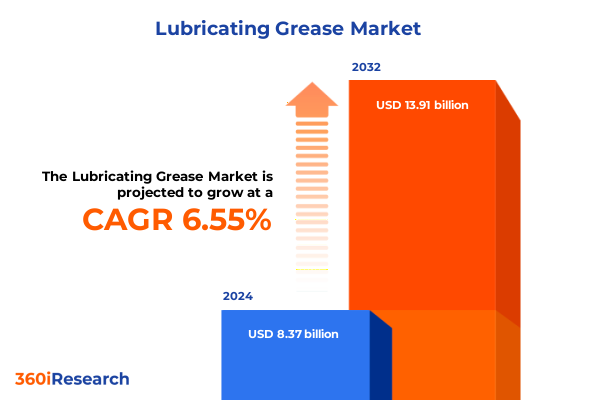

The Lubricating Grease Market size was estimated at USD 8.91 billion in 2025 and expected to reach USD 9.38 billion in 2026, at a CAGR of 6.56% to reach USD 13.91 billion by 2032.

Unveiling the Critical Role of High-Performance Lubricating Grease in Enhancing Operational Reliability and Efficiency Across Diverse Industrial Sectors

High-performance lubricating greases play a pivotal role in modern machinery, underpinning reliability and efficiency across a broad spectrum of industrial applications. Engineered as semi-solid lubricants, these greases minimize friction, protect against wear, and extend equipment life, thereby fostering uninterrupted operations in demanding environments. The importance of selecting the right grease formulation has never been more pronounced, as industries strive to balance operational excellence, environmental sustainability, and evolving regulatory requirements.

In recent years, the landscape of lubricating grease has witnessed a surge in demand driven by the need to support advanced machinery and heavy-duty equipment. From automotive axle assemblies to industrial bearing systems, customized lubrication solutions have emerged as critical enablers of productivity improvements. Manufacturers are increasingly prioritizing greases that not only enhance mechanical performance but also align with corporate sustainability goals by reducing energy consumption and extending maintenance intervals. Consequently, the introduction of next-generation base oil chemistries and additive technologies has sparked competition among suppliers seeking to differentiate through innovation.

As global supply chains face unprecedented pressures, the resilience of lubricating grease producers has become a focal point for stakeholders. Raw material volatility, shifting regulatory landscapes, and geopolitical headwinds are compelling enterprises to adopt more agile sourcing and production strategies. In this evolving context, a holistic understanding of market drivers, competitive dynamics, and emerging opportunities is essential for decision-makers aiming to secure a durable edge. This report sets the stage for that understanding by examining key trends, tariff impacts, segmentation insights, regional dynamics, and strategic imperatives shaping the lubricating grease domain.

Exploring the Technological and Regulatory Transformations Driving Next-Generation Formulations and Sustainable Applications in the Lubricating Grease Landscape

The lubricating grease sector is experiencing a wave of transformative changes driven by breakthroughs in formulation science and intensifying regulatory scrutiny. Technological advancements in base oil chemistries and thickener systems have unlocked new performance thresholds, enabling greases to operate at elevated temperatures, deliver superior load-carrying capacity, and resist oxidation more effectively. These innovations are propelling the adoption of specialty greases in sectors such as aerospace, renewable energy, and advanced manufacturing, where reliability under extreme conditions is non-negotiable.

Alongside these technical developments, regulatory initiatives targeting emissions, waste reduction, and resource conservation are reshaping product portfolios. Manufacturers are increasingly integrating bio-based and biodegradable oils to meet stringent environmental standards without compromising performance. Lifecycle assessments have become a standard part of new product development, guiding investments toward chemistries that minimize ecological footprints. As a result, sustainability is no longer an afterthought but a central pillar of competitive strategy.

