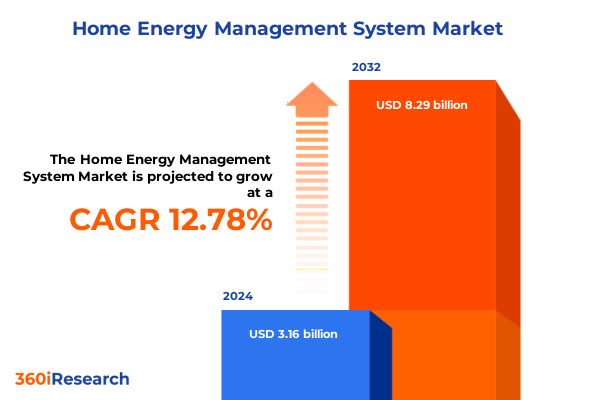

The Home Energy Management System Market size was estimated at USD 3.49 billion in 2025 and expected to reach USD 3.86 billion in 2026, at a CAGR of 13.11% to reach USD 8.29 billion by 2032.

Introduction to Home Energy Management Systems and Why Modern Stakeholders Are Betting on Intelligent Energy Control Solutions

The rising imperative for energy efficiency, cost savings, and environmental stewardship has thrust home energy management systems into the spotlight for homeowners, technology providers, utilities, and policymakers alike. This introduction outlines the fundamental drivers propelling intelligent energy platforms from niche offerings to core elements of residential infrastructure. It examines how digital connectivity, advanced analytics, and consumer awareness converge to form a new paradigm where distributed intelligence enhances comfort while minimizing utility expenses and carbon emissions.

In framing this discussion, it is important to recognize that the home energy management sector no longer operates in isolation; it is increasingly integrated with broader smart grid initiatives, renewable energy generation, and demand response programs. This synergy creates a virtuous cycle whereby deployment of thermostats, sensors, and control software not only serves end users directly but also supports grid balancing and resilience. Consequently, stakeholders are compelled to rethink conventional energy consumption patterns and embrace a decentralized, data-driven approach to residential power management.

Emerging Technological, Regulatory, and Behavioral Forces Revolutionizing Home Energy Management in the Era of Smart Living and Decarbonization

Technological progress, regulatory reforms, and shifting consumer expectations have collectively disrupted the traditional home energy management landscape. On the technology front, the proliferation of low-cost sensors, interoperable communication protocols, and machine learning algorithms has enabled real-time monitoring and autonomous decision-making. For example, artificial intelligence-driven load control now optimizes HVAC operation dynamically based on weather forecasts, occupancy patterns, and energy price signals.

Simultaneously, government policies and utility incentive programs are mandating more stringent energy performance standards for residential buildings, while offering rebates for system upgrades. These regulatory developments are accelerating the retrofit market for older homes and fueling innovation in turnkey services. Moreover, evolving behavioral trends-such as the rise of remote work and heightened environmental consciousness-have elevated homeowner engagement, driving demand for intuitive dashboards and mobile applications that translate complex data into actionable insights.

As a result, industry participants are forging partnerships across sectors, combining expertise in cloud infrastructure, cybersecurity, and energy analytics. These collaborations are redefining value chains, as traditional appliance manufacturers align with software developers and energy retailers to deliver integrated offerings. In turn, ecosystem convergence is generating new business models that emphasize recurring revenue streams through subscription-based services and performance guarantees.

Analyzing the Compound Effects of 2025 United States Tariff Adjustments on Home Energy Management System Supply Chains and Cost Structures

Against this backdrop of rapid innovation, the imposition of revised United States tariffs in early 2025 introduced a significant inflection point for system manufacturers and integrators. Raw materials such as semiconductor components, power electronics, and specialized sensors saw duty rates increase, affecting supply chain economics for hardware-centric solutions. Consequently, suppliers have sought alternative sourcing strategies, including nearshoring to Mexico and leveraging free trade agreement partners to mitigate cost escalation.

Moreover, tariff-induced price pressures have heightened the importance of software-centric models and service revenues. Providers are pivoting towards cloud-based analytics subscriptions and performance contracting to preserve margins while absorbing hardware cost fluctuations. From another perspective, higher import duties have spurred domestic production of key components, stimulating partnerships between OEMs and local contract manufacturers. This reconfiguration of supply networks underscores the interconnectedness between trade policy and the strategic mix of in-house manufacturing, third-party assembly, and cross-border logistics.

