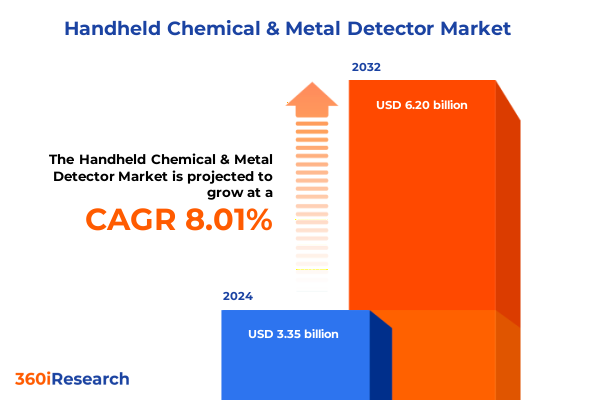

The Handheld Chemical & Metal Detector Market size was estimated at USD 3.61 billion in 2025 and expected to reach USD 3.88 billion in 2026, at a CAGR of 8.05% to reach USD 6.20 billion by 2032.

Emerging Dynamics of Handheld Chemical and Metal Detection Tools Shaping Safety Protocols Across Industries in an Era of Evolving Threats

In the current era of heightened security concerns and environmental vigilance, the handheld chemical and metal detection domain has emerged as a critical linchpin across multiple sectors. Innovations in sensor miniaturization, coupled with robust data processing capabilities, have propelled these portable instruments from niche applications into mainstream operational use. As industrial facilities, government agencies, and frontline security providers seek agile and accurate detection capabilities, handheld technologies offer the promise of rapid threat identification without the constraints of fixed-location equipment.

Moreover, the convergence of chemical detection methodologies with advanced metal sensing mechanisms has given rise to multifunctional devices capable of addressing diverse threat profiles. These advancements not only streamline field operations but also reduce training complexity by consolidating multiple functionalities into a single, user-friendly platform. As a result, decision-makers are reevaluating legacy protocols and procurement strategies to incorporate solutions that deliver both precision and versatility.

Furthermore, recent regulatory and policy shifts have underscored the importance of compliance documentation and traceable inspection procedures. Traceability requirements in environmental monitoring and security screening are driving the adoption of portable detection tools that integrate seamlessly with digital record-keeping systems. Consequently, organizations are investing in technologies that not only detect chemical and metal hazards but also facilitate real-time reporting and data archiving to meet evolving audit standards.

Overall, the handheld chemical and metal detector landscape is at an inflection point where technological maturation, regulatory imperatives, and cross-sector demand converge. As a result, stakeholders must navigate a dynamic environment that rewards innovation, prioritizes adaptability, and emphasizes actionable intelligence.

Rapid Technological Advancements and Policy Overhauls Driving Paradigm Shifts in Handheld Detection Markets Across Security, Industrial, and Environmental Applications

Industry participants are witnessing a renaissance driven by rapid technological advancements that redefine the capabilities of handheld detection instruments. Traditional magnetometry sensors used for basic metal detection are increasingly complemented by spectroscopy modules that leverage laser-based or X-ray fluorescence techniques, enabling more granular identification of elemental compositions. This fusion of sensing technologies is disrupting conventional single-function devices and positioning multi detectors as the new benchmark for field operations.

In parallel, the integration of ion mobility spectrometry with advanced data analytics platforms is enhancing the sensitivity and selectivity of chemical detection. Embedded machine learning algorithms can now differentiate complex chemical signatures under varying environmental conditions, reducing false positives and elevating the confidence in real-time decision-making. Consequently, end users are demanding instruments that not only detect threats but also contextualize findings within a broader analytical framework.

Furthermore, policy overhauls and updated compliance standards are reshaping procurement criteria, especially within government agencies and industrial inspection regimes. Regulatory bodies are mandating stricter thresholds for hazardous substance detection and insisting on enhanced data traceability, prompting solution providers to embed robust cybersecurity features within their devices. As a result, product roadmaps are being recalibrated to prioritize secure wireless connectivity, encrypted data transmission, and user authentication protocols.

Taken together, these transformative shifts herald a new paradigm where handheld detection tools are no longer adjuncts to fixed monitoring stations but integral components of holistic safety and security ecosystems. Manufacturers and end users alike must adapt swiftly to harness these advancements, ensuring that operational workflows maximize both accuracy and efficiency.