Digitalization is another pivotal trend redefining how lubricating greases are selected and monitored. Predictive maintenance platforms powered by sensors and analytics allow real-time condition monitoring of lubrication systems, reducing downtime and optimizing grease replenishment schedules. This shift towards data-driven lubrication management is fostering closer collaboration between grease suppliers, equipment OEMs, and end users, creating integrated service models that deliver performance guarantees and reliability assurances. Taken together, these transformative shifts underscore a dynamic market where innovation, regulation, and digital enablement converge to elevate the role of lubricating grease in achieving operational excellence.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Supply Chains Pricing and Strategic Positioning in Lubricating Grease

The implementation of new United States tariffs in early 2025 has left an indelible mark on the grease value chain, prompting rapid realignment of sourcing and pricing strategies. Import duties imposed on select base oils and additives have elevated production costs for many formulators, compelling them to reassess supplier relationships and explore alternative raw material origins. Domestic producers have seized this moment to expand capacity, while forward-thinking formulators are forging strategic partnerships with non-tariffed regions to preserve margin integrity.

In addition to immediate cost pressures, the tariffs have catalyzed a broader shift towards supply chain resilience. Firms are diversifying procurement portfolios to mitigate the risk of further trade policy shifts, with some investing in localized production facilities to insulate against logistical disruptions. This realignment is fostering new alliances across the supply spectrum, from raw material harvesters to finished grease manufacturers, and is accelerating innovation in additive chemistries that can substitute for higher-cost imported components.

While these dynamics have introduced near-term challenges, they have also created opportunities for industry consolidation and vertical integration. Leading grease producers are leveraging tariff-driven cost volatility to acquire niche formulators and secure intellectual property, strengthening their capacity to deliver differentiated solutions. As a result, the 2025 tariff environment has not merely reshaped cost structures but has also redefined competitive boundaries, compelling all stakeholders to rethink traditional sourcing, manufacturing, and market engagement strategies.

Illuminating Critical Insights from Type Application Consistency and Base Oil Type Segmentation Dynamics in Lubricating Grease Markets

Incorporating diverse formulation types, the market evaluation spans aluminum complex, calcium, lithium, and polyurea greases, each tailored to specific performance requirements. Aluminum complex variants deliver superior high-temperature stability, making them indispensable for industrial applications that demand sustained thermal performance. Calcium-based greases continue to offer versatile corrosion protection and water resistance, critical in scenarios where equipment encounters moisture and contaminants. Lithium thickeners balance mechanical stability and low-temperature flow properties, rendering them a staple in automotive assemblies, while polyurea formulations excel in long-life applications, particularly where extended grease intervals reduce maintenance burdens.

Applications are dissected across automotive, industrial, and metalworking end-uses, with nuanced sub-segments illuminating targeted usage patterns. Within the automotive sector, commercial vehicle fleets benefit from greases engineered for high load tolerance and extended mileage, whereas passenger vehicle systems increasingly require low-viscosity formulations compatible with modern drivetrain technologies. Industrial consumption covers construction and manufacturing settings, where greases must withstand heavy shock loads, dust ingress, and intermittent operation. Metalworking applications further bifurcate into cutting and forming processes, each demanding unique lubricity, adhesion, and chip evacuation properties to maximize tool life and part precision.

Consistency grades categorized from Grade 0 through Grade 3 reveal how mechanical work and temperature extremes influence grease selection. Grade 0 greases, characterized by fluid-like behavior, facilitate automated lubrication in precision machinery, while Grade 3 thick, semi-solid pastes ensure retention under heavy loads and steep inclination angles. Intermediate grades bridge these performance boundaries, offering balanced flow characteristics for centralized lubrication systems. Base oil type segmentation examines both mineral and synthetic oil families, each with further distinctions. Mineral oils from Group I through Group III address cost-sensitive applications with incremental performance enhancements, whereas synthetic oils-ranging from esters to polyalkylene glycols and polyalphaolefins-drive high-temperature resilience, oxidative stability, and extended service life in demanding environments.

