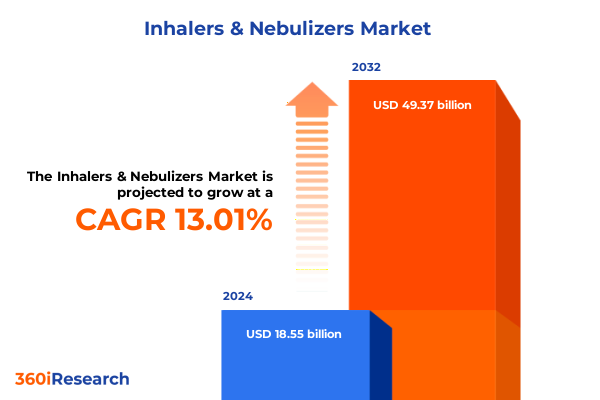

The Inhalers & Nebulizers Market size was estimated at USD 20.87 billion in 2025 and expected to reach USD 23.53 billion in 2026, at a CAGR of 13.08% to reach USD 49.37 billion by 2032.

Exploring the Critical Role, Clinical Advancements, and Market Significance of Inhalers and Nebulizers in Modern Respiratory Healthcare Delivery

The steadily rising burden of chronic respiratory diseases such as asthma and chronic obstructive pulmonary disease has elevated the importance of effective drug delivery mechanisms, positioning inhalers and nebulizers at the forefront of modern respiratory care. These devices not only facilitate direct administration of therapeutics to the pulmonary system, but also enhance patient compliance and treatment efficacy by minimizing systemic side effects. In response to evolving clinical needs, manufacturers have introduced innovations ranging from soft mist inhalers that optimize aerosol particle size to smart inhalers equipped with integrated sensors that track usage patterns in real time.

Moreover, the adoption of novel biologic therapies administered via inhalation pathways has expanded the therapeutic scope of these devices, creating new opportunities for targeted interventions in conditions such as cystic fibrosis. As health systems worldwide strive to improve outcomes while managing costs, inhalers and nebulizers have emerged as indispensable tools. They bridge the gap between advanced pharmacology and patient-centric delivery, charting a course for enhanced quality of life among individuals with respiratory ailments.

Unveiling Technological Innovations Regulatory Reforms and Environmental Sustainability Trends Driving Transformation in the Inhalers and Nebulizers Sector

Disruption in the inhalers and nebulizers sector has accelerated through rapid technological convergence, shifting regulatory expectations, and an intensified focus on sustainability. Recent breakthroughs in digital health integration have enabled devices to collect granular data on inhalation metrics, facilitating adherence monitoring and personalized care. Regulatory authorities now mandate environmentally responsible propellants and reduced global warming potential formulations, prompting a transition toward eco-friendly inhaler platforms and further innovation in propellant-free systems.

Concurrently, patient-centric trends have reshaped product design, with ergonomics and ease of use taking precedence. Wearable nebulizer prototypes and app-enabled devices reflect a broader shift toward connected care ecosystems, allowing clinicians to remotely adjust dosing regimens. These changes underscore a landscape in which regulatory reforms, environmental stewardship, and digital enablement coalesce to redefine product value propositions and chart a new course for respiratory therapy.

Analyzing the Compounding Effects of 2025 United States Tariffs on Global Inhaler and Nebulizer Supply Chains and Cost Structures

The introduction of new United States tariffs in early 2025 has imposed a layered cost structure on imported inhaler components and nebulizer assemblies, leading to tangible shifts in sourcing strategies. Manufacturers reliant on overseas production of mesh and ultrasonic nebulizer parts have faced incremental duties, prompting supply-chain realignment toward domestic or nearshore facilities. As a result, lead times for critical components have lengthened, and procurement budgets have undergone rigorous review to balance cost containment with quality assurance.

In parallel, tariff-driven price adjustments have affected hospital pharmacy formularies and homecare procurement models, generating friction between providers and suppliers. To mitigate financial impact, several global players have initiated collaborative ventures with U.S. contract manufacturers and are exploring tariff classification updates for specialized aerosol devices. Over the long term, these strategic responses are poised to enhance supply-chain resilience, though they require sustained capital investment and cross-sector alignment to fully offset the cumulative effects of the 2025 tariff environment.

Deep Insights into Product Therapeutic Indication Distribution and End User Dynamics Shaping the Inhalers and Nebulizers Market Segmentation

A nuanced examination of product type reveals distinct performance profiles across dry powder inhalers, metered dose inhalers, novel soft mist platforms, and diverse nebulizer formats. Among nebulizers, jet models remain a mainstay in institutional settings, while mesh variants gain traction in portable homecare applications due to their superior drug delivery efficiency. Ultrasonic devices, though less prevalent for certain formulations, retain relevance in specialized clinical protocols.

