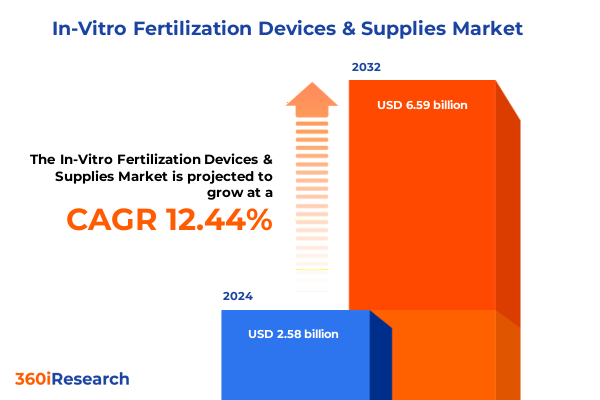

The In-Vitro Fertilization Devices & Supplies Market size was estimated at USD 2.88 billion in 2025 and expected to reach USD 3.23 billion in 2026, at a CAGR of 12.51% to reach USD 6.59 billion by 2032.

Exploring the Complex Ecosystem of In-Vitro Fertilization Devices and Supplies to Set the Stage for Strategic Market Analysis and Industry Insight

The in-vitro fertilization (IVF) devices and supplies market represents a dynamic fusion of cutting-edge technology, medical expertise, and evolving patient needs. With infertility affecting millions of couples worldwide, demand for reliable equipment and consumables has surged, prompting manufacturers and service providers to innovate at an unprecedented pace. As assisted reproductive technology centers expand their capabilities, stakeholders across the value chain are seeking clarity on competitive positioning, regulatory compliance, and emerging growth opportunities. This executive summary lays the foundation by framing the market’s core drivers, challenges, and emerging themes.

In recent years, demographic trends such as delayed parenthood, greater awareness of male and female infertility factors, and increased acceptance of assisted reproductive technologies have propelled demand for advanced lab equipment, precision instruments, and culture media. Concurrently, innovations in micromanipulation, automation, and cryopreservation have elevated procedural success rates, prompting fertility clinics and research institutes to continually upgrade their portfolios. This overview captures how such developments coalesce to redefine both the clinical experience and the strategic imperatives of equipment manufacturers and supply distributors.

By examining the interplay between technological advancements, patient-centric drivers, and regulatory frameworks, this introduction sets the stage for a deep dive into transformative shifts, tariff impacts, segmentation insights, regional dynamics, leading companies, and actionable recommendations. With a comprehensive view of current trends and future directions, industry leaders will be equipped to make informed decisions and anticipate the next frontier in IVF devices and supplies.

Identifying the Key Technological, Regulatory, and Demographic Shifts Transforming the In-Vitro Fertilization Devices and Supplies Industry Landscape

The in-vitro fertilization devices and supplies landscape is undergoing a paradigm shift driven by rapid technological breakthroughs, tightening regulatory standards, and evolving patient demographics. Automation and artificial intelligence have become instrumental in optimizing embryo culture conditions, enabling real-time monitoring and predictive analytics that improve outcomes. Similarly, microfluidic platforms and lab-on-a-chip solutions are streamlining procedures, reducing manual handling errors, and enhancing contamination control. These technological strides are reshaping lab workflows and defining new benchmarks for precision and efficiency.

Regulatory authorities have introduced more stringent quality and safety requirements, prompting manufacturers to integrate advanced traceability mechanisms and robust validation protocols into their development lifecycles. The push for standardized reporting and risk management has elevated the importance of witness verification systems and integrated digital documentation, ensuring compliance and reinforcing patient confidence. This regulatory tightening, while necessitating greater investment in design controls and certification processes, ultimately fosters a more reliable and transparent market environment.

Demographic shifts also play a critical role in redefining market dynamics. An increasing prevalence of age-related infertility, alongside a growing awareness of male factor conditions, has led to more personalized treatment pathways. Clinics are diversifying service offerings to include donor egg cycles, fertility preservation for oncology patients, and same-sex couples seeking family planning solutions. These evolving patient profiles are driving demand for versatile devices and specialized consumables, underscoring the need for manufacturers to remain agile in their product portfolios.

