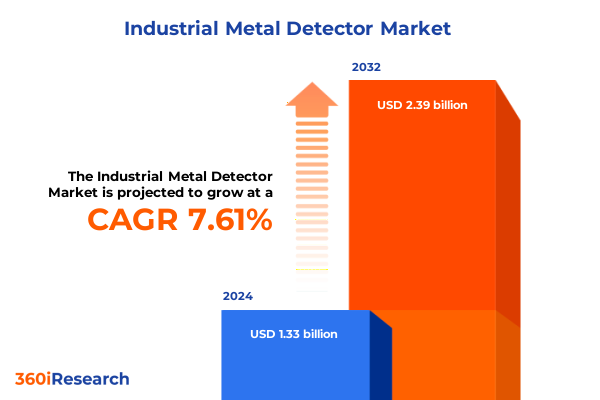

The Industrial Metal Detector Market size was estimated at USD 1.43 billion in 2025 and expected to reach USD 1.54 billion in 2026, at a CAGR of 7.63% to reach USD 2.39 billion by 2032.

Unveiling the Critical Role and Strategic Evolution of Industrial Metal Detection Technologies in Modern Manufacturing, Quality Assurance, and Operational Excellence

Industrial metal detection systems serve as the frontline safeguard for product integrity, operational efficiency, and consumer safety across diverse manufacturing environments. From protecting delicate electronic assemblies to ensuring contaminant-free food processing lines, these technologies are integral to modern quality assurance frameworks. As production processes become ever more complex and regulatory scrutiny intensifies, the importance of precise, reliable metal detection has never been greater.

This executive summary distills the most salient trends, regulatory influences, segmentation insights, regional dynamics, and competitive strategies shaping the landscape of industrial metal detection. Each section offers a targeted viewpoint on critical factors-from technological breakthroughs and tariff impacts to company initiatives and actionable recommendations-designed to equip leaders with a holistic understanding of the market in 2025.

Exploring the Technological, Operational, and Regulatory Transformations Reshaping the Industrial Metal Detection Market Landscape

The industrial metal detection market is undergoing a profound transformation driven by the convergence of advanced sensor technologies, digital connectivity, and data-centric process controls. In recent years, Industry 4.0 initiatives have accelerated adoption of smart detectors that integrate seamlessly with manufacturing execution systems, enabling real-time quality analytics and predictive maintenance. As a result, organizations are shifting from reactive defect management to proactive quality assurance strategies, where early anomaly detection minimizes downtime and reduces waste.

Concurrently, heightened regulatory emphasis on traceability in sectors such as food and pharmaceuticals is catalyzing investments in X-ray based detection systems that offer deeper penetration and enhanced resolution for contaminant identification. This pivot toward more sophisticated inspection apparatus coincides with a broader industry commitment to sustainability, prompting vendors to optimize energy consumption and support circular economy objectives through modular, upgrade-ready designs. Together, these shifts underscore a market landscape defined by agility, intelligence, and environmental responsibility.

Assessing the Broad and Longlasting Consequences of 2025 United States Tariff Measures on Metal Detection Equipment Supply Chains

In 2025, the United States implemented revised tariff schedules on imported components critical to metal detection apparatus, including specialized coils, advanced sensor modules, and high-precision conveyors. These measures have gradually reshaped global supply chain configurations, compelling manufacturers to reassess sourcing strategies and supplier relationships. Although cost pressures have intensified for businesses reliant on offshore production, the adjustment period has also spurred near-shoring initiatives aimed at bolstering domestic manufacturing resilience.

Furthermore, the tariff environment has inadvertently accelerated collaborative ventures between detector OEMs and regional component producers to mitigate exposure to international trade volatility. By reinforcing local ecosystems, industry players are forging partnerships that not only streamline logistics but also foster co-innovation on customized solutions. As these dynamics continue to mature, companies that balance tariff-driven cost controls with strategic alliances will be best positioned to maintain uninterrupted operations and uphold stringent quality standards.

Interpreting Key Segmentation Dimensions to Reveal Distinct Application Patterns and Technology Preferences in Metal Detection

A nuanced understanding of the industrial metal detector market emerges through a layered segmentation analysis that highlights application-specific preferences and technology adoption pathways. Based on installation considerations, fixed detectors dominate stationary processing lines, while a growing emphasis on flexibility has driven uptake of portable units for spot checks and field inspections. When viewed through the lens of operation mode, many facilities are transitioning toward automatic detectors that offer continuous monitoring without manual intervention, though manual variants retain relevance in low-volume or specialized production contexts.

