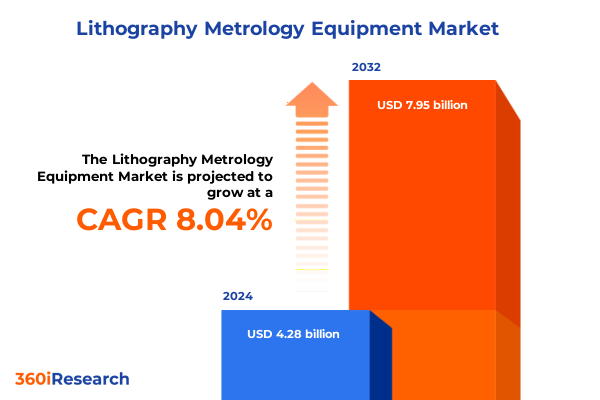

The Lithography Metrology Equipment Market size was estimated at USD 4.61 billion in 2025 and expected to reach USD 4.97 billion in 2026, at a CAGR of 8.08% to reach USD 7.95 billion by 2032.

Unveiling the Critical Role of Advanced Lithography Metrology Equipment in Accelerating Next-Generation Semiconductor Manufacturing

Achieving the nanometer-precision requirements of modern semiconductor fabrication demands robust metrology solutions capable of characterizing critical dimensions, surface topography, and film properties with unparalleled accuracy. At the heart of this capability are advanced lithography metrology instruments that enable fabs to monitor process variations, detect defects early, and optimize yield performance across high-volume production lines. As chipmakers push the boundaries of miniaturization, the inherent resolution of measurement techniques such as atomic force microscopy, critical dimension scanning electron microscopy, scatterometry, and X-ray-based methods becomes indispensable in ensuring process control during each stage of the photolithography sequence.

Over recent years, the proliferation of contact, non-contact, and tapping mode configurations within atomic force microscopy systems has provided engineers with versatile tools to probe surface structures at the single-nanometer scale, while angle resolved and spectroscopic scatterometry solutions have emerged as non-invasive techniques for measuring multilayer film stacks with high throughput. Complementing these optical approaches, X-ray diffraction and reflectometry instruments deliver precise information on crystallographic orientation and film thickness, enabling accurate alignment and defect characterization. Together with critical dimension scanning electron microscopy platforms that balance resolution with productivity, this diversified instrumentation portfolio underpins the ongoing drive for cost-effective, high-yield manufacturing in advanced node technologies.

Moreover, the convergence of these metrology modalities with digital data analytics and automated decision-making frameworks has accelerated feedback loops between measurement and process adjustment, bridging the gap between device design and real-world performance. Within this landscape, the integration of inline metrology, in situ monitoring, and predictive modeling has become critical, as fabs seek to minimize cycle times, reduce scrap rates, and adhere to the stringent regulatory and quality requirements governing semiconductor production. In this way, lithography metrology equipment has not only established itself as a cornerstone of process control but also as a strategic enabler of future innovations in semiconductor fabrication.

Examining the Technological and Operational Paradigm Shifts Redefining Lithography Metrology Equipment Capabilities and Industry Adoption Trends

The introduction of extreme ultraviolet lithography at production scale has catalyzed the development of corresponding metrology solutions, prompting vendors to refine techniques for EUV scatterometry and enhance sensor sensitivity in critical dimension scanning electron microscopy platforms. By leveraging deep ultraviolet and extreme ultraviolet wavelengths, fabs can now detect sub-5nm feature variations with greater confidence, while advanced scatterometry tools provide non-destructive analysis of complex multilayer films that were previously inaccessible with traditional optical methods.

Concurrently, the infusion of artificial intelligence and machine learning algorithms into metrology software has transformed pattern recognition, anomaly detection, and process drift analysis. These data-driven approaches enable real-time feedback on line edge roughness and overlay accuracy, reducing false positives and prioritizing true process excursions for rapid corrective action. As a result, the cycle time between measurement and process adjustment has shrunk dramatically, empowering engineers to maintain tighter process windows and higher on-wafer yield.

