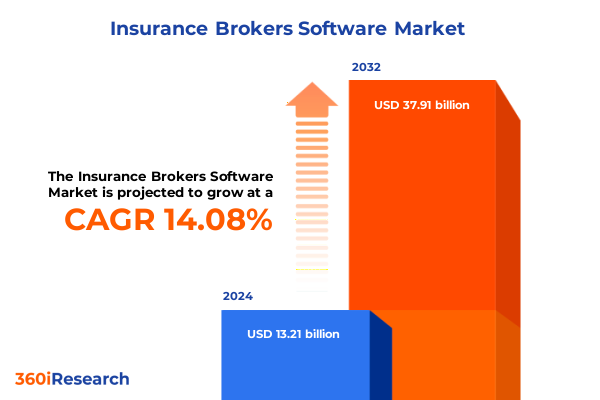

The Insurance Brokers Software Market size was estimated at USD 15.04 billion in 2025 and expected to reach USD 16.93 billion in 2026, at a CAGR of 14.11% to reach USD 37.91 billion by 2032.

Setting the Stage for Next-Generation Insurance Broker Software to Transform and Empower Today's Digital-First Distribution Channels

The insurance broker software landscape is undergoing a profound transformation as brokers strive to meet the evolving expectations of both carriers and policyholders. Legacy systems are being challenged by modern platforms that prioritize agility, seamless user experiences, and robust integration capabilities. In this context, the executive summary provides a strategic overview of the key themes shaping the market and highlights the imperatives that industry leaders must address to maintain a competitive edge.

Beginning with an exploration of the foundational drivers of change, the introduction outlines how digital disruption and shifting consumer behaviors converge to elevate the importance of specialized broker solutions. It also underscores the role of emerging technologies-ranging from cloud architectures to intelligent automation-in enabling brokers to optimize workflows, enhance service delivery, and expand their value proposition. Transitional insights in this section set the stage for the deeper analyses that follow.

By framing the discussion around both strategic and operational perspectives, this introduction equips readers with a clear understanding of the marketplace’s current dynamics. With a balanced lens on technology, regulation, and customer-centricity, the narrative ensures that stakeholders can appreciate the interconnected forces at play. In turn, this orientation creates a cohesive foundation for examining transformative shifts, tariff impacts, segmentation nuances, regional variations, competitive benchmarks, and actionable recommendations throughout the subsequent sections.

Unveiling the Transformative Forces Reshaping Insurance Broker Technology amid Digital and Regulatory Evolutions

The insurance brokerage sector is embracing next-generation technology architectures that prioritize scalability, resilience, and rapid innovation. Increasingly, brokers are migrating from traditional, monolithic systems to cloud-native platforms built on microservices and containerization frameworks. This shift enables modular upgrades, reduces time-to-market for new features, and supports seamless integration with a broad array of third-party services. Today’s platforms offer enhanced flexibility, allowing brokerages to respond dynamically to market demands and emerging regulatory requirements, thereby fostering a competitive advantage in a complex environment.

Simultaneously, artificial intelligence and predictive analytics are reshaping core workflows. Underwriting processes, once reliant on manual assessments and static data sources, now leverage machine learning algorithms to analyze vast datasets-from telematics signals to customer interaction records-in real time. This evolution not only accelerates risk evaluation and pricing accuracy but also helps detect anomalies and potential fraud. As a result, brokerages can deliver personalized policy recommendations while streamlining operational overhead.

Moreover, the rise of API-driven ecosystems is fostering collaborative innovation across the insurance value chain. By exposing modular capabilities-such as quoting engines, compliance modules, and claims orchestration services-through secure APIs, software providers empower brokers to assemble tailored solutions that integrate seamlessly with carrier platforms, insurtech partners, and adjacent service providers. This composable approach unlocks new revenue streams, enhances customer engagement, and accelerates the pace of digital transformation within brokerage firms.

