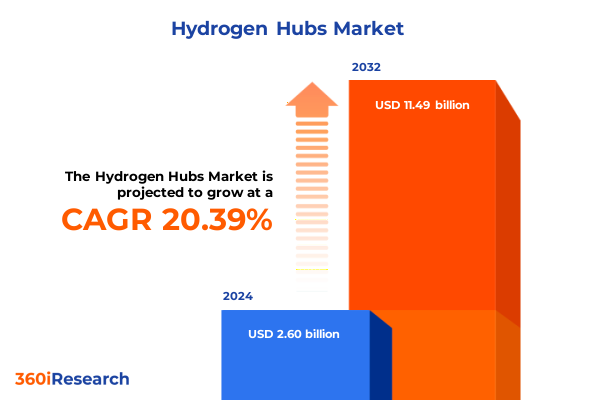

The Hydrogen Hubs Market size was estimated at USD 3.10 billion in 2025 and expected to reach USD 3.69 billion in 2026, at a CAGR of 20.58% to reach USD 11.49 billion by 2032.

Unlocking the Foundations of a Decarbonized Energy Ecosystem through the Emergence and Growth of Hydrogen Hubs in Industrial Clusters

The accelerating global push toward carbon neutrality has placed hydrogen at the forefront of the energy transition, elevating hydrogen hubs from conceptual clusters to pivotal enablers of large-scale decarbonization. These integrated systems co-locate production, storage, and distribution within industrial clusters, offering unparalleled synergies across supply chains. With governments around the world advancing supportive policies, hydrogen hubs are rapidly evolving into critical nodes that link renewable energy generation with hard-to-abate sectors.

As renewable electricity costs continue to decline and electrolyzer technologies mature, hydrogen hubs are scaling from pilot programs to commercial operations, demonstrating the potential for cost-competitive green hydrogen. Moreover, the convergence of private capital and public incentives is unlocking new funding mechanisms that accelerate infrastructure deployment. In this context, hydrogen hubs represent more than isolated projects; they embody systemic solutions that integrate production technologies, distribution modalities, and end-use applications to drive holistic emissions reductions.

Against this backdrop, industrial decision-makers face pressing questions regarding hub siting, technology selection, and policy navigation. This executive summary distills key insights to guide stakeholders through the rapidly changing landscape of hydrogen hubs, laying the foundation for strategic investment and collaboration. It outlines transformative trends, policy impacts, market segmentation dynamics, and regional priorities, equipping leaders with the knowledge to make informed decisions and capitalize on emerging opportunities.

Mapping the Shifting Dynamics of Policy, Technology, and Investment Catalyzing the Rapid Evolution of Hydrogen Infrastructure Worldwide

Recent years have witnessed profound shifts that are reshaping the hydrogen landscape, driven by evolving policy frameworks, technological innovation, and changing capital flows. Policy reforms, ranging from low-carbon procurement mandates to emissions trading enhancements, have signaled clear market direction, incentivizing scale-up of hydrogen infrastructure. Parallel to regulatory momentum, breakthroughs in membrane electrode assemblies and catalyst development have boosted electrolyzer efficiency, shrinking the gap between pilot-scale operations and cost-competitive production.

Meanwhile, investor sentiment is pivoting toward long-duration clean energy assets, with dedicated hydrogen funds and corporate venture arms injecting fresh capital into hub projects. As a result, strategic alliances between utilities, engineering firms, and technology providers are proliferating, forging integrated value chains that accelerate deployment. Simultaneously, digitalization and advanced analytics are enhancing system optimization, enabling real-time balancing between renewable intermittency and hydrogen demand.

These converging forces are driving hydrogen hubs beyond siloed experiments into comprehensive platforms that link renewable generation, centralized production, and downstream supply networks. The ability to harness economies of scale through co-location of multiple applications-ranging from ammonia synthesis to fuel cell power-underscores the growing sophistication of hub design. Consequently, industry stakeholders are navigating a rapidly evolving ecosystem where collaborative models, agile technologies, and adaptive policies are redefining the trajectory of hydrogen deployment.