In practical terms, end users are experiencing a recalibration of installation pricing, leading to renewed emphasis on efficient system design and value-added services that justify upfront investment. This environment has also accelerated R&D investments in modular, standardized hardware architectures that simplify assembly and reduce reliance on high-tariff inputs. Thus, the 2025 tariff adjustments have catalyzed both operational agility and a refocusing on software-driven differentiation.

Deep Dive into Component End-User Application Product Type and Communication Technology Perspectives Shaping Home Energy Management System Dynamics

A nuanced understanding of market segments illuminates the diverse pathways through which home energy management systems deliver value. When examining component segmentation, the discussion traverses hardware, services-ranging from consulting to installation and maintenance-and software with both cloud-based and on-premises deployments. This layered perspective reveals that while hardware investments underpin device interoperability, services cultivate long-term customer engagement and software fuels data monetization and continuous performance optimization.

Equally significant, end-user segmentation separates commercial, industrial, and residential applications, each with distinct operational imperatives and procurement processes. In commercial settings, demand response programs and energy monitoring solutions drive efficiency across portfolios of buildings. Industrial operations, by contrast, leverage load control and automated process heating and cooling to stabilize production schedules and minimize energy wastage. Residential adoption is propelled by convenience features, real-time alerts, and tariff-driven incentives.

Furthermore, application segmentation highlights demand response, energy monitoring, and load control as primary use cases, demonstrating how each functionality aligns with specific stakeholder priorities. The plurality of product types-HVAC controls, lighting controls, smart meters, and thermostats-anchors these applications, providing the physical interface between the digital platform and energy infrastructure. Lastly, communication technology segmentation differentiates wired and wireless networks, underscoring trade-offs between installation complexity, reliability, and scalability.

This comprehensive research report categorizes the Home Energy Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Product Type

- Communication Technology

- End-User

- Application

Assessing Regional Drivers and Market Nuances Across the Americas Europe Middle East Africa and Asia-Pacific in Home Energy Management Adoption

Regional dynamics exert a profound influence on technology adoption, regulatory frameworks, and investment behavior within the home energy management ecosystem. In the Americas, decarbonization mandates at federal and state levels, complemented by robust venture capital activity, have accelerated deployment of advanced energy controls. North American markets benefit from mature grid infrastructure and well-established incentive programs, while Latin American countries are witnessing nascent growth driven by rising urbanization and energy cost volatility.

Shifting to Europe, the Middle East, and Africa, stringent efficiency standards and ambitious carbon neutrality targets have catalyzed demand for integrated energy management solutions. European Union directives on building performance certification compel landlords and homeowners to adopt monitoring and automation tools. In the Middle East, high cooling loads generate a unique value proposition for smart thermostats and load control, while African markets are exploring solar-powered HEMS installations to address grid intermittency.

Across Asia-Pacific, rapid urban development, electrification of transport, and government-led smart city initiatives are driving innovation in both hardware and software domains. Several national programs in Japan and South Korea incentivize cloud-native energy monitoring platforms, whereas Australia’s residential demand response auctions are creating new revenue opportunities for aggregators. This regional mosaic highlights the need for flexible business models that accommodate varying policy environments and infrastructure maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Home Energy Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Moves Innovation Partnerships and Portfolios of Leading Companies Steering the Home Energy Management System Sector Forward

Key players in the home energy management space are leveraging strategic alliances, acquisitions, and platform enhancements to solidify their market positions. In the hardware realm, industry stalwarts have introduced modular HVAC control units and next-generation smart meters with enhanced cybersecurity protocols. Complementing these offerings, software providers have expanded their analytics portfolios to include predictive maintenance and AI-driven load forecasting.

Partnerships between energy retailers and technology startups have given rise to bundled offerings that integrate demand response enrollment, real-time energy monitoring, and consumer engagement applications. Corporate alliances spanning telecommunications companies and utility giants are also emerging, leveraging network infrastructure to deliver high-availability wireless energy management solutions. In parallel, established automation conglomerates are integrating residential segments into their broader smart building platforms, enabling consistent interoperability across commercial and industrial deployments.

Furthermore, leading companies are prioritizing customer-centric features such as intuitive mobile dashboards, seamless integration with home automation ecosystems, and open APIs that facilitate third-party innovation. Innovation accelerators within these organizations are increasingly focused on edge computing capabilities, ensuring that critical energy decisions can be executed locally even in the event of network disruptions. As competition intensifies, differentiation hinges on the ability to deliver end-to-end value, from initial design consultancy through ongoing performance optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Home Energy Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alarm.com Holdings, Inc.

- Eaton Corporation plc

- Ecobee Inc.

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Inspire Smart Home

- Johnson Controls International plc

- Legrand SA

- Leviton Manufacturing Company, Inc.