Assessing the Broad Economic and Operational Repercussions of 2025 U.S. Tariffs on Insurance Broker Technology Strategies

The tariff measures introduced in 2025 have exerted a pronounced macroeconomic drag on the technology ecosystem underpinning insurance broker software. According to the Yale Budget Lab, the cumulative effect of U.S. tariffs implemented this year is expected to suppress real GDP growth by 0.6 percent in the long run, equating to an annual economic shortfall of approximately $180 billion when expressed in 2024 dollars. This broader slowdown reverberates through both enterprise capital budgets and consumer spending, creating a more constrained environment for technology investments.

Focusing on hardware inputs, a sustained 25 percent tariff on semiconductor imports could reduce national economic growth by 0.76 percent over the next decade, imposing an average cumulative cost of $4,208 per U.S. household. For brokerages that maintain on-premise deployments, the increased expense of servers, networking equipment, and storage systems directly elevates the total cost of ownership. Consequently, some firms have had to defer planned hardware refresh cycles or absorb additional costs, while others are accelerating their migration to cloud-based solutions to mitigate exposure to hardware price volatility.

In response to these pressures, many software providers and brokerage firms are prioritizing service-based delivery models. By shifting the emphasis from capital expenditure on physical infrastructure to operational expenditure for managed cloud services and subscription-based offerings, organizations can achieve predictable cost structures and preserve agility. Furthermore, the reallocation of IT budgets toward software and consulting services fosters deeper partnership engagements, enabling brokerages to capitalize on vendor-led optimizations, support, and specialized training to navigate the complex post-tariff environment.

Revealing Key Segmentation Signals Driving Software Adoption Patterns among Diverse Insurance Broker Operating Models

A nuanced understanding of market segmentation reveals the diverse requirements that guide software adoption among brokerages. Within the spectrum of insurance types, solutions designed for health insurance demand comprehensive regulatory tracking and claims adjudication capabilities, whereas platforms serving life and annuities emphasize cash flow modeling and compliance with financial reporting standards. Property and casualty specialists often seek robust quoting engines and risk management modules, while the reinsurance segment requires advanced analytics and treaty administration support.

Beyond insurance lines, the market further divides into services and software components. Consulting engagements help firms tailor implementation roadmaps, integration strategies, and process reengineering efforts. Implementation and integration services ensure seamless data flows between carrier systems, CRM tools, and policy management repositories. Support and maintenance offerings provide ongoing operational stability, while training services equip broker personnel with the skills needed to leverage advanced platform functionalities. On the software side, core modules span billing and payment processing, claims management, compliance and risk management, customer relationship management, policy administration, quoting and underwriting tools, and reporting and analytics, each driving specific operational efficiencies.

Deployment preferences also play a critical role; cloud-based models offer scalability, rapid provisioning, and reduced capital outlay, while on-premise installations appeal to firms with stringent data residency requirements or highly customized processes. Likewise, organizational size influences selection criteria: large enterprises typically adopt fully integrated, enterprise-grade suites, whereas small and medium enterprises prioritize modular, cost-effective solutions that support rapid deployment. Finally, the end-user landscape encompasses agency networks and franchises seeking central governance, independent insurance brokers valuing flexibility, aggregators focused on high-volume quoting, and third-party administrators requiring specialized claims workflows.

This comprehensive research report categorizes the Insurance Brokers Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insurance Type

- Component

- Deployment Model

- Organization Size

- End User

Highlighting Regional Dynamics That Mold Insurance Broker Software Demand across Major Global Markets

Regional dynamics profoundly influence the adoption and evolution of insurance broker software solutions. In the Americas, mature market infrastructures, coupled with a strong regulatory emphasis on consumer protection, have driven brokerages toward platforms that can seamlessly integrate with multiple carriers and support strict compliance frameworks. As a result, North American firms often lead in adopting advanced analytics and CRM integrations, while Latin American markets emphasize modular deployments that accommodate rapid market entry and localized language support.

