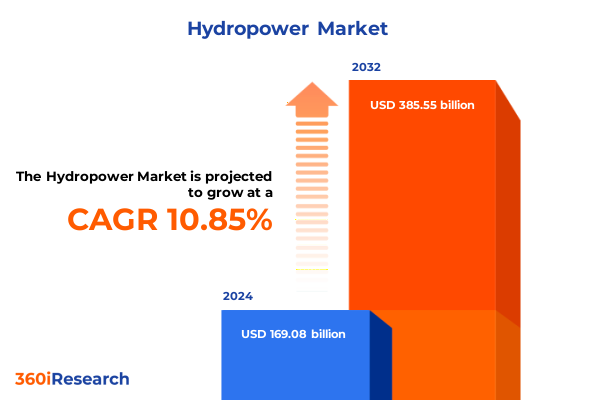

The Hydropower Market size was estimated at USD 186.38 billion in 2025 and expected to reach USD 205.46 billion in 2026, at a CAGR of 10.94% to reach USD 385.55 billion by 2032.

Charting the Unfolding Era of Hydropower as a Pillar of Clean Energy Transition and Climate Resilience in an Evolving Global Power Landscape

Hydropower has emerged as a foundational pillar in the global drive toward decarbonization, offering a unique blend of reliability, dispatch flexibility, and sizeable renewable generation capacity. As nations confront more ambitious emissions targets, the pressure to modernize and optimize existing hydropower infrastructure has intensified, prompting operators to adopt advanced digital controls and predictive maintenance frameworks. Ultimately, the sector’s ability to balance baseload output with rapid-response capabilities positions it as a critical asset amid the growing share of variable renewables in power systems.

Against the backdrop of aging plants and evolving grid demands, hydropower stakeholders are pursuing retrofit strategies that extend asset lifespans and improve operational performance. Investments in sensor networks, data analytics, and remote monitoring have unlocked new pathways to enhance turbine efficiency and minimize downtime. Concurrently, policy mechanisms designed to encourage hybridization-blending hydropower with battery energy storage or green hydrogen production-are receiving increasing attention as part of broader efforts to reinforce grid resilience and decarbonize adjacent sectors.

This executive summary captures the confluence of technological advances, policy shifts, and market forces reshaping the hydropower landscape. It synthesizes key developments across investment, innovation, and regulation while illuminating the interdependencies that will define hydropower asset performance in the coming decade. As you read on, you will discover actionable insights that bridge high-level strategy with the on-the-ground realities of project planning, equipment procurement, and stakeholder engagement.

Uncovering the Strategic Shifts Reshaping the Hydropower Ecosystem Through Technological Innovation Policy Realignment and Market Dynamics

The hydropower landscape is undergoing a profound metamorphosis, driven by a convergence of technological breakthroughs, regulatory realignments, and shifting stakeholder expectations. Whereas traditional developments prioritized maximizing raw generation capacity, the current wave of projects places equal emphasis on operational flexibility, environmental stewardship, and digital integration. Advances such as AI-enabled predictive maintenance platforms and digital twin simulations allow operators to anticipate equipment degradation before it manifests, reducing unplanned outages and optimizing water resource utilization.

Moreover, the proliferation of pumped-storage hydropower in new markets underscores the industry’s response to the volatility introduced by intermittent solar and wind generation. By pairing rapid-ramp storage capabilities with existing reservoirs, project owners can arbitrage energy prices, support frequency regulation markets, and unlock new revenue streams. Simultaneously, run-of-river installations are gaining traction in regions prioritizing low-impact approaches, leveraging minimal head differentials to deliver clean power without large reservoirs or significant ecological disruption.

Policy frameworks are likewise evolving to reflect the strategic importance of hydropower in decarbonization roadmaps. Enhanced incentives for hybrid renewables, streamlined environmental permitting processes, and public-private partnership models are encouraging both retrofit and greenfield initiatives. As a result, the sector is witnessing a dynamic interplay between market-driven innovation and policy-driven scale, setting the stage for hydropower to emerge as a transformative force across global energy systems.

