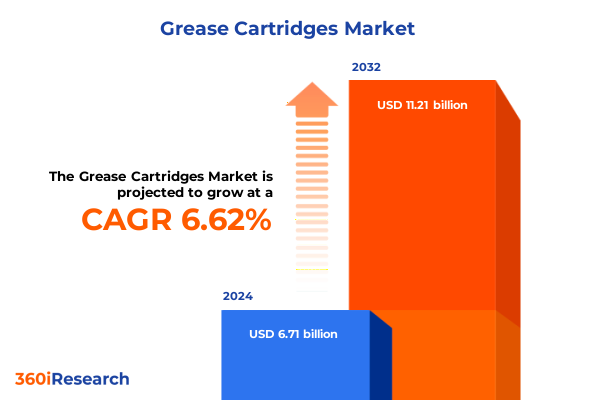

The Grease Cartridges Market size was estimated at USD 7.14 billion in 2025 and expected to reach USD 7.61 billion in 2026, at a CAGR of 6.65% to reach USD 11.21 billion by 2032.

Unveiling the Critical Role of Grease Cartridges in Modern Machinery Maintenance Across Diverse Sectors and the Factors Driving Market Evolution

In an era where machinery uptime and operational reliability underpin competitive advantage across multiple industries the grease cartridges market has emerged as a critical enabler of maintenance excellence. Grease cartridges offer precise greasing solutions that simplify equipment servicing reduce contamination risk and extend component lifecycles. As manufacturing plants scale up production lines construction fleets expand and marine operations intensify the need for reliable lubrication solutions becomes paramount. Consequently professionals across automotive chassis lubrication engine assembly and wheel bearing maintenance heavy earthmoving machinery bearing chains gears and offshore drilling equipment continually seek efficient and standardized greasing methods. This report delves into the multifaceted dimensions of the grease cartridges market delivering a holistic view of technological progress evolving regulatory influences and end user priorities.

Furthermore the pursuit of reduced maintenance downtime heightened safety standards and environmental stewardship has driven stakeholders to adopt grease cartridges over traditional bulk greasing practices. The convenience of prefilled sealed cartridges not only ensures consistent viscosity grade compliance but also aligns with sustainability mandates by curbing grease waste. Against the backdrop of shifting supply chain dynamics global trade policies and intensifying competition a rigorous analysis of market drivers restraints and emerging opportunities is essential. Accordingly this executive summary lays the groundwork for understanding current dynamics while illuminating transformative trends future challenges and strategic imperatives for decision makers.

Identifying Key Technological Innovations Operational Paradigm Shifts and Sustainability Trends Redefining the Grease Cartridges Market Trajectory

Over the past decade the grease cartridges landscape has undergone transformative shifts propelled by rapid technological innovations and an unwavering focus on sustainability. One of the most consequential developments is the integration of sensor enabled lubrication systems capable of monitoring grease depletion in real time. These smart solutions deliver predictive maintenance insights allowing operators to optimize service intervals and prevent unplanned downtime. Moreover additive engineering has progressed significantly unlocking high performance formulations such as calcium sulfonate and lithium complex thickeners that excel under extreme temperature and pressure conditions. As a result equipment reliability has improved notably across sectors ranging from transportation fleets to heavy industrial machinery.

In addition regulatory tightening around waste management and environmental compliance has accelerated the adoption of ecofriendly grease compositions. Polyurea based thickeners and synthetic base oils have gained prominence due to their biodegradability and longer service life which reduce the frequency of disposal. Consequently service centers and industrial OEMs are revisiting their lubrication strategies to align maintenance protocols with corporate ESG aspirations. Furthermore digital supply chain platforms have streamlined inventory management allowing distributors and e commerce channels to respond nimbly to fluctuating demand patterns. Together these technological and operational advances illustrate how innovation and sustainability considerations are fundamentally redefining value propositions and competitive positioning in the grease cartridges market.

Analyzing How New United States Tariffs Announced in 2025 Are Reshaping Supply Chains Cost Structures and Competitive Positioning in the Grease Cartridge Segment

The introduction of new United States tariffs in 2025 has generated significant ripple effects across the grease cartridges supply chain reshaping cost structures and sourcing strategies. These duties have targeted precursor materials such as specialized thickeners and base oils imported from certain regions prompting manufacturers to reassess procurement frameworks. In turn many suppliers have explored nearshoring alternatives to secure critical raw materials within tariff free zones thereby reducing transit times and logistical complexity. However the transition to alternative sources has not been seamless as qualification processes for new material grades often involve rigorous performance testing and regulatory approvals.