Europe, the Middle East, and Africa exhibit a complex tapestry of regulatory regimes and digital maturity levels. GDPR and Solvency II directives in Europe have heightened demand for robust data governance and risk management modules, whereas Gulf Cooperation Council nations focus on mobile-first distribution channels and multilingual user interfaces. Across Africa, emergent broker networks demonstrate a growing appetite for cloud-based solutions that bypass scarce on-premise infrastructure and support microinsurance models tailored to underserved communities.

Asia-Pacific presents distinct growth opportunities driven by rapid digitalization and diverse operating environments. In developed economies such as Australia and Japan, brokerages are investing in AI-powered underwriting and embedded insurance ecosystems, while Southeast Asia’s expanding middle class fuels demand for user-friendly mobile platforms and API-enabled partnerships. Transitional strategies that blend global best practices with region-specific compliance and localization capabilities continue to define success in this dynamic landscape.

This comprehensive research report examines key regions that drive the evolution of the Insurance Brokers Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Landscape and Strategic Profiles of Leading Insurance Broker Software Providers and Innovators

Leading software providers in the insurance broker segment demonstrate a range of strategic approaches to address evolving industry demands. Applied Systems, a long-standing player in North America, has solidified its position through deep carrier integrations and extensive partner networks that deliver turnkey solutions for agencies of all sizes. By contrast, Duck Creek Technologies stands out for its highly composable, cloud-native product suite that enables rapid feature rollouts and seamless version management, appealing to brokerages pursuing continuous innovation.

On the CRM front, Salesforce has leveraged its platform dominance to introduce tailored insurance cloud offerings that unify client data, policy lifecycles, and service interactions. Their solution underscores the value of extensive ecosystem integrations, enabling broking firms to embed add-on services from insurtech partners and carriers without incurring heavy development overhead. Meanwhile, emerging vendors have focused on niche capabilities, with some specializing in advanced analytics, telematics-driven underwriting, or no-code workflow automation to cater to broker networks seeking rapid internal customization.

Smaller, agile startups complement these incumbents by driving API-driven innovation, often collaborating with regional broker associations to pilot cutting-edge features such as AI-powered chatbots, digital ID verification, and embedded insurance modules. Collectively, these providers represent a spectrum of maturity levels and strategic philosophies, offering brokerages a broad array of options to align technology investments with long-term growth aspirations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insurance Brokers Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgencyBloc, LLC

- Applied Systems, Inc.

- BindHQ, Inc.

- BrokerEdge Technologies, Inc.

- ClientCircle, Inc.

- Creatio, Inc.

- Eclipse Software Systems, Inc.

- EZLynx, LLC

- Guidewire Software, Inc.

- HawkSoft, Inc.

- Insly Ltd.

- Insureio Technologies, Inc.

- Jenesis Software, Inc.

- NowCerts, LLC

- Partner XE (by SIS, Inc.)

- Policybazaar Insurance Brokers Private Limited

- Sibro Tech Solutions Pvt. Ltd.

- Turtlemint Insurance Services Pvt. Ltd.

- Vertafore, Inc.

Actionable Strategic Imperatives to Accelerate Digital Excellence and Sustainable Growth for Insurance Broker Leaders

Industry leaders must prioritize a shift from legacy maintenance to proactive transformation. Brokerages should accelerate cloud migration initiatives, leveraging managed service models to reduce upfront infrastructure costs and gain access to continuous platform improvements. Simultaneously, investing in AI-driven underwriting and claims automation can yield significant enhancements in accuracy, speed, and customer satisfaction, establishing a foundation for sustainable competitive differentiation.

To harness the full potential of API-driven ecosystems, brokerages need to cultivate strategic partnerships with carriers, insurtech startups, and adjacent service providers. By co-creating embedded insurance offerings and sharing data insights across value chains, firms can unlock new revenue streams and deliver seamless experiences that align with evolving customer expectations. Additionally, deploying low-code and no-code platforms empowers business users to iterate on workflows independently, accelerating time-to-market for bespoke solutions without overburdening IT teams.

