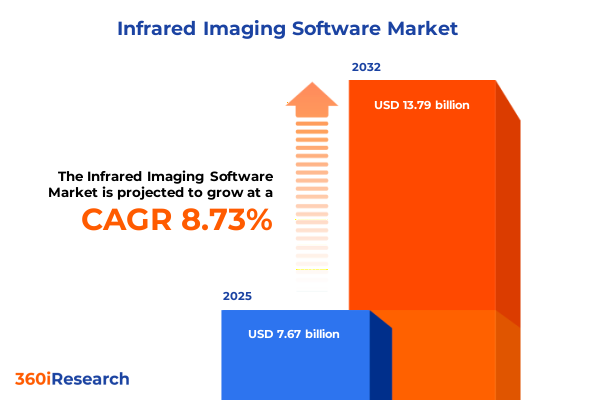

The Infrared Imaging Software Market size was estimated at USD 7.67 billion in 2025 and expected to reach USD 8.26 billion in 2026, at a CAGR of 8.73% to reach USD 13.79 billion by 2032.

Unveiling the Strategic Imperatives and Evolutionary Trajectory of Infrared Imaging Software in an Increasingly Connected World

Infrared imaging software has emerged as a fundamental component in an array of critical systems, enabling organizations to see beyond the visible spectrum. As industries evolve toward increasingly data-driven operations, the ability to capture, process, and analyze thermal signatures delivers unparalleled advantages in efficiency, safety, and innovation. Throughout the past decade, advancements in sensor technology, artificial intelligence, and cloud computing have coalesced to transform infrared imaging from a niche capability into a mainstream strategic asset. Today, enterprises across sectors leverage these tools to derive predictive insights, optimize performance, and ensure compliance with rigorous safety standards.

In this context, organizations must develop a clear understanding of how infrared imaging software aligns with broader digital transformation journeys. Beyond mere heat maps or basic detection features, modern solutions integrate advanced analytics and machine learning algorithms. This enables real-time anomaly detection, adaptive thresholding, and predictive maintenance workflows. As companies continue to confront rising operational complexity and heightened expectations for uptime and reliability, the demand for robust, scalable infrared imaging platforms intensifies. Consequently, decision makers are compelled to evaluate not only the technical capabilities of these solutions but also their integration potential within existing IT and operational technology architectures.

Given the strategic significance of infrared imaging software, this report provides a structured analysis that unpacks key market dynamics, regulatory shifts, segmentation insights, and actionable strategies. By examining both current challenges and emerging opportunities, stakeholders will gain a comprehensive view of the factors driving adoption, the competitive landscape, and the critical success factors necessary for sustained innovation and growth.

Navigating the Pivotal Technological and Market Shifts Driving Innovation and Disruption within Infrared Imaging Software Ecosystems Globally

The landscape of infrared imaging software is undergoing a profound transformation driven by several technological and market forces. Foremost among these is the integration of artificial intelligence and deep learning capabilities, which have revolutionized image processing workflows. Algorithms can now automatically classify thermal patterns, detect anomalies with unprecedented accuracy, and continuously learn from new data sets. This shift toward intelligent imaging has elevated expectations for software performance and has opened new applications in predictive maintenance and safety-critical environments.

Concurrently, the rise of edge computing has redefined deployment models. By enabling real-time data analysis at the point of capture, edge solutions reduce latency and bandwidth requirements while ensuring robust performance in remote or bandwidth-constrained settings. As a result, organizations operating in sectors like energy infrastructure and defense can now deploy infrared imaging tools in isolated locations without sacrificing analytical depth. Moreover, the synergy between cloud-based platforms and distributed edge nodes has fostered hybrid architectures that balance scalability with on-premises control and data sovereignty considerations.

Another pivotal shift involves the proliferation of open standards and interoperable frameworks. By facilitating seamless integration with third-party sensors, enterprise resource planning systems, and Internet of Things platforms, these standards are dismantling barriers to adoption. At the same time, the growing emphasis on cybersecurity has prompted software providers to embed encryption, access controls, and anomaly detection features directly into their offerings. Taken together, these technological and market trends are reshaping the competitive dynamics and value propositions across the infrared imaging software sector, driving vendors to innovate and adapt rapidly.

