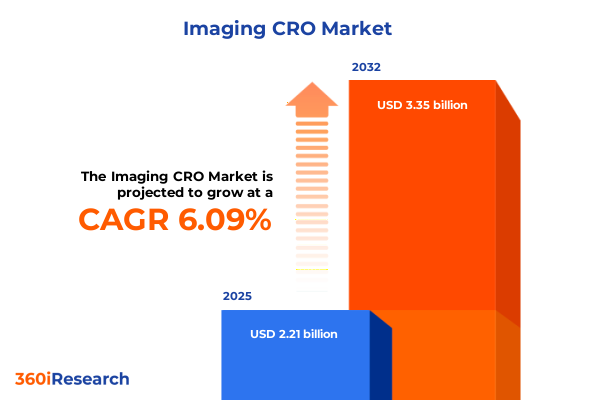

The Imaging CRO Market size was estimated at USD 2.21 billion in 2025 and expected to reach USD 2.35 billion in 2026, at a CAGR of 6.09% to reach USD 3.35 billion by 2032.

Setting the Stage for a Comprehensive Exploration of the Imaging CRO Market Dynamics and Emerging Opportunities in Clinical Research

The landscape of clinical research has undergone a remarkable evolution, with imaging-based trials emerging as a critical nexus between technological innovation and patient-centric therapeutic development. Imaging Contract Research Organizations (CROs) now play an instrumental role in enabling stakeholders to visualize, quantify, and interpret disease processes with unprecedented precision. By integrating advanced imaging modalities into trial protocols, these specialized providers empower sponsors to capture high-resolution biomarkers, enhance endpoint validation, and accelerate decision-making throughout the drug development continuum.

In recent years, the convergence of digital transformation and regulatory emphasis on reproducibility has elevated the value proposition of imaging CROs. As sponsors seek to mitigate risk and optimize trial efficiencies, the expertise of imaging specialists in protocol design, centralized reading, and data standardization becomes indispensable. This report delves into the underlying drivers of this shift, illuminating how imaging CROs have transitioned from peripheral service providers to strategic partners that shape study outcomes and inform regulatory approvals.

Unveiling the Disruptive Technological, Regulatory, and Operational Trends Reshaping the Imaging CRO Ecosystem and Future Clinical Trials

The imaging CRO ecosystem is experiencing profound shifts driven by a confluence of technological, regulatory, and operational forces. On the technological front, the advent of artificial intelligence and machine learning is revolutionizing image analysis workflows, enabling automated lesion detection, volumetric quantification, and prognostic modeling with greater speed and consistency. Cloud-based platforms and interoperable data standards are further breaking down silos, facilitating real-time collaboration between sponsors, core labs, and clinical sites.

Regulatory bodies are also redefining expectations for imaging endpoints, with agencies such as the U.S. Food and Drug Administration issuing updated guidelines on quantitative imaging biomarkers and digital health technologies. These frameworks underscore the imperative for robust quality control, standardized acquisition protocols, and stringent audit trails-all hallmarks of leading imaging CRO services. Consequently, compliance and data integrity are emerging as critical differentiators in a crowded provider landscape.

Operationally, the rise of decentralized and hybrid trial designs has expanded the necessity for remote imaging capabilities and site-agnostic reading models. Decentralization not only enhances patient diversity and retention rates but also demands seamless integration of multisite imaging data across geographic boundaries. As sponsors pivot toward real-world evidence and adaptive trial architectures, imaging CROs must deliver scalable solutions that balance methodological rigor with logistical agility.

Analyzing the Multifaceted Consequences of United States Tariffs in 2025 on Clinical Imaging Operations, Supply Chains, and Cost Structures

United States tariffs implemented in 2025 have imposed multifaceted pressures on the clinical imaging sector, particularly affecting the cost and availability of sophisticated medical equipment. Tariffs on imported imaging components, including semiconductors and precision optics, have risen to as high as 50 percent in certain categories, compelling imaging CROs to reassess supply chain strategies and absorb elevated procurement costs. Hospitals and trial sites now navigate tighter budgets as equipment leases and maintenance contracts are renegotiated to accommodate these unexpected duties.

The imposition of a 25 percent levy on diagnostic instruments sourced from traditional manufacturing hubs such as China and Southeast Asia has further complicated operational planning. Providers of computed tomography, magnetic resonance imaging, and positron emission tomography services report that extended lead times for replacement parts and service contracts are straining turnaround commitments for clinical study endpoints. The downstream effect has manifested in adjusted project timelines, with several sponsor organizations renegotiating milestone schedules to align with equipment availability.

