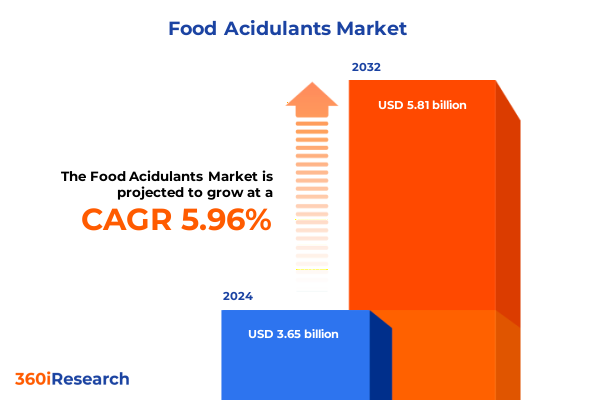

The Food Acidulants Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.10 billion in 2026, at a CAGR of 5.96% to reach USD 5.81 billion by 2032.

Unveiling the Vital Role of Acidulants in Food Formulation to Enhance Flavor Profiles, Shelf Stability, and Consumer Appeal Across Industries

Food acidulants occupy a central position in modern food science, offering much more than simple pH adjustment. Their multifunctional properties extend to enhancing flavor profiles, enabling microbial control, and improving texture in a broad range of products. As flavor trends evolve to favor clean labels and natural ingredient lists, food developers increasingly rely on acidulants to impart vibrant brightness and tartness without compromising on clarity or color. From tangy dairy desserts to effervescent beverages, these compounds underpin texture, stability, and safety across diverse applications.

In addition, regulatory pressure for reduced sodium content and cleaner ingredient decks has heightened interest in acidulants as versatile alternatives to traditional preservatives. By maintaining microbial safety through pH reduction rather than high salt levels, acidulants support both health and taste objectives. As manufacturers innovate to meet consumer demand for more natural, minimally processed foods, acidulants emerge as essential functional ingredients that deliver consistency in quality and shelf life under fluctuating supply conditions and production scales.

Furthermore, the growing emphasis on product personalization and global flavor fusions has prompted formulators to experiment with synergistic blends of organic acids. This trend reflects a deeper understanding of how subtle acid combinations can modulate taste sensations and mouthfeel, creating novel sensory experiences. Consequently, food acidulants now represent a nexus of flavor innovation, safety assurance, and sustainability, positioning them as indispensable tools in the toolkit of ingredient specialists and product developers alike.

Exploring Key Transformations Shaping the Food Acidulants Market Through Technological, Regulatory, and Consumer-Driven Innovations

The landscape of food acidulants is undergoing transformative shifts driven by technological breakthroughs in ingredient processing and heightened consumer scrutiny over ingredient provenance. In recent years, advanced extraction and fermentation techniques have expanded the availability of organic acids derived from plant and microbial sources. These processes not only improve yield efficiency but also align with sustainability goals by reducing energy usage and greenhouse gas emissions compared to petrochemical-derived counterparts.

Concurrently, consumer awareness around clean-label claims has prompted product developers to seek acidulants produced through natural fermentation pathways, thereby reinforcing brand transparency and trust. As a result, manufacturers are investing in traceability systems and blockchain-enabled supply chain tracking to certify the origin and purity of their acidulant offerings. These digital innovations are reshaping procurement strategies, enabling quicker responses to quality concerns and regulatory audits, and facilitating deeper collaboration between suppliers and end users.

Moreover, regulatory landscapes in major markets are evolving to account for novel acidulant sources and applications, requiring businesses to adapt swiftly. For instance, updated guidelines around natural labeling in North America and Europe have created opportunities and challenges alike, compelling stakeholders to refine their communication strategies and compliance frameworks. Taken together, these developments signify a new era where technology, transparency, and regulation converge to define the next chapter in acidulant evolution.