Assessing the Layered Consequences of New United States Tariff Measures on Hydropower Infrastructure Costs Supply Chains and Project Viability

The introduction of United States import tariffs in 2025 has reverberated across the hydropower value chain, exerting pressure on both capital and operational expenditures. Steel and aluminum levies, reintroduced at rates nearing 25%, have elevated costs for civil structures, reinforcing frameworks, and other critical infrastructure components. Meanwhile, equipment sourced from key manufacturing hubs in Asia-subject to Section 301 tariffs of up to 25 percent-has triggered supply disruptions and protracted lead times as project developers retool procurement strategies.

These layered duties extend beyond raw materials to encompass hydromechanical equipment, control and monitoring systems, and electromechanical assemblies. As tariff thresholds were adjusted in early 2025, operators reported cost escalations in turbine components, generator windings, and sensor modules, prompting a reevaluation of sourcing strategies. In response, some firms accelerated stockpiling initiatives to lock in pre-tariff pricing, while others explored alternative suppliers in tariff-exempt jurisdictions. However, these adaptations have introduced fresh complexities, from capacity constraints among domestic fabricators to the logistical challenges of multi-origin supply chains.

The cumulative impact of tariff measures has not been limited to procurement alone. Heightened uncertainty around duty classifications and reciprocal tariffs has led to extended due diligence cycles, where customs valuations and tariff engineering reviews can add weeks to project timelines. In turn, this has compelled stakeholders to allocate greater resources to compliance functions and risk management, diverting focus from project execution. Yet, amidst these headwinds, the industry is also witnessing a strategic pivot: accelerated investment in onshore manufacturing capabilities and collaborative ventures with regional OEMs are aimed at fostering supply chain resilience and insulating hydropower developments from future trade shocks.

In navigating this intricate tariff environment, project sponsors are increasingly prioritizing transparency and stakeholder engagement. By integrating tariff scenarios into contractual frameworks and collaborating with trade specialists, operators are mitigating exposure to unexpected cost overruns. Looking ahead, the interplay between trade policy and infrastructure development is set to remain a defining variable in hydropower’s growth trajectory, underscoring the need for agile procurement strategies and robust supply chain governance.

Deciphering Critical Segmentation Insights from Service Offerings to Ownership Models Illuminating Diverse Hydropower Market Niches

Understanding the hydropower market requires a nuanced perspective across multiple dimensions of segmentation, each revealing distinct value pools and technology pathways. Within the sphere of offerings and services, the legacy of electricity generation remains the primary revenue driver, even as operators expand into electricity sale models and energy storage solutions to capitalize on ancillary services and emerging capacity markets. As grid operators demand more granular load-balancing tools, investment in grid integration and maintenance services is emerging as a critical growth vector alongside traditional plant operations.

At the component level, civil structures form the backbone of dam safety and hydraulic performance, while sophisticated control and monitoring equipment provides the telemetry and automation necessary to optimize water release schedules. Electromechanical equipment, including turbines and generators, underpins core conversion efficiency, whereas hydromechanical components such as gates and penstocks ensure precise flow management. These distinctions influence procurement cycles, risk profiles, and lifecycle maintenance imperatives.

Types of hydropower plants also shape development strategies. Pumped-storage projects offer high-value storage arbitrage opportunities and system stability benefits, whereas run-of-river designs appeal to regions prioritizing minimal environmental footprint and rapid deployment. Reservoir-based hydropower continues to command attention for its storage capacity and multi-purpose water management functions. Each type necessitates distinct engineering considerations and ecological assessments, underscoring the importance of site-specific feasibility analyses.

Capacity segmentation further delineates market dynamics, with mega installations above 500 megawatts driving national grid planning and micro projects under 100 kilowatts often serving off-grid or community-based needs. Mini and small capacities fall between these extremes, catering to rural electrification and distributed energy models. The choice between new builds and retrofit installations hinges on existing asset vintage, regulatory incentives, and environmental constraints. Finally, ownership structures-from private sector operators to public utilities and public-private partnerships-define governance, financing approaches, and stakeholder expectations across every project lifecycle.