Taken together, these transformational forces are catalyzing a new era of innovation in the IVF devices and supplies sector. Stakeholders must navigate the convergence of advanced technologies, regulatory imperatives, and shifting patient expectations to sustain growth and achieve clinical excellence.

Assessing the Multifaceted Consequences of United States Tariff Measures on the In-Vitro Fertilization Devices and Supplies Market in 2025

The 2025 implementation of additional U.S. tariffs on imported medical equipment, including select in-vitro fertilization devices and consumables, has introduced significant cost pressures across the supply chain. Components such as precision micromanipulation systems, incubators, and specialized culture media are facing higher duties, leading suppliers to reexamine sourcing strategies and price structures. Clinics and laboratories, already operating under tight budget constraints, are now evaluating the downstream impact on procedure pricing and patient affordability.

As import costs escalate, suppliers are exploring near-shoring and domestic manufacturing partnerships to mitigate tariff burdens. This realignment offers opportunities for local facility expansion and vertical integration, though it also requires substantial capital investment and operational ramp-up. Some distributors have responded by renegotiating contracts with alternative suppliers in tariff-exempt jurisdictions, seeking to preserve margin stability while ensuring continuity of product availability.

The ripple effects extend to end users, as fertility clinics recalibrate their procurement models. Group purchasing organizations and cooperative buying agreements are gaining traction as collaborative mechanisms to spread the impact of higher equipment and consumable costs. At the same time, manufacturers are offering bundled service contracts and outcome-based pricing initiatives, aiming to provide greater budget predictability despite the external tariff environment.

Looking ahead, ongoing trade negotiations and potential adjustments to the Harmonized Tariff Schedule could further influence cost structures. Industry players must remain vigilant, balancing short-term tactics such as alternative sourcing with long-term investments in regional manufacturing capacities. Such strategic responses will be critical in maintaining competitiveness and ensuring that advances in IVF technology remain accessible to patients across the United States.

Revealing Essential Segmentation Insights Showing How Core Market Dimensions Influence Dynamics Across Product, Procedure, Technology, End User, Patient, and Distribution

Understanding the market through a segmentation lens reveals how each category contributes to overall dynamics. When considering product type, consumables and supplies such as culture media and test kits drive recurring revenue streams, while devices ranging from anti-vibration tables and cryopreservation equipment to embryo transfer catheters, gas analyzers, heating stages, ICSI micromanipulation systems, incubators, laser systems, microscopes, ovum aspiration pumps, sperm analyzer systems, and witness verification systems anchor long-term capital investments. The balance between these segments underpins revenue diversification and innovation focus.

Looking at procedure type, the spectrum spans cryopreservation, embryo culture and assessment, embryo transfer, fertilization, oocyte retrieval, ovulation induction, and sperm collection and processing. Each procedural category demands specialized instruments and tailored consumables, reflecting unique workflow requirements and influencing purchasing patterns. Embryo culture and assessment technologies, for example, have seen heightened interest as clinics pursue higher implantation success rates and data-driven quality control.

Technology segmentation further illuminates market behavior by contrasting donor egg IVF, fresh embryo IVF, and frozen embryo IVF modalities. The rise of frozen embryo approaches, bolstered by vitrification techniques, is reshaping equipment needs and shifting consumable usage toward cryoprotectants and thawing solutions. At the same time, donor egg cycles necessitate stringent traceability and witness verification capabilities, driving demand for integrated system solutions.

End-user segmentation shows that ambulatory surgical centers, cryobanks and biobanks, fertility clinics, hospitals, and research and academic institutes each play distinct roles in adoption. Fertility clinics remain the primary drivers of both device and consumable sales, while cryobanks fuel the growth of preservation technologies. Academic and research institutions contribute to early-stage innovation, often collaborating with manufacturers to validate novel approaches.