Therapeutic class segmentation further underscores differentiated drivers of demand, with anticholinergics and bronchodilators anchoring chronic obstructive pulmonary disease therapy, and corticosteroid formulations continuing to dominate maintenance regimens for asthma patients. Mucolytics occupy a focused niche, particularly within cystic fibrosis care pathways. Indication analysis highlights pediatrics and adult asthma management as high-volume segments, whereas cystic fibrosis requires tailored approaches in both hospital and home settings.

Distribution channels reflect evolving procurement behaviors: hospital pharmacies prioritize reliability and bulk fulfillment, retail pharmacies cater to discontinuous consumer touchpoints, and online pharmacies accelerate direct-to-patient delivery in homecare contexts. Across these avenues, ambulatory care centers, outpatient clinics, and home environments represent critical end-user domains, each shaping product requirements, educational needs, and support infrastructure.

This comprehensive research report categorizes the Inhalers & Nebulizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Drug Class

- Patient Age Group

- Prescription Status

- Distribution Channel

- End User

Examining Regional Adoption Patterns Reimbursement Models and Infrastructure Variations across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional analysis illuminates significant variation in adoption patterns, reimbursement models, and infrastructural capabilities among the Americas, EMEA, and Asia-Pacific. In North America, advanced healthcare infrastructure and centralized purchasing frameworks have accelerated uptake of connected inhaler systems and premium nebulizer devices. Robust reimbursement policies offer price stability, enabling providers to integrate new technologies within care pathways across hospitals, clinics, and homecare programs.

Across Europe, the Middle East, and Africa, harmonized regulatory frameworks emphasize environmental compliance and patient safety. This context has driven accelerated migration from traditional metered dose inhalers to soft mist and propellant-free platforms, supported by national health authorities in Germany, France, and the United Kingdom. In contrast, Middle Eastern and African markets exhibit pronounced variation in distribution efficacy, with urban centers demonstrating rapid modernization while remote areas face logistical barriers.

In Asia-Pacific, demographic shifts and rising respiratory disease incidence have spurred demand for cost-effective nebulizer solutions and generic inhaler formulations. China and India lead volume uptake through expanding online pharmacy networks, while Southeast Asian markets invest in decentralized homecare training and telemedicine integration. Across all regions, tailored strategies that align with local regulatory, clinical, and infrastructural realities will determine the trajectory of inhaler and nebulizer adoption.

This comprehensive research report examines key regions that drive the evolution of the Inhalers & Nebulizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Strategic Alliances and Technological Breakthroughs That Define Competitive Leadership in the Inhaler and Nebulizer Industry

Leading industry participants are forging strategic alliances and pioneering product enhancements to secure competitive advantage. Becton Dickinson has advanced its connected inhaler sensor technology through collaborations with digital health startups, enabling real-time adherence tracking and analytics. Philips Respironics continues to refine its mesh nebulizer platform, achieving lower residual volumes and quieter operation to enhance patient comfort in home environments.

Pharmaceutical partners such as Boehringer Ingelheim and AstraZeneca have incorporated dual-mechanism bronchodilator combinations and inhaled biologics into proprietary device portfolios, reinforcing their presence in chronic respiratory care. GlaxoSmithKline’s transition to lower-global-warming potential propellants underscores its commitment to environmental imperatives, while Teva Pharmaceutical Industries leverages licensing agreements to expand generic inhaler access across emerging markets.

Collectively, these companies invest heavily in R&D to explore novel formulation delivery, integrate adherence-driving software applications, and establish localized production hubs. Strategic M&A activity and cross-sector partnerships continue to shape a dynamic competitive landscape, with innovation pipelines focused on patient engagement, sustainability, and cost optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inhalers & Nebulizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AMIKO Digital Health

- AptarGroup, Inc.

- AstraZeneca PLC

- Beurer GmbH

- Beximco Pharmaceuticals Ltd.

- Boehringer Ingelheim International GmbH

- CHIESI Farmaceutici S.p.A.

- Cipla Limited

- Dr Trust by Nureca Ltd.

- Gerresheimer AG

- GF Health Products, Inc.

- GlaxoSmithKline PLC

- H&T Presspart

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Merck Group

- Mundipharma GmbH

- Novartis AG

- Omron Corporation

- PARI GmbH

- Sensirion AG

- Sunovion Pharmaceuticals Inc.

- Teleflex Incorporated

- Teva Pharmaceutical Industries Ltd.

