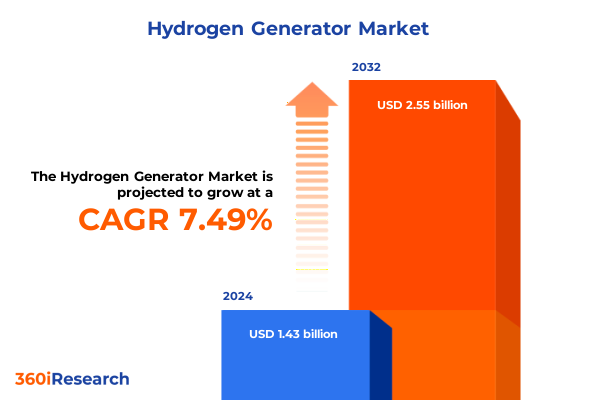

The Hydrogen Generator Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.65 billion in 2026, at a CAGR of 7.50% to reach USD 2.55 billion by 2032.

Understanding the Strategic Role of Advanced Hydrogen Generators in Driving Widespread Sustainable Energy Transitions and Decarbonization Efforts Globally

Hydrogen generator technology stands at the forefront of the global energy transition, offering a compelling pathway to decarbonize heavy industry, transportation, and power generation. As nations pursue ambitious net-zero targets, the ability to produce clean hydrogen efficiently and cost-effectively has emerged as a strategic imperative. This executive summary sets the stage for a comprehensive exploration of the hydrogen generator market, illuminating the forces that are reshaping supply chains, regulatory frameworks, and investment flows around the world.

To begin, the introduction outlines the purpose and structure of the report, highlighting key focus areas such as technological innovation, policy developments, and market segmentation. It underscores the significance of hydrogen generator systems-ranging from coal gasification units to advanced electrolyzers-and explains their vital role in enabling a low-carbon economy. By establishing clear context and objectives, this section ensures that readers understand the breadth and depth of the analysis that follows, positioning them to extract actionable insights and informed strategic recommendations.

Exploring the Innovative Technological and Regulatory Shifts That Are Reshaping the Hydrogen Generation Landscape and Market Dynamics

Over the past decade, rapid advancements in electrolysis technologies have fundamentally altered the hydrogen generator landscape. Breakthroughs in proton exchange membrane and solid oxide electrolyzers have enabled higher efficiency, greater durability, and reduced energy consumption, ushering in a new era of affordability for green hydrogen production. Alongside these technical improvements, policy frameworks such as the Inflation Reduction Act in the United States and the European Union’s hydrogen strategy have provided vital incentives that accelerate research, development, and deployment of large-scale projects.

Meanwhile, shifts in global supply chains have fostered increased collaboration between renewable energy providers and hydrogen equipment manufacturers. Strategic alliances and joint ventures are now common, allowing companies to vertically integrate production, from renewable power generation to on-site hydrogen synthesis. As a result, economies of scale are beginning to materialize, driving down total system costs and expanding the addressable market across industrial applications. Ultimately, these transformative shifts illustrate how innovation and policy are converging to create a fertile environment for hydrogen generators to become a cornerstone of decarbonization strategies worldwide.

Assessing the Comprehensive Effects of 2025 U.S. Import Tariffs on Hydrogen Generators and Implications for Domestic Industry Competitiveness

In 2025, newly implemented U.S. import tariffs on critical hydrogen generator components have introduced a complex set of challenges for manufacturers and end users alike. Tariffs on imported electrolysis stacks, pressure vessels, and control systems have translated into elevated capital expenditure for domestic projects, prompting firms to reassess cost models and supply chain strategies. Although these measures aim to stimulate local manufacturing, they have also triggered short-term disruptions as companies seek alternative sourcing or adjust procurement timelines.

The cumulative impact of these tariffs extends beyond immediate price inflation. Higher input costs have led some developers to delay planned deployments, while others are redirecting investment to jurisdictions with more favorable trade conditions. At the same time, U.S.-based electrolyzer producers have enjoyed a transient competitive edge, experiencing order backlogs as global competitors face steeper duties. In the medium term, sustaining this advantage will depend on domestic firms’ ability to scale production capacity and maintain competitive quality standards. In turn, these tariff-driven market dynamics are reshaping decisions around project siting, capital allocation, and technology adoption throughout the hydrogen generator value chain.