Patient type segmentation highlights divergent needs between female infertility-such as endometriosis, ovulatory disorders, tubal factor infertility, and unexplained infertility-and male infertility characterized by abnormal morphology, low sperm count, and poor motility. Manufacturers and suppliers tailor media formulations, instrumentation sensitivity, and protocol support services to address these specific challenges, reinforcing the importance of patient-centric product development.

Finally, distribution channels split between offline and online pathways, with traditional medical device distributors and direct clinic partnerships dominating capital equipment transactions, while digital platforms and e-commerce channels gain traction for consumable replenishment. This dual-channel environment requires manufacturers to optimize logistics, digital marketing, and customer engagement strategies in parallel.

These segmentation insights collectively shape how stakeholders prioritize investments, align R&D roadmaps, and structure go-to-market approaches in the IVF devices and supplies arena.

This comprehensive research report categorizes the In-Vitro Fertilization Devices & Supplies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Procedure Type

- Technology

- End User

- Patient Type

- Distribution Channel

Highlighting Regional Nuances and Growth Drivers Shaping the In-Vitro Fertilization Devices and Supplies Market Across Americas, EMEA, and Asia-Pacific

Regional analysis uncovers distinct market characteristics and growth drivers across the Americas, Europe-Middle East-Africa (EMEA), and Asia-Pacific. In the Americas, the United States leads with well-established reimbursement frameworks, high clinical adoption rates, and a robust network of fertility clinics investing in state-of-the-art equipment. Canada follows with growing private and public partnerships that focus on expanding access to assisted reproductive services, further stimulating demand for both devices and consumables.

Within EMEA, regulatory harmonization under directives such as the In Vitro Diagnostic Medical Devices Regulation has tightened quality benchmarks, prompting many manufacturers to consolidate production lines to meet common standards. Private fertility clinics in Western Europe continue to invest in advanced micromanipulation and imaging systems, while Middle Eastern markets show rapidly increasing procedure volumes fueled by medical tourism and government support programs. In contrast, several regions in Africa are still developing basic infrastructure, offering significant long-term growth potential as awareness and access improve.

Asia-Pacific demonstrates the most rapid expansion, driven by rising disposable incomes, supportive government initiatives to address low birth rates, and an upsurge in fertility tourism. Countries such as China, India, Japan, and Australia are spearheading large-scale clinic expansions, while emerging markets in Southeast Asia are leveraging public-private collaborations to build advanced lab facilities. Local manufacturers in the region are also strengthening their capabilities, progressively narrowing the technology gap with global players and offering cost-competitive solutions.

Collectively, these regional insights underscore the need for a nuanced approach to market entry, distribution strategy, and product customization. Recognizing the regulatory landscapes, funding mechanisms, and cultural factors in each region enables stakeholders to align their offerings with local priorities and maximize engagement across diverse market environments.

This comprehensive research report examines key regions that drive the evolution of the In-Vitro Fertilization Devices & Supplies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Collaborative Initiatives Driving Innovation Among Leading In-Vitro Fertilization Device and Supply Manufacturers

Leading companies in the in-vitro fertilization devices and supplies sector are deploying a range of competitive strategies to fortify their market positions and accelerate product innovation. Some global manufacturers have prioritized strategic acquisitions of niche technology providers to expand their portfolios, integrating advanced cryopreservation and embryo assessment platforms into their core offerings. Others focus on deepening collaborative research partnerships with academic and clinical centers, co-developing next-generation micromanipulation systems and AI-enabled monitoring solutions.

A number of key players are channeling significant R&D investments into automation, seeking to reduce manual variability and improve throughput in high-volume fertility clinics. This approach extends beyond hardware to encompass digital ecosystems that incorporate cloud-based data analytics, remote monitoring, and outcome benchmarking. By building platforms that unify device controls, imaging data, and patient records, leading vendors aim to deliver end-to-end solutions that enhance operational efficiency and drive evidence-based improvements in clinical protocols.