Product type segmentation reveals clear tendencies: conveyor belt solutions account for the bulk of in-line inspections, free-fall units excel in gravity-fed batch processes, and pipeline detectors are indispensable for liquid‐based applications. Delving deeper, technology segmentation shows electromagnetic induction and vibratory units remain trusted for basic ferrous detection, whereas X-ray systems-available in both high-energy and low-energy configurations-are increasingly adopted for mixed metal and stainless steel challenges. Across metal type, operators calibrate systems to isolate ferrous, mixed metals, non-ferrous, or stainless steel contaminants, ensuring precise compliance with product specifications. Meanwhile, end use industry analysis highlights that automotive and chemical manufacturers emphasize embedded detectors in assembly lines, mining operations rely on ruggedized instruments to withstand harsh conditions, pharmaceutical plants demand ultra-high sensitivity, and the food & beverage sector-from bakery and dairy to meat processing, poultry, and seafood-prioritizes stringent hygiene and traceability.

This comprehensive research report categorizes the Industrial Metal Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installation

- Operation Mode

- Product Type

- Technology

- Metal Type

- End Use Industry

Highlighting Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific Metal Detection Markets

Regional dynamics in the Americas underscore a maturation of digital infrastructure paired with robust investment in agri-processing and pharmaceutical manufacturing. United States and Canada facilities increasingly integrate detectors with digital twins to optimize throughput and validate end-to-end traceability, while Latin American producers leverage cost-effective manual and portable units to address emerging quality regulations.

In Europe, Middle East, and Africa, regulatory harmonization across the European Union continues to drive demand for advanced X-ray solutions, whereas resource-rich markets in the Middle East and Africa emphasize ruggedized, low-maintenance detectors suited for mining and heavy industry. Partnerships between local integrators and global OEMs are enabling tailored deployments that account for regional power and environmental constraints.

Asia-Pacific remains the fastest evolving region, propelled by rapid expansion of food & beverage manufacturing and growth in automotive assembly hubs. Governments in China, India, and Southeast Asia are ramping up quality standards, mandating inline metal detection as part of broader food safety and export compliance frameworks. This policy momentum, coupled with cost-competitive local production, is creating fertile ground for both international suppliers and domestic innovators to capture share.

This comprehensive research report examines key regions that drive the evolution of the Industrial Metal Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Approaches to Innovation, Collaboration, and Market Expansion

Leading participants in the industrial metal detection sphere are demonstrating differentiated approaches to innovation and market reach. Established electromechanical specialists are enhancing their core portfolios by embedding digital interfaces and cloud-enabled analytics, allowing end-users to monitor device performance remotely and receive predictive maintenance alerts. At the same time, newer entrants are focusing on niche applications, such as low-energy X-ray units for micro-contaminant detection or rechargeable portable detectors optimized for field inspections.

Strategic partnerships are another hallmark of the competitive landscape. Detector manufacturers are collaborating with conveyor system providers, robotics integrators, and software vendors to offer end-to-end inspection solutions that minimize integration friction. This ecosystem approach not only streamlines deployment timelines but also enhances overall system reliability by harmonizing component interoperability.

Moreover, corporate investment in R&D is steadily increasing, with many companies establishing regional innovation centers to co-develop advanced sensor materials, AI-driven defect recognition algorithms, and modular hardware architectures. These efforts are aimed at delivering scalable solutions that can adapt to rapidly shifting production requirements and stringent industry standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Metal Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Packaging Machinery Ltd.

- Bunting Magnetics Europe Limited

- CASSEL Messtechnik GmbH

- Codan Limited

- Costruzioni Elettroniche Industriali Automatismi S.p.A.

- Crawfords Metal Detectors Group

- Dongguan COSO Electronic Technology Co., Ltd.

- Douglas Manufacturing Co., Inc.

- Driver Southall

- Fortress Technology Inc.

- Loma Systems

- Macpack Machineries Sdn. Bhd.

- Metal Detection Services

- Metal Detectors, Inc.

- METTLER TOLEDO

- Minebea Intec GmbH

- Nokta Makro Metal Detectors

- Pirate Electronics Ltd.

- PMG Equipments

- Sesotec GmbH

- SNB Electronic Services Ltd.

- TDI PACKSYS

- Thermo Fisher Scientific Inc.

