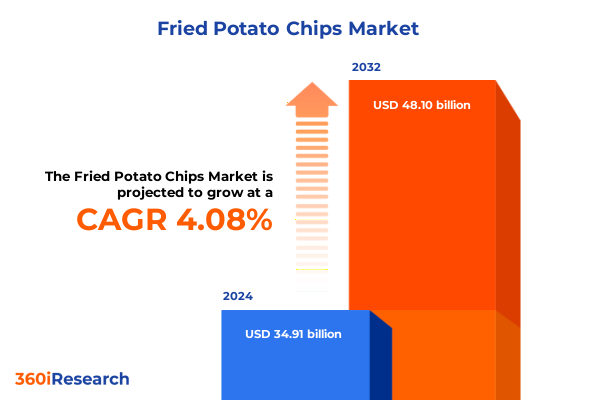

The Fried Potato Chips Market size was estimated at USD 36.35 billion in 2025 and expected to reach USD 37.89 billion in 2026, at a CAGR of 4.08% to reach USD 48.10 billion by 2032.

Unveiling the Transforming Landscape of Fried Potato Chips Through Consumer Trend Analysis, Production Innovations, and Emerging Market Evolution Insights

The fried potato chip industry has evolved far beyond a simple snack option, becoming a dynamic sector that mirrors broader shifts in consumer lifestyle, technological innovation, and global trade patterns. As consumer demand for convenience foods continues to surge, this industry stands at the forefront of snacking, combining heritage practices with forward-looking approaches to meet diverse palate preferences. The interplay of artisanal small-batch producers and global conglomerates has created a competitive environment in which agility, brand differentiation, and supply chain resilience determine market leadership.

This executive summary offers a panoramic view of the fried potato chip landscape, highlighting the most consequential developments that will define industry momentum through 2025 and beyond. It distills critical insights across transformative trends, tariff impacts, segmentation dynamics, regional variances, and corporate strategies. Additionally, it outlines actionable recommendations and the rigorous methodology underpinning these findings, culminating in strategic imperatives for decision-makers. By synthesizing complex data into clear narratives, this summary equips stakeholders with the foundational knowledge needed to navigate market complexities and identify high-impact growth levers.

Examining Revolutionary Shifts Driving the Fried Potato Chips Industry via Technological Advances, Evolving Consumer Preferences, and Distribution Innovations

At the core of the industry’s evolution are profound shifts in how fried potato chips are produced, marketed, and consumed. Health-conscious consumers are reimagining snack choices, demanding cleaner ingredients, transparent sourcing, and lower-fat alternatives without compromising flavor. Concurrently, environmental sustainability mandates have spurred manufacturers to adopt eco-friendly packaging and optimize resource efficiency in processing facilities. These dual pressures have triggered an accelerated cycle of innovation, reshaping product portfolios and supply chain configurations.

Technological advances have been paramount to this transformation. Automated frying systems calibrated for precise oil temperature management now allow for consistent texture and reduced waste. Innovations in air-drying and vacuum frying have opened avenues for lower-oil chips that still deliver satisfying crunch and taste. Digital platforms, including direct-to-consumer brand websites and e-grocery partnerships, are revolutionizing distribution strategies by enabling real-time consumer feedback and customized subscription models. As a result, established brands and emerging challengers alike are reorienting their operations to integrate these advancements, fostering a new era of agility within the fried potato chip sector.

Analyzing the Aggregate Impact of 2025 United States Tariffs on Fried Potato Chip Supply Chains, Cost Structures, and Competitive Market Dynamics

In early 2025, the United States implemented revised tariff schedules affecting a range of agricultural commodities and packaging materials integral to the fried potato chip value chain. Tariffs on imported potatoes from neighboring markets under the United States–Canada–Mexico Agreement were adjusted to protect domestic growers, while additional duties were imposed on aluminum and plastic film used for chip packaging. These measures, intended to bolster local agriculture and manufacturing, have inadvertently elevated input costs and introduced complexity into procurement strategies.

