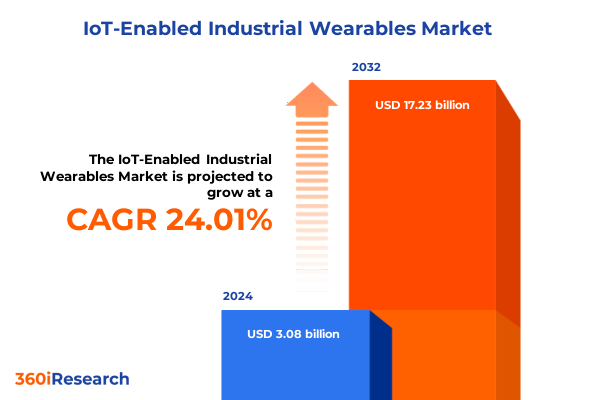

The IoT-Enabled Industrial Wearables Market size was estimated at USD 3.80 billion in 2025 and expected to reach USD 4.70 billion in 2026, at a CAGR of 24.07% to reach USD 17.23 billion by 2032.

Discover how IoT-enabled industrial wearables are redefining operational safety productivity and workforce capabilities in modern enterprises

Over the last decade, industrial wearables have undergone a profound transformation, evolving from rudimentary safety equipment to sophisticated IoT-enabled platforms that seamlessly integrate with enterprise ecosystems. These advanced devices, including smart helmets, glasses, vests, and gloves, now deliver real-time telemetry on environmental conditions, worker biometrics, and equipment performance. This evolution has catalyzed a shift in how organizations approach operational safety, as continuous monitoring and predictive alerts are rapidly replacing manual inspections and reactive protocols.

Furthermore, the convergence of edge computing and cloud analytics has enabled organizations to process critical data at the source while maintaining enterprise-wide visibility. By orchestrating low-latency edge analysis with centralized data lakes, leaders gain actionable insights on workforce behavior and asset health, empowering proactive decision-making. As a result, companies across construction, healthcare, logistics, manufacturing, and oil & gas are accelerating full-scale deployment, unlocking new efficiencies and reshaping the role of frontline personnel in driving productivity and compliance.

Explore the seismic shifts powering IoT-enabled wearables that are catalyzing operational transformation across global industrial landscapes

Industry-wide digital transformation initiatives have set the stage for a series of transformative shifts in how wearables are conceived and deployed. Augmented reality glasses now provide remote experts with immersive visual guidance, enabling hands-free troubleshooting and reducing machine downtime. At the same time, advanced sensor integration has elevated traditional protective gear into multifunctional health monitoring hubs, capable of tracking fatigue, heart rate, and posture to preempt injury before it occurs.

Moreover, predictive maintenance frameworks are now leveraging wearable-collected data to forecast equipment failures with unprecedented accuracy. This shift from scheduled maintenance to condition-based servicing is driving operational resilience across sectors, as analytics-driven insights minimize unplanned outages. Together, these technological breakthroughs are not only enhancing safety but also empowering a new era of human augmentation, where wearables act as both custodians of worker health and engines of productivity.

Understand how 2025 US tariff policies have cumulatively reshaped supply chains manufacturing costs and innovation pathways in industrial wearable markets

United States tariff policies introduced in early 2025 have exerted a cumulative impact on the industrial wearables supply chain, altering component sourcing strategies and cost structures. Increased duties on imported microprocessors, connectivity modules, and sensor arrays have prompted original equipment manufacturers to reconsider traditional procurement hubs. In response, many companies have pursued nearshoring initiatives, relocating assembly operations closer to North American facilities to mitigate tariff exposure and reduce lead times.

Concurrently, the tariff environment has spurred intensified investment in domestic R&D and manufacturing of critical components. Strategic collaborations between technology providers and domestic foundries have emerged, aimed at building resilient, vertically integrated supply networks. This reshuffling of global trade patterns has also accelerated the diversification of component suppliers, with organizations balancing cost pressures against the need for consistent quality and compliance with evolving regulatory standards.

Gain nuanced insights into segmentation across end user industries product types technologies and components illuminating growth drivers and adoption patterns

Gain nuanced insights into segmentation across end user industries product types technologies and components illuminating growth drivers and adoption patterns. The market spans construction healthcare across hospitals and pharmaceutical logistics manufacturing covering automotive with dedicated segments for electric vehicles and heavy vehicles chemicals electronics encompassing consumer devices and semiconductor facilities and food & beverage in addition to oil & gas. On the product side, offerings range from smart glasses including AR-enabled and safety variants to smart gloves, helmets, vests split into heated and high-visibility formats and smart watches, each tailored to specific use cases.

Technology layers further differentiate the landscape through analytics powered by both cloud and edge platforms cloud infrastructure connectivity via Bluetooth cellular or Wi-Fi networks and a diverse sensor ecosystem featuring accelerometers heart rate monitors and temperature detectors. Underpinning these solutions are critical components such as hardware modules including batteries displays and processors professional services encompassing support and system integration and software stacks divided between application and platform solutions. This multi-dimensional segmentation reveals how cross-layer synergies and targeted customization are defining value propositions across diverse industrial contexts.

This comprehensive research report categorizes the IoT-Enabled Industrial Wearables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Component

- End User Industry

Explore how regional dynamics across the Americas EMEA and Asia-Pacific are shaping the adoption and strategic deployment of industrial IoT wearables

Explore how regional dynamics across the Americas EMEA and Asia-Pacific are shaping the adoption and strategic deployment of industrial IoT wearables. In the Americas, robust infrastructure, progressive safety regulations, and high digital maturity have positioned North America as an early adopter, with leading construction and manufacturing firms embedding wearables into their operational fabric. Latin American markets are demonstrating rising interest driven by resource extraction and logistics sectors seeking to modernize legacy workflows.