Analyzing the Multifaceted Impact of 2025 United States Tariff Policies on Sourcing, Pricing, and Trade Dynamics for Acidulants

With the enactment of new tariff schedules in early 2025, the United States has introduced adjusted duties on select imported acidulant grades, yielding a complex array of cost implications for downstream producers. This tariff revision primarily targets acidulants sourced from regions with historically lower production costs, altering the price competitiveness of certain organic acids in domestic formulations. As import duties rise, manufacturers face immediate pressure to reassess sourcing strategies and renegotiate supplier contracts to mitigate escalating input costs.

In response, many food and beverage companies are exploring regional procurement options to offset tariff burdens. Sourcing citric acid and lactic acid from North America and Mexico has gained traction, supported by trade agreements that preserve lower duty rates. However, these shifts also necessitate scrutiny of supply chain resilience and continuity, as alternative geographic sources may entail lead-time adjustments and potential logistical bottlenecks.

Furthermore, the ripple effects of tariff-driven cost increases extend to consumer pricing, with several major brands signaling incremental price adjustments to maintain margin targets. This dynamic underscores the importance of strategic inventory management and forward-purchase agreements to shield against volatility. Importantly, continued dialogue with policy stakeholders and industry associations remains critical, as tariff review processes can yield mid-year adjustments. Therefore, businesses that proactively engage in advocacy and data-sharing initiatives stand to influence favorable revisions and safeguard supply stability.

Decoding Critical Segmentation Insights by Application, Type, Form, Function, End Use, and Distribution Channels Driving Market Differentiation

A nuanced understanding of market segmentation sheds light on the differentiated demand patterns shaping acidulant adoption. When considering the diverse range of applications, it becomes evident that its role in bakery and confectionery formulations emphasizes texture and preservative efficacy, while in beverages the focus shifts toward flavor enhancement and pH balance to support carbonation. In convenience foods, formulators leverage acidulants to maintain visual appeal and prevent microbial spoilage, whereas dairy and frozen products rely on them for controlled crystallization and shelf-life extension. Furthermore, dressings and sauces utilize acidulants to achieve the desired tang and viscosity, and in meat, poultry, and seafood, they function as critical inhibitors of bacterial growth during processing and packaging.

Examining the various acid types reveals that acetic, citric, lactic, malic, phosphoric, and tartaric acids each offer unique sensory and functional profiles that align with specific formulation challenges. For instance, citric acid’s clean, fruity acidity makes it a mainstay in beverage and confectionery sectors, while phosphoric acid remains indispensable for cola and savory snack seasoning. Meanwhile, lactic and malic acids deliver nuanced mouthfeel modulation in dairy and fruit-based applications.

Looking at physical form, liquid acidulants facilitate rapid dispersion in mixing systems but require specialized handling equipment, whereas powder variants appeal to dry blend formulations and extended shelf stability. The functional role further carves out niches, with certain acidulants serving primarily as acidity regulators, others providing distinct flavor notes, and some yielding dual benefits as preservatives. End-use considerations span food and beverage manufacturing to pharmaceuticals, personal care, and even animal feed, demonstrating acidulants’ versatility. Distribution channels, ranging from food service and institutional outlets to retail networks, round out a comprehensive segmentation picture whereby each dimension informs targeted strategies for supplier differentiation and customer engagement.

This comprehensive research report categorizes the Food Acidulants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Function

- Application

- End Use

- Distribution Channel

Uncovering Regional Nuances and Growth Dynamics Across the Americas, EMEA, and Asia-Pacific in the Global Acidulants Landscape

Regional dynamics underscore the complexity and opportunity inherent in the global acidulants marketplace. In the Americas, the United States and Brazil lead in both production and innovation, with strong infrastructure supporting large-scale fermentation and chemical synthesis. Mexico’s growing trade relationships further reinforce supply diversity, enabling North American formulators to navigate evolving tariff landscapes with greater agility. Cross-border collaboration and investments in regional production plants have enhanced supply chain security and minimized lead times for core acidulant products.