At the same time, emerging regional players are leveraging cost-efficient manufacturing capabilities to offer competitive alternatives, particularly in Asia-Pacific markets. These companies often prioritize modular designs and retrofit options, enabling clinics to upgrade existing equipment without full-scale capital expenditure. Their agility in responding to local regulatory requirements and price sensitivities provides a formidable counterbalance to established Western firms.

In addition, some suppliers are introducing outcome-based contracting models, aligning pricing with measured clinical success rates. By offering performance guarantees on live birth or implantation benchmarks, these innovative commercial structures reinforce supplier accountability and support clinics in managing financial risk. Such initiatives exemplify how competitive dynamics are evolving beyond traditional hardware sales, toward partnership-oriented models that share clinical and economic upside.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-Vitro Fertilization Devices & Supplies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIVF Ltd.

- Analis sa

- ASB Medical System Pvt. Ltd.

- Avantor, Inc.

- Carl Zeiss AG

- Cook Medical LLC

- CooperSurgical, Inc.

- Corning Incorporated

- Eppendorf SE

- Esco Group

- Fertipro NV

- FUJIFILM Irvine Scientific, Inc.

- Genea Biomedx Pty Ltd

- Getner Instruments Pvt. Ltd.

- Hamilton Thorne, Inc.

- Hunter Scientific Limited

- IVFtech ApS

- Leica Microsystems GmbH

- Nidacon International AB

- Nikon Corporation

- Olympus Corporation

- Overture Life, S.L.

- Shivani Scientific Industries Limited.

- Thermo Fisher Scientific Inc.

- Vitrolife Sweden AB

Formulating Actionable Recommendations to Help Industry Leaders Optimize Strategies Across the In-Vitro Fertilization Devices and Supplies Landscape

To navigate the intricate landscape of IVF devices and supplies, industry leaders should pursue a multifaceted strategy emphasizing supply chain resilience, technology integration, and stakeholder collaboration. Prioritizing localization of manufacturing and diversifying supplier networks can mitigate tariff risks and safeguard against future trade disruptions. Simultaneously, investing in modular automation platforms and digital service offerings will address clinics’ growing demand for data-driven outcomes and remote support capabilities.

Engagement with regulatory bodies through early-stage consultation and participation in standards-setting initiatives will help streamline product approval timelines and foster trust in safety and quality. Developing comprehensive training programs for end users-covering new device protocols, best practices in consumable handling, and data analytics interpretation-will accelerate adoption and reduce procedural variability. This emphasis on user enablement underscores a shift toward service-oriented models that differentiate suppliers in a competitive environment.

Partnerships with academic and clinical research institutions can catalyze novel applications of emerging technologies, such as organ-on-a-chip systems for gamete culture or AI-based embryo selection algorithms. Collaborating on clinical validation studies and peer-reviewed publications not only enhances technical credibility but also contributes to evidence-based refinement of treatment protocols. As IVF experiences greater personalization, suppliers that anticipate evolving patient profiles-such as oncofertility or same-sex family planning-will be positioned to deliver targeted solutions.

By combining strategic sourcing, regulatory leadership, user training, and collaborative innovation, industry stakeholders can chart a path that prioritizes both commercial success and clinical excellence. These actionable recommendations offer a roadmap for achieving sustainable growth in the competitive and rapidly evolving IVF devices and supplies market.

Detailing the Rigorous Research Approach Ensuring Data Integrity and Comprehensive Analysis of In-Vitro Fertilization Devices and Supplies Market Intelligence

This market analysis is grounded in a structured research approach combining primary interviews, secondary data aggregation, and rigorous validation protocols. In-depth discussions with laboratory directors, embryologists, procurement managers, and regulatory experts provided nuanced perspectives on evolving needs and emerging pain points. These insights were complemented by extensive reviews of peer-reviewed journals, industry white papers, and regulatory filings to triangulate quantitative trends with qualitative feedback.