Unveiling Key Segmentation Insights into Production Methods Technologies Applications Pressures and Distribution Channels in the Hydrogen Generation Market

Segmenting the hydrogen generator market by production method reveals nuanced adoption patterns across coal gasification, steam methane reforming, and various electrolysis techniques. While coal-based units and conventional reformers continue to dominate established industrial hubs, electrolysis has captured the spotlight through its versatility and environmental credentials. Within electrolysis, alkaline systems retain a foothold in cost-sensitive applications, but proton exchange membrane and solid oxide technologies are gaining momentum by delivering higher purity outputs and operational flexibility.

Evaluating market segmentation through a technology lens underscores a parallel narrative: the convergence of alkaline, proton exchange membrane, and solid oxide electrolyzers, each carving out roles based on efficiency, scalability, and integration potential. Meanwhile, application-driven analysis highlights hydrogen’s expanding footprint in chemical manufacturing, electronics fabrication, metal processing, oil and gas refining, power generation, and an emergent transportation sector encompassing fuel cell vehicles, industrial mobility platforms, and portable power systems. Pressure-based segmentation distinguishes high-pressure units suited for pipeline injection and long-term storage from low- and medium-pressure solutions that align with localized distribution. Finally, assessing on-site versus off-site distribution models illuminates how end users balance logistics, storage safety, and capex trade-offs when selecting the optimal hydrogen generator configuration.

This comprehensive research report categorizes the Hydrogen Generator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Method

- Technology

- Pressure

- Application

- Distribution

Highlighting Regional Dynamics and Emerging Opportunities across the Americas Europe Middle East Africa and Asia-Pacific Hydrogen Generation Ecosystems

Regional analysis of the hydrogen generator market underscores distinct growth trajectories and strategic imperatives across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, policy-driven momentum and abundant renewable resources are catalyzing a wave of green hydrogen projects, while existing natural gas infrastructure supports transitional blue hydrogen developments. Regulatory incentives combined with private sector commitments are propelling pilot facilities and regional hubs from concept to reality.

In Europe, the emphasis on energy security and carbon neutrality has galvanized investments into electrolyzer manufacturing and hydrogen network development. Collaborative frameworks link member states through cross-border pipelines and coordinated funding mechanisms, accelerating project execution. Conversely, in the Middle East and Africa, competitive solar energy potential is steering large-scale green hydrogen export schemes, designed to serve global demand. Lastly, Asia-Pacific’s dynamic energy ecosystems-anchored by industrial heavyweights and rapidly evolving regulatory landscapes-continue to prioritize domestic capacity expansion, with several nations unveiling long-term hydrogen roadmaps that integrate both domestic consumption and export-oriented strategies.

This comprehensive research report examines key regions that drive the evolution of the Hydrogen Generator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Profiles and Competitive Positions of Leading Companies Driving Innovation in Hydrogen Generator Technologies

Leading technology developers and system integrators are defining the competitive contours of the hydrogen generator market through differentiated innovation roadmaps and strategic partnerships. Firms with deep experience in electrolysis stack design are expanding into full turnkey solutions, while established industrial gas providers are leveraging distribution networks to introduce integrated hydrogen delivery models. Meanwhile, equipment manufacturers with core competencies in high-pressure vessel fabrication are collaborating with renewable energy developers to co-locate production assets, optimizing both power supply and hydrogen synthesis.

These corporate strategies underscore a dual focus on technological leadership and market access. Some companies are channeling R&D investments into advanced membrane materials and modular system architectures that reduce balance of plant complexity. Others are cultivating strategic alliances with government entities and infrastructure consortia to secure off-take agreements and anchor demand for new facilities. Collectively, these approaches reflect a competitive landscape in which agility, scale, and cross-sector collaboration determine which players will lead the next wave of hydrogen generator deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrogen Generator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Ballard Power Systems Inc.

- Cummins Inc.

- Hygear B.V.

- ITM Power PLC

- Linde plc

- McPhy Energy S.A.

- Nel ASA

- Plug Power Inc.

- Praxair Technology, Inc.

- Siemens Energy AG

- Sulzer Ltd.