Understanding the Far-Reaching Consequences of Revised United States Tariff Regimes on Imported Hydrogen Equipment and Feedstocks in 2025

In January 2025, the United States implemented a revised tariff framework targeting imported electrolyzer stacks, pressure vessels, and specialized feedstocks, aiming to bolster domestic manufacturing capabilities and safeguard strategic supply chains. While these measures have elevated acquisition costs for certain imported components, they have concurrently catalyzed onshore investment, prompting technology incumbents and new entrants to localize production and reduce tariff exposure. As a result, domestic fabricators have accelerated capacity expansions, and equipment suppliers are forging deeper partnerships with U.S. manufacturers.

However, the cumulative effect of these tariffs is nuanced. In the near term, project developers have faced marginal cost uplifts for imports crucial to grid-scale projects and long-distance distribution systems, particularly those reliant on high-pressure cylinders and advanced membranes. To mitigate these impacts, stakeholders are optimizing procurement strategies by blending domestic and imported components, leveraging partial tariff exemptions for vertically integrated supply chains, and advancing product redesigns to align with tariff classifications.

Over the medium term, the recalibrated tariff environment is expected to fortify U.S. competitiveness in hydrogen equipment manufacturing, create skilled manufacturing jobs, and diversify the supplier base. While cost volatility has introduced complexity for project finance models, the measures are encouraging supply chain resilience and fostering a more self-sufficient ecosystem. Consequently, both public and private actors are adapting to a landscape where policy-driven trade measures serve as levers for strategic industrial development.

Revealing Key Insights from Distribution Channels Production Technologies Applications and Hydrogen Types Shaping the Market Structure

Distribution channels in the hydrogen hub ecosystem present distinct operational profiles and growth opportunities. Cylinders remain indispensable for modular, site-specific deliveries, particularly in remote industrial sites where immediate fueling needs coexist with limited pipeline infrastructure. Conversely, pipeline networks excel in linking centralized production hubs to high-demand clusters, enabling uninterrupted supply for large-scale applications, while tube trailers bridge the gap between fixed and networked distribution, offering flexibility for emerging off-grid projects.

Applications of hydrogen extend across two principal domains: industrial and power generation. Within industrial uses, ammonia production, petrochemicals, and refinery operations harness hydrogen as both feedstock and process fuel, benefitting from co-located hub configurations that optimize heat integration and byproduct management. In the power generation segment, fuel cells and gas turbines utilize hydrogen for grid balancing, peaking support, and as a zero-emissions alternative to natural gas, with distribution strategy tailored to volumetric and pressure requirements.

The nature of hydrogen varies by generation method and carbon intensity, spanning blue, green, grey, and the emerging turquoise variants. Green hydrogen, produced via electrolysis powered by renewables, is rapidly gaining prominence in regions with surplus renewable capacity, whereas blue hydrogen-derived from natural gas with carbon capture-continues to serve as a transitional solution in jurisdictions with established gas infrastructure. Grey hydrogen remains the legacy standard, while turquoise hydrogen, created through methane pyrolysis, is moving from lab scale toward pilot-scale demonstration.

Finally, production technologies play a pivotal role in shaping hub economics. Alkaline systems, characterized by proven reliability and lower capital costs, compete with proton exchange membrane electrolyzers that offer rapid response and modularity. Solid oxide electrolysis, operating at high temperatures, promises efficiency gains through heat integration but awaits further commercialization. Each technology’s unique profile of efficiency, scale, and maturity informs strategic decisions in hub design and siting.

This comprehensive research report categorizes the Hydrogen Hubs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Hydrogen Type

- Production Technology

- Application

- Distribution Channel

Highlighting Regional Dynamics and Strategic Opportunities Across the Americas Europe Middle East Africa and the High-Growth Asia-Pacific Corridors

The hydrogen hub sector is intrinsically shaped by regional endowments, policy regimes, and industrial demand profiles. In the Americas, established pipeline networks and burgeoning electrolyzer manufacturing capability create fertile ground for green hydrogen clusters adjacent to renewable power zones. North America’s supportive incentives, including clean energy tax credits, are unlocking projects that integrate hydrogen with existing petrochemical and refining sites, while Latin American markets leverage hydropower and wind resources to advance decentralized hub models.

Meanwhile, Europe, the Middle East, and Africa exhibit a mosaic of strategic initiatives. European Union member states are harmonizing regulations through a green hydrogen framework that incentivizes cross-border trade, with major industrial ports serving as focal points for electrolyzer installations and ammonia exports. The Middle East is channeling sovereign wealth into gigawatt-scale solar and wind farms coupled with large electrolyzer deployments, aiming to become a global exporter of green hydrogen. Simultaneously, African markets are piloting projects that pair renewable generation with local off-grid applications, fostering capacity building and technology transfer.

