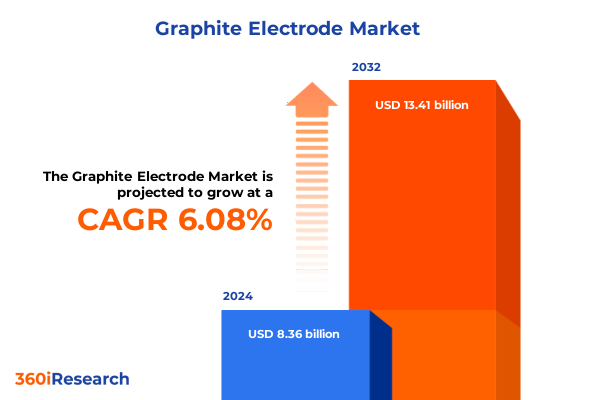

The Graphite Electrode Market size was estimated at USD 8.87 billion in 2025 and expected to reach USD 9.35 billion in 2026, at a CAGR of 6.08% to reach USD 13.41 billion by 2032.

Establishing a Comprehensive Overview of the Graphite Electrode Market’s Foundational Drivers, Strategic Imperatives, and Emerging Opportunities

The graphite electrode market underpins critical segments of the global metallurgical industry, serving as the essential conductive components in electric arc and ladle furnaces. These electrodes facilitate the high-temperature operations that convert raw materials into steel and specialty alloys, making their performance characteristics and supply stability pivotal to downstream manufacturing efficiency and cost control.

In recent years, advancements in electrode design and raw material sourcing have heightened the focus on power rating classifications, diameter variations, and grade selection, driving a need for a granular exploration of market drivers. Meanwhile, macroeconomic factors, including raw material availability, energy costs, and sustainability mandates, continually reshape procurement strategies and production processes across diverse industrial verticals.

This executive summary sets forth the foundational drivers, emerging opportunities, and strategic imperatives shaping the graphite electrode landscape. By establishing the context of technological, regulatory, and trade dynamics, this analysis equips stakeholders with the clarity required to make informed decisions in an increasingly complex and competitive arena.

Examining the Key Technological Innovations, Sustainability Initiatives, and Market Forces That Are Transforming the Graphite Electrode Landscape

Rapid shifts in end-user expectations and industrial electrification mandates have sparked a wave of innovation within the graphite electrode sphere. Manufacturers are responding to decarbonization targets by refining production processes to reduce lifecycle carbon footprints, while simultaneously enhancing electrode thermal conductivity and mechanical strength. This dual focus on sustainability and performance has accelerated the adoption of advanced needle coke grades and novel binder formulations, setting the stage for a new generation of electrodes that marry ecological responsibility with operational excellence.

Moreover, digitalization and Industry 4.0 principles have permeated electrode manufacturing and usage, introducing real-time monitoring, predictive maintenance algorithms, and automated quality control systems. These technological enhancements not only improve yield consistency but also enable traceable performance metrics that inform procurement strategies and maintenance schedules, ultimately lowering total cost of ownership for end users.

Concurrently, broader shifts in global supply chains-driven by regionalization efforts, raw material nationalism, and logistical bottlenecks-are compelling stakeholders to reassess traditional sourcing models. As strategic alliances evolve and alternative feedstock options emerge, the market landscape is undergoing a fundamental transformation that balances cost optimization, risk mitigation, and environmental stewardship.

Analyzing the Far-Reaching Consequences of United States Tariffs Enacted Through 2025 on Supply Chains, Pricing Structures, and Domestic Production Dynamics

Since the initial imposition of tariffs on imported graphite electrodes, the United States has pursued an escalating tariff structure through 2025 aimed at bolstering domestic production and protecting key industries. These duties have progressively altered cost structures for steelmakers and non-steel applications alike, elevating landed costs for electrode imports from principal producing regions and incentivizing investments in local manufacturing capacity to offset imported volumes.

The cumulative effect of these tariff measures has manifested in tighter supply availability for users reliant on international suppliers, prompting procurement organizations to negotiate longer contract terms and explore alternative suppliers outside of tariff scope. In parallel, end users have faced upward pressure on unit prices, leading to a careful re-evaluation of electrode lifespan extension tactics and furnace optimization strategies to preserve margin integrity amid rising input costs.

Domestic producers have responded to this policy environment by accelerating capacity expansions and forging partnerships with raw material suppliers to secure needle coke feedstocks. While these developments aim to enhance self-sufficiency and supply resilience, the tariff-induced cost differentials continue to permeate through global trade flows, influencing both import substitution efforts and broader production economics across the metallurgical sector.