Comprehensive Assessment of 2025 United States Tariff Measures Reshaping Supply Chains and Cost Structures in Handheld Detection Equipment

The introduction of comprehensive tariff measures by the United States in early 2025 has introduced new complexities into the supply chain of handheld detection equipment. Import duties applied to core components, such as specialized sensors and semiconductor packages, have elevated procurement costs for raw material kits sourced from international suppliers. Concurrently, certain finished detector assemblies have been subject to higher duty classifications, shifting the cost burden onto manufacturers that rely on globalized production networks.

Moreover, secondary effects of tariff policy, including updated customs valuation protocols and intensified documentation requirements, have extended lead times for inbound shipments. This has placed additional strain on just-in-time manufacturing models, prompting stakeholders to revisit inventory strategies and buffer stock levels. Some device producers are exploring dual-source procurement strategies to mitigate concentration risks, while others are contemplating onshoring select production stages to county-level facilities to qualify for preferential treatment under new trade agreements.

In addition, end users operating in sectors such as military defense and mining are assessing total cost of ownership in light of these duty shifts. The added expense of imported components is often passed through to buyers via equipment leasing terms or service contracts that include detection instrument calibration and maintenance. Consequently, procurement cycles are lengthening, and decision-makers are requiring more detailed costing analyses to justify capital allocations.

Ultimately, the 2025 tariff environment is redefining cost structures across the handheld detection market, challenging traditional supply chain models and compelling both manufacturers and end users to adopt more resilient sourcing frameworks. Navigating these trade policy headwinds will demand proactive collaboration across procurement, engineering, and strategic planning teams.

Strategic Segmentation Perspectives Revealing Critical Differentiators Across Product Types, Technologies, Applications, End Users, and Sales Channels

Segmentation analysis reveals that handheld detection instruments are no longer homogeneous commodities but specialized tools tailored to unique operational requirements. When viewing the market through product categories, it becomes clear that chemical detectors, metal detectors, and integrated multi detectors each serve distinct end-user pain points, with multi detectors gaining traction among entities seeking consolidated threat coverage. From a technological perspective, the contrast between ion mobility spectrometry systems and magnetometry-based sensors underscores divergent performance trade-offs, while pulse induction modules add depth to metal detection in high-interference environments. Additionally, spectroscopy approaches-whether laser-formulated sampling or X-ray fluorescence-offer varying levels of sensitivity and field deployment considerations.

Furthermore, application-based segmentation elucidates clear demand vectors: environmental monitoring units emphasize trace detection for pollutants, industrial inspection tools prioritize rapid in-line testing of production materials, and military and defense solutions demand ruggedized form factors with encrypted data links. Mining operations look to specialized detectors for heavy metal identification within geological matrices, and security screening contexts require swift throughput and low false alarm rates. In parallel, end-user demarcations illustrate that government agencies adhere to stringent procurement standards, industrial companies focus on operational efficiency, private security firms seek cost-effective scale, and research institutions prioritize analytical precision.

Lastly, the divergence between offline and online distribution channels highlights evolving buyer behavior: traditional offline sales channels maintain relevance for high-touch, end-to-end solution deployments, whereas online portals accelerate access to modular devices and recurring sensor refills. Taken together, segmentation insights lay the groundwork for targeted product development and market entry strategies.

This comprehensive research report categorizes the Handheld Chemical & Metal Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Sales Channel

Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific Handheld Detection Markets

Geographical dynamics across the Americas highlight a mature regulatory landscape driven by federal and state safety mandates. North American entities leverage established compliance frameworks to integrate portable detection tools into environmental monitoring and border security applications, while Latin American operators increasingly adopt entry-level detectors to bolster mining and industrial inspection protocols. Across Europe, Middle East, and Africa, stringent environmental regulations intersect with emerging security threats, prompting diversified demand for both high-sensitivity chemical detectors and robust metal detection solutions. Western European markets emphasize interoperability with digital reporting systems, whereas parts of the Middle East prioritize rapid deployment of ruggedized devices in harsh operational theaters. Meanwhile, African stakeholders focus on cost-effective, versatile instruments that support both environmental safeguards and resource extraction oversight.

In the Asia-Pacific region, a blend of rapid industrialization and heightened security concerns is stimulating significant investment in detection technologies. East Asian economies are at the forefront of integrating spectroscopy-based sampling modules into manufacturing quality control pipelines, while Southeast Asian security agencies emphasize the deployment of lightweight detectors at critical infrastructure points. Additionally, Oceania’s mining and environmental sectors favor highly portable, battery-efficient devices capable of extended field operations. Regulatory harmonization efforts across regional trade alliances are gradually simplifying cross-border equipment transfers, further accelerating the diffusion of advanced handheld detection solutions.