Moreover, tariffs on steel and aluminum derivatives-key materials in imaging gantries and support structures-have increased construction costs for modular imaging suites by up to 20 percent, according to industry associations. This escalation has triggered a wave of capital investment in domestic manufacturing initiatives among major device makers, yet full-scale retooling and certification processes are expected to span multiple years. The combined tariff landscape underscores the urgency for imaging CROs and trial sponsors to cultivate resilient procurement frameworks, diversify vendor portfolios, and explore strategic partnerships that mitigate the volatility of global trade policies.

Synthesizing Critical Segmentation Perspectives Spanning Provider Models, Service Modalities, Trial Phases, Indications, and End-User Requirements in Imaging CROs

A nuanced understanding of provider types reveals the differentiation between full-service CROs, imaging core laboratories, and dedicated imaging CROs, each catering to distinct sponsor requirements. Full-service organizations offer end-to-end clinical trial management that incorporates imaging as a component of broader trial services, whereas core labs focus on centralized reading and standardized image processing. Dedicated imaging CROs, by contrast, specialize in protocol optimization, modality-specific quality control, and advanced analytics tailored exclusively for imaging-intensive studies. By aligning provider expertise with trial complexity, sponsors can optimize data consistency and reduce the risk of regulatory delays.

Service-type segmentation underscores the criticality of clinical imaging services, data management and integration, project management and trial support, and regulatory and compliance offerings. Clinical imaging services span site qualification, training, and accreditation, establishing the foundation for consistent image acquisition across global sites. Data management functions handle the secure transfer, de-identification, and storage of imaging datasets, enabling seamless integration with electronic data capture and clinical trial management systems. Project management teams orchestrate cross-functional workflows, ensuring that imaging milestones synchronize with laboratory, pharmacovigilance, and statistical reporting timelines. Regulatory and compliance specialists guide sponsors through submissions aligned with evolving imaging standards, forging a direct path to market approval.

Imaging modality segmentation highlights the diverse spectrum of diagnostic technologies leveraged in trials. Computed tomography, including multislice and spiral CT, provides rapid volumetric assessments of anatomical structures. Magnetic resonance imaging, encompassing diffusion tensor imaging and functional MRI, captures microstructural and physiological parameters critical for neurology and oncology studies. Positron emission tomography quantifies metabolic activity and receptor expression, while ultrasound modalities such as three- and four-dimensional imaging and Doppler flow studies offer real-time, radiation-free evaluations in cardiology and musculoskeletal research.

Phase-of-trial segmentation-spanning Phase I through Phase III-illuminates how imaging applications evolve from early safety and pharmacokinetic assessments to later-stage efficacy and comparative investigations. Phase I studies often leverage imaging to elucidate biodistribution or dose-related changes, whereas Phase III demands high-volume, standardized reads to support pivotal efficacy claims. Indication-based segmentation spans cardiology, infectious diseases, musculoskeletal, neurology, oncology, and ophthalmology, each presenting unique imaging endpoints and modality requirements. Finally, end-user differentiation across biotechnology firms, medical device companies, pharmaceutical sponsors, and academic institutions reflects divergent priorities-from rapid go/no-go decisions in early-stage startups to rigorous, multi-arm trials in global pharma enterprises. By synthesizing these segmentation dimensions, stakeholders can pinpoint service providers whose core competencies align with specific trial designs and therapeutic targets.

This comprehensive research report categorizes the Imaging CRO market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Provider Types

- Service Type

- Imaging Modality

- Phase of Clinical Trials

- Indication

- End-User

Highlighting Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific to Illuminate Strategic Opportunities and Operational Challenges

The Americas region continues to serve as the largest single market for imaging CRO services, driven by a robust pipeline of oncology and neurology trials sponsored by both multinational pharmaceutical companies and emerging biotechnology firms. North American sites benefit from advanced imaging infrastructure and a regulatory environment that prioritizes accelerated approval pathways. Meanwhile, Latin American countries are gaining traction as cost-effective destinations for early-phase and proof-of-concept studies, with several imaging core labs establishing regional hubs to ensure consistent quality control and local regulatory compliance.