At the operational level, the rise of modular tool architectures and cloud-based data platforms has facilitated remote monitoring, centralized analytics, and collaborative workflow integration across geographically dispersed fabs. This shift toward networked metrology ecosystems accelerates R&D cycles, enables rapid deployment of feature enhancements, and fosters continuous improvement through shared learnings. In parallel, the adoption of inline sensors and in situ measurement modules is redefining the traditional offline paradigm, allowing fabs to embed metrology checkpoints directly into exposure clusters for near–real-time process control and enhanced process stability.

Analyzing the Cumulative Operational and Strategic Impact of Newly Imposed United States Tariffs on Lithography Metrology Equipment Supply Chains

In 2025, the United States extended its tariff regime to encompass a broad array of lithography metrology equipment imports, instituting duties of up to 25 percent on devices originating from certain foreign suppliers. This policy shift has reverberated across global supply chains, compelling semiconductor manufacturers and metrology vendors alike to reassess sourcing strategies, cost structures, and inventory management practices. In the short term, lead times for key instruments have lengthened as suppliers adapt their logistics networks to mitigate duty impacts and maintain service levels for critical semiconductor fabs.

Faced with escalating landed costs, many fabs have accelerated efforts to diversify their supplier bases, engaging second-source qualification of alternative tool manufacturers in regions outside the tariff’s scope. Simultaneously, inventory stocking practices have evolved, with strategic safety stocks established at regional consolidation centers to buffer against future policy fluctuations and logistical disruptions. These measures have been complemented by a growing interest in nearshoring options, including collaborative manufacturing and repair facilities in Mexico and select U.S. states under the auspices of domestic content incentives.

From a strategic standpoint, the tariffs have galvanized stronger partnerships between metrology equipment producers and end users, giving rise to co-development agreements aimed at localizing critical subsystems and minimizing tariff exposure. In parallel, fabs are investing more heavily in long-term service contracts, on-site spare parts inventories, and comprehensive risk-sharing models that align incentives across the value chain. Looking ahead, these adaptations are likely to endure beyond the immediate policy horizon, establishing a more resilient and geographically distributed metrology supply chain.

Uncovering Critical Market Insights Through Equipment Type, Technique, Application, and Wavelength-Based Segmentation Analyses in Lithography Metrology

Segmentation by equipment type reveals a nuanced competitive landscape in which atomic force microscopes, critical dimension scanning electron microscopes, scatterometry systems, and X-ray metrology tools each play distinct roles in lithography process control. Within the atomic force microscopy domain, contact, non-contact, and tapping mode instruments cater to a spectrum of surface characterization requirements, ranging from gentle, non-destructive probing to high-resolution topographical mapping. Scatterometry vendors offer angle resolved and spectroscopic variants that combine non-invasive measurement with rapid data acquisition, while X-ray metrology suppliers deliver both diffraction-based structural insights and reflectometry-driven film thickness measurements.

When viewed through the lens of measurement technique, atomic force, electron beam, optical, and X-ray metrology each present unique trade-offs in terms of resolution, throughput, and material sensitivity. Electron beam platforms excel at imaging nanoscale features but can introduce charging effects on non-conductive layers, while optical metrology solutions offer high-speed inspection with lower spatial resolution. X-ray methods, by contrast, penetrate multilayer stacks to reveal buried interfaces, complementing surface-sensitive modalities.

From an application perspective, data storage manufacturers rely on ultra-flat wafer surfaces characterized by atomic force methods, whereas flat panel display producers emphasize large-area uniformity assessed through spectroscopic and angle resolved scatterometry. MEMS fabricators demand precise microstructure accuracy achievable through a combination of critical dimension scanning electron microscopy and X-ray reflectometry, while advanced semiconductor fabs mandate sub-nanometer overlay and line edge roughness control across all available metrology approaches.