In Europe the Middle East & Africa, regulatory harmonization initiatives and sustainability mandates are driving technology upgrades, as companies seek to meet stringent occupational health standards. Regional consortiums are forming to standardize data protocols and interoperability frameworks, advancing cross-border deployments. Meanwhile, Asia-Pacific is characterized by rapid industrialization in Southeast Asia and established manufacturing hubs in East Asia, with local technology providers innovating to address cost-sensitive applications and harsh environmental conditions.

This comprehensive research report examines key regions that drive the evolution of the IoT-Enabled Industrial Wearables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncover strategic moves mergers partnerships and innovation strategies among leading companies driving competitive advantage in industrial wearable solutions

Uncover strategic moves mergers partnerships and innovation strategies among leading companies driving competitive advantage in industrial wearable solutions. Technology incumbents are forging alliances with specialized sensor manufacturers to enhance device precision, while software vendors are acquiring analytics startups to bolster AI-driven insights. Collaboration agreements between network operators and hardware providers are also emerging to guarantee seamless connectivity in remote or challenging industrial environments.

Additionally, forward-thinking enterprises are launching co-innovation labs where operators, technology vendors, and research institutions collaborate on proof-of-concept deployments. These initiatives accelerate time to market for new features such as advanced biometric authentication, adaptive haptic feedback, and context-aware alerting. As a result, companies are differentiating through bespoke platforms that integrate both domain expertise and cutting-edge IoT capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the IoT-Enabled Industrial Wearables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- AsusTek Computer Inc.

- Ekso Bionics Holdings Inc.

- Eurotech S.p.A.

- Fatigue Science Technologies International Ltd.

- Fujitsu Limited

- Garmin Ltd.

- Generalscan Electronics Co. Ltd.,

- Google LLC

- Hitachi Ltd.

- Honeywell International Inc.

- Intellinium

- Iristick NV

- Jawbone Health Hub Inc.

- Kopin Corporation

- Magic Leap Inc.

- Microsoft Corporation

- Motorola Solutions Inc.

- Nike Inc.

- Optinvent

- RealWear Inc.

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- SmartCap Technologies

- Sony Corporation

- Vuzix Corporation

- Xiaomi Corporation

Implement strategic initiatives to harness the potential of IoT-enabled industrial wearables through cross functional integration and innovation cycles

Implement strategic initiatives to harness the potential of IoT-enabled industrial wearables through cross functional integration and innovation cycles. Organizations should establish centralized data governance frameworks that unify sensor outputs, enterprise resource planning systems, and safety management platforms, ensuring that insights flow seamlessly from the shop floor to executive dashboards.

Moreover, leaders must invest in rigorous cybersecurity measures to protect sensitive operational and biometric data. Embedding security protocols at both the device firmware level and within network infrastructures will safeguard against evolving threats. By fostering a culture of continuous improvement-where frontline feedback loops inform iterative updates-companies can optimize device configurations and user workflows, driving higher adoption rates and tangible operational enhancements.

Examine rigorous research methodology encompassing expert interviews secondary research and advanced data validation for actionable market insights

Examine rigorous research methodology encompassing expert interviews secondary research and advanced data validation for actionable market insights. The study began with in-depth discussions with industry leaders, technology innovators, and domain experts to capture firsthand perspectives on emerging use cases and deployment challenges.

Insights from these conversations were triangulated against a comprehensive review of technical publications, regulatory filings, and publicly available testing reports. Analytical frameworks were applied to evaluate technology maturity, interoperability standards, and competitive landscapes, ensuring that the findings deliver both strategic clarity and operational relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IoT-Enabled Industrial Wearables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IoT-Enabled Industrial Wearables Market, by Product Type

- IoT-Enabled Industrial Wearables Market, by Technology

- IoT-Enabled Industrial Wearables Market, by Component

- IoT-Enabled Industrial Wearables Market, by End User Industry

- IoT-Enabled Industrial Wearables Market, by Region

- IoT-Enabled Industrial Wearables Market, by Group

- IoT-Enabled Industrial Wearables Market, by Country

- United States IoT-Enabled Industrial Wearables Market

- China IoT-Enabled Industrial Wearables Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesize critical findings on IoT-enabled industrial wearables to outline future pathways for innovation risk mitigation and sustainable growth strategies

Synthesize critical findings on IoT-enabled industrial wearables to outline future pathways for innovation risk mitigation and sustainable growth strategies. The report highlights how integration of multisensor data with edge analytics will unlock new dimensions of operational intelligence, enabling real-time decision support and automated compliance reporting.

Leaders who embrace modular architectures and open APIs will be best positioned to adapt to shifting regulatory and market demands, while those who neglect data security or user experience risk limiting ROI. As the industrial sector continues its digital evolution, wearables are set to play an indispensable role in driving both human centricity and process optimization.

Connect directly with Ketan Rohom Associate Director Sales Marketing to secure essential market research insights and drive informed investment decisions

To access the full depth of insights on IoT-enabled industrial wearables, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, for personalized guidance on leveraging this report for strategic decision-making. Engaging with Ketan Rohom will provide tailored support to align the findings with your organization’s objectives, ensuring you capitalize on emerging trends and competitive dynamics.

Secure your copy today to empower your leadership team with the essential research needed to navigate technological complexities, mitigate operational risks, and drive sustainable growth through informed investment strategies in the evolving landscape of industrial wearables.

- How big is the IoT-Enabled Industrial Wearables Market?

- What is the IoT-Enabled Industrial Wearables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?