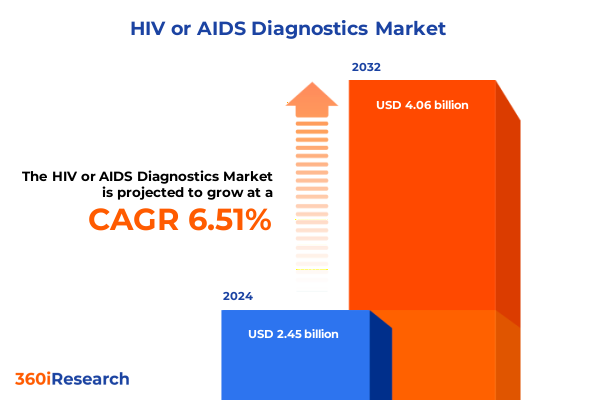

The HIV or AIDS Diagnostics Market size was estimated at USD 2.60 billion in 2025 and expected to reach USD 2.76 billion in 2026, at a CAGR of 6.56% to reach USD 4.06 billion by 2032.

Pioneering Insights into the Dynamic HIV/AIDS Diagnostics Market Landscape and Emerging Opportunities Shaping Patient Care Worldwide

The global pursuit of effective HIV/AIDS diagnostics continues to accelerate as healthcare systems worldwide endeavor to improve early detection, patient outcomes, and cost-effective monitoring. Technological advancements and policy shifts have converged to create a more dynamic landscape, where rapid tests complement laboratory assays and integrated data platforms enhance clinical decision-making. Consequently, stakeholders ranging from public health agencies to private laboratories are realigning their strategies to navigate regulatory complexities, supply chain vulnerabilities, and evolving reimbursement models.

Against this backdrop, an incisive understanding of market dynamics is more critical than ever. Emerging molecular assays enable lower limits of detection, while novel point-of-care devices facilitate decentralized testing in remote regions. At the same time, digital diagnostics platforms are streamlining data sharing across care teams, leading to faster treatment initiation and improved patient adherence. As a result, the diagnostic continuum is witnessing a paradigm shift toward personalized care pathways that integrate early screening, continuous monitoring, and predictive analytics.

This executive summary offers a concise yet thorough overview of the key trends shaping the HIV/AIDS diagnostics ecosystem. Drawing on a robust research methodology, it highlights transformative developments, regulatory impacts, and strategic imperatives for market leaders. It also distills essential segmentation, regional outlooks, and competitive insights to inform investment decisions and guide product innovation. Ultimately, this analysis aims to equip decision-makers with the knowledge required to anticipate future opportunities and foster sustainable growth within this crucial healthcare segment.

Unprecedented Technological Breakthroughs and Strategic Collaborations Redefining the HIV/AIDS Diagnostics Terrain in the Post-Pandemic Era

The HIV/AIDS diagnostics arena has undergone transformative shifts driven by groundbreaking technologies and strategic alliances. Recent years have witnessed the emergence of multiplex molecular platforms capable of simultaneous detection of HIV and co-infections, thereby optimizing clinical workflows and reducing patient burden. Furthermore, the integration of artificial intelligence in image-based assays has enhanced the accuracy of CD4 count analysis, offering clinicians unprecedented precision in assessing immune function.

Parallel to these technological strides, various industry collaborations have forged novel pathways for scale and reach. Diagnostic manufacturers are partnering with logistics providers to deploy point-of-care solutions directly to community centers, facilitating earlier diagnosis in underserved populations. At the same time, academic institutions are co-developing standardized reference materials for viral load testing, ensuring consistency across laboratories and geographies.

Moreover, regulatory agencies have introduced accelerated review pathways for innovative diagnostics that demonstrate significant public health benefits. This paradigm has spurred a wave of smaller, specialized companies to enter the market with disruptive assays, challenging established incumbents and fostering a competitive yet collaborative environment. Through these transformative shifts, the HIV/AIDS diagnostics ecosystem is rapidly evolving toward a more integrated, patient-centric model that emphasizes both speed and accuracy.