- WIPOTEC GmbH

Formulating Tactical and Strategic Recommendations to Enhance Competitiveness and Resilience for Industry Leaders

Industry leaders should prioritize the development of modular detection systems that can be easily upgraded as process requirements evolve and new regulatory mandates emerge. By designing hardware platforms with swappable sensor modules and firmware-driven feature enhancements, manufacturers can extend system lifecycles and minimize capital expenditure for end-users.

In parallel, stakeholders are advised to invest in robust digital ecosystems, integrating detectors with enterprise resource planning and manufacturing execution systems. This connectivity not only enables centralized monitoring of quality metrics across multiple facilities but also provides a foundation for leveraging advanced analytics to predict contaminant risks and optimize inspection protocols.

Supply chain diversification is another critical tactic. By balancing global and regional sourcing for key components, companies can mitigate the impact of tariff fluctuations and logistical disruptions. Establishing strategic partnerships with local suppliers and co-manufacturing agreements can further strengthen resilience and support faster response times to market shifts.

Lastly, enhancing customer support with remote diagnostics, augmented reality-guided maintenance, and targeted training programs will differentiate providers in a competitive marketplace and foster long-term client relationships.

Detailing the Robust Research Methodology Underpinning the Industrial Metal Detector Market Analysis for Reliability and Clarity

This analysis is founded on a multi-tiered research framework combining secondary and primary methodologies to ensure comprehensive and reliable insights. Initially, an extensive review of industry publications, trade journals, patent filings, and regulatory directives established the contextual foundation and identified prevailing trends and innovation vectors.

Subsequently, primary research included structured interviews with key stakeholders: manufacturing executives, quality assurance managers, system integrators, and technology vendors. These engagements provided real-world perspectives on technology adoption challenges, ROI considerations, and future demand signals.

Data triangulation techniques were then applied, cross-validating findings from diverse sources to enhance accuracy. Quantitative inputs were harmonized with qualitative insights to produce a nuanced understanding of segmentation performance, regional dynamics, and competitive positioning. Throughout the process, rigorous quality checks and peer reviews were conducted to uphold methodological integrity and uphold industry research best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Metal Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Metal Detector Market, by Installation

- Industrial Metal Detector Market, by Operation Mode

- Industrial Metal Detector Market, by Product Type

- Industrial Metal Detector Market, by Technology

- Industrial Metal Detector Market, by Metal Type

- Industrial Metal Detector Market, by End Use Industry

- Industrial Metal Detector Market, by Region

- Industrial Metal Detector Market, by Group

- Industrial Metal Detector Market, by Country

- United States Industrial Metal Detector Market

- China Industrial Metal Detector Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Insights and Implications to Guide Stakeholders in the Evolving Industrial Metal Detection Sector with Strategic Roadmap

In summary, the industrial metal detection sector is at a pivotal juncture defined by accelerated digital integration, evolving regulatory landscapes, and strategic supply chain realignments. Technological advances, particularly in smart sensor architectures and X-ray imaging, are expanding the boundaries of contaminant detection, while tariff‐driven regionalization efforts are reshaping global sourcing paradigms.

Stakeholders who leverage deep segmentation insights-from installation modes and operation types to product form factors, detection technologies, and end-use applications-will be poised to deliver highly differentiated solutions. Regional strategies that align with local regulatory requirements and infrastructure maturity will further enhance market penetration and customer satisfaction.

Ultimately, sustained investment in research, collaborative partnerships, and adaptive system design will determine which organizations can capitalize on the next wave of growth. By synthesizing these core insights, decision-makers can chart a strategic course that balances innovation, cost efficiency, and operational excellence.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence Tailored for Strategic Decision Making and Competitive Advantage

For executives seeking to navigate complex market dynamics and capitalize on emerging opportunities in industrial metal detection, direct engagement with Ketan Rohom offers unparalleled insights tailored to strategic growth imperatives. As the Associate Director of Sales & Marketing, Ketan blends deep domain expertise with a consultative approach to deliver customized intelligence that aligns with operational priorities, regulatory requirements, and technology roadmaps.

By scheduling a one-on-one briefing, stakeholders gain early access to the full market research report, enriched with comprehensive analysis across segmentation, regional dynamics, competitive benchmarking, and actionable scenarios. This collaboration ensures that decision-makers can validate strategic investments, optimize supply-chain configurations, and drive sustainable performance improvements. Reach out today to unlock data-driven strategies that will position your organization at the forefront of the industrial metal detection industry and secure a lasting competitive advantage.

- How big is the Industrial Metal Detector Market?

- What is the Industrial Metal Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?