In the Asia-Pacific corridor, energy-hungry economies are forging public-private collaborations to secure hydrogen imports, develop coastal hub infrastructure, and retrofit existing liquefied natural gas terminals. Japan and South Korea are advancing hydrogen import facilities and blending programs, while China pursues domestic electrolyzer production leadership and integration of captive hydropower resources. Australia, endowed with solar and wind assets, is positioning itself as a primary green hydrogen exporter to Asian markets, anchoring its maritime infrastructure in strategic port regions.

This comprehensive research report examines key regions that drive the evolution of the Hydrogen Hubs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Landscape Dynamics Through Profiling Key Players Driving Innovation Partnerships and Market Advancement in Hydrogen Hub Development

Leading stakeholders in hydrogen hub development are forging diverse strategies to capture value across the evolving ecosystem. Major industrial gas companies are leveraging decades of expertise in compression, storage, and distribution to retrofit core assets for low-carbon hydrogen, entering joint ventures with technology innovators to co-develop next-generation electrolyzers. At the same time, pure-play electrolyzer manufacturers are scaling modular production lines, expanding to multiple geographies to reduce delivery timelines and tailor designs to local regulatory standards.

Technology firms specializing in catalysts and membranes are intensifying R&D investments, partnering with research consortia and universities to accelerate breakthroughs in efficiency and durability. Utility companies, recognizing hydrogen’s role in grid flexibility, are structuring offtake agreements that integrate hydrogen hubs into broader energy management platforms, facilitating demand response and ancillary service participation.

Financial players and infrastructure funds are increasingly underwriting multi-stakeholder consortia, providing project finance solutions that combine public subsidy mechanisms with private capital. Meanwhile, engineering, procurement, and construction firms are adapting conventional supply chain practices to accommodate the scale and specificity of hydrogen infrastructure, emphasizing lean fabrication techniques and digital construction management.

Emerging entrants, including conglomerates from adjacent industries, are exploring strategic acquisitions and greenfield ventures to secure upstream and downstream positions within the hydrogen value chain. Collectively, these activities underscore a competitive landscape defined by collaboration, specialization, and rapid scaling, where each player’s strategic focus ranges from core technology innovation to integrated hub development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydrogen Hubs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Green Energy Limited

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Airbus SE

- Amazon.com, Inc.

- ArcelorMittal S.A.

- Bloom Energy

- Cenergy Holdings S.A. by Viohalco S.A.

- Chart Industries, Inc.

- China Petrochemical Corporation

- Cummins Inc.

- DNV AS

- Doosan Corporation

- Enbridge Inc.

- Equinor ASA

- ExxonMobil Corporation

- Gassco AS

- Hensoldt AG

- Linde PLC

- Mitsubishi Heavy Industries, Ltd.

- Nel ASA

- Plug Power Inc.

- Sasol Limited

- Saudi Arabian Oil Company

- Shell PLC

- Siemens AG

- TotalEnergies SE

Formulating Actionable Strategic Imperatives to Equip Industry Leaders with the Tools and Insights Needed for Accelerated Hydrogen Hub Deployment

Industry leaders seeking to maintain a competitive edge should prioritize strategic actions that leverage the unique strengths of hydrogen hubs. First, securing supplier diversity through partnerships with multiple electrolyzer providers and advanced materials manufacturers can mitigate supply chain risks posed by localized trade measures. Concurrently, investing in pilot integrations that combine different electrolyzer technologies and distribution channels will reveal optimal configurations for specific use cases and accelerate learning curves.

Moreover, engaging proactively with regulatory bodies and participating in standards-setting initiatives can help shape policy frameworks that support hub scalability and cross-border hydrogen trade. By contributing empirical data from demonstration projects, companies can influence tariff classifications, emissions accounting protocols, and safety guidelines, ensuring that new regulations reflect real-world operational considerations.

Collaborative offtake agreements with anchor consumers in industrial and power generation sectors will enhance project bankability and secure long-term revenue streams. Integrating hydrogen hubs into corporate sustainability commitments and net-zero roadmaps also creates market pull, aligning stakeholder expectations with tangible deployment milestones.