Analyzing the Ripple Effects of 2025 United States Tariffs on HIV/AIDS Diagnostics Supply Chains and Market Accessibility Dynamics Nationwide

In 2025, newly implemented United States tariffs on imported diagnostic reagents and instruments have introduced fresh challenges for manufacturers and laboratories alike. Increased duties on select consumables have driven procurement teams to reevaluate supplier portfolios, seeking cost mitigation through alternative sourcing strategies. Consequently, some laboratories have reported extended lead times for critical test kits, prompting interim reliance on legacy platforms or manual assays to maintain continuity of care.

Amid these supply chain disruptions, strategic stakeholders have adopted adaptive measures to sustain market accessibility. Several international instrument suppliers have relocated assembly operations to duty-exempt zones, thereby shielding end-users from full tariff impacts. In parallel, diagnostic distributors are renegotiating contractual terms to incorporate tariff-related surcharges transparently, ensuring downstream laboratories remain informed of evolving cost structures.

Despite initial concerns over affordability, the net effect of these tariffs has been to catalyze innovation in reagent formulation and instrument design. Manufacturers are increasingly prioritizing multipurpose reagents and modular instrument architectures that accommodate a broader range of assays without necessitating new imports. Such adaptive strategies underscore the resilience of the HIV/AIDS diagnostics sector in navigating policy-driven headwinds and preserving patient access nationwide.

In-Depth Exploration of HIV/AIDS Diagnostics Market Segmentation Reveals Critical Test Types, Product Categories, Methods, and End-User Applications

A comprehensive segmentation analysis illuminates the nuanced drivers shaping diagnostic strategies and investment priorities. When examined by test type, antibody assays-encompassing ELISA/EIA, rapid tests, and Western blot confirmation-continue to serve as the backbone of initial HIV screening initiatives. CD4 enumeration tests remain indispensable for gauging immune suppression, while viral load quantification assays have become the gold standard for monitoring therapeutic efficacy and guiding treatment adjustments.

Delving into product categories reveals a balanced ecosystem of consumables and reagents, instruments and kits, software solutions, and specialized testing services. Consumables-including assay-specific reagents-drive recurring revenue streams, whereas capital investments in instruments and kits reflect long-term commitments by healthcare providers. Concurrently, laboratory information systems and cloud-based analytics platforms are gaining traction as essential tools for data management and regulatory compliance. Meanwhile, outsourced testing services are expanding to meet demand from regions with limited in-house capabilities.

By testing method, the market bifurcates into laboratory-based testing, point-of-care devices, and self-testing kits designed for individual use. Laboratory-based assays offer unparalleled sensitivity and automation, whereas point-of-care solutions emphasize rapid turnaround and ease of use in decentralized settings. Self-testing modalities have emerged as a critical enabler of confidentiality and accessibility, particularly within populations hesitant to engage with traditional healthcare infrastructures.

End-user segmentation showcases blood banks and transfusion centers as pivotal prevention gateways, diagnostic centers as testing volume hubs, home care settings as facilitators of patient self-management, hospitals and clinics as comprehensive care nodes, and research institutes as innovation catalysts. Finally, application insights underscore three primary uses: disease progression assessment, ongoing patient monitoring, and large-scale screening programs. This stratified view underscores the importance of tailored strategies that align technological capabilities with end-user needs and public health objectives.

This comprehensive research report categorizes the HIV or AIDS Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Type of Product

- Testing Method

- End-User

- Application

Regional Market Dynamics in HIV/AIDS Diagnostics Highlighting Divergent Growth Trajectories Across the Americas, EMEA, and Asia-Pacific Territories

Regional differentiation in HIV/AIDS diagnostics continues to shape strategic priorities and resource allocation. In the Americas, robust healthcare infrastructures and favorable reimbursement frameworks drive widespread adoption of both high-throughput laboratory assays and decentralized point-of-care devices. The presence of leading diagnostic manufacturers and established distribution channels further accelerates technology penetration, while extensive public-private partnerships fund targeted screening initiatives in underserved communities.