The cumulative impact of these tariffs has been significant. Many manufacturers have absorbed higher raw material prices to maintain competitive retail pricing, eroding margins in the process. Others have responded by sourcing from domestic potato cultivars that may differ in starch composition, requiring recipe reformulations to preserve product quality. Import restrictions on certain packaging substrates have led to temporary shortages and logistical rerouting, extending lead times and increasing inventory carrying costs. Collectively, these changes have created a more fragmented cost structure and intensified competition among producers striving to safeguard profitability while upholding consumer expectations for consistent taste and texture.

Unlocking Key Segmentation Factors that Shape the Fried Potato Chip Marketplace Across Nature, Product Types, Flavors, Distribution Channels and End Users

The fried potato chip market exhibits a rich tapestry of segmentation dimensions that inform both strategic planning and product innovation. Based on nature, conventional chips dominate volume sales by virtue of their cost efficiency and widespread availability, yet the organic segment has emerged as a critical frontier for brands seeking to capture premium-minded consumers who prioritize non-GMO sourcing and pesticide-free cultivation. While organic offerings command higher price points, their growth trajectory underscores the enduring consumer appetite for clean-label credentials.

Product type segmentation features kettle cooked, plain, ridged, waffle, and wavy formats, each catering to distinct consumption occasions. Kettle-cooked varieties leverage artisanal appeal and a heartier crunch that appeals to gourmet audiences, whereas ridged and wavy profiles are engineered to support robust dips and toppings. Waffle-cut chips have carved out a niche through their unique lattice structure, often positioned as premium or limited-edition releases to drive trial and margin expansion.

Flavor remains a critical determinant of consumer choice, with salted chips serving as the foundational entry point. Yet barbecue and sour cream & onion varieties lead in new product introductions, reflecting a shift toward bolder, experiential taste sensations. Cheese-infused and vinegar-accented profiles continue to maintain strong followings, driving cross-demographic appeal. From traditional comfort flavors to innovative global spice blends, the flavor matrix remains a fertile ground for differentiation.

Distribution channels bifurcate into offline retail and online retail pathways. Conventional grocery, convenience, and mass merchandisers continue to account for a majority of sales, providing broad physical reach and promotional support. Conversely, online retail has surged through brand websites offering direct engagement, e-grocery services bundling chips with pantry essentials, and third-party marketplace platforms that facilitate rapid scaling and granular consumer targeting. This multi-channel landscape necessitates harmonized merchandising and digital marketing strategies.

The end user dimension distinguishes between Horeca-which encompasses hotels, restaurants, and cafes that utilize bulk packaging and bespoke flavor solutions-and household consumers whose purchasing patterns are driven by single-serve convenience and value packaging. Together, these segmentation factors serve as the blueprint for market participants to tailor product development and channel investments in pursuit of sustainable growth.

This comprehensive research report categorizes the Fried Potato Chips market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Nature

- Product Type

- Flavor

- Distribution Channel

- End User

Highlighting Distinct Regional Dynamics Influencing Fried Potato Chip Demand and Distribution across Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics in the fried potato chip industry reveal stark contrasts in consumer preferences, retail structures, and growth trajectories across major geographies. In the Americas, the United States leads in per-capita consumption, driven by robust demand for indulgent flavors and on-the-go convenience. Mexico’s snack market demonstrates a heightened affinity for spicy and chili-infused chips, while Canada mirrors U.S. trends with incremental adoption of health-oriented and premium products. Across these markets, modern trade formats-such as warehouse clubs and discount retailers-coexist with traditional grocery networks, influencing promotional cycles and private-label penetration.

In Europe, Middle East & Africa, the narrative centers on a growing emphasis on healthier formulations and organic offerings, particularly in Western European markets that have embraced clean-label movements. Northern European countries exhibit high receptivity to sustainably packaged snacks, prompting manufacturers to invest in compostable films and lightweight materials. Conversely, in the Middle East & Africa, rising urbanization and retail modernization are propelling demand, with local distributors increasingly stocking Western brands alongside regional spice-flavored variants. E-commerce platforms and convenience store chains are rapidly expanding their snack assortments, creating opportunities for agile players to capture market share.