Unveiling Critical Insights Across Product Types, Diameter Categories, Raw Material Grades, Application Segments, and End-User Verticals

Insight into the market’s product type segmentation reveals distinct performance and cost considerations across high power, regular power, and ultra high power electrodes. Ultra high power variants, prized for their superior conductivity and thermal capacity, have gained traction in operations targeting maximum throughput, whereas high and regular power options maintain appeal in facilities with balanced performance and cost priorities. These variations underscore the nuanced trade-offs that inform procurement decisions based on specific furnace configurations and production targets.

When evaluating electrodes by diameter, larger sizes above 600 millimeters facilitate extended furnace campaigns and reduced replacement frequency, yet demand higher initial outlays and specialized handling equipment. Conversely, medium and small diameters offer more flexible installation and lower unit cost thresholds, appealing to operations with variable production volumes or frequent process adjustments. This diameter-based segmentation intersects significantly with raw material grade considerations, as the inherent properties of coal tar pitch-based electrodes differ from petroleum needle coke-based counterparts in terms of density, porosity, and arc stability.

Application segmentation further refines market understanding, with electric arc furnaces representing the core demand center, followed by ladle furnaces that prioritize precise temperature control during alloy refining. Non-steel applications, while smaller in volume, exhibit unique requirements for electrode composition and dimensional tolerances, reflecting the diverse end-user industry dynamics that span automotive, chemical, energy, and foundry sectors.

This comprehensive research report categorizes the Graphite Electrode market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Electrode Diameter

- Grade

- Application

- End User Industry

Decoding Regional Growth Patterns and Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific Markets to Inform Strategic Expansion

In the Americas, demand patterns have been shaped by regional decarbonization initiatives and the resurgence of nearshore steelmaking, which have fueled interest in locally produced ultra high power electrodes. The continent’s infrastructure projects and energy sector expansions also drive demand for specialized electrodes tailored to non-steel applications, creating pockets of growth beyond traditional steel production hubs.

Across Europe, the Middle East, and Africa, regulatory pressures around carbon reduction and circular economy principles have elevated the adoption of high-efficiency graphite electrodes and recovery programs. European refiners are investing in closed-loop supply models to reclaim electrode material, while select markets in the Middle East are leveraging new furnace installations to capture value in petrochemical and aluminum production processes. In Africa, infrastructure growth and mining activities spur incremental increases in electrode consumption, albeit on a smaller scale compared to other regions.

The Asia-Pacific region remains the largest single consumer, with China leading production and capacity additions for both electrodes and primary raw materials. Japan and South Korea continue to innovate in advanced electrode formulations for specialty steel, and India’s ongoing furnace modernizations bolster demand across power classifications. Southeast Asian nations are emerging as alternative sourcing destinations, reflecting a diversification of the regional supply base.

This comprehensive research report examines key regions that drive the evolution of the Graphite Electrode market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Leading Graphite Electrode Manufacturers’ Strategic Initiatives, Technological Capabilities, and Competitive Differentiation Tactics

Major graphite electrode producers have fortified their market positions through a combination of capacity expansions, technology partnerships, and vertical integration strategies. Key players have invested in state-of-the-art needle coke processing facilities to secure grade consistency and yield improvements, directly targeting performance metrics valued by electric arc furnace operators.

Collaborations between electrode manufacturers and steel producers have accelerated co-development programs, enabling real-world validation of new electrode designs under high-fidelity operating conditions. These alliances have yielded proprietary formulations that extend furnace campaign lengths and reduce electrode wear, thus differentiating the most competitive suppliers in contract negotiations.

In parallel, leading companies are expanding their global footprints by establishing regional service centers and warehouses, aiming to shorten lead times and offer localized technical support. This approach not only enhances supply reliability but also positions these firms to respond rapidly to shifts in tariff policies, raw material accessibility, and evolving end-user demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Graphite Electrode market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambattur Enterprises Pvt. Ltd.

- Expo Machine Tools Pvt. Ltd.

- Fangda Carbon New Material Co., Ltd.

- Gmax Electric Limited

- GrafTech International Ltd.

- Graphite & Mineral Products (P) Ltd.

- Graphite India Limited

- Nippon Carbon Co., Ltd.

- Oriental Graphicarb Manufactory

- Panasonic Carbon India Co., Ltd.

- Resonac Holdings Corporation

- ROC Carbon Company

- Royal Arc Electrodes Pvt. Ltd.

- SGL Carbon SE

- Sinosteel Jilin Carbon Co., Ltd.

- Tokai Carbon Co., Ltd.

- Weaver Industries, Inc.