Meanwhile, the Europe, Middle East & Africa region exhibits pronounced heterogeneity in diagnostic access and regulatory environments. Western European markets benefit from harmonized approval pathways and high per-capita healthcare spending, supporting the rapid uptake of next-generation viral load assays. Conversely, several countries in the Middle East and Africa are scaling low-complexity rapid tests to overcome infrastructure constraints, often leveraging mobile health platforms to bridge geographic barriers.

In the Asia-Pacific, emerging economies are characterized by dual dynamics: increased governmental investment in national testing programs coexists with growing private sector engagement in urban centers. Countries with established manufacturing bases are leveraging local production capabilities to reduce reliance on imports, whereas others are expanding telemedicine-enabled self-testing solutions to extend reach into remote areas. These regional idiosyncrasies underscore the imperative for flexible distribution models and context-specific technology portfolios.

This comprehensive research report examines key regions that drive the evolution of the HIV or AIDS Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Assessment of Leading Players Driving Innovation, Strategic Investments, and Competitive Positioning in the HIV/AIDS Diagnostics Sector

A cadre of pioneering companies continues to shape the HIV/AIDS diagnostics sphere through strategic innovation and targeted investments. Major multinational diagnostics leaders are expanding molecular assay portfolios and integrating advanced analytics to deliver end-to-end solutions. These incumbents leverage global sales networks and comprehensive technical support infrastructures to sustain market leadership while cultivating emerging markets through local partnerships.

Simultaneously, specialized biotechnology firms are gaining traction with niche assays and point-of-care devices optimized for low-resource environments. By focusing on modular platforms compatible with multiple infectious disease targets, they offer cost-effective alternatives to traditional laboratory assays. Their agility in research and development, coupled with strategic collaborations for distribution, enables rapid deployment of novel technologies.

In parallel, software vendors are revolutionizing data management by incorporating predictive modeling and real-time reporting capabilities into laboratory information systems. These digital solutions not only streamline regulatory compliance but also facilitate population-level surveillance and outcome tracking. Outsourced service providers complement this ecosystem by offering turnkey testing services, laboratory management expertise, and proficiency testing programs, thereby reducing entry barriers for new market entrants and bolstering diagnostic capacity globally.

This comprehensive research report delivers an in-depth overview of the principal market players in the HIV or AIDS Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACON Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories

- bioMérieux SA

- Chembio Diagnostics, Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- ELITechGroup

- Euroimmun Medizinische Labordiagnostika AG

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- InBios International, Inc.

- OraSure Technologies

- Ortho Clinical Diagnostics, Inc.

- SD Biosensor Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific, Inc.

- Trinity Biotech plc

- Viracor Eurofins Diagnostic Services

- Wondfo Biotech Co. Ltd.

Strategic Imperatives and Pragmatic Guidelines for Industry Stakeholders to Amplify Growth and Navigate Challenges in HIV/AIDS Diagnostics

To capitalize on evolving market dynamics, industry leaders must adopt a series of strategic imperatives and pragmatic guidelines. First, prioritizing investment in next-generation point-of-care platforms will enable faster, decentralized testing, addressing both clinician demand and patient convenience. Complementary to this, diversifying supply chain partners and localizing critical reagent production can mitigate tariff-induced disruptions and enhance resilience.

In addition, engaging proactively with regulatory agencies to pursue accelerated review pathways for breakthrough diagnostics will facilitate faster time-to-market. Concurrently, forging alliances with payers and governmental bodies to secure value-based reimbursement models can ensure sustainable pricing structures and broaden patient access. Beyond these measures, integrating digital health solutions-such as AI-driven decision support and cloud-based data sharing-will strengthen product differentiation and deliver actionable insights at the point of care.

Finally, cultivating targeted training programs for end users and community health workers will optimize test utilization and bolster adherence to best practices. By aligning these recommendations with corporate strategy, diagnostics providers can not only navigate current challenges but also position themselves for long-term growth in a competitive, innovation-driven landscape.