Turning to Europe, Middle East, and Africa, stringent regulatory frameworks in the European Union drive demand for certified natural and non-GMO acidulants, thereby fostering premium positioning for high-purity grades. Meanwhile, rapid urbanization in Middle Eastern markets has accelerated food service growth, elevating the need for reliable preservative systems. In Africa, the emergence of localized manufacturing hubs-particularly in South Africa and North Africa-signals increasing self-sufficiency, bolstered by partnerships with global ingredient suppliers and technology licensors.

Asia-Pacific remains a dynamic landscape characterized by significant private-sector investment in research and development. China’s domestic production capacity for citric and lactic acids continues to expand, while Southeast Asian economies such as Thailand and Indonesia leverage abundant agricultural feedstocks to scale fermentation-based acidulant manufacturing. These developments, coupled with rising consumer interest in functional foods, position the region as a hub for both volume-driven growth and niche innovation in acidulant applications.

This comprehensive research report examines key regions that drive the evolution of the Food Acidulants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Driving Innovation, Collaboration, and Competitive Advantage in Acidulants

The competitive arena for food acidulants is distinguished by a mix of traditional chemical manufacturers and specialized ingredient firms, each leveraging distinct capabilities. Large-scale producers with extensive global footprints capitalize on integrated supply chains and economies of scale to offer a broad portfolio encompassing both commodity-grade and high-purity acids. These firms invest heavily in process optimization to reduce production costs and environmental impact, often showcasing carbon footprint reductions and energy-efficient processes in sustainability reports.

Conversely, niche ingredient developers focus on innovation through proprietary fermentation strains or green chemistry techniques, differentiating their offerings on the basis of natural origin and minimal processing. Partnerships between these specialized players and technology companies have led to advancements in bio-based acidulant production, enabling more consistent quality and novel functional attributes such as controlled-release profiles and tailored sensory impacts.

Additionally, strategic collaborations between suppliers and end users have become increasingly prevalent, enabling co-development of customized acid blends and private-label solutions. These alliances foster stronger alignment on product specifications, regulatory compliance, and cost management, thereby reinforcing customer loyalty and shortening product development cycles. Ultimately, the interplay of scale, innovation, and collaboration shapes the competitive contours of the acidulants market, driving continuous enhancement of product performance and value proposition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Acidulants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American International Foods, Inc.

- Archer Daniels Midland Company

- ATPGroup

- B.C.H. America, Inc.

- Batory Foods

- Brenntag Holding GmbH

- Cargill, Incorporated

- Corbion N.V.

- Eastman Chemical Company

- FBC Industries, Inc.

- Foodchem International Corporation

- Jungbunzlauer Suisse AG

- Maruzen Chemicals Co., Ltd.

- Tate & Lyle PLC

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Navigate Market Complexity and Capitalize on Emerging Acidulant Trends

Industry leaders must adopt proactive strategies to secure competitive positioning amidst evolving market pressures and regulatory shifts. First, diversifying the supplier ecosystem is critical to mitigate risks associated with tariff fluctuations and raw material volatility. Establishing relationships with regional producers and exploring co-manufacturing agreements can ensure continuity of supply while controlling costs.

Equally important is the acceleration of innovation pipelines through targeted investments in R&D. By leveraging advances in biotechnology, companies can develop next-generation acidulant solutions that offer enhanced sensory profiles and tailored functionality. Collaboration with academic institutions and technology firms will be instrumental in driving these innovations from concept to commercialization. A focus on sustainable production methods will also resonate with increasingly eco-conscious consumers and support brand differentiation.

Moreover, transparent communication around ingredient sourcing and manufacturing practices builds trust and aligns with clean-label imperatives. Implementing robust traceability platforms not only addresses regulatory requirements but also provides a foundation for storytelling that enhances brand value. Finally, engaging with policymakers and trade bodies through data-driven advocacy ensures that industry voices shape future regulatory frameworks. By combining supply chain resilience, innovation leadership, brand transparency, and active stakeholder engagement, organizations can fully capitalize on emerging acidulant trends.