Assessing the Cumulative Impact of United States Tariffs Enacted in 2025 on the Infrared Imaging Software Supply Chain and Stakeholders

In 2025, the United States government expanded existing tariffs on electronic components, which directly impacts the supply chain for infrared imaging software. Components such as cooled indium antimonide detectors and microbolometer arrays, frequently sourced from key international suppliers, now carry additional import duties. These tariffs have introduced both direct cost pressures and indirect ripple effects as vendors seek alternative supply sources. As procurement teams adjust to revised pricing structures, software pricing models are also under scrutiny to preserve profit margins while maintaining competitive positioning.

The imposition of higher duties has accelerated the search for domestically sourced detector technologies and fostered strategic partnerships between software vendors and U.S.-based hardware manufacturers. While this shift can bolster long-term supply chain resilience, it has also introduced short-term capacity constraints and development delays. Companies at the forefront of infrared imaging software are responding by redesigning products for compatibility with a broader range of detectors and by investing in research and development aimed at detector agnosticism. These measures mitigate tariff-related disruptions and ensure that customers retain access to high-performing imaging solutions.

Looking forward, stakeholders must remain vigilant as the tariff landscape could evolve further in response to geopolitical developments and trade negotiations. By adopting flexible sourcing strategies and modular software architectures, enterprises can reduce exposure to sudden policy shifts. Moreover, working closely with regulatory bodies to clarify tariff classifications can uncover opportunities to optimize duty rates and access potential exemptions. Ultimately, managing cumulative tariff impacts in 2025 requires proactive risk management, diversified supplier networks, and agile product roadmaps.

Leveraging Deep Insights from Multidimensional Segmentation to Uncover Growth Opportunities and Tailored Strategies in Infrared Imaging Software Markets

A robust segmentation framework reveals the diverse pathways through which infrared imaging software delivers value across end-user industries, applications, technology types, wavelength bands, deployment models, and product types. When examining end-user industries, automotive players leverage thermal solutions for autonomous vehicle testing, advanced driver assistance systems, and safety system validation. Consumer electronics firms integrate thermal analytics into home automation devices, smartphone-compatible modules, and wearable health monitors. Defense contractors apply night vision algorithms, surveillance enhancements, and targeting and tracking modules to satisfy stringent mission requirements. Energy and utilities companies drive pipeline monitoring, power plant inspection, and renewable energy maintenance through predictive thermal analysis. Healthcare providers adopt infrared imaging for condition monitoring, early disease diagnostics, and fever screening protocols. Manufacturing environments harness predictive maintenance, process monitoring, and quality control, while academic researchers employ software for biological, environmental, and material studies. Security and surveillance operators rely on border monitoring, intrusion detection, and perimeter security to safeguard assets.

In parallel, segmenting by application uncovers distinct feature requirements and performance benchmarks. Fever detection modules, crucial at airports, hospitals, and workplace checkpoints, emphasize rapid screening with high accuracy under varied environmental conditions. Fire detection software integrates thermal anomaly detection with real-time alerts to prevent catastrophic incidents. Image processing and analytics tools serve core functions across domains, combining thermal and visible spectra for enhanced situational awareness. Night vision imaging systems extend operational capability into low-light environments. Preventive maintenance packages focus on equipment fault detection, lubrication analysis, and continuous machinery monitoring. Thermal analysis suites for building inspection, electrical maintenance, and mechanical evaluation support regulatory compliance and safety assurance.

Technology type also drives differentiation: cooled detectors, including indium antimonide, mercury cadmium telluride, and quantum well infrared photodetectors, offer superior sensitivity for high-precision tasks, while uncooled microbolometer and thermopile sensors support cost-sensitive, lightweight use cases. Wavelength bands ranging from long-wave infrared to short-wave infrared dictate the optimal imaging spectral window for each scenario. Deployment models span cloud-hosted analytics platforms suited for enterprise-scale coordination, and on-premises installations that address data governance concerns. Finally, product type varies from embedded software integrated with hardware appliances, to mobile applications for field technicians, software-as-a-service models that ensure continuous updates, and standalone software packages for specialized analytical workflows. Through this holistic segmentation lens, organizations can align software capabilities to their unique operational demands and strategic objectives.