Robust Research Framework and Methodological Rigor Underpinning the Integrity and Reliability of the Comprehensive HIV/AIDS Diagnostics Market Study

The foundation of this comprehensive market study rests on a robust research framework that synthesizes primary and secondary data sources. In the primary phase, in-depth interviews with industry executives, clinical experts, and regulatory authorities provided nuanced perspectives on technological adoption, reimbursement landscapes, and regional variances. These insights were meticulously validated against quantitative data to ensure consistency and reliability.

Secondary research involved the systematic review of peer-reviewed journals, policy publications, and proprietary databases to map historical trends and identify emerging opportunities. Furthermore, competitive benchmarking analyses assessed product pipelines, strategic partnerships, and intellectual property portfolios, offering a holistic view of the innovation ecosystem. A multi-layered data triangulation process reconciled disparate sources, refining key findings and mitigating biases.

Analytical techniques integrated qualitative inputs with statistical modeling to elucidate segmentation dynamics and regional growth patterns. Rigorous validation procedures, including sensitivity analyses and expert panel reviews, affirmed the integrity of the conclusions. This methodological rigor ensures that the market insights presented herein are both actionable and grounded in empirical evidence, providing stakeholders with a solid foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HIV or AIDS Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HIV or AIDS Diagnostics Market, by Test Type

- HIV or AIDS Diagnostics Market, by Type of Product

- HIV or AIDS Diagnostics Market, by Testing Method

- HIV or AIDS Diagnostics Market, by End-User

- HIV or AIDS Diagnostics Market, by Application

- HIV or AIDS Diagnostics Market, by Region

- HIV or AIDS Diagnostics Market, by Group

- HIV or AIDS Diagnostics Market, by Country

- United States HIV or AIDS Diagnostics Market

- China HIV or AIDS Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis of Essential Insights and Strategic Takeaways Consolidating the Future Outlook of the HIV/AIDS Diagnostics Ecosystem

Drawing together critical insights from technological innovation, policy developments, and market structure, the future of HIV/AIDS diagnostics is characterized by accelerated decentralization, digital integration, and collaborative ecosystems. As point-of-care and self-testing modalities mature, they will complement high-throughput laboratory assays, creating a multi-tiered diagnostics continuum that addresses diverse clinical and public health needs.

Regulatory landscapes will continue to evolve, with expedited pathways incentivizing the rapid adoption of breakthrough assays, while payers increasingly favor performance-based reimbursement frameworks. Simultaneously, regional nuances-from advanced healthcare infrastructures in the Americas to resource-constrained settings in EMEA and emerging economies in Asia-Pacific-will demand tailored deployment strategies and localized partnerships.

Ultimately, stakeholders that embrace agile operational models, invest in modular technologies, and forge cross-sector alliances will be best positioned to harness the full potential of this market. By maintaining a steadfast commitment to research rigor and patient-centric innovation, the HIV/AIDS diagnostics ecosystem will continue to evolve, delivering more sensitive, accessible, and cost-effective solutions that transform care pathways and drive global health impact.

Engage with Ketan Rohom to Access the Definitive In-Depth HIV/AIDS Diagnostics Market Research Report and Propel Your Strategic Initiatives Forward

To explore the comprehensive HIV/AIDS diagnostics market research report and unlock strategic pathways for growth, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will guide you through tailored insights, from in-depth segmentation analysis to competitive benchmarking and actionable recommendations. By partnering with Ketan, organizations can accelerate decision-making, optimize product portfolios, and discover untapped opportunities in the diagnostics landscape. Secure your copy today to catalyze innovation, strengthen stakeholder engagement, and drive sustainable impact across global healthcare settings. Elevate your strategic initiatives with guidance from Ketan Rohom and position your organization at the forefront of HIV/AIDS diagnostics excellence.

- How big is the HIV or AIDS Diagnostics Market?

- What is the HIV or AIDS Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?