Outlining a Rigorous Research Methodology Incorporating Primary Interviews, Secondary Analysis, and Quantitative Techniques for Reliable Market Insights

This report’s findings are underpinned by a rigorous research methodology that integrates primary and secondary data sources. In-depth interviews with senior executives from ingredient suppliers, food and beverage manufacturers, and distribution partners provided qualitative insights into market dynamics, regulatory impacts, and innovation drivers. These stakeholder discussions were complemented by quantitative data collection, encompassing production volumes, trade flows, and cost structures, to ensure a balanced and empirically grounded analysis.

Secondary research included an exhaustive review of industry publications, regulatory filings, and sustainability reports to validate emerging themes and benchmark best practices. Market intelligence databases and trade association records informed the assessment of tariff changes and regional supply trends. Data triangulation techniques were applied to reconcile discrepancies across sources and enhance accuracy.

Furthermore, advanced analytical models were utilized to map segmentation dimensions and evaluate the relative attractiveness of applications, functions, and regions. Scenario analysis examined potential shifts resulting from policy adjustments and technological breakthroughs. Throughout the process, stringent quality assurance protocols were maintained, including peer reviews and expert validation, to uphold the credibility and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Acidulants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Acidulants Market, by Type

- Food Acidulants Market, by Form

- Food Acidulants Market, by Function

- Food Acidulants Market, by Application

- Food Acidulants Market, by End Use

- Food Acidulants Market, by Distribution Channel

- Food Acidulants Market, by Region

- Food Acidulants Market, by Group

- Food Acidulants Market, by Country

- United States Food Acidulants Market

- China Food Acidulants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Evolving Role of Acidulants and Strategic Pathways for Stakeholders to Drive Sustainable Growth and Innovation

In summary, food acidulants are increasingly recognized not merely as functional additives but as strategic enablers of flavor innovation, safety assurance, and sustainable product development. The convergence of technological advancements, shifting regulatory landscapes, and consumer demand for transparency has elevated their significance within the broader food ingredients ecosystem. Stakeholders who harness the multifaceted potential of acidulants stand poised to unlock new avenues for differentiation and value creation.

Moreover, the introduction of 2025 tariff adjustments underscores the importance of agile sourcing strategies and proactive engagement with trade policymakers. Companies that navigate these complexities with foresight and collaboration will mitigate risks and stabilize supply costs. By aligning segmentation insights with regional growth trajectories and competitive intelligence, businesses can refine their go-to-market approaches and tailor solutions to evolving consumer preferences.

Ultimately, the ability to integrate strategic recommendations-ranging from supplier diversification to traceability investments-will determine industry leaders’ success in capturing emerging opportunities. As the acidulants domain continues to evolve, a forward-looking mindset, grounded in robust research and agile execution, will be essential for driving sustained growth and innovation.

Engage with Ketan Rohom for Tailored Acidulant Market Intelligence to Drive Strategic Advantage and Informed Decision-Making

For customized insights and a deep dive into the latest market intelligence on acidulants, connect with Ketan Rohom. As an Associate Director specializing in sales and marketing for market research, Ketan Rohom possesses the expertise to guide you through the strategic value of a comprehensive report. By partnering with him, you gain direct access to curated data, expert analysis, and actionable recommendations tailored to your unique business challenges and aspirations. Initiating this dialogue ensures you are equipped with the clarity and precision needed to optimize formulations, streamline supply chains, and anticipate regulatory changes.

Engagement with Ketan Rohom is more than a transaction; it’s an opportunity to collaborate with a seasoned professional who understands the complexities of ingredient markets and can translate research findings into practical strategies. Reach out today to schedule a personalized consultation, preview report excerpts, and discuss package options that align with your budget and timeline. Seize this chance to transform your approach to acidulants by leveraging robust, up-to-date intelligence that positions you ahead of competitors and empowers decision-making across R&D, procurement, and marketing domains. Your roadmap to enhanced profitability and innovation starts with one conversation.

- How big is the Food Acidulants Market?

- What is the Food Acidulants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?