This comprehensive research report categorizes the Hydropower market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering & Services

- Component

- Type

- Capacity

- Installation Type

- Ownership

Navigating Regional Diversity in Hydropower Development Through Tailored Strategies in the Americas EMEA and AsiaPacific

Regional dynamics exert a profound influence on hydropower development strategies, with each geography presenting unique drivers and constraints. In the Americas, the United States and Canada continue to retrofit aging facilities with digital controls and efficiency upgrades, while Latin America is witnessing robust growth in both large-scale and community-oriented smaller installations. Cross-border transmission initiatives are gaining prominence, leveraging hydropower’s firm capacity to stabilize interconnectivity between energy markets.

Across Europe, the Middle East, and Africa, the landscape is equally diverse. In Northern Europe, stringent environmental regulations and ambitious decarbonization targets are fueling upgrades to existing plants and the exploration of low-impact run-of-river schemes. Southern Europe and parts of North Africa are harnessing reservoir-based hydropower under public-private partnership frameworks to meet rising electricity demand. Sub-Saharan Africa is emerging as a frontier for small to medium capacity projects, often driven by donor financing and decentralized models that address rural electrification challenges.

Asia-Pacific stands at the forefront of hydropower expansion, led by China and India’s investments in both mega dams and pumped-storage facilities. Southeast Asian nations are balancing river basin management with community impact considerations, deploying run-of-river developments in tandem with hydrological data platforms. Australia and New Zealand are extending their hydropower portfolios through retrofits and emerging pumped-storage proposals aimed at augmenting renewable integration. In each region, regulatory frameworks, financing ecosystems, and resource availabilities create a mosaic of opportunities that requires tailored approaches and local partnerships.

This comprehensive research report examines key regions that drive the evolution of the Hydropower market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Postures and Collaborative Innovations of Leading Global Hydropower Companies Driving Industry Progress

Leading companies in the hydropower sector are forging pathways that blend legacy capabilities with forward-looking innovation. One global equipment provider has scaled its digital platform offerings to deliver end-to-end lifecycle support, integrating real-time monitoring with predictive analytics to reduce costs and extend turbine longevity. Another major turnkey solution specialist has pursued strategic joint ventures to broaden its geographic footprint, combining localized engineering expertise with standardized rapid deployment modules.

Within control and automation, select technology companies are differentiating through niche expertise in grid-friendly automation systems, enabling operators to seamlessly incorporate hydropower into broader ancillary service markets. Meanwhile, established OEMs are collaborating with financial institutions and development banks to structure innovative funding vehicles for retrofit and new build projects in emerging markets.

Beyond equipment suppliers, independent power producers are leveraging their project development competencies to assemble greenfield portfolios, often aligning with sustainability standards and off-taker agreements that prioritize carbon neutrality. Partnerships between utilities and private investors are driving asset revitalization programs, where digital substation upgrades and advanced condition monitoring are central to unlocking incremental capacity.

Through these diverse strategic postures, the industry’s leading entities are demonstrating that success hinges on the ability to integrate technology, finance, and regulatory navigation. Their collective actions are shaping an ecosystem where partnerships, digitalization, and adaptive business models converge to define the next generation of hydropower projects.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hydropower market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Brookfield Renewable Partners

- Dulas Ltd.

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Kirloskar Brothers Limited

- Litostroj Power Group

- Mitsubishi Hydro Corporation

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

Actionable Strategies for Industry Leaders to Harness Hydropower Innovation Optimize Operations and Secure LongTerm Competitive Advantage

Industry leaders must adopt a proactive stance to thrive amidst rapid transformation. Prioritizing the integration of digital twins and AI-driven maintenance platforms will unlock efficiency gains, reduce operational risk, and prolong asset lifespans. Simultaneously, diversifying supply chains by cultivating relationships with regional component manufacturers can alleviate exposure to trade uncertainties and accelerate project timelines. By embedding flexible procurement clauses and engaging early with customs and trade experts, organizations can preempt cost escalations and maintain development momentum.

Furthermore, strengthening partnerships with regulatory authorities and local communities is essential to streamline permitting and ensure social license to operate. Collaborative frameworks that emphasize transparent stakeholder engagement and joint benefit programs can expedite project approvals and minimize environmental disputes. Similarly, pursuing hybrid renewable solutions-such as pairing hydropower with battery storage or green hydrogen production-can create new revenue channels and reinforce claims of sustainability leadership.