This comprehensive research report categorizes the Lubricating Grease market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- Consistency

- Base Oil Type

Revealing Regional Dynamics and Key Growth Drivers across Americas Europe Middle East Africa and Asia-Pacific Lubricating Grease Markets

Regionally, the Americas region exhibits robust demand for automotive and heavy equipment greases, anchored by a mature automotive sector and expansive infrastructure projects. In North America, the drive towards electric vehicles and stringent emissions regulations is catalyzing innovation in low-grease-bleed formulations and enhanced wear protection systems. Meanwhile, Latin American markets present diverse opportunities driven by fleet modernization and industrialization, albeit tempered by currency fluctuations and import regulation complexities.

Across Europe Middle East and Africa, regulatory frameworks targeting environmental footprint reduction and waste management are shaping product development trajectories. European manufacturers are pioneering high-performance bio-based and biodegradable greases to comply with the latest Euro emissions standards, while Middle Eastern industries prioritize thermal stability in extreme ambient conditions. In Africa, infrastructure expansion and mining operations are driving demand for heavy-duty greases capable of operating under abrasive and high-dust environments.

The Asia-Pacific region stands out for its rapid industrial growth and evolving manufacturing base. China and India spearhead consumption, with automotive production ramps and renewable energy installations fostering appetite for specialized greases. Southeast Asian economies are focusing on urbanization and port logistics, creating niches for greases that balance affordability with performance reliability. Furthermore, increased OEM collaborations and local joint ventures are accelerating technology transfer, positioning the region as both a key consumer and emerging innovator in lubricating grease solutions.

This comprehensive research report examines key regions that drive the evolution of the Lubricating Grease market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Driving Innovation and Competitive Differentiation in the Lubricating Grease Sector

Leading grease manufacturers are actively redefining competitive edges through strategic initiatives encompassing product innovation, mergers, and sustainability commitments. Major integrated energy conglomerates continue to leverage extensive research and development infrastructures to introduce proprietary additive technologies that enhance wear resistance and oxidation control. In parallel, specialty chemical firms focus on niche applications, tailoring formulations for demanding sectors such as wind energy and aerospace through collaborative programs with equipment OEMs.

Several industry players have recently pursued bolt-on acquisitions to acquire specialty thickener technologies and expand geographic footprints, thereby enriching their portfolios with complementary capabilities. Partnerships between lubricant suppliers and digital platform providers are also on the rise, enabling remote condition monitoring and tailored grease replenishment schedules that reduce unplanned downtime. Sustainability leadership remains a differentiator, with top companies investing in certified bio-base feedstocks and transparent supply chain practices to meet evolving customer and regulatory expectations.

Through these combined efforts, incumbents and challengers alike are intensifying competition on the basis of technological advantage, customer service offerings, and environmental stewardship. This complex landscape demands that all participants maintain a clear strategic vision and operational agility to capture emerging opportunities and mitigate competitive threats in an environment marked by rapid change.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lubricating Grease market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BP p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Fuchs SE

- Idemitsu Kosan Co., Ltd.

- Klüber Lubrication München GmbH & Co. KG

- Lucas Oil Products, Inc.

- LUKOIL Public Joint Stock Company

- Motul S.A.

- Nye Lubricants, Inc.

- PetroChina Company Limited

- Petroliam Nasional Berhad

- Phillips 66 Company

- Shell plc

- SKF AB

- The Lubrizol Corporation

- TotalEnergies SE

- Valvoline Inc.

Strategic Action Points for Industry Leaders to Capitalize on Emerging Opportunities Optimize Operations and Advance Sustainability in Lubricating Grease

Industry leaders aiming to solidify market positions should prioritize integrated value-chain strategies that marry supply chain resilience with innovation agility. Establishing diversified sourcing agreements for critical base oils and thickener materials can buffer against tariff-driven cost fluctuations and geopolitical uncertainties. Concurrently, investing in modular production platforms enables rapid scale-up of specialty formulations, ensuring that new performance chemistries reach customers swiftly and reliably.

