelligence on the Flour Market Landscape

This research adhered to a comprehensive methodology that integrates primary and secondary data sources. Initial insights were gathered through in-depth interviews with senior executives and supply chain experts, providing qualitative perspectives on strategic priorities, operational challenges, and emerging opportunities within the flour industry. These conversations were conducted across key regions to ensure broad representation of market dynamics.

Secondary data collection involved rigorous analysis of industry publications, academic research, trade association reports, and regulatory filings. Data points were cross-validated through triangulation to ensure reliability and to reconcile any discrepancies among sources. In addition, supply chain mapping exercises were undertaken to delineate value-chain interdependencies and identify critical leverage points.

Throughout the research process, stringent quality control measures were enforced. Data integrity checks, peer reviews, and methodological audits were conducted to uphold objectivity and accuracy. This robust framework has produced actionable intelligence that is both comprehensive in scope and finely attuned to the strategic needs of industry decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flour market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flour Market, by Type

- Flour Market, by Application

- Flour Market, by Distribution Channel

- Flour Market, by Packaging

- Flour Market, by Grade

- Flour Market, by Region

- Flour Market, by Group

- Flour Market, by Country

- United States Flour Market

- China Flour Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Insights to Reinforce Strategic Decision-Making and Propel Flour Market Success Through Innovation, Efficiency, and Collaboration

The flour market stands at a pivotal juncture, shaped by transformative technological advances, shifting consumer preferences, and the evolving tapestry of global trade policies. As the industry continues to embrace digitalization, sustainability, and product innovation, stakeholders must remain agile in responding to both challenges and opportunities. The interplay of these forces will define competitive positioning and long-term viability.

In summary, a deep understanding of segmentation nuances, regional dynamics, and corporate strategies is essential for business leaders seeking to guide their organizations through this dynamic environment. By synthesizing insights on production technologies, sustainability initiatives, tariff impacts, and distribution trends, decision-makers can craft informed strategies that capitalize on growth pockets and mitigate emerging risks. Ultimately, this coherent approach will empower organizations to drive innovation, deliver value to consumers, and secure a leading role in the flour market’s next chapter.

Empower Your Business Growth Today by Partnering with Ketan Rohom to Access the Definitive Flour Market Intelligence for Informed Strategic Decisions

Are you ready to transform your market understanding into decisive action? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the definitive flour market research report. With tailored insights and expert guidance, you can refine growth strategies, optimize supply chains, and stay ahead of emerging trends. Connect with Ketan today to secure comprehensive intelligence and empower your organization’s strategic planning for lasting competitive advantage

- How big is the Flour Market?

- What is the Flour Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?