- Toshiba Energy Systems & Solutions Corporation

Delivering Actionable Recommendations for Industry Leaders to Navigate Regulatory Tariff and Technological Challenges in Hydrogen Generation Strategies

To navigate the intertwined challenges of tariffs regulatory shifts and rapid technological evolution, industry leaders should prioritize a holistic approach that aligns procurement decisions with long-term supply chain resilience. First and foremost companies must engage in proactive dialogue with tariff authorities and trade associations to advocate for calibrated duty structures that encourage domestic capacity without undermining competitive cost dynamics. Parallel to this policy engagement it is crucial to diversify supplier ecosystems through strategic alliances and joint manufacturing initiatives that mitigate single‐source dependencies.

From a technology standpoint organizations should accelerate pilot testing of emerging electrolyzer platforms and invest in flexible balance of plant designs that allow rapid retrofits as component costs evolve. Additionally forging partnerships with renewable energy providers will secure preferential power tariffs and help qualify projects for green energy incentives. Finally empowering cross‐functional teams to integrate tariff projections and regulatory timelines into scenario planning will enhance investment agility and ensure alignment between corporate strategy and evolving market conditions.

Detailing a Rigorous Research Methodology Combining Primary and Secondary Approaches and Analytical Frameworks to Understand Hydrogen Generator Markets

This report’s findings are grounded in a rigorous research methodology that blends primary interviews with industry executives leading hydrogen generator projects alongside secondary analysis of policy publications patent filings and technical white papers. Primary research entailed structured conversations with key stakeholders across system integration consultancies equipment providers and end‐user organizations, ensuring direct insights into decision criteria and deployment experiences.

Secondary research involved an exhaustive review of government regulations trade policies and incentive programs, complemented by analysis of corporate financial statements and project announcements. Data triangulation was achieved by cross‐referencing technology performance metrics against independent laboratory studies and field trial results. Finally, an analytical framework encompassing supply chain mapping, cost component modeling, and regulatory scenario analysis was applied to synthesize diverse data sources into coherent strategic insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrogen Generator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrogen Generator Market, by Production Method

- Hydrogen Generator Market, by Technology

- Hydrogen Generator Market, by Pressure

- Hydrogen Generator Market, by Application

- Hydrogen Generator Market, by Distribution

- Hydrogen Generator Market, by Region

- Hydrogen Generator Market, by Group

- Hydrogen Generator Market, by Country

- United States Hydrogen Generator Market

- China Hydrogen Generator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on the Strategic Imperatives and Future Prospects Shaping the Evolution of Hydrogen Generation Technologies Worldwide

The evolution of hydrogen generator technologies reflects an intricate interplay of innovation regulatory momentum and strategic investment. As electrolyzer efficiency climbs and manufacturing footprints expand, the path toward economically viable green hydrogen becomes clearer. Nonetheless, policy shifts-such as the recent U.S. tariffs-and evolving incentive landscapes underscore the necessity for adaptive strategic planning.

Looking ahead, sustained collaboration among technology developers policymakers and end‐user industries will be pivotal to overcoming cost challenges and scaling infrastructure. By synthesizing the insights outlined in this executive summary industry leaders can chart robust decarbonization pathways that leverage hydrogen generators as a central enabler of clean energy objectives. Ultimately, the collective pursuit of technological refinement and supportive policy will shape the global competitiveness and environmental impact of the hydrogen ecosystem for decades to come.

Empowering Your Strategic Decision Making Through Expert Market Research Support from Our Associate Director of Sales and Marketing

For organizations navigating the complexities of hydrogen generation, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, will provide unparalleled access to tailored insights and personalized guidance. By leveraging his deep understanding of market dynamics and strategic positioning, readers can align their investment decisions with the most critical trends shaping the industry. Whether you require further clarification on tariff impacts, segmentation nuances, or regional opportunities, Ketan’s expertise will ensure that your organization secures the data and analysis necessary to move forward with confidence.

Connect with Ketan Rohom today to discuss how this research report can drive your strategic initiatives. His proactive partnership approach will help integrate these executive insights into your operational roadmap, empowering your team to capitalize on emerging hydrogen generation opportunities and stay ahead of regulatory and technological shifts.

- How big is the Hydrogen Generator Market?

- What is the Hydrogen Generator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?