Moreover elevated input costs have exerted downstream pressure on distributors and end users who are now prioritizing cost effective lubricant management programs. Organizations with robust maintenance planning capabilities have leveraged bulk procurement agreements and centralized distribution hubs to mitigate price volatility. Conversely smaller service centers have faced margin compression leading them to prioritize high margin premium grease formulations or value added services. Consequently the tariff environment has underscored the importance of agility and advanced forecasting capabilities in navigating trade policy disruptions. Looking ahead supply chain diversification and collaborative supplier partnerships will likely remain essential levers to buffer the impact of future trade fluctuations.

Deriving Strategic Insights from Thickener Type Application End User Viscosity Grade and Sales Channel Segmentation Trends in Grease Cartridges

A nuanced view of the grease cartridges market emerges when segmented by thickener type application end user viscosity grade and sales channel revealing differentiated growth drivers and value levers. Calcium thickeners continue to hold appeal for general industrial use due to cost efficiency whereas advanced calcium sulfonate formulations provide exceptional corrosion resistance in marine applications. Meanwhile lithium and lithium complex options have cemented their status as the workhorse choice for automotive and construction equipment benefiting from high dropping points and mechanical stability. Polyurea based thickeners are rapidly gaining traction in heavy load bearing applications requiring long term lubrication without relubrication cycles. Transitioning to various applications automotive segments such as chassis lubrication engine assembly and wheel bearings demand meticulous grease compatibility testing to ensure component longevity while construction earthmoving equipment and heavy machinery operations prioritize high performance under shock loads and extreme temperatures. In parallel industrial uses including bearings chains and gears require specialized viscosity grades like NLGI 0 NLGI 1 and NLGI 2 to accommodate enclosed systems and open gears. Meanwhile marine operations spanning offshore drilling equipment and ship machinery are progressively adopting higher quality formulations to withstand saline environments and prolonged service intervals. End user preferences further delineate the aftermarket automotive OEM industrial manufacturer and service center channels each with unique procurement behaviors. For instance OEMs emphasize strict compliance with engineering specifications while service centers value ease of cartridge disposal and throughput efficiency. Finally sales channels ranging from direct sales through distributors to e commerce platforms and traditional retail outlets influence the customer experience and delivery lead times thus shaping product development and pricing strategies.

This comprehensive research report categorizes the Grease Cartridges market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Thickener Type

- Viscosity Grade

- Application

- End User

- Sales Channel

Deciphering Distinct Regional Market Behaviors and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Grease Cartridge Sectors

Across the Americas leading economies exhibit strong aftermarket demand driven by mature maintenance infrastructures and the proliferation of automated lubrication systems particularly in the United States and Canada. In contrast growing industrialization and infrastructure investments in Latin America have spurred interest in robust high performance grease solutions for construction and mining equipment. Moving to Europe Middle East and Africa established manufacturing hubs in Germany and Italy continue to prioritize sustainability enhancing grease formulations that comply with stringent EU directives while Middle Eastern countries rely heavily on polyurea and lithium based products for oil and gas operations. Meanwhile Africa presents a dual narrative of burgeoning adoption in mining sectors accompanied by persistent challenges in cold chain distribution and storage conditions. Shifting focus to Asia Pacific this region accounts for the most dynamic growth trajectory propelled by rapid expansion in automotive OEM plants in China India and Southeast Asia. These facilities demand a broad spectrum of grease consumables from NLGI 0 to NLGI 2 grades to support diverse assembly line requirements. Moreover the rise of e commerce platforms in the Asia Pacific has democratized access to specialized grease cartridges among small service centers and independent garages further accelerating market penetration.

This comprehensive research report examines key regions that drive the evolution of the Grease Cartridges market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers Collaboration Strategies and Competitive Differentiators Shaping the Competitive Landscape in the Grease Cartridges Industry

Leading companies in the grease cartridges segment have employed a combination of acquisition strategies product portfolio expansions and technological partnerships to strengthen their market positioning. Established lubricant manufacturers with global footprints have integrated in house thickener innovation facilities to accelerate new formulation development while smaller specialized firms have carved niches by focusing on high performance marine and offshore drilling applications. In addition several players have forged alliances with sensor technology providers to launch smart lubrication solutions that seamlessly retrofit existing grease dispensing equipment. Such collaborations not only enhance value for end users through condition based maintenance but also generate recurring revenue streams from software subscriptions. Meanwhile forward integration initiatives have enabled select distributors to offer private label grease cartridges tailored to local end user requirements. This trend underscores the shifting power dynamics within the value chain as channel partners assume more control over product specifications pricing and inventory management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Grease Cartridges market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMSOIL Inc.