Proposing Actionable Strategies for Industry Leaders to Seize Emerging Graphite Electrode Opportunities while Mitigating Supply Chain Challenges

Industry leaders should proactively diversify their supplier portfolios, integrating both domestic and international sources to balance cost volatility with supply resilience. Establishing strategic relationships with alternative feedstock suppliers and exploring co-investment opportunities in needle coke production can further safeguard against raw material bottlenecks.

Investing in digital furnace monitoring and predictive maintenance platforms will enhance electrode performance by enabling data-driven replacement schedules and condition-based interventions. By leveraging real-time analytics, operations can minimize unplanned downtime and optimize electrode utilization rates, thereby reducing overall consumption and associated costs.

To navigate the evolving tariff environment, organizations are advised to cultivate flexible sourcing frameworks, including bonded inventory models and capacity reservation agreements. Complementing these measures with collaborative R&D efforts focused on longer-life and lower-carbon electrode technologies will position stakeholders to meet regulatory requirements and differentiate on sustainability credentials.

Detailing a Robust Research Methodology Integrating Primary Stakeholder Interviews, Secondary Data Analysis, and Triangulation for Unparalleled Market Insight

This analysis is grounded in a multi-layered research approach that integrates primary and secondary data sources. Primary research included in-depth interviews with senior procurement managers, technical directors at steel producers, and executives at leading electrode manufacturers, providing firsthand insights into operational challenges and strategic priorities.

Secondary research drew on rigorous review of industry white papers, patent filings, and environmental compliance records to contextualize technological trends and regulatory developments. Publicly available company disclosures and trade association reports were systematically analyzed to map capacity expansions, supply agreements, and tariff implications.

Quantitative data were validated through triangulation techniques, reconciling production volumes, import‐export statistics, and price indices to ensure data consistency. This robust methodology ensures that the insights presented are both authoritative and actionable, offering decision makers a high‐confidence basis for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Graphite Electrode market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Graphite Electrode Market, by Product Type

- Graphite Electrode Market, by Electrode Diameter

- Graphite Electrode Market, by Grade

- Graphite Electrode Market, by Application

- Graphite Electrode Market, by End User Industry

- Graphite Electrode Market, by Region

- Graphite Electrode Market, by Group

- Graphite Electrode Market, by Country

- United States Graphite Electrode Market

- China Graphite Electrode Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings and Strategic Imperatives to Illuminate the Future Trajectory and Investment Priorities of the Graphite Electrode Market

The graphite electrode market stands at a pivotal juncture where technological breakthroughs, evolving regulatory landscapes, and trade policy drivers converge to redefine competitive advantage. Strategic imperatives center on securing resilient supply chains, harnessing performance-enhancing innovations, and aligning with decarbonization agendas to maintain relevance in the decarbonized steel value chain.

Key findings emphasize the importance of segmentation‐specific approaches, from selecting the optimal power classification and diameter to tailoring grade and application choices for maximal operational efficiency. Regional nuances and tariff impacts further underscore the need for dynamic sourcing strategies and regional engagement models that can adapt to shifting trade and policy environments.

Looking ahead, stakeholders equipped with an integrated view of product, application, and regional dynamics will be best positioned to navigate uncertainty and capture sustainable growth. The insights compiled herein serve as the foundation for informed decision making, guiding investments in technology, capacity, and partnerships that shape the future of the graphite electrode ecosystem.

Encouraging Direct Dialogue with Ketan Rohom, Associate Director of Sales & Marketing, to Unlock Tailored Insights and Secure Graphite Electrode Market Report

For executives seeking to transform their approach to graphite electrode procurement and strategic planning, an immediate conversation with Ketan Rohom, Associate Director of Sales & Marketing, offers an unparalleled opportunity to align on customized insights that directly address your organization’s unique challenges. Engaging directly with Ketan Rohom will unlock access to detailed analyses, comparative benchmarks, and strategic recommendations that empower decision makers to implement proactive measures in a rapidly evolving environment. His expertise in translating complex market dynamics into actionable intelligence will enable you to navigate supply chain disruptions, capitalize on emerging high-performance technologies, and anticipate policy shifts with confidence.

By reaching out to initiate this dialogue, you will secure the comprehensive market report that serves as a definitive roadmap for investment, production optimization, and long-term value creation. This engagement is designed to deliver immediate value through a tailored briefing, followed by ongoing support to integrate insights into your business planning processes. Take the first step toward gaining a competitive edge by contacting Ketan Rohom today, ensuring your organization possesses the strategic foresight and market clarity required to excel in the graphite electrode sector.

- How big is the Graphite Electrode Market?

- What is the Graphite Electrode Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?