On the financing front, exploring innovative structures like green bonds, tariff-stabilization incentives, and public-private partnership models will be instrumental in reducing capital costs and attracting diversified investment pools. Aligning project designs with environmental, social, and governance criteria not only enhances access to climate finance but also bolsters reputational value among stakeholders and investors.

By embracing these strategies, industry actors can position their organizations at the vanguard of hydropower development, securing competitive advantages and resilience in a landscape marked by evolving policies, technological breakthroughs, and dynamic global energy demands.

Elucidating the Rigorous Research Methodology Underpinning the Comprehensive Analysis of the Global Hydropower Sector’s Evolution

This analysis is grounded in a multifaceted research methodology designed to ensure robustness and credibility. Primary insights were derived from structured interviews with hydropower executives, project developers, and technology vendors, capturing firsthand perspectives on operational challenges and strategic priorities. These qualitative inputs were complemented by survey data collected from a broad cross-section of industry participants, enabling triangulation of emerging trends and sentiment.

Secondary research encompassed a thorough review of government policy documents, regulatory filings, and white papers issued by leading energy agencies. Technical specifications and performance benchmarks were extracted from equipment datasheets and case studies published by manufacturers. In addition, trade data and tariff schedules were analyzed to quantify the scope and timing of recent policy measures impacting the sector.

To enhance analytical rigor, we employed scenario analysis frameworks that stress-tested tariff outcomes and technology adoption rates across diverse regional contexts. Data validation was conducted through expert workshops and peer review sessions, ensuring that interpretations accurately reflect on-the-ground realities. Finally, our findings were synthesized into structured models that integrate segmentation, regional, and corporate dimensions, providing a holistic view of the hydropower landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hydropower market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hydropower Market, by Offering & Services

- Hydropower Market, by Component

- Hydropower Market, by Type

- Hydropower Market, by Capacity

- Hydropower Market, by Installation Type

- Hydropower Market, by Ownership

- Hydropower Market, by Region

- Hydropower Market, by Group

- Hydropower Market, by Country

- United States Hydropower Market

- China Hydropower Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Conclusions on Hydropower’s Strategic Role in Sustainable Energy Portfolios and Future Industry Trajectories

Hydropower stands at a strategic inflection point, empowered by technological innovation yet challenged by evolving policy and trade dynamics. The sector’s capacity to balance baseload reliability with flexible grid services positions it as an indispensable component of resilient energy systems. At the same time, new United States tariffs underscore the importance of agile supply chain management and proactive risk mitigation in safeguarding project economics.

Segmented insights reveal that market opportunities span from high-capacity pumped-storage facilities to micro installations serving off-grid communities, each underpinned by distinctive engineering and financing requirements. Regional variations further highlight the need for tailored development strategies, whether navigating stringent environmental mandates in Europe or unlocking growth potential in Asia-Pacific’s rapidly expanding grids.

Leading companies are demonstrating that success hinges on integrated business models that blend digital platforms, localized supply chains, and collaborative finance structures. Moving forward, industry leaders must embrace holistic approaches that align technological prowess, stakeholder engagement, and policy acumen to chart sustainable growth pathways. By synthesizing these core themes, this summary offers a blueprint for navigating hydropower’s evolving terrain and capitalizing on its enduring promise.

Engage Directly with Ketan Rohom for Immediate Access to the Definitive Hydropower Market Research Report for Strategic Advantage

To gain unparalleled insights into hydropower’s evolving landscape and to equip your organization with data-driven strategies, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By securing the full hydropower market research report, you will unlock detailed analyses of tariff implications, segmentation breakdowns, cutting-edge technological trends, and regional dynamics that will inform your strategic planning. Ketan Rohom stands ready to tailor a briefing session and provide exclusive access to proprietary findings that can sharpen your competitive edge. Contact him today to transform high-level intelligence into actionable initiatives and ensure your projects thrive in the rapidly shifting renewable energy market

- How big is the Hydropower Market?

- What is the Hydropower Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?