Within Europe, the Middle East, and Africa (EMEA), diversity in healthcare systems presents both opportunities and challenges. Western European nations, characterized by sophisticated imaging networks and harmonized clinical trial regulations, attract late-phase studies requiring high-volume, multisite coordination. In contrast, emerging markets in Eastern Europe and the Middle East offer competitive cost structures and untapped patient populations for niche indications such as rare diseases. Africa remains an underpenetrated region, yet growing investments in imaging infrastructure and public–private partnerships are laying the groundwork for future study expansion.

Asia-Pacific reflects a dynamic mosaic of maturity levels, with Japan and South Korea leading in high-end imaging research supported by advanced reimbursement frameworks. China is rapidly scaling its domestic CRO capabilities, spurred by government initiatives aimed at localizing clinical development. Southeast Asian hubs such as Singapore and Malaysia leverage favorable regulatory pathways and regional distribution networks, appealing to sponsors seeking accelerated multi-country recruitment. Australia’s established investigator networks provide reliable site performance for Phase II and III programs. Together, these regional insights guide stakeholders in selecting geographies that balance patient access, cost optimization, and regulatory certainty.

This comprehensive research report examines key regions that drive the evolution of the Imaging CRO market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Imaging CRO Players and Their Strategic Initiatives Driving Innovation Collaboration and Competitive Differentiation in Clinical Research

Leading providers in the imaging CRO sector exhibit a spectrum of strategic positioning and service differentiation. Industry titans leverage extensive global footprints, offering integrated imaging and data analytics solutions supported by proprietary software platforms. These multichannel providers invest heavily in artificial intelligence development and regulatory consulting to deliver end-to-end trial orchestration. Mid-sized specialists focus on niche therapeutic areas, differentiating through modality-specific expertise and personalized client engagement models. They often develop bespoke reading algorithms and maintain tight feedback loops with sponsor teams to refine imaging endpoints in real time.

Smaller, agile imaging CROs are gaining traction by embracing digital-first approaches and scalable cloud infrastructures. Their ability to rapidly deploy decentralized reading workflows and virtual site monitoring resonates with sponsors conducting hybrid trials or operating in resource-constrained regions. This flexibility is complemented by partnerships with academic institutions and technology incubators, enabling access to cutting-edge imaging biomarkers and early adoption of novel modalities.

The competitive landscape also reflects a wave of strategic alliances between imaging CROs and ancillary service providers. Collaborations with data management firms enable seamless integration of imaging and clinical datasets, while joint ventures with hardware manufacturers facilitate priority access to next-generation scanners. These alliances aim to deliver value-added bundles that address both the scientific rigor and logistical complexity of modern clinical trials, reinforcing the critical role of imaging CROs as strategic innovators rather than transactional vendors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Imaging CRO market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABX-CRO Advanced Pharmaceutical Services Forschungsgesellschaft mbH

- Aragen Life Sciences Ltd.

- Biospective Inc.

- Biotrial

- Bruker Corporation

- Celentyx Ltd.

- Charles River Laboratories, Inc.

- CLARIO

- EPS Corporation

- Fortrea, Inc.

- ICON PLC

- Image Analysis Group

- Intelerad Medical Systems Incorporated

- IQVIA Inc.

- IXICO plc

- Median Technologies PLC

- Medidata by Dassault Systèmes S.E.

- Medpace, Inc.

- MERIT CRO, Inc.

- Micron, Inc.

- Mint Medical Inc.

- MUSASHI IMAGE JOHO CO.,LTD.

- Parexel International Corporation

- Perceptive Informatics LLC

- Radiant Sage LLC

- Syneos Health

- Visikol, Inc.

- WCG Clinical, Inc.

Delivering Practical Forward-Looking Strategies for Industry Leaders to Capitalize on Imaging CRO Trends Optimize Workflows and Enhance Stakeholder Value

Industry leaders should prioritize the integration of advanced analytics and machine learning into core imaging workflows to enhance consistency and reduce time to deliverables. By investing in algorithm validation and establishing clear performance metrics, sponsors can harness AI to identify patient subpopulations and optimize endpoint selection. Moreover, bolstering data interoperability through adherence to emerging standards such as DICOMweb and HL7 FHIR ensures cohesive data exchange across imaging devices, trial management systems, and regulatory submissions.