This comprehensive research report categorizes the Infrared Imaging Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology Type

- Wavelength Band

- Deployment Model

- Application

- End-User Industry

Exploring Region-Specific Dynamics and Strategic Advantages Shaping the Adoption and Evolution of Infrared Imaging Software across Key Global Territories

Regional dynamics shape the infrared imaging software market in unique and compelling ways, driven by varying regulatory environments, industrial priorities, and technological readiness. In the Americas, industrial modernization efforts and infrastructure renewal projects fuel demand for advanced thermal inspection tools. The presence of leading semiconductor manufacturers and sensor producers in North America supports innovation, while government-funded safety initiatives in Latin America foster broader adoption of screening and surveillance applications.

Europe, Middle East & Africa showcase a mosaic of market drivers: stringent building energy efficiency regulations in Europe drive uptake of thermal analysis solutions, while defense modernization programs across the Middle East underscore the value of advanced night vision and surveillance software. In Africa, mining and energy sectors invest in predictive maintenance tools to reduce downtime and enhance safety under challenging environmental conditions.

The Asia-Pacific region represents a fast-growing frontier, where rapid industrialization and urbanization propel widespread infrastructure inspections and smart city deployments. Key markets in East Asia benefit from robust electronics manufacturing ecosystems, accelerating development of integrated consumer devices with thermal capabilities. Meanwhile, nations in South and Southeast Asia prioritize healthcare screening solutions and energy management applications to support population health initiatives and grid reliability. Across all regions, collaboration between local partners and global vendors ensures that software offerings align with regional compliance frameworks, language requirements, and integration standards.

This comprehensive research report examines key regions that drive the evolution of the Infrared Imaging Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators and Market Trailblazers Driving Competitive Differentiation in the Infrared Imaging Software Sector

A number of leading innovators have established differentiated positions within the infrared imaging software segment by aligning advanced analytics capabilities with specialized industry requirements. These companies drive product roadmaps that emphasize AI-driven anomaly detection, modular architectures for seamless integration, and user-friendly interfaces that accelerate time to insight. Strategic partnerships with detector manufacturers reinforce direct access to the latest sensor technologies, enabling first-mover advantages in emerging application areas.

Innovation leaders also distinguish themselves through investment in cross-platform compatibility, ensuring their software can operate on edge devices, mobile endpoints, and cloud ecosystems without sacrificing performance. This “one-platform” approach supports diverse deployment scenarios and reduces total cost of ownership. Companies with a global footprint leverage localized development centers to address region-specific compliance and language needs, while building strong channel networks that facilitate rapid market penetration.

Furthermore, collaborative research initiatives between vendors and academic institutions drive breakthroughs in areas such as hyperspectral thermal imaging and multimodal sensor fusion. By co-creating proof-of-concept solutions, these organizations accelerate the transition from laboratory research to field-ready applications. Together, these key players set the pace for the market, raising the bar for performance, reliability, and user experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infrared Imaging Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Vision Technologies GmbH

- Axis Communications AB

- CorDEX Instruments Ltd.

- Fluke Corporation

- GRAYESS Inc.

- Infra Red Distributions Ltd.

- InfraTec GmbH

- IRay Technology Co., Ltd.

- IRCAM GmbH

- JENOPTIK AG

- Keysight Technologies, Inc.

- Land Instruments International by AMETEK, Inc.

- LI-COR, Inc.

- LYNRED USA

- Med-Hot Medical Thermography

- Microsoft Corporation

- Optris GmbH

- PEMA THERMO GROUP, S.L.

- Process Parameters Ltd.

- SENSE SOFTWARE Sp. z o.o.

- Sensors Unlimited by Collins Aerospace Company

- Teledyne FLIR LLC

- Testo SE & Co. KGaA

- Xenics NV

- Zhejiang Dali Technology Co.,Ltd.

Implementing Targeted Strategies and Actionable Recommendations to Navigate Market Complexities and Accelerate Growth in Infrared Imaging Software

To capitalize on the opportunities within infrared imaging software, industry leaders should adopt a multi-faceted strategic approach that aligns technological investment with market demand. First, focus on integrating machine learning models that continuously refine detection algorithms based on real-world usage data, ensuring adaptability to evolving application scenarios. By embedding these models in both cloud and edge platforms, organizations can deliver low-latency analytics without compromising on computational power.

Next, cultivate strategic alliances with sensor providers and system integrators to co-develop turnkey solutions. This collaborative model accelerates go-to-market timelines and secures preferential access to cutting-edge detector technologies. Simultaneously, invest in building an extensible software framework with open APIs, enabling customers to customize workflows and integrate third-party modules for specialized functions.