Finally, embedding digital twins and data analytics platforms within hub operations will facilitate predictive maintenance, performance benchmarking, and dynamic optimization of production, storage, and distribution assets. Through these measures, industry leaders can transform strategic intent into operational excellence, driving the next wave of hydrogen hub commercialization.

Outlining Robust Mixed-Method Research Approach Combining Qualitative Interviews Quantitative Data Analysis and Secondary Source Validation

This analysis synthesizes findings from a comprehensive mixed-method research framework designed to capture both quantitative trends and qualitative insights. A systematic review of publicly available policy documents, technical standards, and trade filings formed the foundation for mapping regulatory impacts and tariff developments. Concurrently, a database of hydrogen infrastructure projects was assembled through company disclosures, press releases, and industry association registries, enabling identification of technology adoption patterns and deployment timelines.

To enrich contextual understanding, in-depth interviews were conducted with senior executives from electrolyzer manufacturers, infrastructure developers, utility operators, and end-user consortia. These conversations provided firsthand perspectives on supply chain dynamics, financing structures, and operational challenges within emerging hub projects. Additionally, technical workshops and consortium meetings offered opportunities to validate assumptions regarding energy integration, system performance, and regulatory compliance.

Data triangulation was achieved by cross-referencing interview insights with project databases and secondary literature, ensuring consistency in observed trends and mitigating potential biases. Throughout the research process, methodological rigor was maintained by documenting source provenance, applying standardized frameworks for technology assessment, and deploying peer-review checks with subject matter experts.

As a result, the research delivers a balanced and robust understanding of hydrogen hub development, reflecting real-time industry developments, policy shifts, and technological advancements, while offering actionable intelligence to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydrogen Hubs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydrogen Hubs Market, by Hydrogen Type

- Hydrogen Hubs Market, by Production Technology

- Hydrogen Hubs Market, by Application

- Hydrogen Hubs Market, by Distribution Channel

- Hydrogen Hubs Market, by Region

- Hydrogen Hubs Market, by Group

- Hydrogen Hubs Market, by Country

- United States Hydrogen Hubs Market

- China Hydrogen Hubs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Illuminate the Strategic Significance and Future Trajectory of Hydrogen Hubs in a Rapidly Decarbonizing Global Energy Landscape

The collective analysis underscores hydrogen hubs as transformative catalysts in the transition to a low-carbon economy, uniting diverse stakeholders within integrated energy ecosystems. Policy momentum, technological innovation, and new financing paradigms have converged to propel hubs from pilot-scale demonstrations to commercially viable platforms. Distribution channel diversity, from cylinders to pipelines, and a spectrum of production technologies, spanning alkaline to solid oxide, enable customized solutions for distinct industrial and power generation needs.

Tariff measures implemented in 2025 have reshaped supply chain strategies, urging increased domestic manufacture while preserving supply flexibility through strategic sourcing. Regional dynamics reveal a global mosaic of hub adoption, from North America’s tax incentives and Latin America’s renewable resources to Europe’s cross-border frameworks, the Middle East’s export ambitions, and Asia-Pacific’s hybrid import-export strategies.

Competitive landscapes highlight the emergence of collaborative joint ventures, electrification pioneers, and integrated service providers, each charting unique pathways to build resilient and scalable infrastructures. Actionable imperatives-from supplier diversification to regulatory engagement and digitalization-serve as clear guideposts for industry leaders aiming to accelerate deployment and optimize returns.

In sum, hydrogen hubs represent a compelling solution for decarbonizing hard-to-abate sectors, offering systemic efficiencies and enabling the large-scale integration of clean energy. Stakeholders equipped with the insights presented herein are positioned to navigate complexity, harness emerging opportunities, and contribute meaningfully to a decarbonized energy future.

Inviting Stakeholders to Engage with Ketan Rohom for Customized Insights and Expert Guidance to Secure Comprehensive Hydrogen Hub Market Intelligence

To access the full depth of our analysis, tailor-made for driving strategic growth in the hydrogen hub sector, reach out directly to Ketan Rohom to secure your copy of the comprehensive hydrogen hub market report and gain exclusive insights.

- How big is the Hydrogen Hubs Market?

- What is the Hydrogen Hubs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?