Collectively, these regional nuances underscore the importance of customizing product features and commercialization strategies to local operational and regulatory contexts. Market players must remain attuned to shifting policy landscapes and end-user preferences to capture opportunities and optimize resource allocation across these diverse territories.

This comprehensive research report examines key regions that drive the evolution of the Handheld Chemical & Metal Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlighting Leading Handheld Detection Vendors, Their Technological Investments, and Collaborative Market Positioning

An examination of leading vendors within the handheld detection space reveals distinct strategic orientations. Certain established instrumentation manufacturers have doubled down on research partnerships to enhance the sensitivity of their ion mobility spectrometry platforms, while others have pursued targeted acquisitions to integrate machine learning capabilities into their sensor suites. Collaborative ventures between sensor chip producers and data analytics providers are accelerating the rollout of intelligent detectors that can autonomously calibrate and self-diagnose performance anomalies.

Moreover, specialized technology startups are carving niche positions by introducing modular architectures, enabling end users to swap between chemical and metal sensing modules in the field. This plug-and-play philosophy contrasts with traditional all-in-one devices, offering customers flexibility in managing capital expenditures and evolving operational requirements. In parallel, select global conglomerates are leveraging their expansive distribution networks to bundle handheld detectors with complementary safety equipment, driving cross-selling synergies and reinforcing brand loyalty among large enterprise accounts.

Furthermore, competitive differentiation is emerging around service models, with some companies offering subscription-based calibration and maintenance packages that include remote diagnostics and real-time performance tracking. These innovative offerings align with end-user priorities for uptime assurance and lifecycle management, thereby elevating total solution value beyond the hardware itself. As a result, competitive positioning is increasingly defined by the depth of aftermarket support and the robustness of supplier ecosystems.

In summary, companies that effectively blend cutting-edge technology investments, collaborative partnerships, and differentiated service models are best positioned to capture strategic share within the handheld detection domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Handheld Chemical & Metal Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc

- Ametek Inc

- Bruker Corporation

- Codan Limited

- Driver Southall

- Drägerwerk AG & Co. KGaA

- Honeywell International Inc

- Metal Detection Services

- Metal Detectors, Inc.

- MSA Safety Incorporated

- PerkinElmer Inc

- Smiths Group plc

- SNB Electronic Services Ltd.

- Teledyne Technologies Inc

- Thermo Fisher Scientific Inc

Proactive Strategies and Tactical Recommendations Enabling Industry Leaders to Capitalize on Innovations and Navigate Emerging Market Complexities

Industry leaders seeking to maintain a competitive edge should prioritize the integration of artificial intelligence-driven analytics into handheld detection platforms. By adopting adaptive algorithms capable of contextual learning, organizations can significantly reduce false alarms and enhance operational throughput. Additionally, cross-functional collaboration between engineering teams and end-user stakeholders will ensure that device form factors and interface designs align with real-world field requirements, thereby improving user adoption rates and compliance with standard operating procedures.

Furthermore, supply chain resilience must be elevated through strategic diversification of component sourcing. Establishing secondary supplier relationships for key sensor components and semiconductor wafers will mitigate the impact of future tariff fluctuations and logistical disruptions. Organizations should also explore near-shoring or regional assembly options to shorten lead times and foster closer alignment with local regulatory frameworks.

In the realm of commercialization, companies are encouraged to develop comprehensive service portfolios that combine hardware, software updates, and proactive maintenance in a unified package. Subscription-based models for sensor calibration and performance health monitoring can generate recurring revenue streams while reinforcing customer loyalty. Moreover, fostering partnerships with academic and research institutions can yield early access to emerging sensing technologies and novel materials, accelerating product innovation.

Ultimately, a balanced focus on technological differentiation, operational agility, and customer-centric service frameworks will enable industry leaders to navigate evolving market complexities and secure long-term growth trajectories.

Rigorous Multi-Method Research Approach Integrating Primary and Secondary Data to Ensure Robust Insights into Handheld Detection Market Trends

This study employs a rigorous, multi-method research approach to ensure the integrity and depth of insights into handheld detection market trends. The primary research component comprises in-depth interviews with subject-matter experts, including instrumentation engineers, procurement specialists, and regulatory officers, capturing firsthand perspectives on technology adoption barriers and emerging compliance priorities. These qualitative insights are complemented by a structured survey of end users across environmental monitoring, industrial inspection, and security screening segments to quantify priorities in device features and service expectations.