Wavelength-based segmentation further refines this picture by delineating measurement capabilities according to deep ultraviolet, extreme ultraviolet, infrared, and visible light spectra. Deep ultraviolet wavelengths at 157, 193, and 248 nanometers underpin traditional scatterometry accuracy, while extreme ultraviolet scatterometry is emerging for next-node process layers. Infrared techniques operating in far, mid, and near bands excel at material contrast and defect detection in specialized applications, and visible-light interferometry remains a reliable, high-throughput option for wafer warpage and overlay verification.

This comprehensive research report categorizes the Lithography Metrology Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technique

- Wavelength

- Application

Exploring Regional Dynamics and Adoption Patterns Across the Americas, Europe Middle East Africa, and Asia-Pacific in Lithography Metrology Technology Deployment

Across the Americas, robust semiconductor manufacturing capacity in the United States has driven widespread adoption of advanced metrology platforms, particularly critical dimension scanning electron microscopy and atomic force microscopy, to support leading-edge logic and memory fabs. In this region, investment in extreme ultraviolet process control and inline, in situ measurement modules is complemented by an ecosystem of research consortia and vendor partnerships focused on aligning tool roadmaps with domestic content incentives and the objectives of the CHIPS Act.

In Europe, the Middle East, and Africa, collaborative R&D clusters in Germany, France, and Israel are fueling innovation in spectroscopic scatterometry and infrared-based metrology techniques tailored to automotive, aerospace, and defense applications. While adoption of extreme ultraviolet scatterometry has been measured, pilot implementations in advanced packaging and specialized compound semiconductor fabs are gaining momentum, supported by public–private investment vehicles and transnational research consortia.

The Asia-Pacific region remains the largest consumer of lithography metrology equipment, with China, Taiwan, and South Korea leading high-volume deployments of deep ultraviolet tools at 193-nanometer wavelengths and burgeoning integration of extreme ultraviolet scatterometry into mainstream process flows. Regional metrology suppliers and joint ventures have emerged to meet surging demand, driven in part by government-led semiconductor self-sufficiency initiatives and aggressive scaling targets.

Taken together, these regional dynamics underscore the importance of aligning technology roadmaps with local policy frameworks, ecosystem partnerships, and capital investment strategies. As equipment vendors calibrate their geographic go-to-market approaches, they must balance global R&D leverage with targeted regional support to address the distinct needs of each market segment.

This comprehensive research report examines key regions that drive the evolution of the Lithography Metrology Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Advantages of Leading Players Shaping the Future of Lithography Metrology Equipment Market Landscape

The competitive landscape of lithography metrology equipment is defined by several leading players executing strategic initiatives to expand their portfolios and capture emerging opportunities. KLA has reinforced its position in critical dimension scanning electron microscopy and scatterometry by integrating advanced sensor technologies and automating defect review workflows, thereby enhancing productivity and enabling fabs to manage rising data volumes with minimal manual intervention.

ASML, renowned for its lithography systems, has deepened its involvement in metrology by embedding scatterometry modules within its extreme ultraviolet exposure platforms. This approach streamlines tool integration, reduces alignment uncertainty, and positions ASML to offer end-to-end lithography solutions that integrate measurement and exposure in a unified process flow.

Applied Materials has broadened its atomic force microscopy offerings, introducing enhanced non-contact and tapping mode configurations optimized for novel materials and three-dimensional device architectures. By leveraging synergies with its deposition and etch equipment business, the company can offer comprehensive process control solutions that address both film formation and metrology requirements.

Hitachi High-Tech and Nanometrics have each pursued targeted expansions in electron beam and spectroscopic scatterometry technologies, respectively. Hitachi’s expertise in high-resolution imaging complements Nanometrics’ development of angle-resolved and X-ray diffraction systems, with both companies forging partnerships with AI software vendors to deliver advanced data analytics platforms.