- Lutron Electronics Co., Inc.

- Schneider Electric SE

- Sense Labs, Inc.

- Siemens AG

- SolarEdge Technologies, Inc.

- Vivint Smart Home, Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Opportunities and Navigate Risks in the Evolving Home Energy Management Ecosystem

Industry leaders should prioritize the development of interoperable platforms that seamlessly integrate hardware, software, and services. By aligning roadmap investments around open standards and API-first architectures, organizations can foster third-party ecosystems and accelerate time to market. In addition, companies must explore subscription-based pricing models for analytics and consulting services that provide predictable recurring revenue while enhancing customer retention.

Next, cultivating strategic partnerships with utilities and grid operators can unlock demand response and ancillary service revenue streams that are increasingly pivotal in grid modernization efforts. Establishing joint ventures or pilot programs with regional energy authorities will position providers as trusted collaborators in the pursuit of reliability and decarbonization. Meanwhile, investing in modular hardware designs and local sourcing strategies will attenuate the financial impact of trade policy shifts and supply chain disruptions.

Finally, leaders must enhance customer engagement by deploying advanced user interfaces and leveraging behavioral science to drive energy conservation behaviors. Customized alerts, gamification elements, and integration with home automation voice assistants can transform passive energy consumers into proactive participants. By orchestrating these measures, companies can deliver differentiated offerings that resonate with evolving consumer and regulatory demands.

Detailing Rigorous Research Methodology Integrating Quantitative and Qualitative Insights to Inform Robust Home Energy Management Market Analysis

This research is underpinned by a rigorous mixed-methods approach, combining qualitative interviews with senior executives across technology providers, utilities, and policy organizations, and quantitative analytics derived from primary surveys of end users. Detailed vendor profiling and competitor benchmarking were conducted through structured data collection and triangulated with public financial disclosures, patent filings, and regulatory filings.

Secondary research sources included academic journals, government publications, and industry whitepapers, ensuring a comprehensive perspective on regulatory developments, technological breakthroughs, and market trends. All findings were validated through a multi-stage review process involving subject matter experts, with iterative feedback cycles to refine insights. Geographic analysis was enriched by localized field studies and consultations with regional analysts, allowing nuanced interpretation of market nuances across the Americas, EMEA, and Asia-Pacific.

Data synthesis employed advanced statistical techniques and scenario modeling to identify key drivers, challenges, and emerging opportunities. Throughout the research process, strict adherence to ethical standards and confidentiality protocols ensured the integrity of proprietary information and stakeholder trust.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Home Energy Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Home Energy Management System Market, by Component

- Home Energy Management System Market, by Product Type

- Home Energy Management System Market, by Communication Technology

- Home Energy Management System Market, by End-User

- Home Energy Management System Market, by Application

- Home Energy Management System Market, by Region

- Home Energy Management System Market, by Group

- Home Energy Management System Market, by Country

- United States Home Energy Management System Market

- China Home Energy Management System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Deliver a Cohesive Perspective on Home Energy Management System Market Trends

In summary, the home energy management system market is at a pivotal juncture, driven by technological innovation, shifting policy landscapes, and heightened consumer expectations. Key insights reveal that modular, software-centric approaches and service-oriented business models are essential to navigate cost pressures and unlock new revenue pools. Furthermore, tariff adjustments underscore the critical importance of supply chain resilience and strategic sourcing.

Regional analysis highlights disparate adoption patterns, with mature markets in North America and Europe requiring advanced feature sets, while emerging economies in Asia-Pacific and Latin America demand affordability and simplicity. Leading companies are responding with ecosystem partnerships, open architectures, and customer-centric platforms that integrate seamlessly with broader smart home environments.

Ultimately, organizations that embrace interoperability, invest in analytics-driven services, and collaborate with utilities and policymakers will be best positioned to capitalize on the transformative potential of home energy management. This cohesive perspective underscores strategic imperatives for stakeholders seeking to sharpen their competitive edge in a rapidly evolving marketplace.

Engage with Associate Director Sales and Marketing to Secure In-Depth Home Energy Management Research and Empower Strategic Decision-Making

To gain a competitive edge and comprehensive understanding of home energy management systems, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise bridges market intelligence with actionable insights, ensuring your organization secures the tailored data and strategic recommendations needed to engineer optimized energy solutions. Contact him to explore bespoke research packages, engage in in-depth consultations, and leverage our in-house analytical frameworks for transformational decision-making. Start the conversation today to empower your team with the most robust investigative report designed to drive efficiency, sustainability, and profitability in the modern energy landscape.

- How big is the Home Energy Management System Market?

- What is the Home Energy Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?