The Asia-Pacific region stands out as the fastest-growing locus for fried potato chips, underpinned by rising disposable incomes and a flourishing middle class. In China and India, multinational brands collaborate with local partners to introduce both classic Western flavors and region-specific taste innovations, such as masala and seaweed. Southeast Asian markets are witnessing a surge in premium line extensions, while Australia and New Zealand balance established consumption patterns with interest in novel formats like air-fried and reduced-oil chips. Digital marketplaces and social commerce further accelerate product rollouts, enabling rapid iteration based on real-time consumer feedback.

This comprehensive research report examines key regions that drive the evolution of the Fried Potato Chips market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Driving Innovation, Strategic Partnerships, and Competitive Positioning within the Fried Potato Chip Sector

Across the competitive spectrum, several key companies are shaping the future contours of the fried potato chip market through targeted investments, strategic partnerships, and innovative product launches. One prominent player has leveraged its global supply chain network and R&D capabilities to introduce lower-oil formulations, sustainable packaging, and experiential flavor line extensions that resonate with younger demographics. This brand’s scale enables rapid national and international rollouts, reinforcing its leadership position.

Another market participant, recognized for its regional heritage, has carved out a niche by focusing on small-batch production and premium seasonings. This company’s emphasis on direct-to-consumer channels and limited-edition offerings has fostered a loyal following and supported higher margins. Through strategic facility upgrades and automation, it has balanced artisanal branding with efficiency improvements.

A leading Asia-based conglomerate continues to expand its western snack portfolio by forging distribution partnerships and acquiring local snack producers. Its approach emphasizes cross-border knowledge transfer, enabling swift adaptation of European and North American recipes to suit regional taste profiles.

In Europe, a family-owned specialist has strengthened its foothold through the acquisition of niche brands and investments in shared innovation centers that test novel frying techniques and flavor formulations. This group’s diversified portfolio, encompassing both mainstream and gourmet lines, underpins its resilience amid shifting consumer preferences.

Finally, an emerging player is making inroads by pioneering single-serve, resealable packaging innovations and forging collaborations with digital grocery platforms to secure prominent positioning in virtual shelf spaces. This agile strategy underscores the growing importance of digital ecosystems in driving brand discovery and purchase frequency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fried Potato Chips market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ballreich's

- Better Made Snack Foods, Inc.

- Charles Chips

- Golden Flake Snack Foods, Inc.

- Great Lakes Potato Chip Co.

- Herr Foods Inc.

- Lorenz Snack-World

- Mikesell's Potato Chip Company

- Old Dutch Foods, Inc.

- PepsiCo, Inc.

- Shearer's Foods, Inc.

- The Kellogg Company

- UTZ Brands, Inc.

- Wise Foods, Inc.

Delivering Practical Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Key Challenges in the Fried Potato Chip Market

Industry leaders must embrace a multifaceted strategy to capitalize on emerging opportunities and navigate the complexities that define today’s fried potato chip marketplace. First, a renewed focus on ingredient transparency and sustainability will resonate with increasingly conscientious consumers. By sourcing potatoes from certified sustainable farms and transitioning to recyclable or compostable packaging, companies can reinforce brand trust and command price premiums.

Equally critical is the acceleration of flavor innovation. Brands should harness insights from global culinary trends and local palates to develop limited-edition and seasonal offerings that stimulate trial and loyalty. Collaborative ventures with culinary influencers and micro-brands can amplify reach and diversify portfolios without overextending internal R&D resources.

Optimizing distribution requires a balanced omnichannel approach. While grocery, convenience, and wholesale channels will remain foundational, a dedicated investment in owned e-commerce platforms and partnerships with leading online marketplaces will unlock incremental revenue streams and higher margins. Subscription models and personalized digital marketing campaigns can further deepen consumer engagement.

To mitigate the effects of import tariffs and supply volatility, stakeholders should engage proactively with industry associations and policymakers to advocate for tariff exclusions or phased adjustments. Concurrently, diversifying supplier networks and exploring contract farming initiatives will enhance supply chain resilience and reduce exposure to single-source risks.