Data integrity was ensured through cross-referencing multiple information sources, including company press releases, financial reports, patent databases, and clinical outcome registries. A detailed segmentation framework was applied to dissect trends across product types, procedure categories, technology variants, end users, patient types, and distribution channels. Geographical analyses leveraged trade data, reimbursement schedules, and macroeconomic indicators to contextualize regional performance nuances.

Expert validation sessions with key opinion leaders and technical advisors tested preliminary findings against real-world observations, resulting in iterative refinements of data models and narrative interpretations. Scenario planning and sensitivity analyses were employed to assess the potential impact of regulatory changes, tariff adjustments, and technological breakthroughs. Throughout the process, adherence to quality assurance standards and peer review protocols ensured that conclusions rest on a robust evidentiary foundation.

This methodology delivers a comprehensive, transparent, and replicable framework that underpins the report’s strategic insights and recommendations, empowering decision-makers with confidence in the accuracy and relevance of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-Vitro Fertilization Devices & Supplies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-Vitro Fertilization Devices & Supplies Market, by Product Type

- In-Vitro Fertilization Devices & Supplies Market, by Procedure Type

- In-Vitro Fertilization Devices & Supplies Market, by Technology

- In-Vitro Fertilization Devices & Supplies Market, by End User

- In-Vitro Fertilization Devices & Supplies Market, by Patient Type

- In-Vitro Fertilization Devices & Supplies Market, by Distribution Channel

- In-Vitro Fertilization Devices & Supplies Market, by Region

- In-Vitro Fertilization Devices & Supplies Market, by Group

- In-Vitro Fertilization Devices & Supplies Market, by Country

- United States In-Vitro Fertilization Devices & Supplies Market

- China In-Vitro Fertilization Devices & Supplies Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Presenting a Concise Conclusion That Emphasizes Strategic Imperatives and Future Directions for the In-Vitro Fertilization Devices and Supplies Industry

Drawing together the core findings, this report underscores how technological innovation, regulatory evolution, and demographic shifts converge to reshape the in-vitro fertilization devices and supplies market. The rise of automation, AI, and advanced cryopreservation techniques is enhancing procedural outcomes, while new tariff measures and trade dynamics compel stakeholders to rethink sourcing and manufacturing strategies. Segmentation analysis reveals that demand patterns vary significantly across product categories, procedure types, end users, patient profiles, and distribution channels, each presenting unique opportunities and challenges.

Regional dynamics further illustrate the importance of tailored approaches: the Americas benefit from supportive reimbursement frameworks, EMEA is defined by harmonized regulations and growing private-clinic demand, and Asia-Pacific leads in expansion driven by government initiatives and fertility tourism. Competitive intensity is heightened by global leaders investing heavily in R&D, regional players offering localized solutions, and emerging models such as outcome-based contracting reshaping commercial engagements.

Industry leaders are encouraged to adopt strategic recommendations centered on supply chain resilience, regulatory engagement, user training, and collaborative innovation to maintain momentum and capitalize on emerging growth vectors. By aligning internal capabilities with external market forces, organizations can deliver differentiated value, strengthen patient outcomes, and secure long-term competitive advantage.

Ultimately, this executive summary provides a consolidated roadmap for navigating the complexities of the IVF devices and supplies market, equipping decision-makers with the insights necessary to seize opportunities and address challenges in equal measure.

Taking the Next Step by Engaging with Associate Director Ketan Rohom to Access the Comprehensive In-Vitro Fertilization Devices and Supplies Market Research Report

To take advantage of the in-depth insights and strategic analysis presented in this executive summary, engage directly with Associate Director Ketan Rohom. He can guide you through the comprehensive research report, tailoring key findings to your organization’s specific needs and ensuring you have the data-driven intelligence required to stay ahead in the competitive in-vitro fertilization devices and supplies market. Reach out to secure your copy today and empower your team with the actionable insights necessary to drive innovation and growth.

- How big is the In-Vitro Fertilization Devices & Supplies Market?

- What is the In-Vitro Fertilization Devices & Supplies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?