A disciplined focus on cybersecurity and compliance will remain essential as brokerages integrate complex data flows and expand digital touchpoints. Embedding zero-trust architectures, conducting regular security audits, and ensuring adherence to global regulatory standards will mitigate risk and reinforce trust. Finally, adopting an agile operating model-characterized by cross-functional teams, continuous improvement cycles, and data-driven decision-making-will position brokerages to respond rapidly to market disruptions and customer needs.

Exploring the Rigorous Multi-Source Research Methodology Underpinning Our Comprehensive Insurance Broker Software Analysis

The research methodology underpinning this analysis employed a rigorous blend of primary and secondary data collection, ensuring both breadth and depth of insights. Secondary research encompassed publicly available financial statements, patent filings, regulatory publications, industry white papers, and technology roadmaps. Complementing this, primary interviews were conducted with C-level executives, IT directors, and operations leads from leading brokerage firms, software vendors, and industry associations, enabling the capture of first-hand perspectives on technology adoption challenges and strategic priorities.

Data triangulation techniques validated key findings by cross-referencing multiple sources to mitigate bias and enhance accuracy. Vendor profiling involved assessing solution capabilities against critical success factors such as integration flexibility, compliance support, and user experience. Segmentation analyses were performed by synthesizing market sizing studies, user adoption surveys, and deployment case studies, while regional evaluations accounted for macroeconomic indicators, regulatory frameworks, and digital infrastructure maturity levels.

The actionable recommendations and competitive benchmarks presented in this report derive from a structured evaluation framework that emphasizes scenario planning, opportunity sizing for emergent technologies, and risk assessment. This comprehensive approach ensures that stakeholders receive a balanced view of the market landscape, informed by both quantitative data and qualitative insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insurance Brokers Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insurance Brokers Software Market, by Insurance Type

- Insurance Brokers Software Market, by Component

- Insurance Brokers Software Market, by Deployment Model

- Insurance Brokers Software Market, by Organization Size

- Insurance Brokers Software Market, by End User

- Insurance Brokers Software Market, by Region

- Insurance Brokers Software Market, by Group

- Insurance Brokers Software Market, by Country

- United States Insurance Brokers Software Market

- China Insurance Brokers Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights on Embracing Innovation and Strategic Adaptation in the Evolving Insurance Broker Technology Realm

As the insurance broker software market evolves, the convergence of cloud-native architectures, intelligent automation, and API-driven ecosystems will continue to redefine industry standards. Firms that embrace these trends, while rigorously assessing their unique segmentation needs and regional imperatives, will secure a leadership position in the digital distribution channel.

Moreover, the ability to navigate external pressures-such as the cumulative effects of trade policies on technology costs-will underscore the importance of flexible deployment strategies and service-based delivery models. By aligning technology roadmaps with both macroeconomic realities and customer-centric imperatives, brokerages can optimize resource allocation and accelerate time to value.

In closing, the journey toward digital excellence demands a holistic approach that combines strategic foresight, operational agility, and a relentless focus on innovation. Brokerages that integrate these elements into their organizational DNA will be best positioned to capture emerging opportunities, strengthen customer engagement, and drive long-term growth in an increasingly competitive market.

Engage with Ketan Rohom to Unlock Exclusive Insights and Acquire the Definitive Insurance Broker Software Market Research Report

To delve deeper into the comprehensive analysis of the insurance broker software market and secure the detailed insights that drive strategic decisions, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise and guidance will ensure you obtain the definitive market research report tailored to your organization’s specific needs. Discover how customized data, actionable recommendations, and in-depth segmentation analyses can empower your next growth initiative. Connect with Ketan to unlock exclusive access to the full report and position your organization for sustained success in the evolving insurance broker technology landscape.

- How big is the Insurance Brokers Software Market?

- What is the Insurance Brokers Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?