To stay ahead of performance trends and regulatory shifts, executives should cultivate deeper collaborations with equipment manufacturers and research institutions. Co-development programs focused on advanced tribological testing and lifecycle assessments will expedite validation cycles for sustainable greases. Leveraging digital maintenance platforms and predictive analytics will further differentiate service offerings, enabling performance-based contracts and data-driven lubrication management that enhance customer value.

Finally, embedding sustainability throughout product life cycles-from bio-based feedstock selection to end-of-life recyclability-will resonate with environmentally conscious stakeholders and unlock new market segments. Transparent reporting on carbon footprint and circularity initiatives can strengthen brand reputation, support premium positioning, and foster long-term growth in a landscape increasingly defined by environmental and social governance criteria.

Comprehensive Research Methodology Employed to Ensure Data Integrity Validity and Actionable Insights in Lubricating Grease Market Analysis

This analysis integrates a rigorous research framework combining comprehensive secondary research and targeted primary engagements. Initially, an exhaustive literature review of technical journals, regulatory filings, and industry publications laid the groundwork for identifying core trends and competitive activities. This was complemented by detailed patent analysis and review of innovation pipelines to map emerging formulation technologies.

Primary research comprised in-depth interviews with executives from lubricant producers, equipment OEMs, end-user maintenance professionals, and chemical suppliers. These discussions provided qualitative insights into procurement strategies, performance pain points, and adoption barriers for advanced grease chemistries. Data triangulation techniques were employed to reconcile diverse perspectives and ensure consistency across input sources.

Quantitative validation involved cross-checking interview findings against historical trade data, tariff schedules, and environmental regulations. Rigorous data quality protocols, including peer review and methodological audits, were implemented to safeguard the integrity of conclusions. This structured approach ensures that the strategic insights presented are both actionable and reflective of real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lubricating Grease market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lubricating Grease Market, by Type

- Lubricating Grease Market, by Application

- Lubricating Grease Market, by Consistency

- Lubricating Grease Market, by Base Oil Type

- Lubricating Grease Market, by Region

- Lubricating Grease Market, by Group

- Lubricating Grease Market, by Country

- United States Lubricating Grease Market

- China Lubricating Grease Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Imperatives to Navigate Challenges and Leverage Prospects in the Evolving Lubricating Grease Ecosystem

The evolving lubricating grease ecosystem is characterized by a convergence of advanced formulation technologies, shifting regulatory imperatives, and strategic supply chain realignments. As operators demand greases that deliver enhanced performance, extended service intervals, and lower environmental impact, suppliers must adapt through continuous innovation and agile manufacturing practices. The introduction of new tariff regimes has further underscored the importance of resilient sourcing strategies and localized production capabilities.

Segmentation insights highlight the multifaceted nature of grease selection, with type, application, consistency, and base oil chemistry each playing a critical role in aligning product properties with service requirements. Regional analyses underscore divergent growth drivers-from sustainability compliance in Europe to industrial modernization in Asia-Pacific-while competitive profiling reveals that differentiation increasingly hinges on proprietary formulations, digital service models, and sustainability credentials.

In this dynamic environment, success will hinge on the ability to anticipate evolving needs and swiftly translate technical advances into differentiated offerings. Organizations that combine robust research capabilities, strategic collaborations, and a clear focus on environmental and operational outcomes will be best positioned to navigate uncertainty and capture long-term value. This report equips decision-makers with the insights needed to chart a proactive course in a market defined by rapid change and emerging opportunities.

Engage with Ketan Rohom to Secure Your Comprehensive Lubricating Grease Market Intelligence Report and Unlock Actionable Strategic Insights

To explore deeper insights and obtain a comprehensive perspective on the lubricating grease ecosystem, readers are encouraged to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise and personalized guidance will help align your strategic objectives with tailored research solutions, ensuring that your organization can navigate emerging trends and competitive dynamics with confidence. Reach out to schedule a consultation to secure your copy of the definitive market research report and empower your decision-making with actionable intelligence.

- How big is the Lubricating Grease Market?

- What is the Lubricating Grease Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?