- Bel‑Ray Company, LLC

- BP plc

- Castrol Limited

- Chevron Corporation

- Dow Corning Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Limited

- JX Nippon Oil & Energy Corporation

- Klüber Lubrication München GmbH & Co. KG

- Lubrication Engineers, Inc.

- Lukoil PJSC

- Parker‑Hannifin Corporation

- Petroliam Nasional Berhad (PETRONAS)

- Petro‑Canada Lubricants Inc.

- Phillips 66 Company

- Royal Purple, Inc.

- Schaeffer Manufacturing Company

- Shell plc

- SKF AB

- TotalEnergies SE

- Valvoline Inc.

Actionable Strategic Roadmap for Industry Leaders to Adapt Enhance Operational Efficiency and Capitalize on Emerging Opportunities in Grease Cartridges

Industry leaders must adopt a multifaceted approach to capitalize on emerging opportunities and fortify resilience against volatility. First strengthening supply chain agility is paramount by diversifying raw material sourcing across tariff free regions and establishing strategic buffer inventories to cushion trade disruptions. Simultaneously investing in smart lubrication technologies will empower maintenance teams with real time asset health data facilitating predictive interventions and minimizing operational disruptions. In addition companies should accelerate the development of ecofriendly grease formulations that satisfy tightening environmental regulations while reducing total cost of ownership for end users. To optimize market reach aligning sales channels through integrated digital platforms can streamline order fulfillment and enhance customer engagement. Moreover forging deeper partnerships with end users through customized service offerings and training programs can foster long term loyalty and unlock new revenue streams in aftermarket and service center segments. Lastly leadership must foster an innovation culture that encourages cross functional collaboration between R&D engineering and marketing teams ensuring rapid adaptation to shifting market demands and regulatory landscapes.

Detailed Explanation of Research Approaches Data Collection Techniques and Analytical Frameworks Employed to Ensure Rigorous Insights in Grease Cartridges Analysis

This analysis draws upon a blend of primary and secondary research methodologies designed to deliver robust and unbiased insights. Primary data was gathered through extensive interviews with equipment OEM maintenance professionals service center managers and key distribution partners across major geographical regions. In parallel surveys targeting lubrication engineers and procurement specialists provided quantitative validation of emerging preferences and pain points. Secondary research encompassed a comprehensive review of technical journals manufacturer whitepapers industry association publications and regulatory filings to understand technological advancements and policy developments. Furthermore trade data and customs statistics were analyzed to map material import patterns and tariff impacts. Data triangulation techniques were employed to cross verify findings and ensure consistency while thematic analysis facilitated the identification of core trends and strategic imperatives. Throughout the process rigorous quality checks and expert peer reviews guaranteed methodological transparency and the credibility of projected scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Grease Cartridges market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Grease Cartridges Market, by Thickener Type

- Grease Cartridges Market, by Viscosity Grade

- Grease Cartridges Market, by Application

- Grease Cartridges Market, by End User

- Grease Cartridges Market, by Sales Channel

- Grease Cartridges Market, by Region

- Grease Cartridges Market, by Group

- Grease Cartridges Market, by Country

- United States Grease Cartridges Market

- China Grease Cartridges Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Strategic Takeaways and Forward Outlook to Guide Stakeholders in Navigating the Evolving Grease Cartridges Market Environment

In summary the grease cartridges market stands at a pivotal intersection of technological innovation sustainability mandates and evolving trade regulations shaped by the latest United States tariffs. As advanced thickeners gain prominence and smart lubrication systems emerge as a maintenance cornerstone stakeholders must prioritize agility and forward planning. Strategic segmentation insights reveal distinct value drivers across thickener types applications end user categories viscosity grades and sales channels underscoring the importance of tailored product offerings. Regional dynamics further highlight the necessity for geography specific strategies that address local infrastructure and regulatory nuances. Meanwhile competitive differentiation will hinge on collaborative alliances technological integration and an unwavering commitment to environmental stewardship. Ultimately stakeholders equipped with these strategic perspectives will be best positioned to navigate complexity capture growth opportunities and drive long term success in the grease cartridges landscape.

Secure In-Depth Market Research Insights and Tailored Consultation with Ketan Rohom to Accelerate Strategic Decision Making in Grease Cartridges

To secure unparalleled industry insights and actionable guidance, connect directly with Ketan Rohom Associate Director Sales & Marketing at 360iResearch for a personalized consultation and to purchase the comprehensive market research report on grease cartridges

- How big is the Grease Cartridges Market?

- What is the Grease Cartridges Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?