In parallel, smaller specialized vendors are carving out niches in infrared and visible-light metrology, driving innovation through focused R&D and strategic alliances. These firms are leveraging agility and domain-specific expertise to introduce capabilities that larger incumbents may overlook, stimulating healthy competitive dynamics and accelerating overall technology progress.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithography Metrology Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantest Corporation

- Applied Materials, Inc.

- ASML Holding NV

- Camtek Ltd.

- Canon Inc.

- Carl Zeiss AG

- DuPont de Nemours Inc.

- EV Group

- Hitachi High-Tech Corporation

- HORIBA Ltd.

- KLA Corporation

- Lam Research Corporation

- Lasertec Corporation

- Nanometrics Inc.

- Nikon Metrology Inc.

- Nova Ltd.

- Onto Innovation Inc.

- SCREEN Semiconductor Solutions Co., Ltd.

- Tokyo Electron Limited

- Veeco Instruments Inc.

Actionable Recommendations for Industry Leaders to Leverage Technological Advancements and Mitigate Risks in the Evolving Lithography Metrology Ecosystem

Industry leaders must prioritize investment in artificial intelligence–driven analytics to harness the full potential of multi-modal metrology datasets, developing fusion frameworks that correlate atomic force microscopy topography with scatterometry spectral responses and optical CD measurements. Such integrated data models can unlock new levels of process insight, enabling proactive drift correction and rapid identification of root causes in high-volume manufacturing environments.

Forming co-development partnerships with equipment suppliers is critical for customizing sensor architectures and software workflows to specific node requirements, thereby reducing time to qualification and accelerating return on metrology investment. By collaborating closely with metrology vendors, fabs can influence feature roadmaps, ensure seamless integration into existing process tools, and secure early access to next-generation capabilities.

To mitigate the impact of evolving trade policies, risk-conscious organizations should diversify their supplier portfolios across multiple regions and prioritize dual qualification of alternative tool providers. Implementing dynamic inventory management strategies, including regional safety stocks and on-site spare parts reserves, will cushion against tariff-induced disruptions and maintain uninterrupted production schedules.

Strengthening regulatory intelligence and compliance functions can help companies navigate shifting duties and export controls, turning potential barriers into competitive advantages by proactively shaping policy discussions and securing grandfathered arrangements. Engaging with industry associations and standard bodies further amplifies these efforts, ensuring that evolving trade frameworks remain aligned with broader innovation goals.

Building internal centers of excellence for digital twin modeling and real-time process simulation will enable organizations to test new metrology configurations virtually, reducing the need for physical tool redeployment during scale-up. Leveraging cloud-based platforms for collaborative design review and predictive maintenance simulations can streamline R&D cycles, minimize downtime, and accelerate the adoption of emerging measurement techniques.

Detailing the Rigorous Multi-Method Research Approach Underpinning Insights into Lithography Metrology Equipment Technologies and Market Dynamics

Our analysis draws upon a rigorous multi-method research approach that combines primary insights and secondary data to deliver a holistic view of lithography metrology technologies. We conducted in-depth interviews with metrology engineers, process integration heads, and equipment procurement managers at leading semiconductor fabrication facilities across North America, Europe, and Asia-Pacific, capturing firsthand perspectives on current challenges and future priorities.

Complementing these qualitative engagements, our team carried out on-site visits at high-volume manufacturing fabs and pilot lines to observe inline metrology workflows, system-to-host integration architectures, and data management protocols in action. These field observations illuminated the practical constraints associated with cycle time, tool uptime, and data throughput, informing our evaluation of emerging measurement modalities.

Extensive secondary research underpins our technology and competitive assessments, leveraging peer-reviewed journal articles, conference proceedings from SPIE Photomask Technology and SEMICON events, patent landscape analyses, and technical white papers from industry thought leaders. This repository of technical literature enabled us to map innovation trajectories, identify cross-company collaboration networks, and contextualize patent activity within broader product roadmaps.