Leverage regional partnerships to navigate regulatory landscapes and local market nuances effectively. In markets with stringent data governance requirements, emphasize on-premises deployment options and robust security certifications. In high-growth territories, tailor offerings to address specific use cases such as energy infrastructure monitoring or public health screening. Additionally, implement a tiered subscription model that balances entry-level affordability with premium feature bundles, driving customer acquisition across different segments.

Lastly, prioritize ongoing user training and support programs to maximize software adoption and ensure customer success. By establishing dedicated centers of excellence and interactive e-learning resources, organizations can minimize churn and foster long-term client relationships, ultimately driving sustained revenue growth.

Employing Rigorous Primary and Secondary Research Methodologies to Ensure Comprehensive and Unbiased Insights within Infrared Imaging Software Analysis

This analysis is built on a robust research methodology that ensures comprehensive, unbiased, and up-to-date insights. Primary research involved in-depth interviews with C-level executives, technical specialists, and end users across key industries, gathering qualitative perspectives on adoption drivers, integration challenges, and future expectations. These interviews covered a range of use cases from predictive maintenance in manufacturing to fever screening in healthcare settings, ensuring relevance across application domains.

Secondary research encompassed a thorough review of publicly available technical documentation, white papers, and industry consortium publications. Where possible, proprietary data on sensor shipments, software licensing models, and patent filings were analyzed to triangulate market intelligence. Trade publications and regulatory databases provided context on tariff developments and compliance standards, while conference proceedings and academic journals informed emerging technology trends such as hyperspectral imaging and sensor fusion.

Data synthesis involved cross-validation of qualitative and quantitative findings to identify consistent patterns and divergent viewpoints. A structured framework was employed to segment the market across end-user industries, applications, technology types, wavelength bands, deployment models, and product types, ensuring that insights remain actionable and aligned with stakeholder priorities. This rigorous approach underpins the reliability of strategic implications and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infrared Imaging Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infrared Imaging Software Market, by Product Type

- Infrared Imaging Software Market, by Technology Type

- Infrared Imaging Software Market, by Wavelength Band

- Infrared Imaging Software Market, by Deployment Model

- Infrared Imaging Software Market, by Application

- Infrared Imaging Software Market, by End-User Industry

- Infrared Imaging Software Market, by Region

- Infrared Imaging Software Market, by Group

- Infrared Imaging Software Market, by Country

- United States Infrared Imaging Software Market

- China Infrared Imaging Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Future Direction of Infrared Imaging Software Adoption and Innovation

The confluence of advanced analytics, sensor innovations, and evolving regulatory environments has positioned infrared imaging software as a transformative technology across multiple industries. Key findings highlight the imperative of integrating AI-driven capabilities and adopting hybrid deployment architectures to balance performance, security, and scalability. The diverse segmentation framework underscores the need for tailored solutions that align with distinct end-user requirements, from autonomous vehicle developers to energy infrastructure operators.

Regional analysis reveals that while mature markets prioritize integration with enterprise systems and compliance with stringent standards, high-growth regions focus on cost-effective deployment models and application-specific functionality. The cumulative impact of U.S. tariffs in 2025 underlines the importance of supply chain resilience and strategic sourcing, prompting a shift toward modular software designs that can readily adapt to hardware substitutions.

Looking ahead, industry leaders must embrace collaborative innovation models, forging partnerships across the value chain to accelerate product development and market entry. By leveraging open standards, maintaining strong customer support frameworks, and continuously investing in research, organizations can navigate the complexities of this dynamic landscape and seize emerging opportunities. Ultimately, infrared imaging software will continue to redefine how enterprises monitor, analyze, and optimize critical operations, driving enhanced safety, efficiency, and insight.

Connect Directly with the Associate Director of Sales and Marketing to Secure Your Comprehensive Infrared Imaging Software Market Research Report Today

To learn more about how infrared imaging software can revolutionize your strategic initiatives and unlock unseen operational efficiencies, reach out to Ketan Rohom, the Associate Director of Sales & Marketing. He possesses deep expertise in guiding organizations through data-driven decision making and can tailor insights to your unique requirements. By partnering with him, you gain early access to a comprehensive market research report that illuminates emerging trends, competitive landscapes, and actionable growth strategies. Don’t miss this opportunity to secure a competitive edge in an increasingly dynamic market; connect today to begin your journey toward informed, future-ready investments in infrared imaging software.

- How big is the Infrared Imaging Software Market?

- What is the Infrared Imaging Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?