Expanding decentralized and hybrid trial capabilities is imperative for mitigating patient recruitment challenges and maintaining trial continuity under shifting field conditions. Imaging CROs can support virtual site qualifications, remote image acquisition validation, and real-time quality monitoring to enable sponsors to access geographically dispersed populations without compromising data integrity. Simultaneously, establishing strategic partnerships with local imaging networks enhances site readiness and compliance within diverse regulatory landscapes.

To strengthen supply chain resilience in the face of tariff volatility and component shortages, stakeholders should conduct comprehensive vendor risk assessments and cultivate dual sourcing agreements. Engaging in co-investment initiatives with device manufacturers can accelerate the localization of critical consumables and spare parts. Finally, embedding cross-functional governance frameworks that integrate imaging, clinical, and regulatory teams will foster proactive decision-making, enabling sponsors to navigate complexities and seize emergent opportunities with confidence.

Describing the Robust Research Framework and Methodological Rigor Underpinning the Comprehensive Analysis of the Imaging CRO Market Landscape

This analysis is grounded in a multi-tiered research methodology combining primary and secondary data sources to ensure both breadth and depth of market intelligence. Primary research comprised structured interviews and surveys with key decision-makers from pharmaceutical sponsors, biotechnology firms, medical device companies, and academic institutions, providing firsthand perspectives on project priorities, service expectations, and pain points. Expert consultations with regulatory authorities and imaging technology innovators offered additional validation of emerging trends and compliance frameworks.

Secondary research encompassed a thorough review of public domain documents, including regulatory guidelines from the U.S. Food and Drug Administration and the European Medicines Agency, industry white papers, and peer-reviewed literature on quantitative imaging biomarkers. Trade association reports and financial disclosures from leading imaging CROs and device manufacturers supplemented this information, delivering insights into strategic investments and operational footprints. Data triangulation ensured consistency and reliability, with comparative analysis across multiple sources to reconcile potential discrepancies.

Quantitative modeling was employed to map service mix distributions, modality utilization patterns, and phase-specific imaging applications, enabling a structured segmentation framework. Qualitative assessments, including SWOT analyses and scenario planning workshops, informed the evaluation of competitive dynamics and regional growth prospects. This rigorous approach underpins the credibility of the findings and empowers clients with actionable intelligence aligned to strategic decision-making processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Imaging CRO market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Imaging CRO Market, by Provider Types

- Imaging CRO Market, by Service Type

- Imaging CRO Market, by Imaging Modality

- Imaging CRO Market, by Phase of Clinical Trials

- Imaging CRO Market, by Indication

- Imaging CRO Market, by End-User

- Imaging CRO Market, by Region

- Imaging CRO Market, by Group

- Imaging CRO Market, by Country

- United States Imaging CRO Market

- China Imaging CRO Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Insights Emphasizing the Imperative for Strategic Adaptation and Continuous Innovation within the Evolving Imaging CRO Environment

The evolution of the imaging CRO market underscores the critical intersection of technology, regulation, and operational innovation in driving clinical trial excellence. As imaging emerges as a pivotal determinant of trial success, stakeholders must adapt to a dynamic environment shaped by artificial intelligence, decentralized models, and shifting trade policies. The segmentation insights presented herein offer a roadmap for aligning service capabilities with trial objectives, while regional analysis illuminates the geographies best suited to specific study designs.

In this context, strategic collaboration between sponsors, imaging CROs, and technology partners will be instrumental in harnessing the full potential of advanced imaging biomarkers and data analytics. By embedding rigorous methodological standards and fostering supply chain resilience, industry leaders can mitigate risks and enhance the efficiency of trial execution. Ultimately, the capacity to anticipate market shifts and deploy integrated imaging solutions will distinguish the organizations that deliver transformative clinical outcomes.

Connect with Ketan Rohom to Secure Your Definitive Imaging CRO Market Research Report and Unlock Actionable Insights for Strategic Growth

To gain an in-depth understanding of the imaging CRO market and to leverage tailored insights that drive strategic growth, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in translating complex data into actionable business imperatives ensures that your organization will receive a customized presentation of findings aligned with your key objectives.

Embark on a transformative partnership that equips your leadership team with the intelligence needed to anticipate market shifts, optimize clinical pathways, and secure a competitive edge. Reach out to Ketan Rohom today to secure your definitive market research report and begin unlocking value for your next wave of clinical imaging initiatives.

- How big is the Imaging CRO Market?

- What is the Imaging CRO Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?