To ensure the integrity of our findings, we applied a strict triangulation methodology that aligned qualitative feedback with quantitative performance benchmarks, validated through expert advisory panels and peer review workshops. Iterative refinements were implemented based on emerging data points, with final validation provided by subject matter experts in metrology physics, data analytics, and fab operations.

This comprehensive research framework guarantees that our strategic insights and recommendations reflect the most current technological breakthroughs, regional market dynamics, and competitive imperatives shaping the lithography metrology equipment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithography Metrology Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithography Metrology Equipment Market, by Equipment Type

- Lithography Metrology Equipment Market, by Technique

- Lithography Metrology Equipment Market, by Wavelength

- Lithography Metrology Equipment Market, by Application

- Lithography Metrology Equipment Market, by Region

- Lithography Metrology Equipment Market, by Group

- Lithography Metrology Equipment Market, by Country

- United States Lithography Metrology Equipment Market

- China Lithography Metrology Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing the Pivotal Insights and Strategic Imperatives Shaping the Future Trajectory of Lithography Metrology Equipment Industry Evolution

The landscape of lithography metrology equipment is undergoing a fundamental transformation driven by the relentless pursuit of finer feature control, higher throughput, and greater process resilience. As semiconductor manufacturers navigate this era of sub-nanometer precision, the role of metrology has expanded beyond defect detection and yield measurement to become an integral component of real-time process governance and predictive optimization.

Emerging paradigms such as multi-modal data fusion, where atomic force microscopy, scatterometry, and optical sensors converge, are unlocking new possibilities for correlated analysis of physical and spectral properties. Meanwhile, the strategic ramifications of United States tariffs have underscored the importance of supply chain diversity, regional sourcing, and tariff risk mitigation strategies-factors that will continue to influence vendor–fab relationships and investment decisions.

Segmentation analyses across equipment type, measurement technique, application domain, and wavelength spectrum have revealed specialized pockets of growth and opportunity. For instance, deep ultraviolet and extreme ultraviolet scatterometry are poised to address the most stringent overlay and film stack characterization needs, while infrared and visible-light metrology techniques offer complementary strengths in defect detection and wafer warpage assessment.

From a regional vantage point, the Americas lead in integrated EUV metrology deployments, EMEA is rapidly scaling spectroscopic and infrared-based solutions for vertical markets, and Asia-Pacific continues to drive volume adoption of DUV and emerging EUV scatterometry modalities. Against this backdrop of dynamic regional ecosystems, leading equipment manufacturers are differentiating through strategic partnerships, targeted R&D investments, and the integration of AI-driven analytics into their product portfolios.

Looking ahead, industry participants that align their technology roadmaps with segmentation-driven use cases, regional policy frameworks, and co-development initiatives will be best positioned to capitalize on the next wave of lithography metrology innovation, ensuring sustained competitiveness and robust process control for future technology nodes.

Engage with Our Sales Leadership to Secure Comprehensive Insights into Lithography Metrology Equipment and Purchase the Full Report Today

For decision-makers seeking a comprehensive understanding of current and emerging trends in lithography metrology equipment, direct dialogue with Ketan Rohom, Associate Director of Sales & Marketing, will pave the way to actionable insights. His expertise can guide you through the report’s in-depth analyses of equipment type advancements, technique-driven performance benchmarks, application-specific use cases, and wavelength-focused measurement innovations. Engaging with Ketan provides you with the opportunity to explore detailed regional dynamics across the Americas, Europe Middle East Africa, and Asia-Pacific, as well as the strategic moves of leading equipment vendors shaping the competitive landscape. By partnering with him, you’ll gain clarity on how to navigate tariff-driven supply chain disruptions, harness segmentation-based growth opportunities, and implement high-impact recommendations tailored to your organization’s unique objectives. Reach out today to secure your copy of the full market research report and equip your teams with the intelligence needed to stay ahead in the rapidly evolving world of lithography metrology equipment

- How big is the Lithography Metrology Equipment Market?

- What is the Lithography Metrology Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?