- Vectura Group Ltd. by Molex Asia Holdings LTD

Strategic Roadmap Highlighting Digital Integration Supply Chain Resilience and Patient Engagement to Seize Emerging Growth Opportunities in Respiratory Care

Industry leaders should prioritize the integration of digital capabilities into core product offerings, leveraging sensor-enabled inhalers and app-driven analytics to monitor adherence, personalize dosing regimens, and strengthen provider-patient communication. By aligning with technology partners and establishing interoperable data ecosystems, organizations can deliver value-based care that resonates with payers and regulators.

To counteract tariff-induced cost pressures, it is imperative to cultivate flexible manufacturing models, whether through modular facilities, contract manufacturing partnerships, or strategic nearshoring initiatives. This approach not only mitigates supply chain disruptions but also shortens lead times for critical inhalation therapy devices. In parallel, forging collaborative relationships with procurement consortia and GPOs can unlock volume discounts while preserving quality standards.

Enhancing patient engagement through targeted education programs and telehealth support can improve adherence and outcomes, translating into demonstrable value for payers. Expanding distribution channels to include online pharmacies and homecare platforms will broaden market reach and accommodate evolving consumer preferences. Finally, embedding sustainability into product lifecycles-from eco-design to end-of-use recycling programs-will satisfy regulatory mandates and support corporate responsibility objectives.

Comprehensive Research Framework Combining Primary Expert Interviews Secondary Data Analysis and Rigorous Validation to Ensure Actionable Market Intelligence

Our research harnessed a combination of primary and secondary data collection to ensure comprehensive coverage and analytical depth. Primary research involved structured interviews with device manufacturers, respiratory therapists, procurement directors, and clinicians across major healthcare institutions. In addition, patient and caregiver surveys provided critical perspectives on usability, adherence challenges, and support needs.

Secondary research encompassed a thorough review of regulatory filings, clinical trial registries, peer-reviewed literature, patent databases, and proprietary databases tracking device approvals and environmental mandates. This information was triangulated with industry white papers and thought leadership publications to validate emerging trends.

A multi-stage data validation process incorporated expert panels and advisory board workshops, ensuring that insights reflect real-world experiences and practical constraints. Quantitative and qualitative inputs were cross-referenced to deliver balanced, actionable intelligence. Throughout the study, rigorous documentation standards and peer reviews upheld data integrity, providing a robust foundation for strategic decision-making in the inhalers and nebulizers space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inhalers & Nebulizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inhalers & Nebulizers Market, by Product Type

- Inhalers & Nebulizers Market, by Indication

- Inhalers & Nebulizers Market, by Drug Class

- Inhalers & Nebulizers Market, by Patient Age Group

- Inhalers & Nebulizers Market, by Prescription Status

- Inhalers & Nebulizers Market, by Distribution Channel

- Inhalers & Nebulizers Market, by End User

- Inhalers & Nebulizers Market, by Region

- Inhalers & Nebulizers Market, by Group

- Inhalers & Nebulizers Market, by Country

- United States Inhalers & Nebulizers Market

- China Inhalers & Nebulizers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Concluding Perspectives Illuminating How Converging Technologies Regulatory Shifts and Patient Needs Are Steering the Future of Inhalers and Nebulizers

As inhalers and nebulizers evolve under the influence of digital innovation, regulatory imperatives, and changing patient expectations, stakeholders must navigate a complex interplay of technological advances and policy shifts. The trajectory of respiratory care delivery hinges on the ability to integrate connected device functionality, uphold environmental commitments, and adapt to new tariff landscapes without compromising affordability or quality.

Looking ahead, organizations that can align multidisciplinary expertise-from device engineering to data science and supply chain optimization-will unlock opportunities to improve clinical outcomes and operational efficiency. By focusing on patient-centric design, fostering collaborative partnerships, and anticipating regulatory developments, the inhaler and nebulizer industry is well positioned to meet the challenges of the next decade.

In this dynamic context, strategic insight and timely intelligence become critical differentiators. The industry’s capacity to harness innovation while maintaining cost and quality discipline will determine which players lead the market and drive the future of respiratory therapy.

Compelling Invitation to Leverage Expert Market Intelligence and Connect with Ketan Rohom for Exclusive Inhaler and Nebulizer Industry Research Access

We invite you to harness targeted, data-driven analysis that can inform strategic investments, refine operational processes, and elevate patient outcomes within the respiratory care arena. By partnering with Ketan Rohom, Associate Director, Sales & Marketing, you gain privileged access to a comprehensive report that distills the most relevant intelligence on inhaler and nebulizer innovations, regulatory developments, and competitive tactics.

Connect with Ketan Rohom to secure the full market research report and empower your organization with actionable insights that drive growth, optimize supply chain resilience, and strengthen patient engagement initiatives. Don’t miss this opportunity to transform your strategic planning with unparalleled expertise and a nuanced understanding of the inhalers and nebulizers landscape.

- How big is the Inhalers & Nebulizers Market?

- What is the Inhalers & Nebulizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?