Lastly, strategic alliances and mergers can accelerate entry into new geographies or categories. By aligning with specialized manufacturers-whether in organic lines or alternative frying technologies-companies can achieve rapid scale while distributing investment risk. This collaborative mindset will be indispensable in an environment where agility and innovation are the primary differentiators.

Detailing the Research Framework Combining Primary Interviews, Secondary Data Analysis, Verification and Analytical Techniques Ensuring Insight Reliability

This analysis is built upon a rigorous research framework that marries primary intelligence with robust secondary analysis. The primary phase conducted in-depth interviews with senior executives at major snack manufacturers, procurement specialists from leading retailers, potato growers, and industry consultants. These discussions yielded nuanced perspectives on operational challenges, innovation pipelines, and evolving channel strategies.

Secondary research was sourced from public filings, trade association reports, government agricultural data, and peer-reviewed studies on food processing technologies. Historical trade and tariff records offered insights into the macroeconomic forces influencing cost structures, while sustainability reports illuminated the emerging demand landscape for eco-friendly practices.

To ensure reliability, data points were triangulated across multiple sources and subjected to rigorous verification processes, including cross-referencing with proprietary datasets and validating factual accuracy through direct follow-up queries with subject matter experts. Analytical techniques included SWOT and PESTEL assessments to contextualize internal capabilities and external pressures. Porter’s Five Forces analysis underscored competitive intensity, while qualitative content analysis of consumer feedback provided real-time sentiment tracking.

An expert advisory panel comprised of former industry executives and academic researchers reviewed preliminary findings. This iterative process refined the conclusions and ensured that recommendations align with practicable industry scenarios. As a result, the insights presented herein are both evidence-based and actionable for stakeholders seeking to make data-driven decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fried Potato Chips market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fried Potato Chips Market, by Nature

- Fried Potato Chips Market, by Product Type

- Fried Potato Chips Market, by Flavor

- Fried Potato Chips Market, by Distribution Channel

- Fried Potato Chips Market, by End User

- Fried Potato Chips Market, by Region

- Fried Potato Chips Market, by Group

- Fried Potato Chips Market, by Country

- United States Fried Potato Chips Market

- China Fried Potato Chips Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Core Findings and Strategic Implications for Stakeholders Navigating the Evolving Fried Potato Chip Industry Landscape

The fried potato chip industry is at a pivotal juncture, defined by escalating consumer expectations for healthier and more sustainable options, rapid technological adoption, and the reverberations of trade policy adjustments. These forces collectively are reshaping product development roadmaps, pricing architectures, and distribution models across key geographies. Brands that respond with agility-realigning supply chains, innovating with bold flavor profiles, and embracing omnichannel distribution-will be best positioned to thrive.

Strategic implications extend beyond product innovation to encompass operations, partnerships, and policy advocacy. Manufacturers must configure flexible production systems that can accommodate formulation shifts and packaging innovations. Retailers, on the other hand, should optimize shelf space and promotional strategies to feature both core and fringe SKUs that cater to evolving tastes. Collaborative engagement with policymakers and agricultural stakeholders can help stabilize input costs and ensure a predictable trade environment.

In sum, stakeholders who leverage segmented insights, commit to sustainable practices, and pursue strategic collaborations will unlock new growth pathways in an ever-changing market. The collective momentum of these initiatives will define the competitive hierarchy of the fried potato chip sector in the years ahead.

Driving Next Steps to Acquire the Definitive Fried Potato Chip Market Research Report with Ketan Rohom to Empower Data-Driven Growth Strategies

Embark on the next phase of strategic decision-making by securing the definitive market research report on fried potato chips. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to access deeper quantitative and qualitative insights tailored to your organizational needs. By partnering with this report, you will gain unparalleled visibility into emerging consumer trends, technological breakthroughs, and competitive strategies that will shape the industry’s future trajectory. Act now to leverage data-driven growth strategies, optimize supply chain resilience, and unlock new market segments before your competitors do. Reach out to Ketan Rohom to discuss customized insights packages, sample chapters, and licensing options to ensure your leadership team is equipped with the most robust intelligence available.

- How big is the Fried Potato Chips Market?

- What is the Fried Potato Chips Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?