Secondary research sources include publicly available regulatory documents, government procurement records, and peer-reviewed journal articles on sensor technologies such as ion mobility spectrometry, magnetometry, pulse induction, and spectroscopy methodologies. Proprietary databases and patent filings were analyzed to trace innovation trajectories and identify emerging technology roadmaps within key geographies.

Analytical frameworks, including cross-segmentation matrices and supply chain impact assessments, were employed to map relationships among tariff policies, component sourcing strategies, and product architecture decisions. Rigorous data triangulation methods were applied to reconcile primary and secondary findings, ensuring consistency and robustness in the final insights. All research processes adhered to stringent quality control protocols, including peer review and validation workshops with industry stakeholders, thereby guaranteeing the report’s relevance and accuracy for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Handheld Chemical & Metal Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Handheld Chemical & Metal Detector Market, by Product Type

- Handheld Chemical & Metal Detector Market, by Technology

- Handheld Chemical & Metal Detector Market, by Application

- Handheld Chemical & Metal Detector Market, by End User

- Handheld Chemical & Metal Detector Market, by Sales Channel

- Handheld Chemical & Metal Detector Market, by Region

- Handheld Chemical & Metal Detector Market, by Group

- Handheld Chemical & Metal Detector Market, by Country

- United States Handheld Chemical & Metal Detector Market

- China Handheld Chemical & Metal Detector Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis of Market Dynamics and Strategic Imperatives Underscoring the Critical Role of Handheld Detection Solutions in Future Safety and Security Frameworks

Throughout this analysis, handheld chemical and metal detection solutions have been established as indispensable tools within safety-critical and compliance-driven environments. The convergence of advanced sensing technologies, from ion mobility spectrometers to integrated spectroscopy modules, underscores the market’s trajectory toward multifunctional, intelligent devices. At the same time, evolving tariff landscapes and regulatory mandates are accentuating the need for supply chain resilience and adaptive sourcing strategies.

Key segmentation insights reveal that product types, technological architectures, applications, end-user requirements, and distribution channels each present unique vectors for growth and differentiation. Regional dynamics across the Americas, EMEA, and Asia-Pacific further illustrate the importance of tailoring solutions to localized operational contexts, from robust, ruggedized platforms to streamlined cloud-connected instruments.

Competitive positioning is increasingly defined not only by hardware performance but also by the depth of service offerings and collaborative ecosystems. Companies that excel at integrating predictive maintenance models, subscription-based calibration services, and strategic partnerships are poised to lead the next wave of market expansion. Meanwhile, proactive recommendations emphasize the importance of artificial intelligence integration, supply chain diversification, and customer-centric product development as essential levers for sustained success.

In conclusion, the handheld detection market is entering a phase marked by rapid innovation, heightened regulatory scrutiny, and shifting cost paradigms. Stakeholders that embrace these dynamics through informed strategic planning and agile operational execution will be best positioned to capitalize on emerging opportunities and secure their leadership in the years to come.

Engage with Ketan Rohom to Acquire the Definitive Handheld Detection Market Report and Drive Informed Strategic Decisions

For organizations seeking to fortify decision-making processes and drive strategic initiatives in the handheld chemical and metal detection space, direct engagement offers unparalleled value and clarity. Connect with Ketan Rohom, the Associate Director of Sales & Marketing, to explore a tailored discussion that aligns the nuances of this comprehensive report with your specific operational and business objectives. Through a personalized briefing, stakeholders will gain an in-depth understanding of market dynamics, segmentation intricacies, tariff implications, and competitive strategies that resonate most closely with their organizational goals.

By collaborating with Ketan, companies can unlock immediate access to exclusive insights, supplemental data sets, and expert interpretations, enabling rapid integration of findings into product development roadmaps and go-to-market plans. This collaborative approach ensures that decision-makers are equipped not only with factual intelligence but also with actionable context that addresses regulatory landscapes, technological evolutions, and end-user requirements.

Contact Ketan Rohom to schedule a consultation and secure your copy of the definitive handheld chemical and metal detector market research report today. Empowers your leadership team to navigate emerging challenges and capitalize on strategic opportunities with confidence and precision.

- How big is the Handheld Chemical & Metal Detector Market?

- What is the Handheld Chemical & Metal Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?